Hedge Fund Course Details

Let’s get this straight. Hedge Funds are a tough nut to crack. And you would agree that learning on your own takes toil on your psyche. Why not do something to ease up on your effort? Why not transform years of learning time into hours? Can you do it? Actually, you can. And here we will show you how.

This Hedge Fund Training Course is a bundle of 8 courses with 20+ hours of HD video tutorials and Lifetime Access. Along with this professionally made training program, you get verifiable certificates for each of the eight courses!

This Hedge Fund course is designed for students and professionals who want to master private equity skills. These tutorials start from the basics and train you on advanced concepts using practical case studies

- About Hedge Fund Course

- Hedge Fund Course Curriculum

- What is Hedge Fund

- Which Tangible Hedge Fund Skills you will learn in this course?

- What are the requirements / pre-requisites to this Training?

- Target Audience for this training

- Hedge Fund Course FAQs

- Career Benefits of this training

- Sample Preview of this course

- Hedge Fund Course Reviews / Testimonials

About Hedge Fund Course

| Course | Hedge Fund Course | |

| Deal | This is 8-course bundle. Please note that you get access to all 8 courses. You do not need to register for each course separately. | |

| Hours | 20+ Video Hours | |

| Core Coverage | Hedge Funds Basics, Classic Strategies in Hedge Funds, Important Hedge Fund Strategies, Performance Analysis, Concept of Leverage, Hedge Fund Accounting & Taxation, Hedge Fund Risk Management, Case Studies | |

| Excel Templates Included? | Excel templates that were used are provided as a download | |

| Course Validity | You get Lifetime Access. No limit on the number of times you can view this course. | |

| Eligibility | No eligibility as such. You should have a keen interest in learning. | |

| Pre-Requisites | None. If you have basic knowledge of accounting, it will be great. However, if you do not have one, then you must complete the accounting modules in the bundle first. | |

| What do you get? | Certificate of Excellence for each of the 8 courses | |

| Certification Type | Course Completion Certificates | |

| Verifiable Certificates? | Yes, these are verifiable certificates. This means that you will be provided with a unique URL/Link which you can include in your resume/Linkedin profile for online verification. | |

| Type of Training | Video Course – Self-Paced Learning | |

| Software Required | Excel | |

| System Requirement | 1 GB RAM or higher | |

| Other Requirement | Speaker / Headphone |

Hedge Fund Course Curriculum

The course description is an important part for you to understand how we have sequenced the course for maximum learning. This course is not for everyone. You can learn this course if you’re willing to delve deep into hedge funds. Here is a brief overview of the course, which will help you understand what you will get.

View Curriculum

| S. No | Course Name | Description |

| 1 | Hedge Fund Basics | First, it’s important to build the foundation. So we took special care to make it easy and lucid. In this section, we have included the definition and brief overview of the hedge fund. You will also get to know the history of hedge funds and how it got started. We will also highlight the merits and demerits. And then, we will talk about legislation, fee structure, current trends, and finally the difference between hedge funds & mutual funds. |

| 2 | Classic strategies in Hedge Funds | In this section, we will delve deep. Once you have a brief idea about how a hedge fund works and how one operates it, now it’s time to understand the strategies applied in hedge funds. You will learn the leverage of Hedge Fund strategies. And we will not only give you theories but will explain everything through case analyses. You will also get to know long-only strategy, short-only strategy, what is short bias and long bias, and examples of the same. |

| 3 | Important strategies in hedge funds | In this section, you will learn about multi-strategy. Other than that, you will also learn credit strategy, event-driven strategy, and global macro strategy and their examples. There are a ton of things to learn. And if you keep on learning, you would find them irresistible at times. |

| 4 | Hedge fund performance analysis: | Once you have an idea about the strategies, then you need to go to the most important part of the course. And that is how you would be able to analyse the performance of hedge funds. You will learn high water mark calculation, traditional performance measures, CAPM, Sharp Ratio, Sortino Ratio and many such tools and techniques. You will also get to know the software available for the same. |

| 5 | Concept of leverage in hedge funds | As we have already mentioned in the brief overview that leverage in hedge funds is used a lot frequently; you will learn this here. In this section, you will understand the concept of leverage in hedge funds, how you can measure leverage in hedge funds, what strategy to use, how hedge funds can gain leverage and what can go wrong. This is a comprehensive course, thus we go in detail analysis of everything you need to learn to be able to acquire the required skills. |

