What is Horizontal Merger?

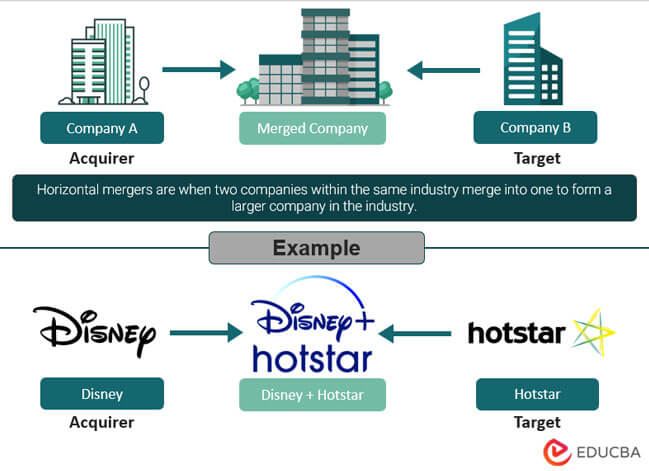

Horizontal mergers are a form of business combination in which two companies within the same industry or business sector merge into one to form a larger company in the industry. The company that merges is the target, and the company it integrates into is an acquirer.

Let’s say there are two companies that make smartphones. Both have many customers and sell similar products. If these two separate companies decide to join together and become one big company, that is what we call a horizontal merger.

Explanation

A critical factor for horizontal mergers is that the two companies in the same industry can be competitors. So they can merge to enter a new market or geography. For example, a foreign company might join with a local company to leverage the local company’s established customers and resources.

Another reason is for a mature company to stay successful by growing. Sometimes, a company grows a lot, becomes a moneymaker, reaches its peak, and still wants to keep growing. Such a company may merge with a minor player in the same industry with newer variants of its own products to stay relevant or boost its growth inorganically in the industry and not get phased out.

Another reason is to benefit from the economies of scale and the synergies that arise from such mergers. When companies of the same industry merge, they gain greater bargaining power in raw material sourcing and can buy materials for cheaper. They also have more control over pricing power in the consumer market. However, the antitrust regulators watch such actions very closely.

Horizontal Merger Examples

Following are examples of horizontal mergers:

1. Disney+ & Hotstar

Disney+ is a streaming platform owned by Disney, and Hotstar is a streaming platform owned by Star Network in India. Instead of entering India’s streaming industry directly, Disney merged with Hotstar and rebranded it as Disney+ Hotstar.

The platform, launched in March 2020, gives Indian consumers access to Disney’s shows and movies. To gain a bigger market share, Disney has removed much of its content from rival platforms like Netflix after launching their streaming service.

2. Integration of Facebook, Whatsapp, Instagram & Messenger

It is one of the best examples of horizontal mergers of present times. All of these were independent social media platforms started by different companies and one after another.

Over time, they integrated into a single, large social media company led by Mark Zuckerberg, now known as Meta Platforms Inc. Each platform retains its independence despite the integration, and the individual websites remain intact. However, users can interact freely across the platforms operating on a single network.

In part, the merger with WhatsApp intended to implement end-to-end encryption technology to protect user privacy. Integration is a growth strategy for Facebook, which has reached maturity.

3. PepsiCo & Rockstar

In March 2020, PepsiCo made headlines when it announced its plan to acquire Rockstar for $3.85 billion. It wanted to expand its presence in the energy drink market and gain a competitive edge against rivals such as Coca-Cola. This acquisition was a combination of horizontal and vertical mergers, as Rockstar is not only one of PepsiCo’s distributors but also a famous energy drink brand.

By acquiring Rockstar, PepsiCo aimed to strengthen its position in the market alongside its other energy drink products, such as Mountain Dew. With Red Bull currently leading the energy drink category, PepsiCo hopes to gain deeper penetration into the market. However, as the acquisition is a recent development in the beverage industry, they are yet to finalize the deal.

4. Frito Lay & Uncle Chipps

Amrit Agro Ltd. was a New Delhi-based company that owned and produced the “Uncle Chipps” potato chip brand, which dominated up to 70% of the Indian market until 1998.

In 2000, Frito Lay, a competitor owned by Pepsi, acquired Uncle Chipps along with their existing brand Ruffles Lay’s, which had already entered the Indian market.

The merger allowed Frito Lay to expand its potato chip portfolio and penetrate the Indian market further. Despite the acquisition, Uncle Chipps has retained its name and popularity among Indian consumers. However, it did not rebrand its brand to avoid losing its market share.

5. T-Mobile & Sprint

T-Mobile and Sprint merged in a big $26 billion merger to get more customers – they were trying to reach 100 million! They did this to compete better with other phone companies like AT&T and Verizon.

With this merger, T-Mobile aimed to speed up the progress of 5G technology and enhance the customer experience multi-fold. It also aimed to give people better network coverage and more value for money by combining the good things from both companies.

More Real-World Horizontal Mergers Examples

|

Year |

Horizontal Merger |

Synergy Effects |

| 1998 | Exxon and Mobile | They were able to reduce their costs by eliminating redundancies, consolidating operations, and streamlining supply chains. |

| 1999 | MCI and WorldCom | Merged telecom company became one of the significant players in the industry, with the scale and resources to compete more effectively against its rivals. |

| 2004 | JPMorgan and Bank One | The merger allowed JP Morgan to expand geographically and compete with other banks. |

| 2006 | Procter & Gamble and Gillette | Through the merger, P&G increased its market share in key product categories (razors, blades, and batteries). |

| 2008 | Delta Air Lines and Northwest Airlines | The combined company cut costs by eliminating duplicate functions and reducing staff, resulting in $2B in annual savings. |

| 2015 | Dell and EMC | Merged entity gained broader tech expertise and resources, invested heavily in R&D, and brought innovative products to market faster. |

| 2016 | Dow Chemical and DuPont | Merger aimed to create a stronger, more efficient company for better global market competition. |

| 2017 | Amazon and Whole Foods | The merger allowed Amazon to leverage a physical retail network of grocery stores for online delivery expansion. |

| 2018 | Disney and 21st Century Fox | Disney acquired 21st Century Fox’s movie and TV assets, including popular franchises like X-Men and Avatar. |

| 2021 | WarnerMedia and Discovery Communications | The merger between the two networks created cross-promotion opportunities for more comprehensive viewer options. |

Horizontal Mergers in Various Industries

Healthcare: In the healthcare industry, horizontal mergers involve consolidating healthcare providers or organizations that offer similar services in the same region. While this can lead to cost savings and greater bargaining power, it can also raise concerns about reduced competition, higher prices, and limited access to care.

Regulators like the Federal Trade Commission and the Department of Justice should carefully evaluate proposed mergers to protect consumers and ensure compliance with antitrust laws.

Media and Entertainment: The primary driver for horizontal consolidation in media and entertainment is the need to increase market share and bargaining power with advertisers and distributors. The merger can lead to cost savings, increased investment in technology, and better content creation.

Banking and Financial Services: Horizontal mergers in banking and financial services can create more prominent and diversified institutions that are more competitive. Consolidation can lead to cost savings, increased investment in technology and innovation, and expansion into new markets.

Retail: In the retail industry, horizontal mergers can help companies diversify their product offerings and enter new markets. However, they require regulatory approval to prevent anti-competitive behavior or monopoly practices.

Technology: Horizontal mergers in technology can help companies expand their product offerings, customer base, and access to new markets. However, they face regulatory scrutiny and potential conflicts with existing partnerships and alliances.

Final Thoughts

Horizontal mergers have existed for a long time but can still face challenges with antitrust laws. Regulators in different parts of the world have stopped or delayed many big unions to prevent the creation of monopolies and protect consumers.

Frequently Asked Questions (FAQs)

Q1. Give horizontal Merger examples in the agriculture industry.

Answer: The merger between Dow Chemical and DuPont in 2017 into a new company DowDuPont is a prominent example of a horizontal merger in the agricultural industry. They had a significant presence in the industry through their respective agricultural divisions, Dow AgroSciences and DuPont Pioneer. The new company became the largest seed and pesticide company in the world and was able to compete with other major players in the industry.

By merging, they could pool their resources and expertise in seed production, crop protection, and agricultural biotechnology to develop new products and technologies. They were also able to streamline their operations and expand their market share in the agriculture industry.

Q2. What are some horizontal Merger examples in the fashion sector?

Answer: In 1999, fashion houses Yves Saint Laurent (YSL) and Gucci, known for their high-end luxury goods, merged and created a powerhouse in the luxury fashion industry. The merged company was called Gucci Group and became a significant player in the fashion industry.

They combined their resources, expertise, and brand recognition to create a more diverse portfolio of luxury products. They also lowered their costs, achieved more significant economies of scale, and improved their distribution network. YSL had expertise in women’s fashion, while Gucci was an expert in men’s fashion. The merger allowed the new company to offer a comprehensive range of luxury products.

Q3. Give horizontal Merger examples in the travel and tourism industry.

Answer: The merger between Marriott International and Starwood Hotels and Resorts Worldwide in 2016 is an excellent example of a horizontal merger in the tourism industry. Both companies were major players in the hotel industry, with Marriott operating over 30 hotel brands and Starwood managing 11 hotel brands.

The new company, now known as Marriott International, offers its customers a broader range of choices across its many brands, including Marriott, Sheraton, Westin, Ritz-Carlton, and St. Regis. The new company has over 5,500 hotels and 1.1 million rooms worldwide and has a diverse range of properties in the broader geography. They were able to save costs through the consolidation of operations, marketing, and technology systems.

Q4. What are examples of a horizontal merger and a vertical merger?

Answer: The merger of American Airlines and USAirways in 2013 is a classic example of a horizontal merger. The consolidation allowed them to combine their resources, increase their market share, and enhance their overall competitiveness in the airline industry.

An example of a vertical merger is the 2018 AT&T and Time Warner merger. While AT&T is a telecommunications company, Time Warner owns various media and entertainment properties. The union allowed AT&T to control both the creation and distribution of content and gain access to a wide range of media properties to offer their customers.

Recommended Articles

This is a guide to Horizontal Merger Examples. Here we also discuss the introduction and examples of a horizontal merger, which includes PepsiCo & Rockstar, T-Mobile & Sprint, etc. You may also have a look at the following articles to learn more –