Updated October 6, 2023

What is Inflation?

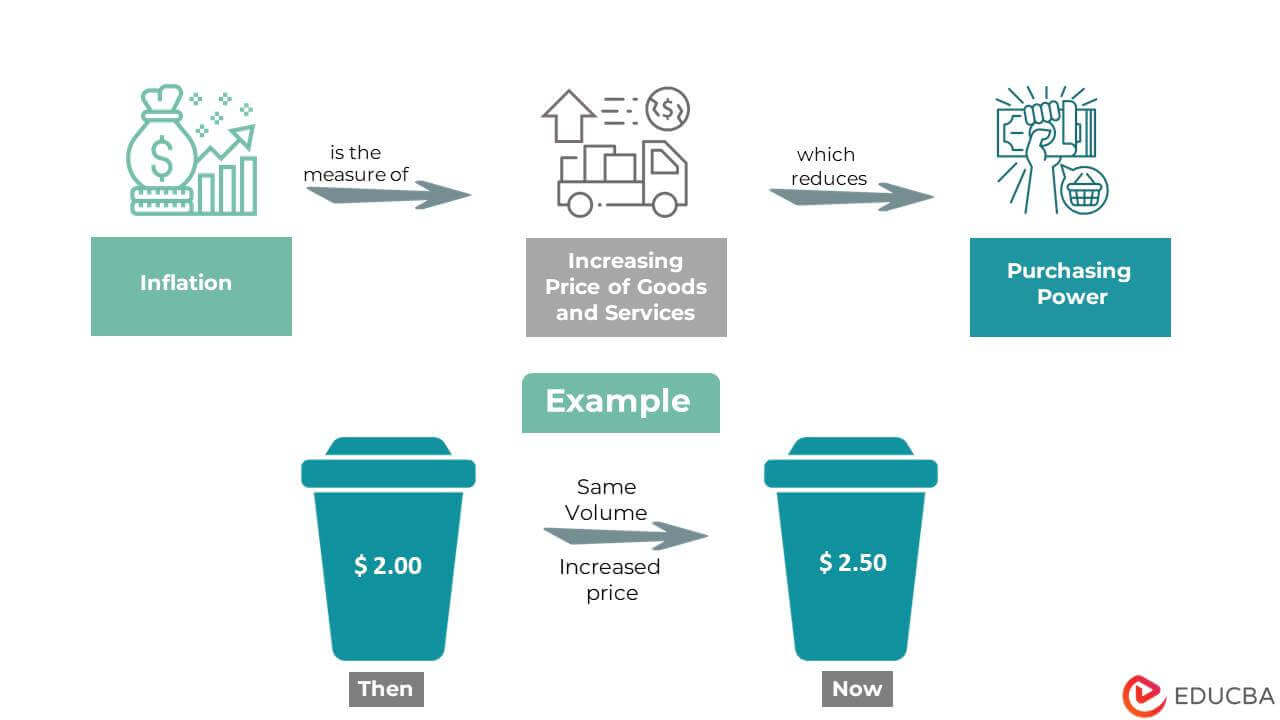

Inflation is an economic concept that represents an increase in the prices of goods over time, reducing purchasing power and affecting individuals, businesses, and governments.

For instance, a cup of coffee costs $2.00 in 2020, but in 2023, it costs $2.50. This increase in the price of coffee is an example of inflation because the same amount of money ($2.00) can now buy less coffee than before.

Factors such as increased demand, reduced supply, or government policies cause inflation. Inflations can have significant economic impacts, such as reducing the purchasing power of consumers, increasing the cost of borrowing, and affecting business investment decisions.

Key Highlights

- Inflation is an economic concept that affects everyone, from individual consumers to businesses and governments.

- Economists use metrics like the Consumer Price Index (CPI) or the Producer Price Index (PPI), which track the prices of goods and services at different production levels to measure it.

- Strategies for managing it include monetary policy tools like adjusting interest rates and government policies to increase the supply of goods and services.

- Over time, it can erode the value of savings and investments, emphasizing the importance of managing inflation to ensure long-term economic stability.

How Does Inflation Work?

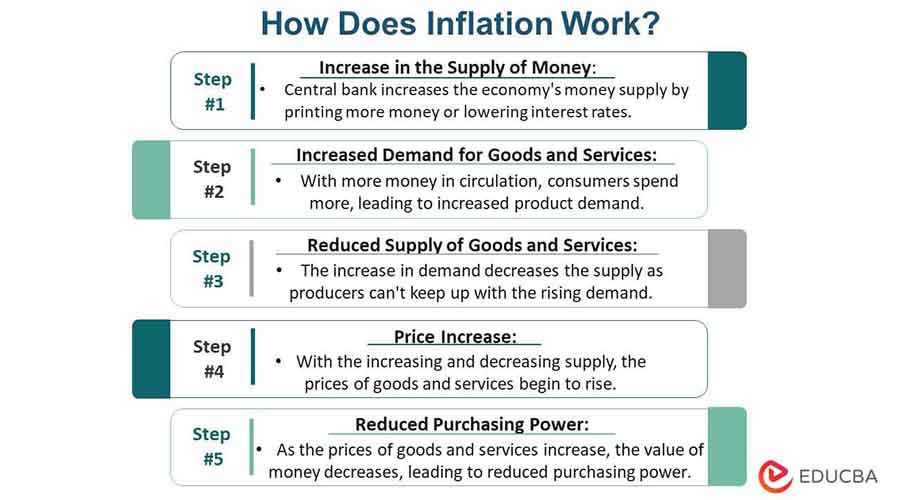

Step #1 Increase in the supply of money:

- When the central bank increases the supply of money in an economy by printing more money or lowering interest rates, it increases the amount of money circulating in the economy.

