Difference Between Income Statement and Balance Sheet

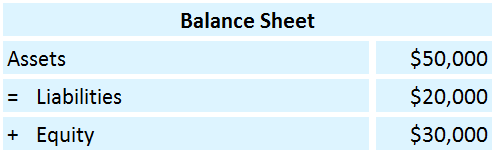

The main difference between an income statement vs balance sheet is that the income statement shows a company’s earnings (revenue) and spending (expenses) in one year. In contrast, the balance sheet shows what a company owns (assets), what it owes (liabilities), and its equity value at a specific point in time.

The income statement and the balance sheet provide different but complementary information about a company’s financial performance and position. Investors and analysts typically use both statements together to understand a company’s financial health.

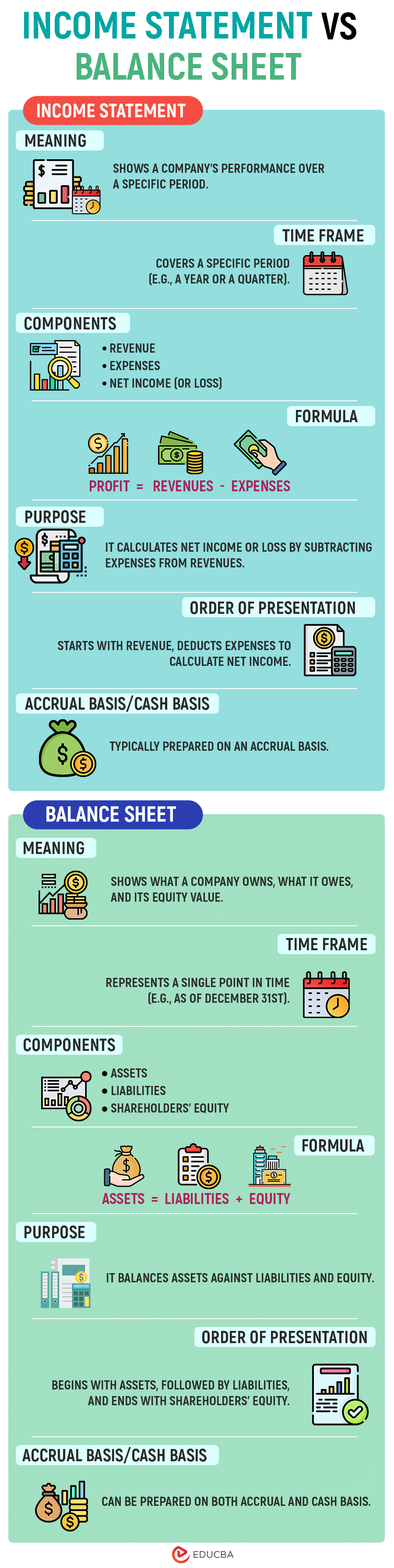

Income Statement Vs Balance Sheet – Infographic

Below is the table highlighting the key differences between the income statement vs. balance sheet.

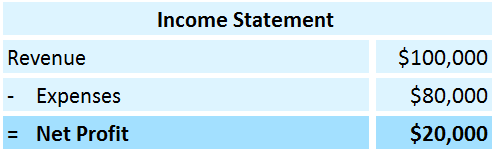

Income Statement Vs Balance Sheet – Example

For example, Let’s consider a retail store that functions in your locality.

The income statement for the retail store would show the revenues generated by the store from the clothing sales, e.g., $100,000. It will also show expenses incurred to run the store, such as rent, salaries, inventory, marketing, and other expenses totaling $80,000. Finally, the difference between the revenues and the expenses would be the store’s net profit for the period, i.e., $20,000.

On the other hand, the balance sheet for the retail store would list the store’s assets of $50,000, such as cash, inventory, furniture, and equipment. Then, it will present the store’s liabilities of $20,000, such as loans, accounts payable, and taxes owed. At the end, it would list the store owner’s equity of $30,000, which represents the amount of money invested by the owner in the store.

Income Statement Vs Balance Sheet – Key Differences

- An income statement helps assess a company’s profitability and operational performance, while a balance sheet is useful for assessing a company’s financial health and overall worth.

- While the income statement emphasizes profitability and efficiency, the balance sheet emphasizes liquidity, solvency, and financial flexibility.

- Investors and analysts use income statements to understand the company’s ability to generate profits. It helps them make decisions about investing or lending to the company. On the other hand, a balance sheet helps them assess a company’s ability to meet its short-term and long-term obligations.

Final Thoughts

When it comes to financial statements, the income statement and balance sheet are two of the most important statements that give insights into a company’s profitability and financial health, respectively. While both statements are essential, they have their respective uses. For instance, if assessing the long-term financial health and stability of a company, the balance sheet becomes highly significant. If evaluating the company’s performance and profitability trends, the income statement takes precedence.

Frequently Asked Questions (FAQs)

Q1. What do companies prepare first – a balance sheet or income statement?

Answer: Companies usually build and present the income statement first, summarizing a company’s sales and expenses. After that, companies create the balance sheet.

Q2. What are the three types of financial statements?

Answer: There are three sorts of financial statements:

- Income Statement: It illustrates a company’s revenues and costs over a specified time period and calculates the resulting net income or loss.

- Balance Sheet: It depicts a company’s financial situation at a given point in time by displaying its assets, liabilities, and equity. It gives an overview of the company’s financial health.

- Cash Flow Statement: It shows the cash and cash equivalents a business receives and spends over a certain time period. It is useful in determining a company’s liquidity and ability to satisfy financial obligations.

Recommended Articles

We hope you found this EDUCBA article on Income Statement vs. Balance Sheet informative. To learn more, please read the recommended articles: