Updated August 21, 2023

Hawala Meaning

Hawala is when a person sends money from one location to another with the help of hawaladars, who carry out the transaction process. It is common in the Middle East, North Africa, and South Asia.

In simple terms, there is no involvement of the traditional banking system in transferring funds. Also, there is complete anonymity, i.e., these transactions do not have official documents. In several parts of the world, there are concerns regarding this method due to its potential to facilitate illegal activities, like money laundering, tax evasion, etc.

Table of Contents

Participants

The three main groups of people present in the hawala system are,

- Sender: A person who wants to send money to someone else in a different location.

- Hawaladars or Hawala Dealers: These people carry out the transaction. They collect the money from the sender and pay it to the receiver.

- Receiver: A person who receives money from the sender through

hawaladars.

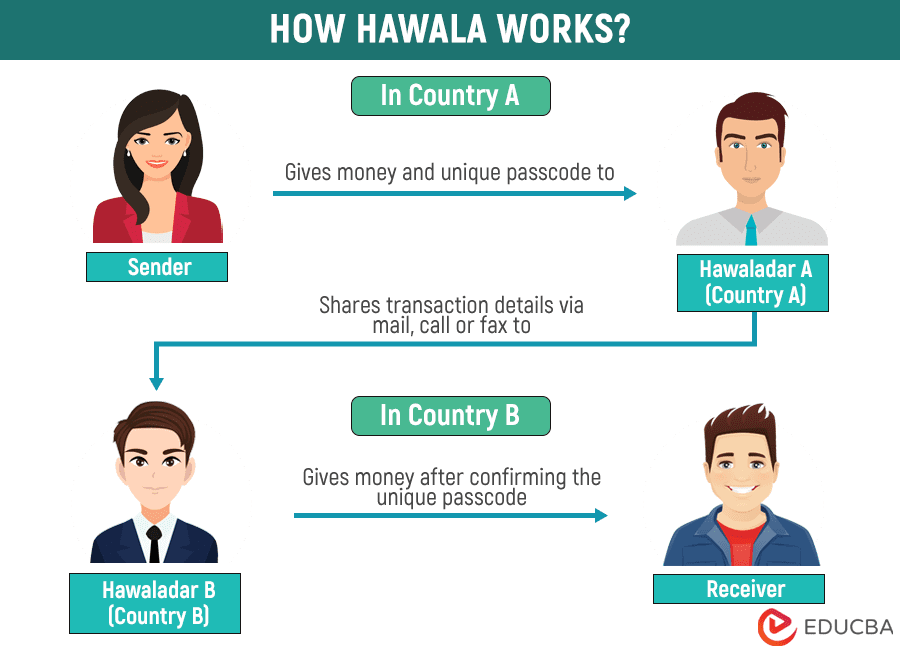

How Does Hawala Work?

Imagine a sender from country A who needs to send money to the receiver in country B. The money transfer involves the following steps:

Step #1: Approach the Local Hawala Operator

- The sender approaches the local Hawaldar A from country A, who has its counterparts in country B.

Step #2: Handling Funds and Authentication Code to Hawaldar A

- The sender gives the receiver’s details and hands the money and fees in local currency to Hawaldar A.

- Hawaldar A also receives a password code or any other authentication details from the sender.

- Meanwhile, the sender gives the same authentication code to the receiver.

Step #3: Hawaladar A contacts Hawaladar B

- Now, Hawaldar A contacts their counterpart or correspondent, i.e., Hawaldar B, in the recipient’s country (country B).

- Hawaldar A also provides information about the receiver and the amount to transfer.

Step #4: Hawaldar B gives money to the Receiver

- The receiver provides the authentication code to Hawaldar B.

- After verification, Hawaldar B delivers the desired money to the receiver.

- The mode of payment can be in cash or electronic transfer, depending on the agreement.

Step #5: End of the Transaction

- The transaction is complete after the receiver receives the money

- There is no official documentation or records of the transaction.

- Hawaldar A and Hawaldar B share their fees or commission to complete the settlement.

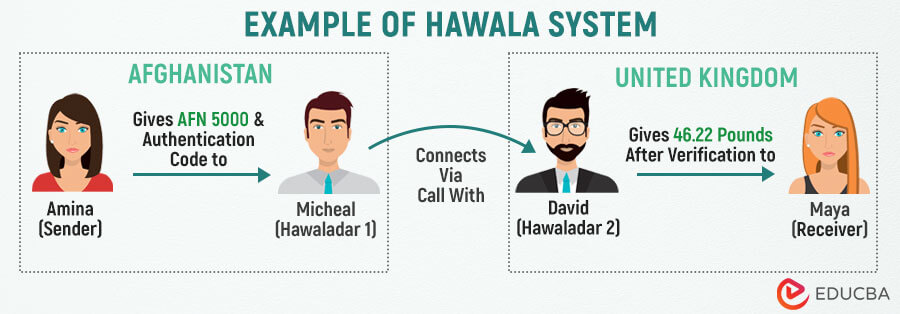

Hawala Example

Let’s consider an example to understand how this system works.

Suppose Amina, who lives in Afghanistan, wants to send AFN 5,000 to her cousin Maya in the United Kingdom (AFN 5,000 = Approximately 46.22 Pounds). Amina contacts Micheal, a hawaladar in Afghanistan, and gives him the money, along with Maya’s name, address, and an authentication code. She also provides the same authentication code to Maya.

Micheal then contacts David, a hawaladar in the United Kingdom where Maya resides. Both Michael and David are registered hawaladars as per their country’s laws. Micheal provides David with the transaction details and authentication code.

Later, Maya and David meet in person, where Maya provides the authentication code Amina gave her. When David confirms her identity, he transfers 46.22 Pounds to Maya.

Finally, both Micheal and David charge commissions or fees for their services.

Real-World Cases

Case #1:

In 2019, the French and Italian arrested a criminal group (19 suspects) in Europe as part of a money laundering operation carried through hawala transactions. The authorities seized gold worth almost €1 million.

Case #2:

In February 2023, the Indian Enforcement Directorate conducted raids on 12 places in West Bengal. The investigation from the Income Tax department suggests that a famous business group from Kolkata transferred Rs 300 crore illegally using hawala.

Hawala Methods

- Wire Transfer: It is a quick and easy money transfer method where the hawaladars transfer funds electronically between their accounts or the accounts of another trusted person.

- Promissory note: Hawaladar may give a promissory notice to the sender as a guarantee note stating that they will transfer the amount to the recipient.

- Over-Invoicing and Under-Invoicing: People exchange goods instead of money in trade-based hawala. The value of goods is usually the same as the amount of money.

- Money Muling: Sometimes, hawaladars physically transfer smaller amounts across borders to avoid suspicion.

- Smurfing: Smurfing involves breaking up large amounts of money into smaller transactions to avoid detection by legal or regulatory authorities.

- Remittance Settlements: Hawaladars usually maintain temporary internal transaction records so they can later settle their debts through mutual agreements.

Features

- Informal Method: It does not involve traditional or formal transfer methods like banking.

- Non-Physical Money transfer: The sender does not need to personally send money to the receiver as the transfer occurs through a mediator, usually hawaladars.

- Fast Transfer: The transfer of money takes place within a few hours or minutes.

- Minimal Paperwork: There is no requirement for legal documentation or any formal paperwork to transfer money.

- Risk of Misuse: This unconventional transfer mode may result in illegal or illicit activities, such as money laundering, terrorist activities, etc.

Country-Wise Regulations on Hawala

1. United States

The United States government has regulations for informal fund transfers. The United States Patriot Act of 2001 requires individuals to obtain a special permit to engage in money transfer services.

2. United Kingdom

It is legal in the UK, but individuals must register with HMRC (H.M. Revenue and Customs) to perform hawala transactions.

3. Afghanistan

There are over 300 money exchangers registered as self-regulatory organizations. These organizations have specific rules and regulations that members must follow to facilitate a transparent transaction system within the country.

4. United Arab Emirates (UAE)

The Central Bank of the UAE (CBUAE) regulates and monitors hawala in UAE. As per the CBUAE’s regulation, individuals performing these activities must hold a Hawala Provider certificate.

5. India

In India, the Foreign Exchange Management Act (FEMA) and the Prevention of Money Laundering Act (PMLA) regulate illegal foreign exchange, including hawala transactions.

Advantages & Disadvantages

| Advantages | Disadvantages |

| It is a quick and easier way to transfer money. | Many countries have banned this system, making sending money to those countries difficult. |

| There is no need to open bank accounts in the recipient’s country. | Criminals may misuse this practice system for illegal activities. |

| Hawaladars usually charge lower fees for their services. | There is a potential loss of money if the dealer is a fraud. |

| Transactions are private, and there is no official record of any transactions. | It is difficult to track and monitor, and there is a lack of transparency and no record of transactions. |

Frequently Asked Questions (FAQs)

Q1. Is hawala illegal?

Answer: Yes, hawala is illegal in many countries, such as the US. However, certain countries allow it if the hawaladars follow the required rules and have the right permissions.

Q2. What are the punishments for hawala in India?

Answer: In India, hawala transactions are illegal under the Foreign Exchange Management Act (FEMA) and the Prevention of Money Laundering Act (PMLA). Under FEMA, the monetary penalty is three times the sum involved in that infringement or up to ₹2,00,000.

Although there is no direct punishment for it under PLMA, any individual caught money laundering using hawala can receive a 3-7 year prison sentence. They may also have to pay a fine of ₹5,00,000.

Q3. Who controls hawala transactions?

Answer: Any legal authority or institution does not regulate hawala transactions. Instead, a network of trusted individuals operates this system by facilitating money transfers based on personal relationships and mutual trust. This informal system is usually legal, but some may also misuse it for illegal activities.

Q4. Differentiate between hawala vs. money laundering.

Answer: Hawala and money laundering are concepts related to financial transactions. However, there are a few differences between them, which are as follows:

| Hawala | Money Laundering |

| It is a system of transferring money across locations. | It is a criminal activity where the person makes illegally obtained funds appear legitimate. |

| The purpose is to transfer money for legitimate purposes such as family support. | Money laundering aims to convert black money into white (legal). |

| It is not exactly illegal unless used for unlawful activities. | It includes various crimes, like drug trafficking, corruption, fraud, etc. |

Recommended Articles

This is a comprehensive article on Hawala. It includes a detailed explanation of how it works, who are the participants, what are the regulations and features, etc. We have also added a few real-life examples. You can go through the following EDUCBA articles for more details.