Updated July 14, 2023

What is the Income Statement Format in Accounting?

An income statement is a financial statement that reports a company’s revenues, expenses, gains, and losses over a specific period, typically a quarter or a year. Income statement formats are the Pro-forma for the presentation of an income statement that shows the result of the organization for the period, i.e. profit or loss.

There are two common formats of the income statement: the single-step income statement and the multi-step income statement. The single-step income statement presents all revenues and gains in one section and all expenses and losses in another section. We can calculate the net income or loss by subtracting the total expenses and losses from the total revenues and gains.

The multi-step income statement, on the other hand, presents revenue, cost of goods sold, gross profit, operating expenses, and other income and expenses in separate sections. We can calculate the net income or loss at the bottom of the statement by subtracting the total operating expenses, other expenses, and income tax from the gross profit.

The multi-step income statement provides more details about a company’s financial performance and helps investors and analysts to understand the company’s revenue sources and cost structure.

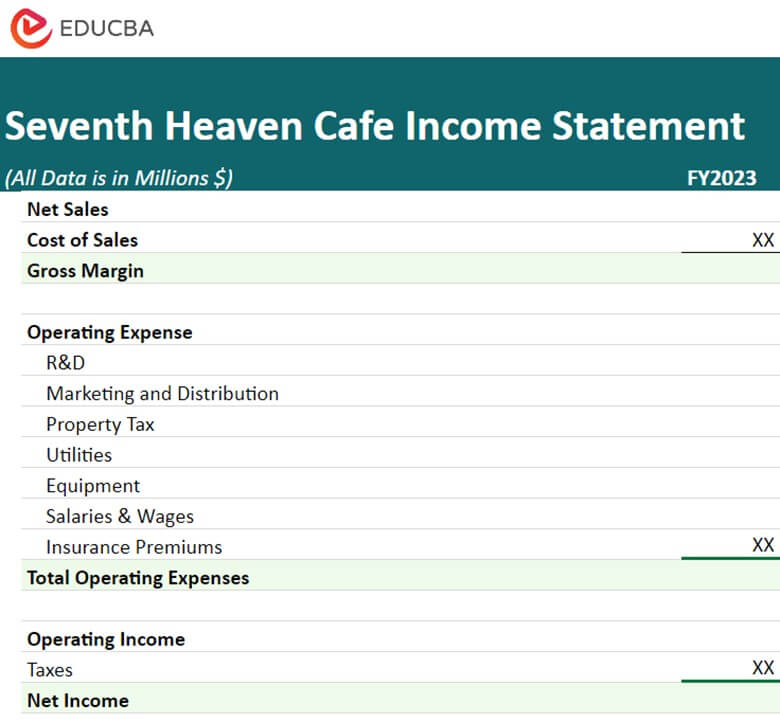

Given below is the format of a multi-step income statement.

Income Statement Formats in Excel (Free Template)

#1. US GAAP Income Statement Format

Income Statement format as per US GAAP is:

