Updated August 14, 2023

What is Incumbency Certificate?

- A Company is a separate legal artificial entity, and it has its common seal. However, the Company cannot physically transact on its own. Thus, it needs to authorize the directors on its behalf. This is where an incumbency certificate is required.

- The incumbency certificate is an official document of a Company issued by the Company secretary. It has the Company’s seal. It may or may not be notarized by a public notary.

- The Company’s seal certifies that the Company authorizes the person holding the said certificate to act on its behalf. It may also be called a secretary certificate or officer certificate, a register of directors, or a Certificate of Incumbency.

- The Secretary is authorized to sign the certificate since the Secretary is held responsible for maintaining the Company records.

- The primary job of this certificate is to specify the position of the director and the authority bestowed by the Company. Thus, this certificate forms a basis for the identification of the officers of the Company.

How to Write an Incumbency Certificate?

- There is no fixed format for an incumbency certificate. However, it should specify the essential particulars such as the name of the incumbent director, his position in the Company, identification number, whether he is elected or appointed, the term for which he would hold the office.

- The certificate should be titled “Certificate of Incumbency” or “Incumbency Certificate” in clear and bold words.

- The certificate should also state the name of the Company, its registered address, its registration number. After the directors’ signature, it should be signed and authorized by the Company’s Registered Agent (i.e., the Company Secretary). It is generally printed on the letterhead of the Company.

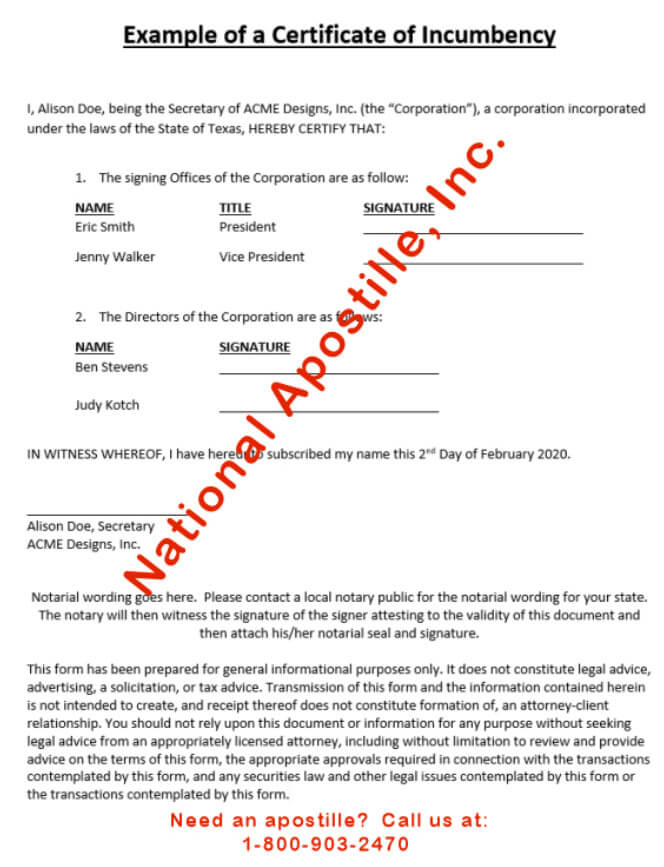

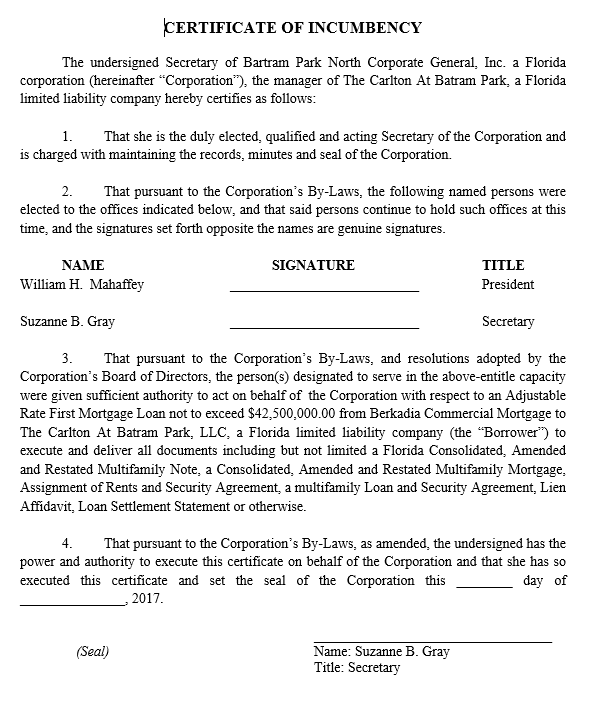

Examples

To provide clarity for the format, the following are the classic examples of an incumbency certificate:

Example #1

Source: https://www.internationalapostille.com/2020/01/27/certificate-of-incumbency-apostille/

Example #2

Source: https://templatelab.com/certificate-of-incumbency/#google_vignette

Who should sign a Certificate of Incumbency?

- Any certificate is complete only if a signature accords to it. The signature provides validity to the certificate. Today, the certificate can be signed physically or through a DSC (Digital Signature Certificate).

- The certificate needs to be signed by the following parties:

- President of the Company

- CEO of the Company

- Other authorized officers

- Registered Agents

- Company Secretary

- Any other natural person as the Secretary may require to sign (such as Witnesses)

- After all the relevant parties have signed, the secretary signs at the bottom, the Company seal is provided. After this, the deal is treated as final.

- In case of changes required, an addendum may be created. In some instances, a new certificate of incumbency may be made, which will replace the original certificate.

How to Order a Certificate of Incumbency?

- The foremost step is to draft the certificate. It is the most crucial step since it specifies the actual intent of the certificate. The Secretary of the Company is responsible for the drafting.

- The respective personnel is required to sign the document along with Company’s seal. The document obtains its legality only after the Company’s seal.

- In a few states, the certificate may be required to be notarized through a public notary. However, this step is optional and differs from state to state.

- The certificate is then filed to the State Secretary Office. This filing needs to be made in the state where the Company has its headquarters located as per official records.

- Certificate of incumbency delegates authority to the officers of the Company. Hence, it needs to be filed in the minutes’ book. A minute book refers to a file that contains all the legal documents relating to the Company.

- Thus, an incumbency certificate can be ordered by contacting the Company secretary through its official email address.

Need of Incumbency Certificate

- A financial institution may require a certificate of incumbency. The financial institution may request such a certificate when opening a new bank account or accepting a loan application.

- The Company cannot transact on its own, and hence, it requires its officers to sign on behalf. Furthermore, any transaction by the director of the Company binds the Company with the said contract. Thus, the attorneys may also request the certificate to ensure the person’s authority transacting on behalf of the Company.

- In case of any legal proceedings due to the default either by Company officials or any third party, this incumbency certificate ensures the legality of the proceedings.

- It confirms the position of the director within the Company. It may also certify the number and names of the key shareholders.

- It assures any third party while dealing with the directors of the Company.

Key Takeaways

- The incumbency certificate is an official document of a Company issued by the Company secretary. It has the Company’s seal. It may or may not be notarized by a public notary.

- The Company’s seal certifies that the Company authorizes the person holding the said certificate to act on its behalf.

- The primary job of this certificate is to specify the position of the director and the authority bestowed by the Company.

- The certificate needs to be signed by the President, CEO, Directors, and Secretary. The certificate bears legality only after the common seal.

- The certificate is filed to the State Secretary Office. This filing needs to be made in the state where the Company has its headquarters located as per official records.

- A financial institution may require this certificate before opening a bank account or transacting into the Company’s material transactions. Also, this certificate may be required by attorneys before binding the Company into a contract.

Conclusion

It forms a basis for the identification of the directors and the responsibility bestowed upon them. It is a legal document that may be required to open accounts in the Company’s name or transact on behalf of the Company. It assures the third party that a genuine and authorized person is dealing on behalf of the Company.

Recommended Articles

This is a guide to Incumbency Certificate. Here we also discuss the definition, examples, and how to write an Incumbency Certificate along with its needs. You may also have a look at the following articles to learn more –