Difference Between Income Tax vs Payroll Tax

Income Tax vs Payroll Tax is a contract that is traded publically on the future exchange, while forwards are customized private agreements that are privately traded over the counter and not on the future exchange. A futures contract is publically quoted and traded on the futures exchange, whereas the customer and the supplier directly negotiate a forward contract. A futures contract is standardized, and it is generally used for the purpose of speculation, whereas a forward contract is customized as per the needs of the buyers and is generally used for the purpose of hedging. The government regulates a futures contract.

CFTC (the Commodity Futures Trading Commission) governs the futures contract market, whereas the government or any governing body does not regulate forwards contract. A futures contract has a lower rate of counterparty risk, whereas a forward contract has a higher rate of counterparty risk. The expiry date and the contract size of a futures contract are standardized, whereas the expiry date and the contract size of a forwards contract completely depend on the financial transaction as well as the requirements quoted by the parties to a particular transaction. Futures contracts are standardized, whereas forwards contracts are over-the-counter (OTC) contracts. Futures contracts are settled on the maturity date, whereas forwards contracts are settled on a daily basis.

Futures contracts are highly liquid as compared to forwards contracts. In a futures contract, the settlement is made on a daily basis, whereas, in a forwards contract, the settlement will take place at the end of a particular period.

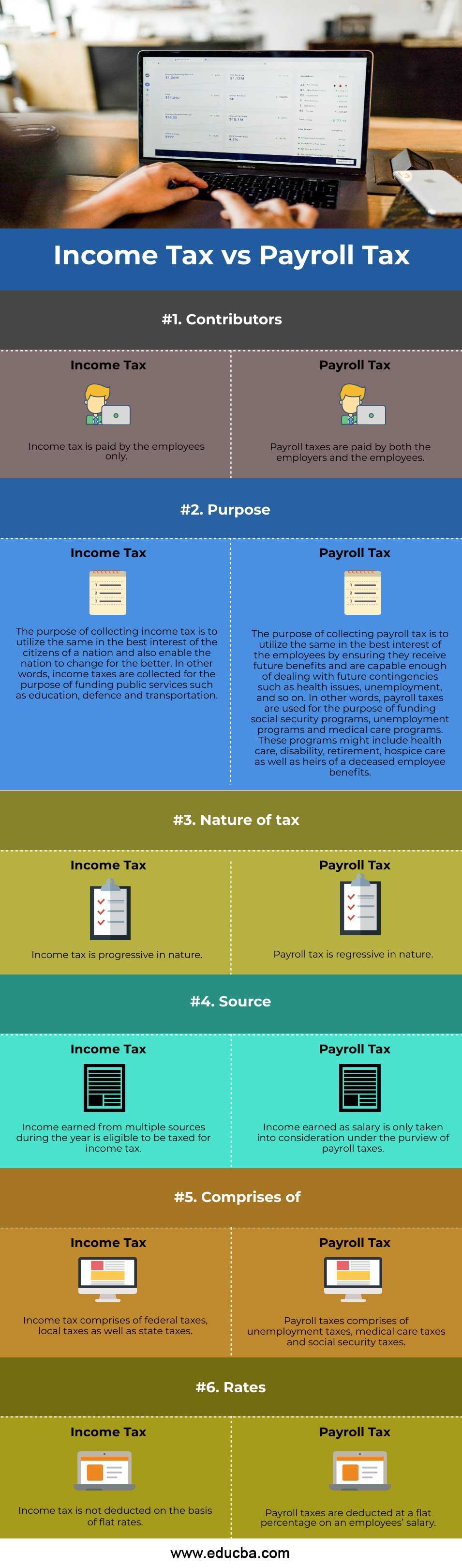

Head To Head Comparison Between Income Tax vs Payroll Tax

The top 6 comparison between Income Tax vs Payroll Tax:

Key Differences Between Income Tax vs Payroll Tax

The key differences between income tax and payroll tax are provided and discussed below:

- In an income tax system, it is solely the responsibility of an employee or an individual who has earned the salary or an income to pay the income tax. On the other hand, in a payroll tax system, both the employers and the employees are responsible for making contributions towards the payroll tax.

