Updated November 2, 2023

Difference Between Hedge Fund vs Mutual Fund

A hedge fund is an investment partnership that maintains a portfolio of investments to generate returns through advanced investment and risk management strategies. The fund raises capital through private placement and pools the money of a few qualified wealthy investors along with the fund manager’s money. A mutual fund is an investment vehicle wherein many investors pool their money to exploit the benefits of diversification and expert fund management. The minimum investment levels are usually very low and affordable for retail investors with limited disposable income.

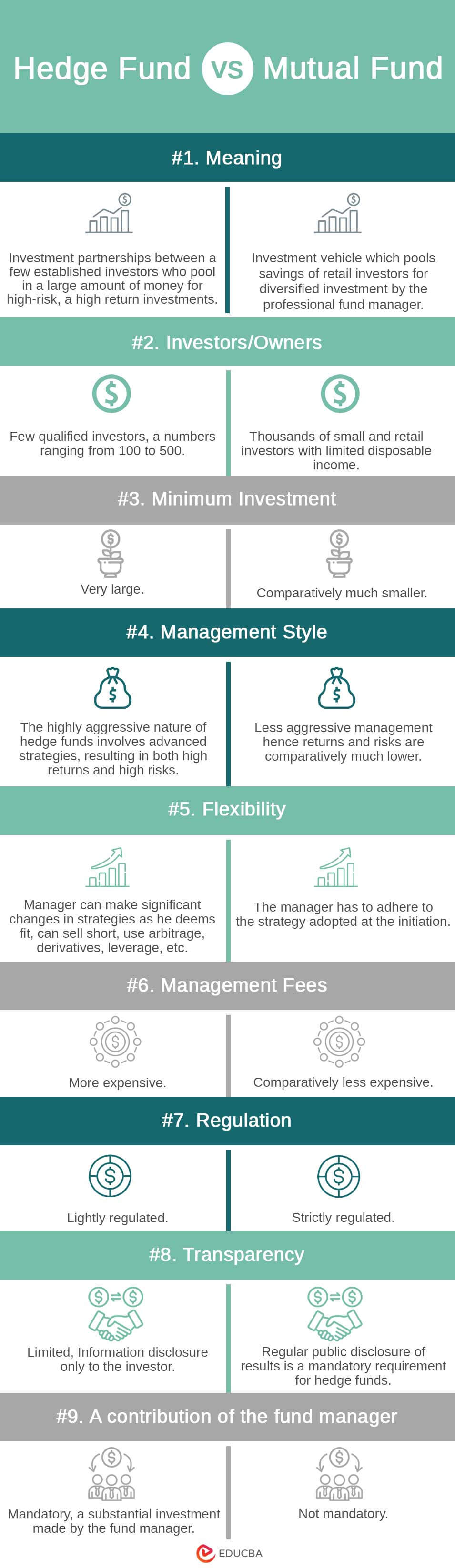

Hedge Fund vs Mutual Fund Infographics

Below is the top 9 difference between Hedge Fund and Mutual Fund:

Key Difference Between Hedge Fund vs Mutual Fund

Below is the list of points describing the difference between a Hedge Fund and a Mutual Fund:

- While a hedge fund is an investment partnership consolidating funds from a few established investors who could be high net worth individuals (HNIs), pension funds, endowment funds, etc., mutual funds are investment vehicles pooling money from several retail investors who seek diversification of their investment and professional management of their funds for generating higher returns at lower risk.

- Hedge funds are characterized by a small number of large investments, which could be a minimum of Rs 1 crore for each investor, while mutual funds constitute a large number of small investments, which could be as low as Rs 500 for an investor.

- The goal of a hedge fund is to maximize returns from the investment, while the goal of the mutual fund is to generate returns over and above the risk-free rate of return/benchmark returns.

- Hedge fund managers hold a substantial share of the fund through their investment, while mutual fund managers are not mandatorily required to invest in the fund.

- Hedge funds are virtually unregulated and, hence, can pursue a wide range of high-risk strategies without requiring public disclosure of information. Regulators heavily oversee mutual funds, with the most important requirement being the safety of the investors. Hence, these funds must pursue strategies within the set objectives and ensure regular public performance disclosure.