Name of Company _____________________

Income Statement for the year ended ______

| Particulars | Amount ($) | Amount ($) | Amount ($) | |

| I | Sales | XXXXX | ||

| II | Less: Sales Discount | XXX | ||

| Sales Returns and allowances | XXX | XXXX | ||

| III | Net Sales Revenue (I – II) | XXXX | ||

| IV | Cost of Goods Sold | XXXX | ||

| Gross Profit (III-IV) | XXXX | |||

| V | Selling Expenses | |||

| Sales Salaries and Commission | XXX | |||

| Sales Office Salaries | XXX | |||

| Travel and Entertainment | XXX | |||

| Advertising Expense | XXX | |||

| Freight and Transportation – out | XXX | |||

| Shipping Supplies and expenses | XXX | |||

| Postage and Stationery | XXX | |||

| Telephone and Internet Expense | XXX | |||

| Depreciation of Sales Equipment | XXX | |||

| Other Selling Expense | XXX | XXXX | ||

| VI | Administrative Expenses | XXX | ||

| Officers’ salaries | XXX | |||

| Office Salaries | XXX | |||

| Legal and Professional services | XXX | |||

| Utilities expense | XXX | |||

| Insurance expense | XXX | |||

| Depreciation of Building | XXX | |||

| Depreciation of Office Equipment | XXX | |||

| Stationery, Supplies and Postage | XXX | |||

| Miscellaneous office expenses | XXX | XXXX | XXXX | |

| VII | Other Income and Expenses | |||

| Dividend Revenue | XXX | |||

| Rental Revenue | XXX | |||

| Gain on sale of Plant Assets | XXX | XXX | XXXX | |

| VIII | Income from operations | |||

| Interest on Bonds and notes | XXX | |||

| Income before Income Tax | XXXX | |||

| Income Tax | XXX | |||

| Net Income for the year | XXXX | |||

| Attributable to: | ||||

| Shareholders of Company | XXX | |||

| Non-Controlling Interest | XXX | |||

| Earnings Per Share | XX |

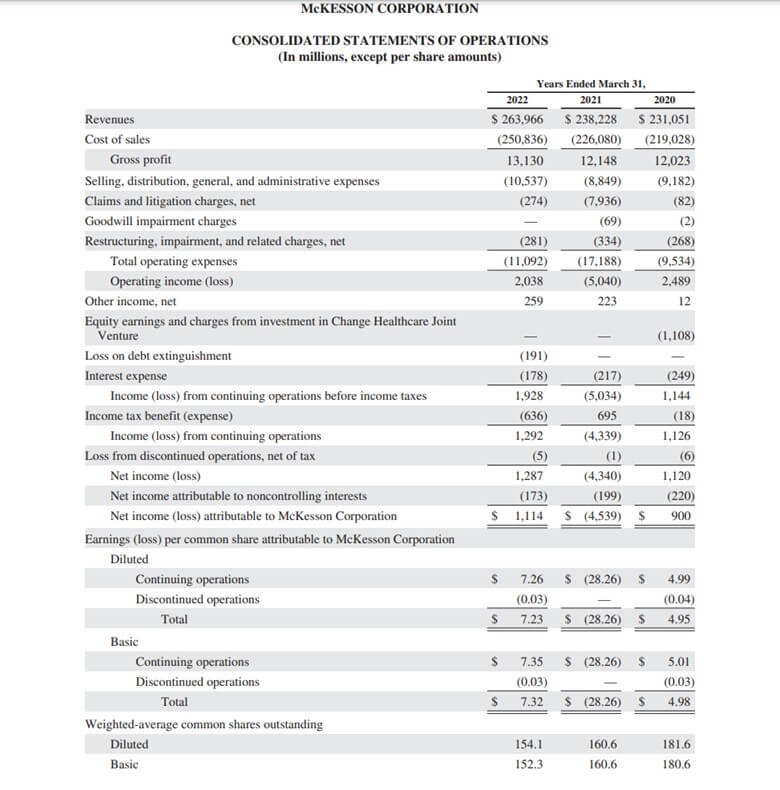

Example: McKesson Corporation

(Source: Annual Report of McKESSON Corporation 2022)

McKESSON Corporation is a well-established company based in the USA and we will be analyzing their income statement to understand the format they follow.

- Under the US Securities Act of 1933 (the Securities Act), public securities need to register with the US Securities and Exchange Commission (the SEC).

- A registration statement filed with the SEC and a prospectus must distribute in connection with the offering.

- We calculate the earnings Per Share as Net Income for the year divided by the number of shares.

- The Securities and Exchange Act governs the US Companies and the regulations of the above acts to be followed.

- An IPO will involve close scrutiny of a company’s internal control over financial reporting or ICFR.

#2. UK GAAP Income Statement Format

Income Statement format as UK GAAP is:

Name of Company _____________

Income Statement for the period ended ___________

| Particulars | Amount (£) | |

| Continuing operations | ||

| I | Revenue | XXX |

| II | Cost of sales | XXX |

| III | Gross profit (I – II) | XXX |

| IV | Distribution costs | XXX |

| V | Administrative expenses | XXX |

| VI | Profit from operations (III – IV – V) | XXX |

| VII | Finance costs | XX |

| VIII | Profit before tax (VI-VII) | XXX |

| IX | Tax | XX |

| X | Profit from continuing operations | XXX |

| Other comprehensive income for the year | ||

| XI | Gain on revaluation of property | XXX |

| XII | Total comprehensive income for the year (X + XI) | XXX |

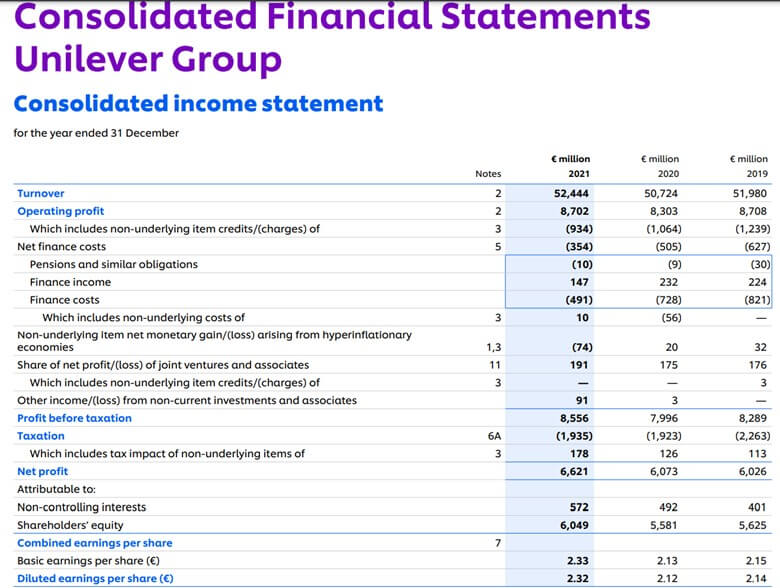

Example: Unilever

(Source: Annual Report of Unilever 2021)

Unilever is a very reputed organization based in the UK and we analyze their income statement to understand what format they follow.

- Distribution cost includes the cost incurred to deliver the product and other costs related to product distribution and promotion.

- Administrative cost includes salaries, wages, and other office costs.

- Finance Cost includes the interest on borrowings, other interest, etc.

- It’s important to show the Profit or Loss on Revaluation in the income statement as per US laws.

- As per UK law, every company in the country must publish its income statement under the Companies Act.

#3. IFRS Income Statement Format

Income Statement format as IFRS is:

Name of Company _____________

Income Statement for the period ended ___________

| Marks & Associates Income Statement on December, 2022 | ||

| Particular | Amount | Amount |

| Continuing Operations | ||

| Revenue with contracts with customers | XXX | |

| Cost of sales of goods | XXX | |

| Cost of providing services | XXX | XXX |

| Gross Profit | XXX | |

| Distribution costs | XXX | |

| Administrative expenses | XXX | |

| Net impairment losses on financial and contract assets | XXX | XXX |

| Other income | XXX | |

| Other gains/losses | XXX | |

| Operating Profit | XXX | |

| Finance income | XXX | |

| Finance costs | XXX | |

| Finance costs (net) | XXX | |

| Share of profits of associates and ventures | XXX | |

| Profit Before Income Tax | XXX | |

| Income tax expenses | XXX | |

| Profit from continuing operations | XXX | |

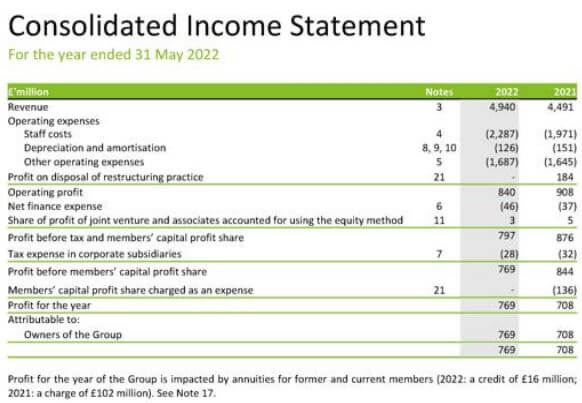

Example: Deloitte

(Source: Annual Report of Deloitte 2021-22)

Deloitte is a firm based in the UK and follows IFRS for reporting its income statement. We can make the following conclusions based on the analysis of the above statement:

- In the IFRS system, we call the income statement as the “Profit and Loss Statement.”

- All the activities that are unusual and continuous are undertaken and mentioned in the statement.

- Share profits of associates and ventures are also mentioned in the statement.

- The statement is very comprehensive and gives detailed information about the company’s financial position.

- The format is more or less similar to others but represented in a more detailed way.

