Definition of Index Fund

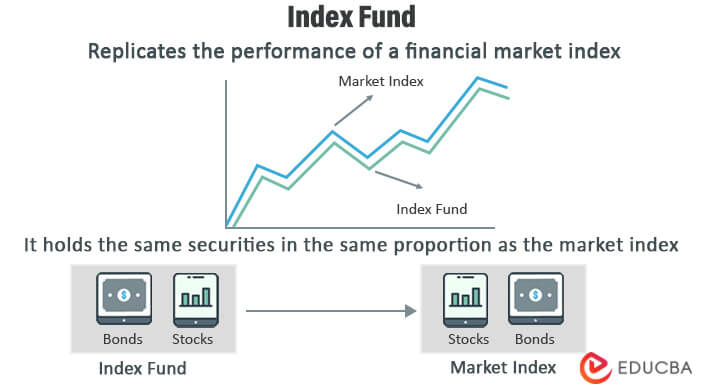

An index fund is a kind of mutual fund or ETF whose portfolios are built to replicate the performance and follow the constituent parts of a financial index of any country, such as the S&P 500 Index or NASDAQ Index or Nifty Index, etc.

They also provide the investor with the risk & returns by mimicking the index.

Key Takeaways

- An index fund is a collection of equities or bonds created to closely resemble the make-up and activity of an index of the stock markets.

- Index funds incur fewer fees and charges than actively managed mutual funds.

- In order to represent the same percentage as the market portfolio, the index fund is under passive management.

- The fund, in this case, will mirror the market’s risk-return profile because it resembles the country’s index or the entire market. Compared to individual stocks, this has far greater volatility.

Explanation

- To follow a market index, index funds can employ various strategies. Some investors buy every security in a market index, whereas others just invest in a representative selection of those assets.

- Market indices frequently determine the weight of securities in the index by looking at the market capitalization of the organization.

- A good portfolio is reflected by the diversification it contains. The returns are to be stable when diversified into various investment streams. Such diversification minimizes the risk. A mutual fund borrows the concept of diversification in stocks of different sectors. So, we have the idea of index funds.

- Thus, the index fund is passive to reflect the same proportion as the market portfolio.

- An index fund is, therefore, a portfolio of stocks in different sectors of the economy.

How Does It Work?

- Index funds are not about active fund management wherein the investor wisely chooses the securities with attention to the timing of buying & selling the stock. Instead, these funds are under passive management.

- The fund here mimics the index of the country, i.e., the entire market. This means it will match the risk & return portfolio of the market. This comes with more massive volatility than individual stocks.

- Whenever an investor invests money in an index fund, that money is then used to acquire shares of all the businesses that comprise that index, giving them portfolios that are more comprehensive than individual stocks.

- The index funds in the United States of America follow the S&P 500 Index. However, one should note that there are other indexes as well which are useful as the basis for mimics:

-

- Dow Jones Industrial Average (DJIA): It is an index representing 30 large-cap companies in the US

- Morgan Stanley Capital International for Europe, Australia & Far East ( MSCI EAFE ): It is an index representing the most productive & profitable stocks of the EAFE regions.

- Russell 2000: It is an index created in 1984 by the Frank Russell Company. It comprises 2000 small-caps.

- Barclays Capital US Aggregate Bond Index: It represents an intermediate term of bonds traded in the US.

- The portfolio manager may choose to follow a weighted index of securities. In this case, the manager re-balances the percentages to reflect the stocks or bonds in an index.

Example of Index Fund

Let us discuss a few index funds on a broader basis.

Vanguard S&P 500 ETF:

It follows the movements in the S&P 500 index. As of September 2022 (latest), the total assets are $ 241.73B. This is an exchange-traded fund that began trading in 2010. Vanguard is the fund industry. It is one of the most significant funds. Here, the expense ratio is 0.03%, which means if you invest $ 100,000, it would cost only $ 30 per annum.

Fidelity Zero Large Cap Index:

It is popular as FNILX. The best thing about this index fund is that the expense ratio is NIL, i.e., zero, as suggested in its name. It follows the Fidelity US Large Cap. The expense ratio is lower since this fund does not have to pay license fees for using the name of S&P. This implies that if an investor invests $ 100,000, it would cost him nothing per annum. All returns earned are in the pocket of the investor. FZROX is another Fidelity index fund known for its zero expense ratio and total market exposure.

Schwab S&P 500 Index:

It is popularly known as SWPPX. The expense ratio here is 0.02%. As of September 2022 (latest), it has $ 56.4 billion worth of assets. Charles Schwab sponsors the index. He is one of the most respected persons in the industry, with his image providing investor-friendly products. It started in the year 1997. The expense ratio is attractive.

