Updated November 11, 2023

Impairment Meaning

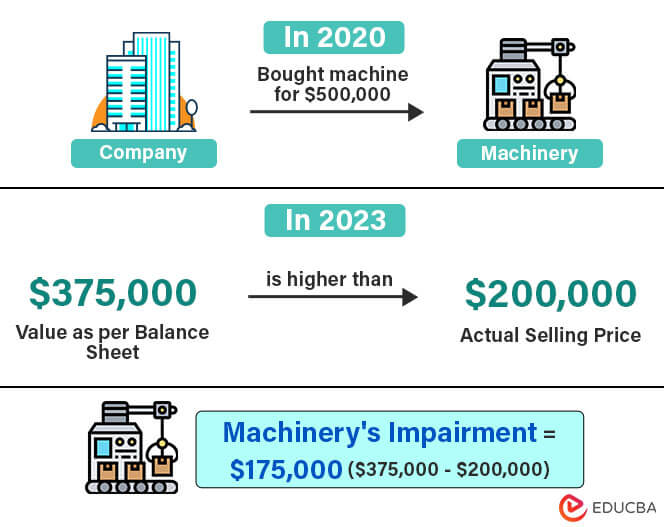

Impairment is when businesses find that their asset’s reported value (in accounting books) is higher than the amount they will get if they sell the asset. In such a case, the company declares the asset as “impaired” and reduces its value in its accounting records. It can either be a tangible (property) or intangible (goodwill) asset.

When a company acquires an asset, its value may fluctuate due to various factors such as market conditions, changes in business strategy, economic downturn, etc. This difference is sometimes higher than usual depreciation; thus, companies must report it on their balance sheet and income statements as an impairment loss.

The purpose of asset impairment is to ensure that a company’s financial statements accurately reflect the current value of its assets, preventing the overstatement of asset values. This adjustment gives stakeholders a more realistic idea of the company’s financial health. Additionally, it helps make informed decisions regarding the asset’s future, including additional investments or other strategic actions.

Table of Contents

Key Highlights

- Impairment refers to a sharp decrease in the fair market value of an asset due to several internal and external factors.

- Internal and external factors influencing impairment are changes in the legal regulations, increased maintenance costs, etc.

- It is important to calculate the impairment loss of an asset to know the difference between the asset’s book value and fair value.

- Companies must comply with US GAAP and IFRS requirements for asset impairment.

Where is Impairment Loss Recorded?

You can find the impairment loss before the operating profit in the income statement. Although we don’t record this on the balance sheet, due to the expense on the income statement, the value of the impaired asset decreases in the balance sheet.

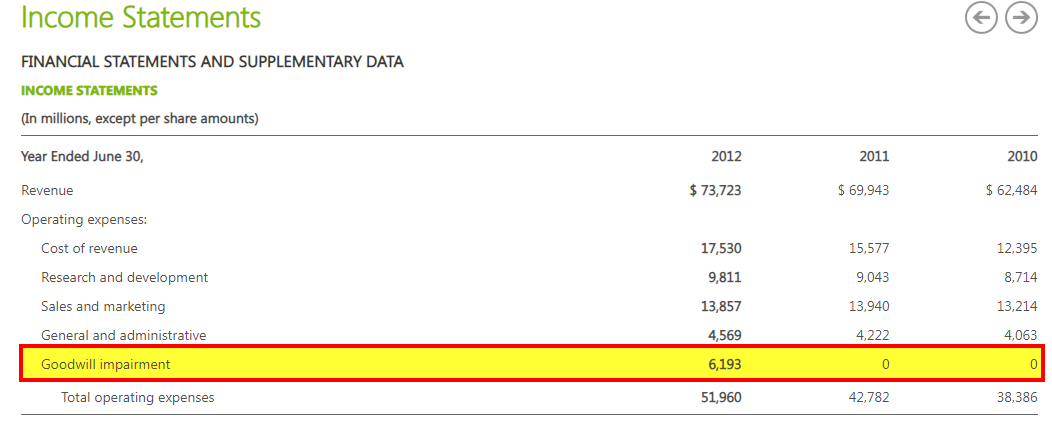

Example: Microsoft

Microsoft conducted an annual goodwill impairment test on May 1, 2012, and reported a goodwill impairment of $6.193 billion. The impairment was related to their OSDs (Online Services Division) business segment, which exceeded its estimated fair value. Moreover, this goodwill impairment decreased the operating income and net income by $6.2 billion and reduced earnings per share by $0.73.