- Hedge fund management fees are based on the performance of assets and usually work on a 2/20 basis, comprising a 2% charge as annual management fees and 20% of net profits. Hedge fund managers do not share the losses. For mutual funds, management fees are based on a percentage of assets managed.

- Hedge fund investments usually have a lock-in period of 3 years, after which redemption is made in blocks. Investments in most mutual funds (open-ended funds) can be easily redeemed with a much shorter lock-in period. Hence, they are comparatively more liquid instruments.

- Mutual funds must publicly price their shares daily (Net Asset Value) and provide quarterly disclosure of their asset allocation, whereas hedge funds have no such obligations. Hedge funds can selectively make their private placement memorandum available to potential investors, while mutual funds must make their prospectus available on request.

- The minimum investment levels are generally very high; hence, it is meant for something other than small retail investors. The fund manager uses the pooled resources to invest in a diversified basket of tradable securities in a capital market, like stocks, bonds, money market instruments, etc., for a common goal.

- Mutual funds are strictly regulated and cannot deviate from their purpose or their ambit of allowable strategies/securities. Hedge funds are not strictly regulated and can be managed aggressively to generate high returns.

- A risk factor is also very high for these funds since strategies like short-selling securities, trading in complex derivative instruments, investment in deep discount securities, using leverage (borrowing) to increase returns, etc., are undertaken to enhance returns.

Head To Head Comparison Between Hedge Funds vs Mutual Fund

Below is the Topmost comparison between Hedge Funds vs Mutual Funds:

| The Basis Of Comparison | Hedge Fund | Mutual Fund |

| Meaning | Investment partnerships between a few established investors who pool in a large amount of money for high-risk, a high return investments | An investment vehicle that pools savings of retail investors for diversified investment by the professional fund manager |

| Investors/Owners | Few qualified investors, with numbers ranging from 100 to 500 | Thousands of small and retail investors with limited disposable income |

| Minimum investment | Very large | Comparatively much smaller |

| Management Style | The highly aggressive nature of hedge funds involves advanced strategies, resulting in both high returns and high risks. | Less aggressive management hence returns and risks are comparatively much lower |

| Flexibility | Manager can make significant changes in strategies as he deems fit, can sell short, use arbitrage, derivatives, leverage, etc. | The manager has to adhere to the strategy adopted at the initiation |

| Management fees | More expensive | Comparatively less expensive |

| Regulation | Lightly regulated | Strictly regulated |

| Transparency | Limited, Information disclosure only to the investor | Regular public disclosure of results is a mandatory requirement for hedge funds. |

| A contribution of the fund manager | Mandatory, a substantial investment made by the fund manager | Not mandatory |

Conclusion

Both Hedge Funds and Mutual Funds are investment vehicles in which many investors pool their money to be professionally managed and invested in a portfolio of investments. Save this one similarity between Hedge Funds vs. Mutual Funds; these funds differ in every other aspect owing to the difference in pace and strategies adopted. Unlike mutual funds, hedge funds involve large minimum investments. They are open to only accredited investors with a net worth of more than $1.5 million or an income of more than $200,000 annually. Being virtually unregulated, they can borrow any amount to bet big and enhance their returns. Hedge funds can invest in any stock class, including highly risky or speculative asset classes, which do not allow for mutual funds like packaged subprime mortgages.

Hedge funds can also invest in highly concentrated portfolios, unlike mutual funds, which must stay diversified to protect investors’ investments. Owing to this highly aggressive management style in the case of hedge funds, returns generated are much higher than mutual funds, even during bear phases.

Thus hedge funds are affordable and feasible only for the financially well-off who are aggressive risk seekers. Since deposit level, risk level, and expense ratio are much higher with low liquidity and transparency, first-time typically advise depositors to stay away from these funds until they have gained experience in the investment field. In contrast, mutual funds target retail investors who are comparatively risk-averse but prefer to see their money grow over a long-term period.

You should use a mutual fund if you have limited resources or are a first-time depositor. If you are wealthy enough to qualify for a hedge fund, have considerable investment experience, and like to take a risk, you can invest in a hedge fund.

Recommended Articles

This has been a guide to the top difference between Hedge Fund vs Mutual Fund. Here we also discuss the Hedge Fund vs Mutual Fund key differences with infographics and a comparison table. You may also have a look at the following articles –