SPDR S&P 500 ETF Trust:

It is founded in the year 1993 & it has an expense ratio of nearly 0.09%. It has assets of about $ 326.28B as of September 2022 & it is the most popular exchange-traded fund. It follows the S&P 500 index, as suggested by its name. The expense ratio is higher, costing $ 90 for investors who wish to invest $ 100,000.

iShares Core S&P 500 ETF:

This fund is sponsored by BlackRock & it had assets to the tune of $ 268.45B as per the latest figures in September 2022. It started in the year 2000 & thus it has a long work tenure. It has an expense ratio of 0.03%, making it cost $ 30 for an investor who wishes to invest $ 100,000

Who Should Invest in an Index Fund?

- The indexes over the globes are mainly under a prediction with the help of specialized software or fundament sources. Thus, the investor category who likes predictable returns may prefer to invest in such funds.

- Index fund typically gives approximate returns reflected by the index. Since the performances are predictable, the fund manager churns the composition accordingly.

- However, one should note that since the index fund has a management with a passive approach, the index fund’s return profile will be as significant as the actual index offers. If an investor seeks to have an ample return quantum of returns, he should suggestively invest in actively managed funds.

- One’s financial objectives and tolerance for risk are the only factors in determining whether to invest. Investing in index funds is a viable alternative if one is risk-conservative and seeking consistent gains and portfolio diversity.

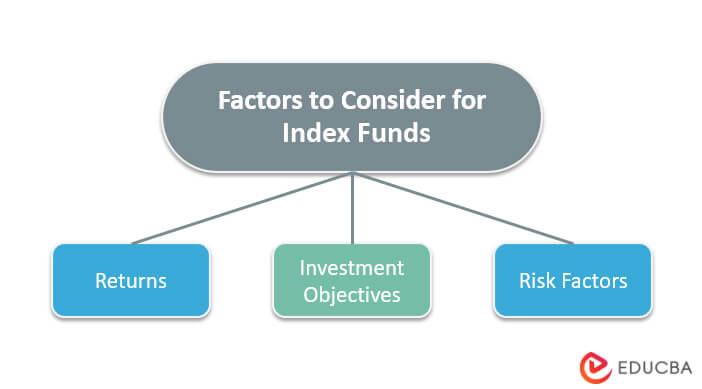

Factors to consider while investing in an index fund

Index funds offer a variety of securities in a single low-cost investment, allowing you to diversify your portfolio in order to meet your financial objectives and reduce risk overall.

As an investor, there are several factors you should think about before investing.

Returns

Index funds mimic the behavior of the index rather than trying to surpass it. The performances of the fund and the index may therefore differ (called tracking error). The goal is to select investments with a low tracking error since the lower the inaccuracy, the higher the investment’s performance will be.

Investment Objectives

Since index funds tend to suffer long-term swings that often balance out over the long run, they are generally ideal for people with long-term investment horizons.

Risk Factor

Index funds are less volatile because they are passive. During a market upswing, one may earn better returns through index funds.

Stocks vs. Index Funds

- One becomes a part owner of the company when they purchase stock in particular companies, which entitles them to a portion of the earnings or losses, depending on how well the organization runs.

- On the other hand, purchasing an index fund entails purchasing a collection of equities that follow a specific index, which results in the indirect ownership of shares in multiple diverse businesses.

- Given that they just need to spend a couple of hours each year reviewing their portfolios, index fund investing attracts many investors.

- A stock investor, however, needs to be knowledgeable about the financials of a firm, including its financial report, balance sheet, etc.

- Although an investor gains by investing in stocks since their earnings increase depending upon their ownership, investing in index funds offers various advantages over buying individual stocks, including lower expenses and lesser need to regularly monitor company earnings reports.

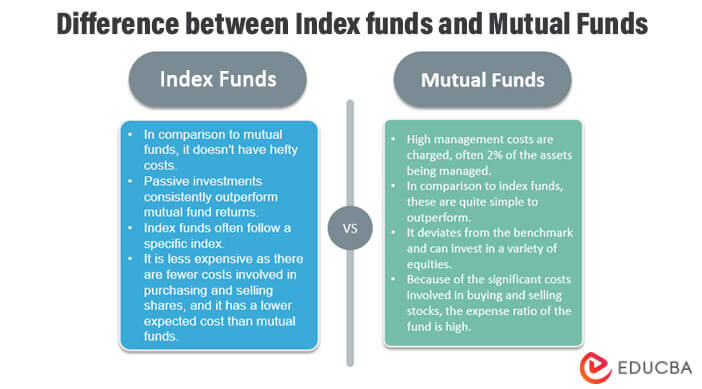

Index Funds vs. Mutual Funds

- The main distinction is that the investment goal of mutual funds is to outperform the standard yield of the market. The investment goal of an index fund, however, is to retain or replicate the performance of the stock index.

