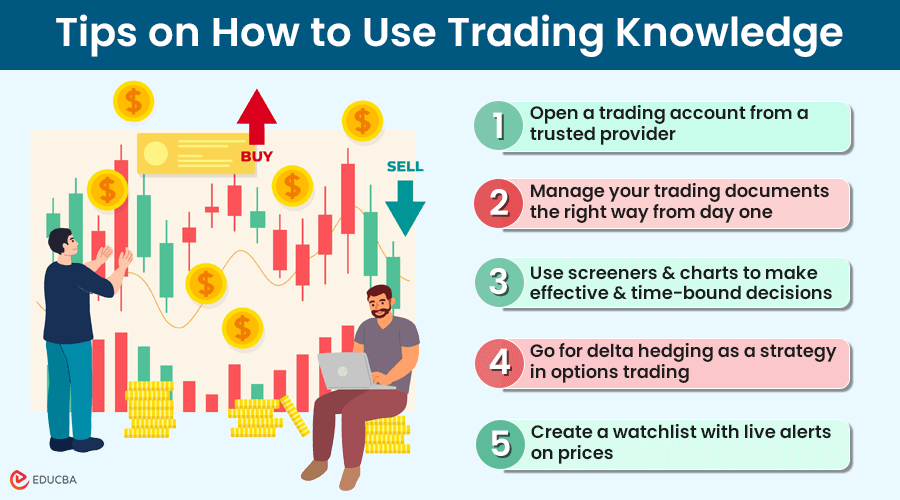

Tips on How to Use Trading Knowledge Effectively

Trading is subject to stock market risk, but you can increase your profits from daily trades using your knowledge. To achieve this, you need to maintain a tracker and keep your documents up to date for filing returns and capital gains taxes. Here is how to use trading knowledge effectively.

1. Open a trading account from a trusted provider

Before you begin trading, you need a trading account. This account allows you to trade on multiple stock exchanges, depending on your chosen provider. Here is what to look for:

- Provider Features: Check the withdrawal rate and the minimum deposit cap.

- Regulation and Registration: Verify if the trading and investment app or software is nationally and internationally regulated and registered regulated and registered.

- Account Setup: Provide relevant identification and proof of income. After uploading your documents, you may receive a one-time password on your phone and email to activate your account.

2. Manage your trading documents the right way from day one

Use an AI PDF summarizer online to manage your trading and investment documents. These documents are essential for filing income and capital tax returns. Here is what you need to consider:

- Centralize Documents: Keep your documents updated and maintained in one place. It helps your chartered accountant file returns on time and avoid hefty penalties.

- Utilize AI Tools: Use the PDF summarizer to read the context of documents shared by your CA. It can help you track the submission status of forms and identify pending ones, consolidating all trading account information into simpler language. This technique helps prevent exploitation.

3. Use screeners and charts to make effective and time-bound decisions

If you are a new retail trader, leverage screeners and charts from popular sites online. Search for the keyword of the stock or the screener you want, and you will get it on the top few pages. Screeners have you check which stocks are at an all-time high or all-time low.

You can use other freely available screeners online to watch over the stocks forming certain patterns like:

- Three black crows

- Dark horse

- Inverted W pattern

- Inside bar

- Morning star

- Evening star

- Cup & handle pattern

- Rising three pattern

The above list is just an example of the most used screeners.

Next, you can use live charts. They help you to track the live price action on different time frames like:

- Hourly

- Daily

- Weekly

- Monthly

Combine screeners with charts, and then you can back-test the trades to know the accuracy of the strategies. Then, you pick one of your favorite ones, to begin with, the ones you understand the most and the ones that are easier to track.

4. Go for delta hedging as a strategy in options trading

You can be a retail trader or an institutional one – it doesn’t matter. With delta hedging, you can safeguard your trades. This strategy is famous among traders because it overcomes the issues of buy-and-hold limitations. Retailers follow and implement this strategy to protect and hedge their trades against price action swings. Institutional traders master it to meet their investment goals for a particular period.

5. Create a watchlist with live alerts on prices

Every stock market has thousands of stocks, making it difficult to track every one when the time is right. So, create a watchlist of various stocks on your trading account and set triggers to send automated alerts on these stocks.

That way, you can time each trade well based on your back-tested strategies and online alerts. You would not have to sit in front of the computer system that way. This strategy works best for working professionals to make profits and automatically set GTT for booking profits.

The same applies when you put a stop loss on a stock depending on your watchlist and alerts.

6. Record your trades or find the trade book and P/L reports

Manage the risk and make efficient decisions on each trade when you record your trades. These are most often available on the trading app or software. You can filter the dates and download the PDF files to scrutinize the capital further and return on investments.

Similarly, download P/L reports and use them when filing for returns or making further investment decisions. From the P/L reports, you can learn how much profit you earn over time by investing a certain amount of capital. Review these reports continuously to improve your timings on trades and know your history of booking losses or profits.

Final Thoughts

You can be a retail or institutional trader, and these best trading tips work in either situation. Create a trading account and keep learning about price action movements and strategies. Calculate your risk appetite first. Consult a financial advisor for the same, and you can continue to make profitable trades regularly.

Recommended Articles

We hope you find these tips on how to use trading knowledge effectively informative. Check these other trading-based articles.