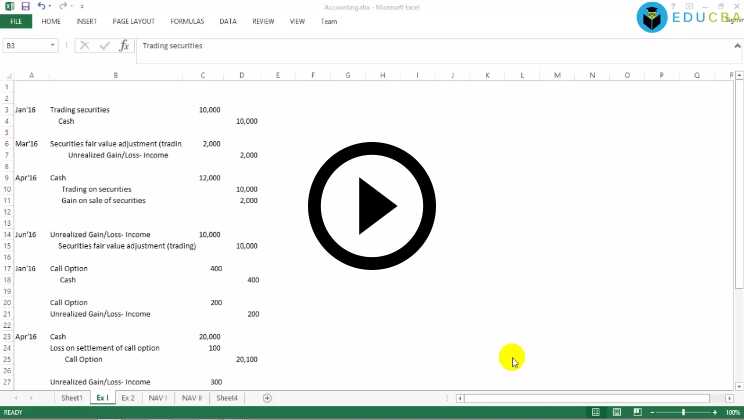

| 6 | Hedge funds accounting and taxation | Most courses never talk about this part of hedge fund; however, this is one of the most important parts of hedge funds. You need to know the accounting and taxation part of hedge to be able to be useful to companies and investors. You will learn from structure of hedge funds, carried interest, Bermuda to accounting, accounting entries, interest rate, NAV calculation and more. |

| 7 | Risk management of hedge funds | Now once the accounting and taxation part is done, the course will take you to learn risk management of hedge funds. You will learn risk exposure, measure of risk, value at risk (VaR) and many more simulations and techniques. |

| 8 | Case Studies | The final section we have kept to discuss the success and failure of hedge funds. In this section, you will be able relate to whatever you have learned this far. Most courses don’t understand the value of application. Without application theory has no value. So we go in detail and explain you how you can relate to the real life case studies with the concepts you have learned in this course. |

Now you can see for yourself how comprehensive this entire course is. You will learn everything you need to learn about hedge funds. There is almost no course available in the market which can provide you so much value.

And all you need to invest in 20+ hours of your time and you’re done. We did the hard work of assimilating 115+ lectures so that you can just watch them and learn.

What is a Hedge Fund?

View

Hedge fund includes two sorts of partners. One partner is called general partner and other partners are called limited partners. In lucid way, the general partner of a hedge fund is the fund manager who manages the money. Then what the limited partners do? They invest money into the fund.

But you may wonder why the limited partners invest money into a fund? They invest fund to maximize the return on investment, of course, that is given. But there is another part to this equation and that’s why this fund is called hedge. The limited partners expect the general partner (fund manager) to eliminate risk altogether from the investment.

There may be another question lurking in your mind – why they invest into hedge fund and not any other fund! The basic answer is hedge fund promises to maximize their return irrespective of market performance.

Here are some of the features of hedge fund. Let’s have a look –

- Only qualified investors are eligible for investing into hedge funds: Yes, not all investors are qualified for investing into hedge funds. And your net worth has a lot to do in this case. Usually, you need to have a net worth of US $1 million excluding your residence to be qualified to invest into hedge funds.

- Wider investment arena: Hedge fund can invest on anything to make money. It can be stocks, real estates, land, derivatives or currencies. It depends on the decision taken by the particular hedge fund.

- Leverage is often applied in hedge funds: To maximize the return of hedge funds, the idea is to always borrow money and apply leverage.

- Fee: If you want to invest in hedge fund or want to learn the nitty-gritty of it, you need to have knowledge about the fee. Usually, hedge funds charge in both ways – a management fee of 2% and a 20% cut on any gains generated.

We have given a brief overview of the hedge fund so that now you can understand where this course is coming from. This course is a comprehensive course which will help you learn the technical skills to handle hedge funds. You can get hired by a company in your initial stage and later on you can become a fund manager for hedge fund. The opportunities are really limitless once you learn the skills.

Which Tangible Hedge Fund Skills you will learn in this course?

View

You will learn the nuts and bolts of Hedge Fund skills including the following –

- Core concepts of Hedge Funds

- Hedge Fund Strategies

- Hedge Fund Performance Analysis

- Hedge Fund Accounting and Taxation

- Concept of Leverage

- Risk Management of Hedge Funds

What are the requirements/prerequisites to this Training?

There are few requirements which you need to have for doing this course. Yes, not everyone is eligible for this course. Let’s have a look at the prerequisites below –

- Willingness: The first thing is willingness. You shouldn’t do this course because you have to. If you are not willing to do this course by yourself, you won’t be able to appreciate the merit of this course. We crafted this course with lot of effort and after researching and investing hours and hours of work so that this can be useful for you.

- Basic knowledge in finance: Though this is not mandatory, but if you have a basic finance knowledge, it will help you understand the concepts of hedge funds. You cannot just get into this course and understand everything upfront.

- A computer and an internet connection: We have made this course in such a manner that you don’t need to worry about place, time and convenience. If you want to take this course, all you need is a computer and an internet connection and you would be good to go.

- Resilience to finish this course: You would agree that not everyone would like to go into complex things. Hedge funds are complex and you need to have enough patience and perseverance to put in 21+ hours into the material. And then you need to practice everything that you learn if you want to transform your knowledge into your skills.

Target Audience for this course

- Finance students: Finance students who want to go into hedge funds should do this course. If you are in graduation or pursuing post-graduation and want to pursue a career in hedge fund, this comprehensive course will help you most.

- Finance professionals: People who are doing jobs in financial domain will also get benefit out of this course. If you’re in hedge fund, you would already know some parts of it. This course then may act as a refresher course for you. Otherwise, you can also use this course to learn from scratch if you’re currently not in hedge funds.

- Consultants/CEO/Fund managers/Entrepreneurs: People who are in similar field or want to start their own hedge funds should know what hedge fund is all about and how it is being operated. And once you do this course, you would know everything you need to know about hedge fund. Look at the course description and you would understand how comprehensive the entire course is.

Hedge Fund Course FAQs

Why should I do this course at the first place?

The primary reason is this course will add tremendous value to your professional qualifications. You would not only gain insights and learn concepts; but you will also be able to apply them whenever you feel you need to (even if you are not in hedge fund).

There are many courses in the market; why should I do this particular course on hedge fund?

There are several reasons. First this course is comprehensive. There are no courses available in the market which can teach you hedge funds in less than 25 hours like this course. Secondly, you would get this course not only to know, but to apply in professional setting. Because this course is made possible by industry & domain experts! Thirdly, this course is accessible to you at any place, anywhere you choose to learn. All you need is a laptop/computer and an internet connection.

If I am not from hedge fund or don’t want to go in, should I do this course still?

The answer is both yes and no, because it completely depends on personal preference. This course can be learnt if you have a little knowledge in finance. So if you are in finance, but don’t have much idea about hedge funds, you can certainly do this course.

Where do learners come from?

WallStreetMojo’s courses have been preferred by professional across the globe. Top places include New York, San Francisco, Bay Area, New York, New Jersey, Houston, Seattle, Toronto, London, Berlin, UK, Dubai, Riyadh, UAE, Singapore, Australia, New Zealand, Hong Kong, Bangalore, New Delhi, Mumbai, Pune, Kolkata, Hyderabad and Gurgaon among many.

Can i see the Demo Videos?

Yes, you can view the demo videos below.

What are the Payment Options?

You can pay by Credit Card, Debit Card or Net Banking from all the leading banks. Additional payment options include pay by PayPal and 2checkout.

Career Benefits of this Hedge Fund course

There are multiple career benefits. Here are the most important ones –

- Adds tremendous value to your candidature: Imagine that you have a plan look for hedge fund jobs soon after you complete your degree. And you have another friend who has the same plan as yours. Now, while pursuing your degree, you are also availing this course; and your friend is only pursuing her degree. Once you do this course, your candidature would be much more to an organization than your friend.

- This course hand-holds you till you learn on your own: There is an easy way to reduce your time of learning. And you can do it by learning from a mentor. Think about all the industry experts and trainers of the hedge funds market come together and hand-hold you to learn hedge funds till you are ready to go out in the market and apply. Won’t you do better in your professional life?

- Apply in your own investments: If you’re thinking of starting a hedge fund or investing in a hedge fund and you don’t have any idea where to start, you can start with this course. Once you’re done with the course, you would be ready to take the plunge.

Sample Preview of this Hedge Fund course

Course Testimonials

-

-

I will appreciate if the faculty for course is disclosed so that the student can personally appreciate the teacher. The structure of the course was practical oriented. The course content was up to the mark and all basic features were well emphasized. Overall a good course.

Linked

-

-

-

Amazing course to get into hedge funds. Easily explained in well comprehensible english by the narrator. I look forward for the same kind of information throughout this learning package. I’ve written down some notes so that I can review everything before going into Hedge Fund one day.

-

-

-

I have worked in the Hedge Fund Industry for 5 years, and this course has given me an amazing experience of what I have learned in the past. I have done much research in find a school that offers hedge fund courses and found this course perfect to help suit my needs. Learnt few more new things in this course which helped me to enhance my skills.

Linked

-

-

-

So far its been more than I ever expected it to be!, loved it! The academic side of things is also great as the lectures are informative and lecturers are willing to help us to achieve are maximum potential. The course is awesome, learning so much whilst not being overwhelmed by new material. Thoroughly satisfied this training.

Linked

-

William A. Ellis

I learned a lot about hedge fund. Great website, great information. Course provides you clear concepts of strategies in hedge funds, performance analysis, risk management in hedge fund and various other concepts. Due to practical case study the course has become easier to understand.

Linked