- While mutual funds evaluate the effectiveness of individual equities and monitor the progress of their holdings, index funds monitor the growth of the index, which is a baseline.

- While index funds are often closed-ended, mutual funds are typically open-ended.

- Since passive investing is useful in index funds, there is not a huge managerial staff. In contrast to mutual funds, which are under professional management and have a huge investing staff, the loss of charges by index funds is, therefore, not as great of a return loss.

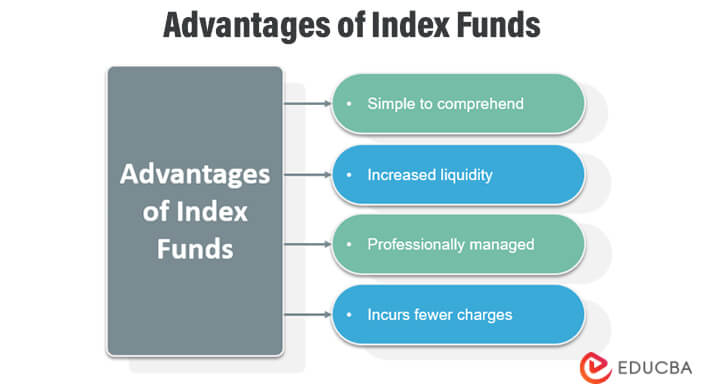

Advantages of Index Fund

Some of the advantages are as below:

- New investors easily attract to these types of funds.

- Index funds are typically preferred these days and are hugely popular because the fund managers can manage to beat the benchmark the market refunds through these funds, which is usually tricky in case the market becomes more effective.

- Index funds have lower costs due to their expense ratio.

- The investment is made through a bunch of assets (i.e., a bunch of stocks) together & thus, the index funds do not have to worry a lot about the risk associated with any specific stock. Favorable movements in other stocks compensate for adverse actions in one stock.

- Index funds are passively managed & thus, they do not need any active management.

- The index automatically removes underperforming stocks.

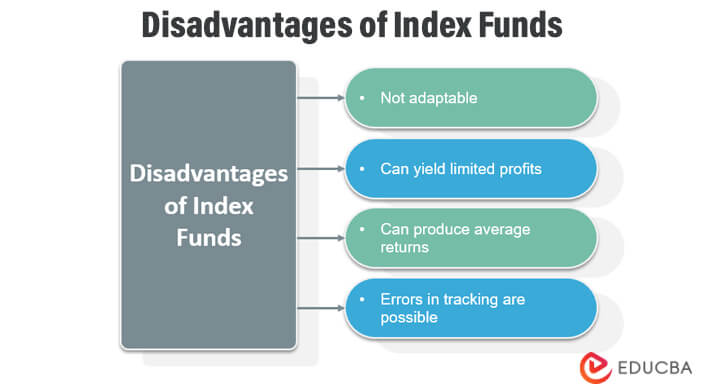

Disadvantages of Index Fund

Some of the disadvantages are as follows:

- The investor retains no control over the performance of the index. Thus, he cannot use his strategies to gain up.

- As said earlier, the index funds mimic the index it is following. In the case of the downside trend of the main index, there is no protection from the loss.

- The correlation of the index fund with the market is very high. Thus, even though it has the potential to gain as per the market, it is equally near to lose due to the market downturn.

- Thus, investors with a lower risk appetite should think strategically before investing in index funds.

- Index funds do not enjoy flexibility and discretion since they are regulated by various policies & procedures.

- Since index funds are passive, the investor should not expect massive gains through such investment.

Conclusion

You cannot invest in each & every share of the economy. However, an index fund makes it possible for even an individual to go through its units. Investors can enjoy the benefit of diversification at a lower cost. The fund manager’s skill chooses which stocks to include in the index fund. However, no such discretionary right goes to the investor. Due to its direct correlation with the market, such funds have performed massively over the long term.

FAQs

1. Is investing in equities or index funds preferable?

Answer: One will own stock in every company if one invests in an index fund that follows that index. Over the long run, index funds frequently outperform active mutual funds and are cheaper than the latter. In general, index funds are less risky than individual equities.

2. How Do Index ETFs (Exchange-Traded Funds) Operate?

Answer: Exchange-traded funds (ETFs) can be arranged as index funds (index ETFs). These items essentially consist of actively managed portfolios of equities, where each share is a little ownership position in the overall portfolio.

3. What is an index fund’s typical return?

Answer: Since its establishment in 1957 through the conclusion of 2021, the index has generated historical annualized average returns of about 11.88%. Even though the average may seem appealing, timing is crucial.

Recommended Articles

This is a guide to Index Fund. Here we also discuss the definition and examples of index funds along with their advantages and disadvantages. You may also have a look at the following articles to learn more –