(Image Source: Microsoft Income Statement 2012)

Impairment Loss

Formula

Where,

- Carrying Value: It is the value of an asset on a company’s balance sheet.

- Recoverable Amount: It is the estimated value an asset can generate from its use or sale in the future.

Example

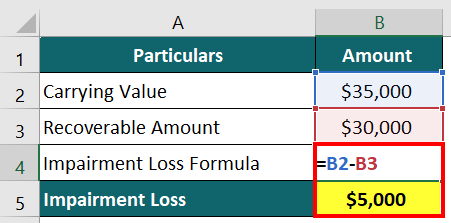

A FastLane Logistics company purchases trucks for their delivery business for $50,000, with a 5-year useful life. It leads to a yearly depreciation expense of $10,000 for each truck ($50,000/5). After using the trucks for 1.5 years, the total depreciation expenses over time amount to $15,000 ($10,000 x 1.5).

Steps to calculate impairment loss:

Step #1: Calculate the carrying value using the following formula:

Carrying Value = Original Cost – Accumulated Depreciation Carrying Value

= $50,000 – $15,000 = $35,000

Step #2: Evaluate the actual worth of the asset by finding its future cash flows and discounting them back to the present time or estimating the amount you will get from selling it.

In this case, the estimated recoverable amount is $30,000.

Step #3: Calculate the impairment loss using the below formula:

Impairment Loss = Carrying Value – Recoverable Amount

= $35,000 – $30,000 = $5,000

Step #4: Reporting the Loss

Finally, the company must record an impairment loss of $5,000 in the income statement. It helps us adjust the carrying value of the trucks on the balance sheet to match their recoverable amount.

Thus, after this adjustment, the truck’s carrying value on the balance sheet would be $30,000, which aligns with the estimated market value. It helps the company keep its financial records accurate and up-to-date.

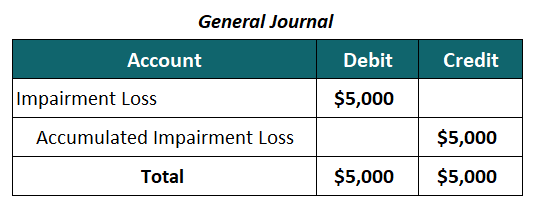

Journal Entry

In the journal entry, we debit the impairment loss account or expense account and credit in the corresponding asset. For this example, the journal entry would be:

Indicators of Impairment

These are signs that help companies determine when to impair their assets. It usually happens when the carrying value of an asset exceeds its recoverable amount. The following are some external and internal sources that indicate impairment.

1. External Sources

#1: Rising costs

When the operating costs associated with the maintenance of the asset are higher than the initial estimated costs, it leads to a decrease in asset value.

#2: Market Down

A decline in the market value of an asset or investment indicates impairment. For example, if the real estate market faces a downturn, the value of real estate owned by the company may decrease. It can make investors think that the company’s financial position is not good, affecting the company’s stock price.

#3: Natural Disasters

Natural disasters, such as earthquakes, floods, or hurricanes, can cause damage to assets, resulting in a decrease in their value.

2. Internal Sources

#1: Changes to existing laws

Changes in existing laws, rules, or policies can impact the value of assets. For instance, if a company raises its production quality standards, it might buy more advanced machinery, which can affect the value of existing equipment.

#2: Asset Damage

When an asset, like a machine or real estate, gets damaged, it can lead to impairment. For instance, an accidental fire can damage a factory’s equipment, reducing the recoverable value of the affected assets.

#3: Post-Mergers Synergy Shortfalls

When two companies merge to increase profits, it does not work as planned. It can lead to financial and operational difficulties for the newly merged company.

Requirements for Impairment

Here are the mandatory rules businesses must follow while calculating and reporting impairment.

#1: IFRS

Under IFRS, the IAS 36 covers the impairment of loss. Following are a few highlights of IAS 36 – impairment of assets.

