Updated July 17, 2023

What are High Yield Bonds?

The term “high yield bonds” refers to those bonds rated below the investment grade by the leading credit rating agencies. As such, these bonds are considered to have a higher risk of default than other bonds; hence, these bonds offer higher returns to compensate the investors for the higher perceived risk.

Established capital-intensive companies typically issue high-yield bonds with high leverage ratios or new companies that have yet to prove their credentials.

Explanation of High Yield Bonds

It is characterized by lower credit ratings from the rating agencies, such as a rating below Baa3 from Moody’s or below BBB- from S&P. Such bonds are considered high-risk and speculative and must offer a higher yield. Historically, it exhibits a higher propensity to default than investment-grade bonds. Although most high-yield bond issuers are either capital-intensive firms or startup companies, some of these bonds are issued by fallen angels who lost their good credit ratings over time.

Features of High Yield Bonds

Now, let us look at some of the most common features of high-yield bonds:

- These bonds are rated at non-investment grade credit rating.

- As the name suggests, these bonds offer significantly higher yield vis-à-vis the investment grade bonds.

- Most of these bond issuers have the flexibility to defer interest payments to improve their cash flow position.

- It is usually an unsecured debt obligation for the issuers.

- Covenants are put in place to restrict the issuers from performing any such activities that are detrimental to the interest of the creditors/ lenders.

How to Buy a High Yield Bond?

Interested investors can directly invest in these high-yield bonds through the broker-dealers or indirectly by purchasing shares in exchange-traded funds (ETFs) or mutual funds. These ETFs and mutual funds are the ones that have a portfolio with a greater focus on it.

Types of High Yield Bonds

It can be broadly categorized into the following six types:

- Straight cash bonds: These are plain vanilla bonds that offer a fixed coupon rate, usually paid semi-annually, up to maturity or early redemption, and are paid out in cash.

- Split-coupon bonds: These bonds offer two different coupon rates in the early and later years of the bond. Split-coupon bonds in which the coupon rates increase in the later years are known as step-up notes.

- Pay-in-kind bonds: The issuers of these bonds can either pay the bondholders in cash or additional securities.

- Floating-rate notes: The coupon rate of these bonds is linked to a benchmark, and hence it fluctuates as the benchmark interest rates change.

- Extendable reset notes: The issuers of these bonds can reset the coupon rate and extend the bond’s maturity at a periodic interval or at the occurrence of a specified event. In exchange, the investors can sell the bonds back to the issuers.

- Deferred-interest bonds: The bond issuers can defer the coupon payment to the bondholders until a future date.

Investment in High Yield Bond

The trend witnessed in the investment in high-yield bonds can indicate the economy’s state. If investment in high-yield bonds increases, investors are willing to take risks, which is a sign of optimism in the economy. Conversely, if investment in high-yield bonds declines, investors have turned risk-averse, which shows pessimism in the economy. In this way, the trend in investment in high-yield bonds may be used to predict both expansion or contraction of the economy.

High Yield Bond Rates

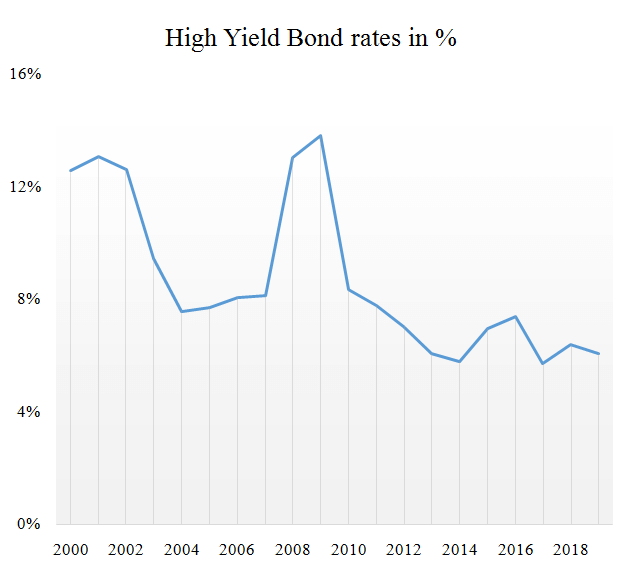

The below table and chart show how high-yield bond rates in the US have varied over the years. It can be seen that the bond rates peaked in 2009 to reach 13.83%, which was during the great recession of 2008-09. After that, the bond rates gradually declined, primarily driven by the declining treasury bond rates.

| Year | Yield in % |

| 2000 | 12.58% |

| 2001 | 13.09% |

| 2002 | 12.63% |

| 2003 | 9.46% |

| 2004 | 7.58% |

| 2005 | 7.70% |

| 2006 | 8.06% |

| 2007 | 8.14% |

| 2008 | 13.06% |

| 2009 | 13.83% |

| 2010 | 8.34% |

| 2011 | 7.79% |

| 2012 | 7.05% |

| 2013 | 6.08% |

| 2014 | 5.79% |

| 2015 | 6.96% |

| 2016 | 7.39% |

| 2017 | 5.72% |

| 2018 | 6.38% |

| 2019 | 6.09% |

Source: FRED Economic Data

Who Issues High Yield Bond?

Established companies usually issue it with high leverage ratios or financial difficulties. On the other hand, smaller and emerging companies also issue high-yield bonds to compensate for their lack of proven track record. Other issuers of high-yield bonds include companies whose financial plans are considered to be highly speculative or risky.

Advantages

Some of the significant advantages are as follows:

- These bonds offer a significantly high spread over treasury securities.

- These securities exhibit a low correlation with other fixed-income securities, resulting in consistently high returns.

- Investors of high-yield bonds are paid off ahead of common and preferred shareholders in case of liquidation. These bonds’ shorter maturity periods help lower the portfolio’s overall duration.

Disadvantages

Some of the major disadvantages are as follows:

- These bonds are more prone to defaults during economic stress than other bonds.

- Given the inherent risks and limited supply, these bonds exhibit low market liquidity, wide bid-ask spread, and high transaction costs.

Conclusion

So, it can be seen that high-yield bonds are beautiful as they can generate returns like equities with risks similar to that of bonds. However, evaluating the risks vis-à-vis the returns is essential to avoid any value trap.

Recommended Articles

This is a guide to High Yield Bonds. Here we also discuss the introduction and features along with advantages and disadvantages. You may also have a look at the following articles to learn more –