#4. Indian Income Statement Format

Income statement format as per Indian companies is:

Name of Company ________________________

Profit and Loss/ Income statement for the period ended _________

| Particulars | Note No. | Amount (Rs.) as at the end of a current reporting period | Amount (Rs.) as at the end of a previous reporting period | |

| Continuing Operations | ||||

| 1 | Revenue From Operations (Gross) | – | – | |

| 2 | Other Income | – | – | |

| 3 | Total Revenue (1+2) | – | – | |

| Expenses | ||||

| i) Cost of the consumed material | – | – | ||

| ii) Stock in Trade purchases | – | – | ||

| iii) Changes in the value of Inventories of stock in trade, WIP or the finished goods | – | – | ||

| iv) Employee Cost | – | – | ||

| v) Finance charges | – | – | ||

| vi) Depreciation & Amortization expenses | – | – | ||

| vii) Any other Expenses | – | – | ||

| 4 | Total Expenses amount | – | – | |

| 5 | Profit Before the exceptional items & the extra ordinary items & the Tax (3 – 4) | – | – | |

| 6 | Exceptional Items Amount | – | – | |

| 7 | Extraordinary Items Amount | – | – | |

| 8 | Profit Before the Tax (5-6-7) | – | – | |

| 9 | Tax Expense | |||

| Current Tax | – | – | ||

| Deferred Tax | – | – | ||

| 10 | Profit or (Loss) from the continuing operations (8 – 9) | – | – | |

| 11 | Profit or Loss from the Discontinuing Operations | – | – | |

| 12 | Tax expense from the Discontinuing Operations | – | – | |

| 13 | Net Profit or Loss from the Discontinuing Operations (11 – 12) | – | – | |

| 14 | Profit or Loss for the Period (10 + 13) | – | – | |

| 15 | EPS | |||

| Basic | ||||

| Diluted |

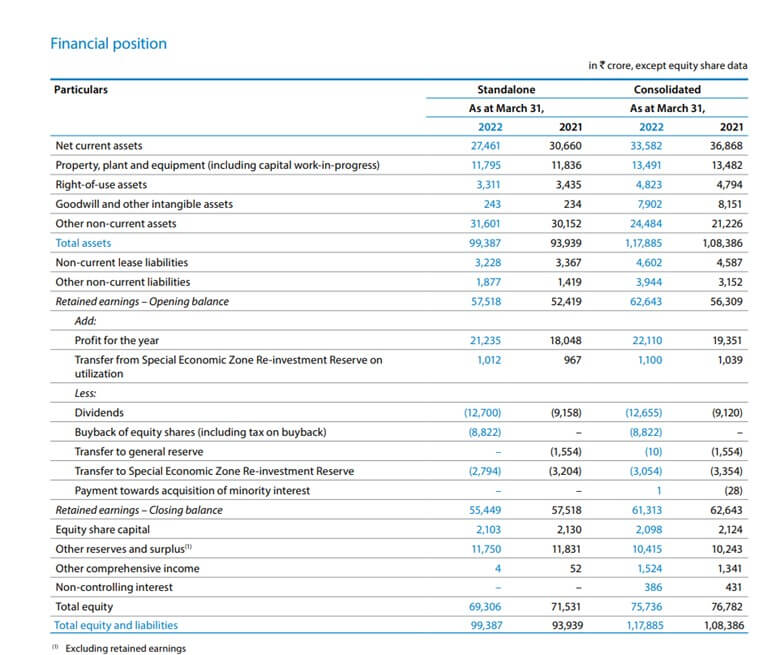

Example: Infosys

(Source: Annual Report of Infosys 2021-22)

Infosys is a renowned company based in India and we will be analyzing its income statement to understand the format they follow.

- The Companies Act governs that Indian Companies must list themselves under the Securities and exchange board of India. Hence the regulations are followed as per the Companies Act and SEBI.

- In the case of revenue from operations revenue from the sale of goods, sale of services, and other operating revenue less recoverable taxes are shown separately in notes.

- Other income like dividends and interest must be shown separately so that the nature of income can become known.

- In the case of finance cost, borrowing cost, interest cost, and finance cost due to currency fluctuations are separately depicted in notes to accounts.

- We calculate the basic earnings as Net earnings divided by the number of shares.

- Companies calculate the diluted earnings as net income less preference dividend divided by the weighted average number of shares, including the effect of convertible preference shares and convertible debentures.