- IAS 36 states that when an asset’s carrying value is greater than its recoverable amount, companies must recognize it as an impairment loss.

- IAS 36 rules apply to all assets, with specific exceptions for assets other accounting standards cover, like inventors, insurance contracts, deferred tax, etc.

- At the end of each year, as per IAS, an entity must assess the external and internal indicators of asset impairment.

- If there is an indication, they should calculate the asset’s recoverable amount according to IAS 36.9.

- After that, check for impairment loss; if yes, calculate the loss.

- IAS 36 also outlines the conditions where a company can reverse an impairment loss. It is applicable when the recovering amount is greater than the carrying amount.

- However, losses on goodwill are not reversible. For other assets, the loss can be reversed if the condition improves.

#2: US GAAP

US GAAP has accounting codes like ASC 350 and ASC 360 that cover impairment of assets. US GAAP is a little complex, unlike IAS 36, which is very simple. Following are the rules by US GAAP.

- To check if an asset is impaired, US GAAP has the following standards:

| Assets | FASB Standard | Includes |

| PP&E | ASC 360 | 2-step test and trigger-based model |

| Goodwill | ASC 350-20 | 1-step test, Annual testing requirement, and Optional qualitative assessment |

| Intangible Assets | Finite lived: ASC 360 | 2-step test and trigger-based model |

| Indefinite lived: ASC 350-30 | 1-step test, Annual testing requirement, and Optional qualitative assessment |

- The 2-step test includes:

- Recoverability Test: If the asset’s book value is more than with undiscounted future cash flows, the asset value is not recoverable.

- Impairment Test: Check if the carrying value is less than the fair value of an asset; if yes, the asset is impaired. Fair value is the selling price calculated using market or income approaches.

- To calculate the loss, firms must subtract the fair value of assets from the carrying value.

- The loss is then recorded in the income statement.

- Finally, under US GAAP, reversal of impairment is not allowed.

Impairment Vs. Depreciation

The following shows a comprehensive difference between impairment vs. depreciation.

| Basis | Impairment | Depreciation |

| Definition | An unexpected and irreversible decline in the value of an asset due to factors like natural disasters or market down | An expected decrease in the value of an asset due to regular wear and tear. |

| Assets Considered | It applies to both intangible and fixed assets. | It applies to only fixed assets. |

| Calculation Method | It is determined by understanding fair value, recoverable, and carrying amount. | It is determined by either straight-line or accelerated depreciation methods. |

| Example | A company’s manufacturing equipment is damaged by flooding, leading to an impaired asset value. | A software company’s patent loses its market value over time due to competition in advanced technology. |

Final Thoughts

Impairment is an essential accounting practice that ensures transparency by valuing assets accurately. It involves identifying both internal and external indicators of impairment. Companies must comply with the requirements in IAS 36 and GAAP to recognize asset impairment. Impairment loss is the difference between an asset’s carrying value and its recoverable amount or fair value. This practice enables better decision-making, promotes financial transparency, and helps build stakeholders’ trust in a company’s financial position.

Frequently Asked Questions (FAQs)

Q1. When does impairment of goodwill occur?

Answer: When the carrying amount of a reporting goodwill unit exceeds the estimated fair value, it leads to goodwill impairment. Companies typically recognize this during annual impairment tests. The factors that trigger this loss are economic conditions, increased competition, changes in legal requirements, etc. The two common methods companies use to test this are the income and market approaches.

Q2. When and how should you reverse an impairment loss?

Answer: The reversal of an impairment occurs if a change in circumstances indicates the asset’s recoverable amount has increased since the impairment was recognized. Following are some of the indicators of when to reverse.

External Sources:

- Clear signs of the asset’s value going up.

- Positive changes in technology, markets, economy, or laws can reverse impairment.

- Lower market rates reduce the discount rate, raising the asset’s recoverable amount.

Internal Sources:

- Favorable changes in the costs to improve the asset’s performance.

- Evidence indicates an asset’s economic performance is, or will be, better than expected.

Lastly, the reverse of impairment loss is possible only when the recoverable amount of an asset is higher than its carrying value. Companies should consider the above indicators before reversing an impairment loss.

Recommended Articles

We hope this article on impairment was comprehensive and informative. For further guidance on related topics, we recommend the following articles: