Impact of the Exchange Rate on Money Transfers: Overview

Understanding exchange rates is essential when sending money overseas. They directly affect how much money the recipient gets, making them a key factor in international money transfers. This article looks at the impact of the exchange rate on money transfers, what influences them, and how to reduce risks.

Understanding Exchange Rates

Exchange rates show the value of one currency compared to another. These rates fluctuate due to economic factors and influence international money transfers. For example, suppose you are sending U.S. dollars (USD) to Europe. In that case, the exchange rate will decide how many euros (EUR) the recipient gets.

How do Exchange Rates Impact International Money Transfers?

The impact of the exchange rate on money transfers is significant as it determines the exact amount the recipient receives. Even minor changes in exchange rates can affect transactions in the following ways:

1. Conversion Amounts

- A strong currency benefits the recipient, providing more of their local currency.

- A weak currency reduces the recipient’s final amount.

- Example: If the USD strengthens against the EUR, sending the same amount in dollars will yield more euros.

2. Transfer Costs

- Many financial institutions add a margin to the exchange rate, increasing costs.

- A poor exchange rate means you pay more to send the same amount.

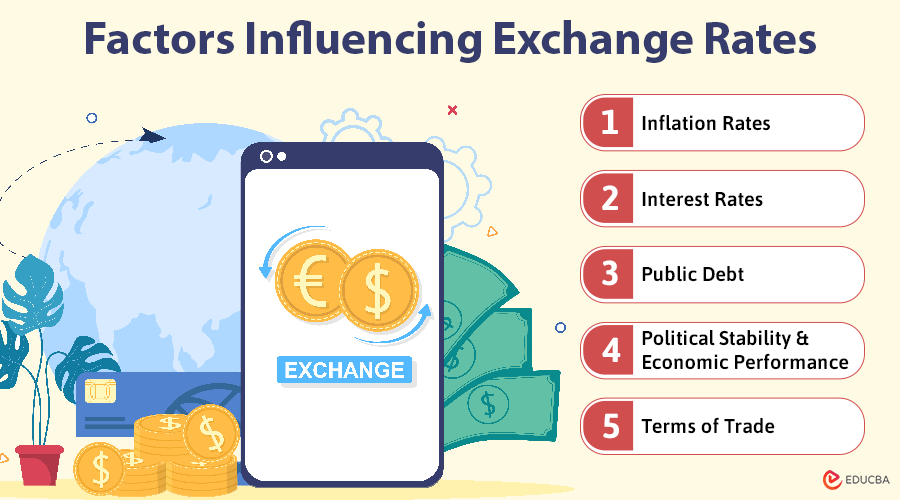

Factors Influencing Exchange Rates

Exchange rates fluctuate due to various factors. Understanding these factors can help predict how exchange rates affect money transfers:

1. Inflation Rates

Countries with lower inflation usually have a stronger currency, making international transfer more favorable. In contrast, high inflation leads to currency depreciation, reducing the recipient’s funds.

2. Interest Rates

Higher interest rates attract foreign investors, strengthening the currency and improving exchange rates. However, the currency may still weaken if inflation rises alongside interest rates.

3. Public Debt

Large national debt discourages foreign investment, leading to a weaker currency. As a result, currency depreciation negatively impacts the value of international money transfers.

4. Political Stability and Economic Performance

Political stability and strong economic performance attract investors, boosting the currency’s value. On the other hand, political instability can weaken the currency, making international transfers less beneficial.

5. Terms of Trade

A country that exports more than it imports sees its currency appreciate, leading to better exchange rates. A stronger currency allows for higher-value international money transfers.

How to Mitigate Exchange Rate Risks?

To minimize the impact of the exchange rate on money transfers, consider these strategies:

1. Timing Transfers

- Monitor exchange rate trends to send money when the rate is favorable.

- Small timing adjustments can significantly affect the recipient’s amount.

2. Forward Contracts

- Lock in an exchange rate for a future transfer.

- This protects against unfavorable rate changes but prevents benefiting from rate improvements.

3. Using Multi-Currency Accounts

- Holding funds in multiple currencies allows flexibility.

- You can transfer money when the exchange rate is better.

Real-World Example

Exchange rate fluctuations can have a real impact. For example, if the U.S. dollar weakens due to economic concerns, people sending money overseas may find that their recipients receive less. This demonstrates why it is crucial to stay informed about exchange rate trends.

Final Thoughts

The impact of the exchange rate on money transfers is crucial for anyone sending money internationally. By understanding exchange rate fluctuations and using smart strategies, you can ensure your money goes further. Staying informed and planning your transfers wisely can help you save on costs and maximize the amount your beneficiary receives.

Recommended Articles

We hope this guide on the impact of the exchange rate on money transfers has been helpful. Check out these recommended articles for more insights on foreign exchange, international remittances, and financial strategies.