Updated July 14, 2023

What is Inflation Risk?

The term “inflation risk” refers to the probability that inflation might dent the return of an investment fund resulting in a decline in purchasing power. In other words, the cash flows generated from an investment fund might not be worth as much in the future because of inflation.

Bond investments are mostly exposed to inflation risk as their payouts are usually fixed, and an inflation rate increase undercuts their real returns.

Explanation of Inflation Risk

An increasing trend in the inflation rate can significantly stress the purchasing power of an economy. The investment portfolio has to generate much higher returns to help beat the inflation rate and maintain the same level of purchasing power, or else the portfolio will fail to generate real returns. The more inflation and prices rise. It is equally important for overall portfolio returns and individual investment returns.

Example of Inflation Risk

Examples of inflation risk are:

Let us take the example of a 1-year $1,000 bond that pays 5% as an annual coupon. So, the investor or holder of the bond will receive a $50 coupon and $1,000 principal at the end of one year, which results in an aggregate bond value of $1,050. But now the real question is – has the purchasing power also increased by 5%?

So, first, let us look at what the bondholder can purchase today with the $1,000. Today, the bondholder can buy a wooden table representing the purchasing power of $1,000. Now, let us imagine that the inflation rate is 8%; hence, after one year, the same wooden table will be priced at $1,100. So, it means that the bondholder won’t be able to purchase the wooden table with the proceeds from the bond a year later. The purchasing power will deteriorate due to the inflation rate greater than the bond’s return. Therefore, although the bond will generate a nominal return of 5%, the real return will be -3% (= 5% – 8%). This is how inflation risk works – it undercuts the real return.

How to Measure Inflation Risk?

Some of the primary metrics used to measure inflation risk are –

- Consumer Price Index or CPI

- Retail Price Index or RPI

- Consumer Price Index, including Housing costs or CPIH

CPI is calculated based on a basket of goods and services that are commonly purchased, such as food, clothes, postage, etc. The calculation of RPI includes house prices in addition to the basket of CPIand; hence RPI is usually higher than CPI. On the other hand, CPIH considers various housing costs, which include council tax and other taxes. CPIH is also invariably higher than CPI.

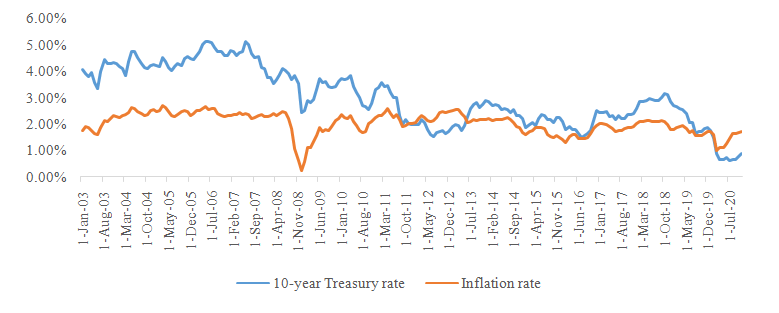

Inflation Risk Graph

Source: FRED

The above graph has been created by plotting the US’s inflation rate and 10-year Treasury rates from January 2003 to November 2020. It can be seen that there are some instances where the inflation rate (orange line) is above the return generated by Treasury (blue line), which means it generated a negative real return despite delivering a positive nominal return. However, in most periods, the blue line is above the orange line, indicating that the Treasury return has largely beat the inflation rate. The risk of the Treasury return falling below the inflation rate represents the inflation risk.

How to Minimize Inflation Risk

Some of the investment options that can help in minimizing inflation risk are:

- The investment portfolio should be diversified with a mix of growth and value stocks, as these stocks usually offset the effects of inflation. Growth stocks signify companies with the potential to beat the market growth, while value stocks represent established companies with impeccable track records.

- Real estate is another form of alternative investment, which includes the purchase of homes and land. Typically, real estate property prices tend to appreciate over time and account for the effects of inflation. In some cases, the investors also benefit from the growing inflation rate.

Inflation Risk Bonds

Treasury Inflation-Protected Securities or TIPS is an inflation-risk bond that helps mitigate inflation risk. These bonds index their coupon and principal payments to the inflation rate, ensuring that investors receive consistent real returns regardless of the ongoing inflation rate.

Impact of Inflation Risk

Inflation risk can be detrimental to an investment portfolio because it affects the real return and, in turn, the purchasing power. Even after generating a healthy nominal return, the portfolio return might fail to deliver real return due to steadily up-trending inflation. The reason is that the nominal return doesn’t adjust the negative effect of inflation, while the real returns are inflation-adjusted. Fixed-income securities are more susceptible to inflation risk as these securities offer a fixed and stable rate of return over time. Further, long-term securities suffer more due to inflation risk than short-term securities.

Advantages

Some of the major advantages are as follows:

- As a result, people tend to increase their spending because they anticipate future increases in the prices of the same goods and services. The economy can certainly boost from such a spending spree.

- It allows businesses to increase the prices of their goods and services in line with the increase in their input costs. This can provide major support to revenue growth.

Disadvantages

Some of the major disadvantages are as follows:

- It leads to purchasing power risk, wherein the savings are insufficient to meet the expenditure requirements.

- If businesses pass on the increase in the input costs to the customers, then it may result in the sale of fewer units, which may prove detrimental to revenue growth.

- If businesses cannot pass on the increase in input costs to the customers, it would result in downward pressure on their profit margins.

Conclusion

So, it can be seen that inflation risk isn’t something that can be overlooked or avoided while managing an investment portfolio. The adverse impact of inflation on real return is a genuine concern for investors. Hence, it is important to build strategies to offset the effects of inflation to secure better investment returns.

Recommended Articles

This is a guide to Inflation Risk. Here we also discuss the introduction and how to measure inflation risk. Along with advantages and disadvantages. You may also have a look at the following articles to learn more –