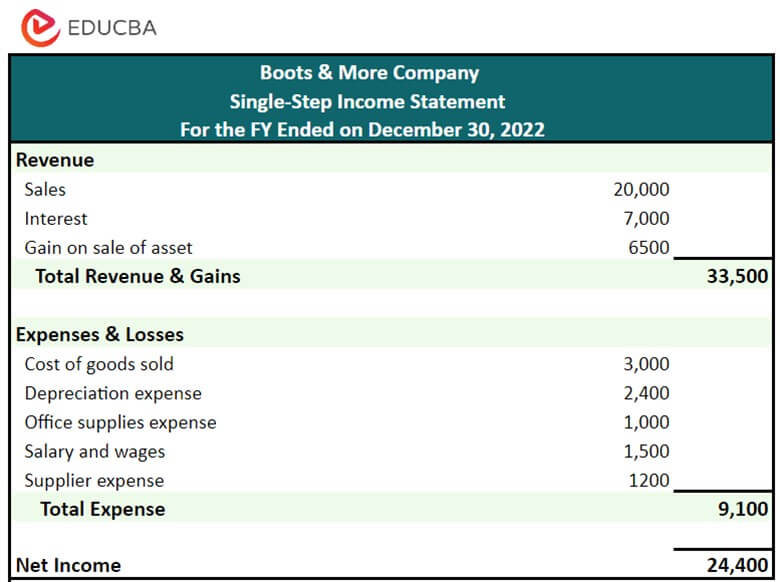

Income Statement Format Example For Small Business

Boots & More is a small business based in California, USA. We will analyze their income statement to see what format they follow.

- The above income statement is in accordance with the single-step format followed where a simplified snapshot showed off the business via its gains and expenses.

- A small business must compile its reports in accordance with US generally accepted accounting principles because external stakeholders evaluate them.

- This practice makes it simpler for creditors and investors to compare the financial position of a business to its competitors.

- Typically, the businesses calculate the net income after subtracting the revenues or gains from the expenses.

Frequently Asked Questions (FAQs)

Q1. What is the income statement and explain its format?

Answer: The income statement, also known as the profit and loss statement or P&L, is a financial statement that provides a summary of a company’s revenues, expenses, and net income for a specific period. The income statement is typically presented in a vertical format, with revenues listed first, followed by expenses, and finally, the resulting net income. The format is as follows:

[Company Name] Income Statement for [Period]

| Revenue | Amount |

| Gross Sales | XXX |

| Less: Returns & Allowances | (XXX) |

| Net Sales | XXX |

| Cost of Goods Sold | (XXX) |

| Gross Profit | XXX |

| Operating Expenses | (XXX) |

| Operating Income | XXX |

| Other Income | XXX |

| Interest Expense | (XXX) |

| Income Before Taxes | XXX |

| Income Tax Expense | (XXX) |

| Net Income | XXX |

Q2. What is the income statement traditional format?

Answer: The traditional format of the income statement presents financial information in a single-step format, where all revenues and gains are listed together, followed by all expenses and losses. The resulting figure is the net income or net loss. Though the single-step format is simpler and easier to understand, but it doesn’t provide as much detail as the multi-step format.

Here’s the traditional format of an income statement:

[Company Name] Income Statement for [Period]

| Revenue and Gains | Amount | |

| Sales | XXX | |

| Interest Income | XXX | |

| Other Gains | XXX | |

| Total Revenue | XXX | |

| Expenses and Losses | ||

| Cost of Goods Sold | (XXX) | |

| Operating Expenses | (XXX) | |

| Interest Expense | (XXX) | |

| Income Tax Expense | (XXX) | |

| Other Losses | (XXX) | |

| Total Expenses | (XXX) | |

| Net Income (or Net Loss) | XXX |

Q3. What is the difference between GAAP and IFRS income statements?

Answer: The key difference between GAAP and IFRS income statements lies in their presentation and the rules for recognizing revenue and expenses. While GAAP income statements typically adopt a multi-step approach, IFRS income statements tend to follow a single-step approach.

In a GAAP income statement, one can find details such as gross profit, operating income, and income before taxes, while the IFRS income statement includes revenues, gains, expenses, and losses, which are totaled to arrive at the net income figure.

Q4. What are the 2 formats of the income statement?

Answer: The income statement is available in two formats: single-step income statement and multi-step income statement.

Q5. What is an income statement called in IFRS?

Answer: The income statement in IFRS is known as the “statement of profit or loss.” Like US GAAP, the income statement in IFRS includes the majority of revenues, income, and expenses but not all of them.

Recommended Articles

This is a guide to Income Statement Formats. Here we also discuss the definition and income statement format example as per India Companies, US GAAP, and UK GAAP. You may also have a look at the following articles to learn more –