- Payroll taxes are collected solely for the purpose of providing future benefits to employees. On the other hand, income taxes are collected in the best interest of society and the country at large.

- Payroll taxes are highly regressive in nature, whereas income taxes are highly progressive in nature. Payroll taxes are regressive because the tax slabs are fixed, which means that employees’ tax liability with a high salary shall be totally equal to the tax liability of employees with a lower salary. Income taxes are progressive in nature because the tax slabs are not fixed as compared to payroll taxes. This means that the rise in the level of pre-determined tax slabs will cause the income tax to increase as well.

- Income taxes consist of federal taxes, state taxes, and local taxes. The federal taxes are paid for the government of the country the tax-payer resides in, the state taxes are paid for the state that the tax-payer resides in, and the local taxes are paid for the locality where the tax-payer actually resides in. On the other hand, payroll taxes include medical care taxes, social security taxes, and unemployment taxes, etc.

- Income taxes are collected so that the governments can appropriately function, whereas payroll taxes are collected so that the employees receive future benefits pertaining to healthcare, employment, and social security.

- Income tax is collected on income that is generated and earned from multiple sources during a particular year, whereas payroll tax is collected on income earned as salary.

- Income tax is taxed on the basis of total income earned, and the tax rate is then determined from the tax slab under which the total income earned by an employee falls. On the other hand, the payroll tax is fixed in nature. This means that in a payroll tax mechanism, an individual’s tax liability will not change with the increase or decrease in the employees’ salary.

Income Tax vs Payroll Tax Comparison Table

The table below summarizes the comparisons between Income Tax vs Payroll Tax:

| Basis of Comparison | Income tax | Payroll tax |

| Contributors | Income tax is paid by the employees only. | Payroll taxes are paid by both the employers and the employees. |

| Purpose | The purpose of collecting income tax is to utilize the same in the best interest of the citizens of a nation and also enable the nation to change for the better. In other words, income taxes are collected for the purpose of funding public services such as education, defense, and transportation. | The purpose of collecting payroll tax is to utilize the same in the best interest of the employees by ensuring they receive future benefits and are capable enough of dealing with future contingencies such as health issues, unemployment, and so on. In other words, payroll taxes are used for the purpose of funding social security programs, unemployment programs, and medical care programs. These programs might include health care, disability, retirement, hospice care as well as heirs of deceased employee benefits. |

| Nature of tax | Income tax is progressive in nature. | Payroll tax is regressive in nature. |

| Source | Income earned from multiple sources during the year is eligible to be taxed for income tax. | Income earned as salary is only taken into consideration under the purview of payroll taxes. |

| Comprises of | Income tax comprises federal taxes, local taxes as well as state taxes. | Payroll taxes comprise unemployment taxes, medical care taxes, and social security taxes. |

| Rates | Income tax is not deducted on the basis of flat rates. | Payroll taxes are deducted at a flat percentage on an employees’ salary. |

Conclusion

Income taxes are paid by the employees or the individuals who have earned the income. On the other hand, payroll taxes are paid by employers as well as employees. Payroll tax is regressive in nature, while an income tax is highly progressive in nature. The payroll tax rate is fixed, while the income tax rate will increase or decrease depending on the earnings of an employee. Payroll taxes are collected to ensure that employees receive future benefits related to medical care, probable unemployment, and social security. On the other hand, income taxes are collected so that the government can enforce development in the country and benefit society as a whole.

Recommended Articles

This is a guide to Income Tax vs Payroll Tax. Here we also discuss the Income Tax vs Payroll Tax, key differences with infographics, and comparison table. You may also have a look at the following articles to learn more –