Starting an LLC – Introduction

In recent years, instead of customers visiting a shop, there are new types of businesses that come to the customers. These are mobile businesses that are like shops on wheels. For example, trucks selling delicious food that come right to your neighborhood. There are even vans that groom pets at your home, making it much easier for pet owners. These businesses make life more convenient by bringing services directly to people, saving them time and effort.

Now, if you are starting a mobile business, you must consider opening a limited liability company (LLC). LLCs offer many benefits, including keeping personal assets safe, simplified taxation processes, etc.

In this easy-to-follow guide, you will learn all the necessary steps to start an LLC for your mobile business.

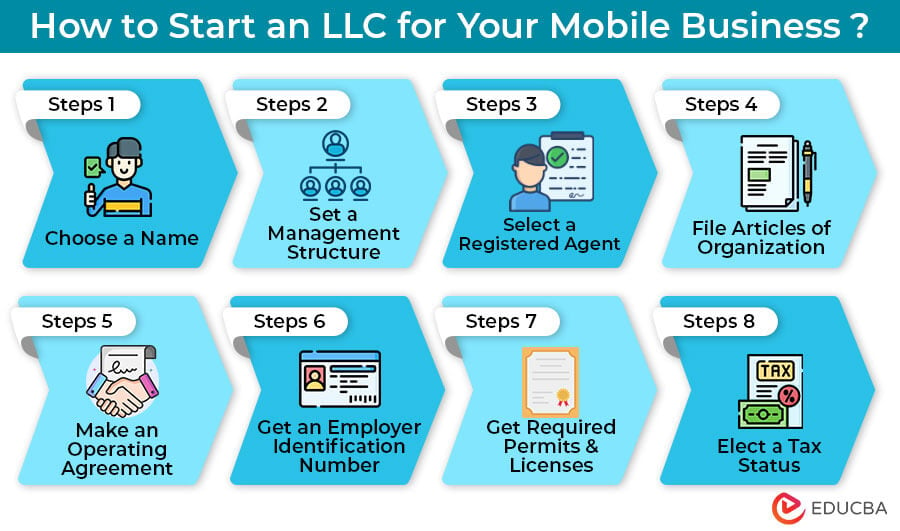

How to Start an LLC for Your Mobile Business? (Stepwise Guide)

Here are the steps to start an LLC:

- Choose a Suitable Name

- Determine the Management Structure

- Select a Registered Agent

- File Articles of Organization with the State

- Create an Operating Agreement

- Get an Employer Identification Number

- Get Required Permits & Licenses

- Elect a Tax Status

Let us explore how to start an LLC for your mobile business in detail.

1. Choose a Suitable Name for Your LLC

Your business name serves as the first impression on potential customers. Therefore, selecting your LLC name is an important step for your mobile business.

Good business names generally have the following characteristics:

- It should be short and unique

- It must be easy to spell and remember

- It should express the brand’s identity so customers connect with your business.

- It must include keywords to help with SEO and boost your online visibility.

- It must convey good feelings to the consumers, leaving a favorable impression.

- It should be versatile to accommodate for future expansion.

How to Choose a Good Name?

To generate good business names, start by describing your brand identity, vision, and mission. As you do, certain words will likely stand out that have the potential to be part of your LLC name. You can also seek input and feedback from family and friends to refine your choices.

Once you have a short list of potential names, you must check your state’s business name rules. All states require that your name include an identifier such as “limited liability company” or LLC. Most also restrict the use of certain words like bank or university. These rules can differ from one state to another, so it’s essential to research your state’s guidelines.

Once you have your favorite names that comply with your state’s regulations, conduct a business name search on your Secretary of State’s website. This is to verify if the name is available. Additionally, check the United States Patent and Trademark Office’s website to ensure others do not already trademark your chosen names.

2. Determine the Management Structure for Your LLC

When forming an LLC, you have the flexibility to determine its management structure. Your LLC can either be member-managed or manager-managed. The most common LLCs are member-managed LLCs, followed by manager-managed LLCs, where some members serve as managers and others do not.

Management Structures:

1) Member-Managed LLC: In a member-managed LLC, all members actively participate in the day-to-day management and decision-making of the business. Non-members typically do not have management authority.

2) Manager-Managed LLC: An LLC is manager-managed in a few scenarios as follows:

⇒ Some members are designated as managers, while others have a financial interest in the LLC but do not possess management powers.

⇒ Some or all members serve as managers alongside one or more non-member managers.

⇒ No members hold managerial roles, and one or more non-members are appointed managers.

How to Choose the Right Management Structure?

The manager can make decisions on behalf of the LLC, such as entering contracts, handling bank accounts, and hiring employees. Therefore, the choice between member-managed and manager-managed LLCs should align with your business’s needs, the level of involvement you desire from members, and your long-term vision.

Your decision will be documented in your LLC’s operating agreement, which outlines the roles, responsibilities, and decision-making processes within the company. It’s wise to seek legal or business advice when you want to make rules for your business that fit your specific requirements and comply with your state’s regulations.

3. Select a Registered Agent

In every state, having a registered agent for your LLC is a mandatory requirement. A registered agent is a business or individual with the authority to accept official communications and legal documents on behalf of your LLC at their registered address.

While you, another member, or a manager of your LLC can act as the registered agent, it’s important to note that a registered agent must be physically present at the registered address during regular business hours.

How to Hire a Good Registered Agent?

Many entrepreneurs opt for a more convenient and efficient solution by hiring a registered agent service. These services specialize in fulfilling the registered agent role and offer several advantages like:

- Safeguarding your privacy

- Ensuring timely receipt of important documents

- Availability during business hours

- Flexibility

In short, hiring a registered agent service makes compliance and document management easier. Thus, you can focus on growing your mobile business without dealing with these responsibilities.

4. File Articles of Organization with the State

Officially, setting up an LLC requires filing articles of organization with the state. In some states, the document is also called a certificate of formation or a certificate of organization. It establishes your LLC legally, providing you with the protection and recognition needed to operate your mobile business within the law.

Where to File the Articles of Organization?

Here’s what you need to know:

#1: Prepare the document including essential information about your LLC, such as its name, address, purpose, management structure (member-managed or manager-managed), and the name and address of your registered agent.

#2: Submit the document to the appropriate state agency, typically the Secretary of State’s office. It can often be done online or by mail.

#3: Pay a filing fee for processing your LLC formation documents. The fee varies by state, generally between $40 to $500.

#4: Once the state receives the document, it will review and process it. It usually takes a few weeks.

#5: After approval, you’ll receive a confirmation or a Certificate of Formation from the state, which serves as legal proof that your LLC is officially registered.

5. Create an Operating Agreement

A very important step in the LLC formation process is creating an operating agreement. Although it’s not mandatory in most states and is not submitted to the state, having one is critical for several reasons.

An Operating Agreement Defines:

- Ownership and Management Structure: The agreement clarifies ownership percentages, management roles, and member responsibilities.

- Profit Distribution and Voting Rights: It details how profits are shared among members and defines voting rights and operational specifics.

- Legal Documentation: Without it, you lack legal proof of ownership, leading to disputes and confusion.

- Dispute Resolution: The agreement offers a way to settle member conflicts efficiently, avoiding costly legal battles.

While online templates are available, it’s wise to consult an attorney, especially for multi-member LLCs. This ensures member rights and interests are protected and that the document complies with state laws. Legal guidance is valuable in creating a robust agreement that safeguards your business and its members.

6. Get an Employer Identification Number (EIN)

EIN is a unique nine-digit tax number that the IRS assigns to organizations operating in the United States. It serves several tax-related purposes, including federal tax filings, hiring, banking, and permits.

Having an EIN ensures your business’s compliance with tax regulations. It’s a vital identifier that helps separate your personal and business financial matters. To get an EIN, you can apply online for free, and you will immediately receive one. However, some states may require a state-specific EIN, so check with your state’s revenue agency.

7. Obtain Required Permits and Licenses

Obtaining the necessary state and local permits and licenses is a critical step in ensuring your mobile business operates legally and complies with local regulations.

Here is how you can do that:

- Research the specific permits and licenses required for your mobile business on government websites.

- Identify various permit types, including business registration, health, etc.

- Start the application process in advance to avoid delays in your business launch. Follow each permit’s unique application process, requirements, and fees diligently.

- Maintain compliance with local regulations and renew permits on time to avoid fines. Be aware that requirements can vary from one place to another, so check local regulations.

- Seek legal or business development guidance if you are unsure about requirements or applications.

8. Elect a Tax Status

Selecting the appropriate tax status for your LLC is essential for managing your LLC’s tax liability and complying with tax regulations. This is the last step in learning how to start an LLC for your mobile business, but it might be a little complex, as taxes usually are. Thus, consulting with a tax professional will help you make the best choice for your business.

Here is everything you must know:

#1: Default Tax Status

- If you don’t elect a tax status, the state will treat a single-member LLC as a sole proprietorship and a multi-member LLC as a partnership.

- The state will not tax the LLC. Instead, it will tax the members of the LLC. It means profits pass through to the members, and members pay self-employment taxes on their share of profits.

#2: Electing S-Corporation (S-Corp) Status

- If an LLC elects the S-Corp status by filing Form 2553 with the IRS, then the state will tax the LLC and not the members.

- First, the managing members must pay themselves a reasonable salary, and they will have to pay taxes on this amount they receive as salary.

- Then, they can share the remaining profits after paying all salaries. Now, they don’t have to pay taxes on these distributed profits, leading to tax savings.

#3: Considerations

- The decision between default status and S-Corp status is complex and depends on factors like your business income and the administrative costs of payroll.

- The potential tax savings with S-Corp status often become significant as the business income grows.

- Given the complexities involved, it’s highly recommended to consult with a tax adviser or accountant to make an informed decision.

Final Thoughts

Forming an LLC takes some time and effort, but it’s worthwhile because of the many benefits of an LLC, particularly personal liability protection. Don’t skip any of the steps on how to start an LLC for your mobile business so that your mobile business has the best chance of success.

Recommended Articles

We are glad you found this detailed article on how to start an LLC for your mobile business helpful. For more such articles, check out the following recommendations,