- Example: Let’s say a country’s central bank decides to print more money, and the total money supply increases from $1 trillion to $1.5 trillion.

Step #2 Increased demand for goods and services:

- With more money in circulation, consumers have more money to spend, leading to increased demand for goods and services.

- Example: With more money in circulation, people may start buying more cars, electronics, and other goods, leading to increased demand for these products.

Step #3 Reduced supply of goods and services:

- The increase in demand for goods and services leads to a decrease in the supply of these goods, as producers are unable to keep up with the rising demand.

- Example: Car manufacturing companies may not be able to produce enough cars to meet the increased demand, leading to a shortage of cars.

Step #4 Price increase:

- With the demand for goods and services increasing and the supply decreasing, the prices of these goods and services begin to rise.

- Example: The shortage of cars may lead to an increase in car prices, making it more expensive for people to buy cars.

Step #5 Reduced purchasing power:

- As the prices of goods and services increase, the value of money decreases, leading to reduced purchasing power.

- Example: With the increase in car prices, people may have to spend more money to buy the same car they could have bought at a lower price before. This means that the same amount of money can now buy fewer goods and services than before.

Types of Inflation

Demand-pull Inflation

It occurs when consumers want to buy more than businesses can produce and supply, increasing the product prices. For instance, if the tomato harvest falls by 50% over a given period, the demand will be more than the supply, which increases the crop price.

Cost-push Inflation

It results from an increase in daily wages and production costs. For instance, if the production cost of cooking oil increases, food prices in restaurants will automatically rise.

Built-in Inflation

It is when employees and laborers expect an increase in wages as a result of the increasing cost of living.

What Causes Inflation?

Increase in Demand: Wages constitute a big part of any production cost. An increase in wages of the workers in a firm leads to an increase in demand, leading to a rise in prices.

Decrease in Supply: With the rise in prices of raw materials, the production volume declines, decreasing the supply altogether. When supply becomes less than the demand, the prices automatically increase.

Government Policies: An increase in taxes implied by the government, such as VAT and excise duties, leads to an increase in the overall prices of all consumer goods and services.

International Factors: A significant part of a country’s economy depends on its import and export relations. When the import rate increases, the price of all imported goods increases in the domestic market.

Effects on the Economy

Reduced Purchasing Power: Inflation makes money worth less, so people can buy fewer things with the same amount of money.

Hardship for the Poor: It hurts poor people the most because they spend most of their income on things like food and energy. The cost of essential goods has risen more than wages over the last seven years.

Increased Interest Rates: When inflation gets too high, central banks often raise interest rates. It makes borrowing money expensive, and people tend to spend less.

Boost in Employment and Growth: In the short term, it can actually help the economy grow faster. It can lower labor costs and encourage job growth.

Risk of Recession: If inflation keeps rising, people may expect higher wages, leading to even higher prices. It could create a cycle of inflation that eventually causes a recession.

How to Measure Inflation?

There are several ways to measure inflation, including:

Consumer Price Index (CPI):

- It tracks the changes in the prices of goods and services that households usually buy.

- It includes things like food, housing, clothing, transportation, and healthcare.

- CPI is published regularly by government agencies and is often used to adjust wages, benefits, and taxes.

Producer Price Index (PPI):

- It measures the average price change that producers receive for their goods and services.

- It tracks changes in wholesale prices and can indicate changes in consumer prices at an early stage.

GDP Deflator:

- It compares the nominal GDP (total value of all goods and services produced in an economy at current prices) to the real GDP (adjusted for inflations).

- It takes into account changes in both consumer and producer prices and is frequently used to compare inflations across countries.

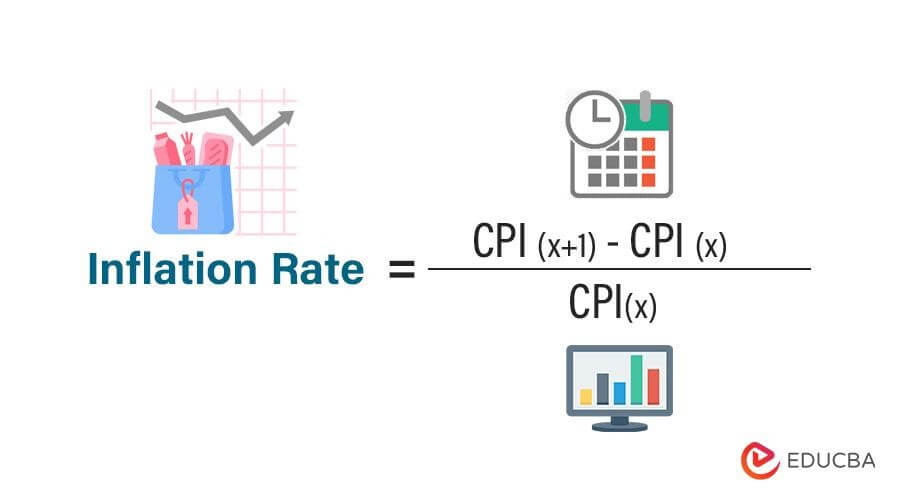

Inflation Rate Formula

The formula is,

Where

- CPI x is the CPI rate value for the first year.

- CPI x + 1 is the CPI value for the second/next year.

Examples

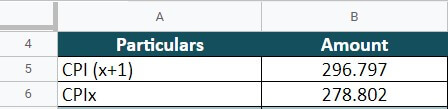

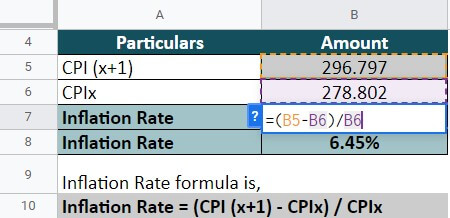

#1 US

The CPI Index for the US in 2021 was 278.802. It rose to 296.797 in 2022. Calculate the inflation rate.

Given,

Solution:

The inflation rate for the US is 6.45%. It indicates that the prices of goods/services in the US economy increased by 6.45% in a year.

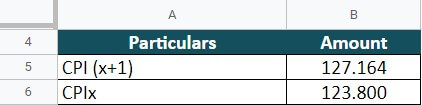

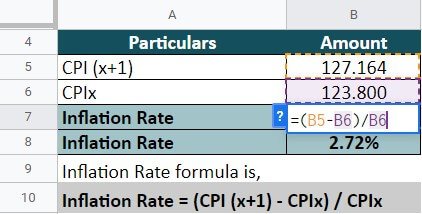

#2 UK

The consumer price index was 123.8 as of 2021. The recent value in December 2022 was 127.164. Calculate the inflation rate.

Given,

Solution:

The UK’s inflation rate is at 2.72%. It signifies that the increase in prices of products over a year has been over 2.72%.

Inflation vs. Deflation

| Inflation | Deflation | |

| Definition | It is a continuous increase in products (goods and services) over time. | It is a constant decrease in the prices of goods and services over a period. |

| Causes | Increase in money supply, increased demand, decrease in supply, or government policies | Decrease in money supply, decreased demand, or economic recession |

| Examples | Hyperinflation in Germany during the 1920s, inflation in the US during the 1970s | The Great Depression in the US during the 1930s, the deflationary spiral in Japan during the 1990s |

| Impact on prices | It increases the prices of goods and services | It decreases the prices of goods and services |

| Impact on investments | It tends to increase the value of assets such as stocks, real estate, and commodities | It tends to decrease the value of assets such as stocks, real estate, and commodities |

| Impact on borrowing | It increases the cost of borrowing money due to higher interest rates | It decreases the cost of borrowing money due to lower interest rates |

| Impact on employment | It can lead to job creation in the short run but may also cause a wage-price spiral and lead to unemployment in the long run | It can lead to job losses due to decreased demand and economic slowdown |

Frequently Asked Questions (FAQs)

How does the government control inflation?

Governments can control inflation by using monetary policy tools such as increasing interest rates, reducing the money supply, and selling government securities. It can also use fiscal policy tools such as reducing government spending and increasing taxes.

Is inflation good or bad for the economy?

Inflation affects the economy in both good and bad ways. A certain level of inflation is beneficial as it encourages spending and investment. But high or unpredictable inflation can reduce consumer purchasing power, lower economic growth, and cause financial instability. So, the government and central banks must manage inflation carefully to promote stable and sustainable economic growth.

Q3. What is an example of inflation?

Suppose the inflation rate in a country was 6% per year. Here’s how much a loaf of bread would cost:

First year: $1.00

Second year: $1.06 (an increase of 6%)

Third year: $1.12 (another increase of 6%)

Real example: In 2020, the COVID-19 pandemic caused a surge in demand for homes in suburban areas, which led to an increase in the prices of houses and rental properties. This is an example of demand-pull inflation.

How to reduce inflation?

The most important measures to reduce inflation are:

- Monetary measures: credit control, demonetization, and issuance of new currency

- Fiscal measures: reducing expenses, increasing taxes, promoting savings, and managing public debt.

- Other measures: increasing production, implementing wage policy reforms and establishing price control mechanisms.

Recommended Articles

This is an EDUCBA guide to Inflation. You can learn more from EDUCBA’s recommended articles.