Updated July 17, 2023

Definition of In the Money

The Money, which is also generally known as ITM, is defined as the “moneyness” state of an option, i.e., when compared to the price at which the option can be bought or sold, i.e., its strike price and precisely the term in the Money means the situation when the option on an underlying asset has crossed its strike price which results in the intrinsic value of more than £0.

Explanation

There are two parts: the call option and the Put option. When the option holder can purchase the share or the security at a price below the current market price, it is called an in-the-money call option. In contrast, when the option holder can sell the share or the security at a price above the current market price, it is called a money Put option.

When there is the money option, it does not necessarily give the profit-making to the trader on the trade. Other expenses should be considered, like buying the option, paying any commission fees, or any additional expense incurred directly or indirectly. In Money, an option is the opposite of a money option.

Example

Let’s take the example of XYZ company. The shares of XYZ Company Ltd are currently trading at $500 per share. A call option would be said to be in the Money if it has the strike price of $450 because it gives rise to the opportunity for the option holder to purchase the option and sell it straight away at $450. In this case, the option’s intrinsic value would be $50.

In other cases, if the put option is bought on the shares of the company XYZ Ltd and its strike price is $550, it would be again the situation of in the Money because it gives rise to the opportunity for the option holder to purchase the option and sell it straight away for $550. The value of the option would be $50. However, if the option is already this at the time of purchase, the trade will need to move further into the Money to make a profit.

Call Option

When the option holder can purchase the share or the security at a price below the current market price within a fixed period, it is called an in-the-money call option. Buying call options is the simplest way of call options. The below example explains it:

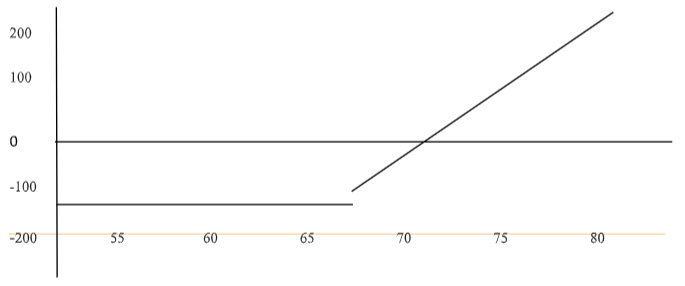

The below payoff diagram explains how the total profit or loss of the option (Y-axis) depends on the option’s underlying price (X-axis).

Strike Price = $65

In the above graph, 65 is the point that divides the graphs into two parts. Below the payoff, there is a negative figure, which is a loss; above the payoff, there is a profit. The line which is rising above the payoff is the rising profit. Point 65.8 is the breakeven point; trades start to be profitable from here.

In the Money-Put Option

When the option holder can sell the share or the security at a price above the current market price within a fixed period, it is called an in-the-money put option. Selling the Put options is the simplest way to Put options. The below example explains it:

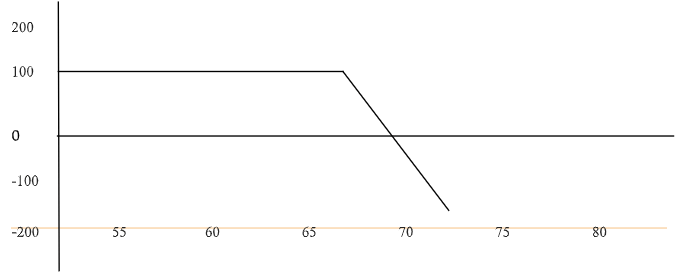

The below payoff diagram explains how the total profit or loss of the option (Y-axis) depends on the option’s underlying price (X-axis).

Strike Price = $65

In the above graph, 65 is the point that divides the graphs into two parts. Below the payoff is a negative figure, which is a profit; above the payoff is a loss, just the opposite of the call option. The line which is falling below the payoff is the rising profit. Point 65.8 is the breakeven point, and trades are profitable from here.

Advantages

Some of the advantages are mentioned below:

- In this, options are very cost-efficient and provide great leveraging power.

- Compared to equities, they are less risky.

- Many strategic alternatives, like calls, puts, etc., are involved under the money options.

- It provides the potential and opportunities to deliver higher returns than other options.

- Under the money option, time decay has less impact as both the time value and intrinsic values are carried.

Disadvantages

Some of the disadvantages are mentioned below:

- The purchase cost of in-the-money options is higher than out-of-money options.

- Provides fewer returns than other options like the money option.

Conclusion

It provides various options in the form of a call option and a put option. So, if the market increases, the investor can also earn profit by purchasing call options, and when the market goes down, the investor can also earn profit by selling put options. Hence, money options give strategic options to investors in the fall and rise. Also, there are lots of advantages and disadvantages associated with it. One should thoroughly investigate and study all the pros and cons and, according to preference, decide on investment.

Recommended Articles

This is a guide to In the Money. Here we also discuss the definition and examples along with advantages and disadvantages. You may also have a look at the following articles to learn more –