Updated November 17, 2023

Difference Between Inflation vs Interest Rates

One can define inflation as a continual rise in the price level within an economy over a period of time. The economy is not facing inflation if the price level increases suddenly in a single jump but does not continue increasing. Also, it is not inflation in an increase in the price of any specific good or service or relative prices of some goods or services. The interest rate is the rate banks borrow money from the Central Bank. Central Banks use interest rates, such as the Federal Funds rate in the US or the Repo rate in India, to shape monetary policy and target a specific inflation rate.

Let us study much more about Inflation vs Interest Rate in detail:

If inflation is present, almost all goods and services are increasing. Inflation erodes the purchasing power of a currency. It benefits borrowers at the expense of lenders since the principal amount returned to the lender is worth less in terms of goods and services than when borrowed. Inflation that accelerates out of control is called hyperinflation, which can destroy a country’s monetary system and bring about social and political upheavals. The inflation rate represents the percentage increase in the price level compared to a base year. Analysts use the inflation rate as an indicator of the business cycle and anticipate changes in the Central Bank’s monetary policy.

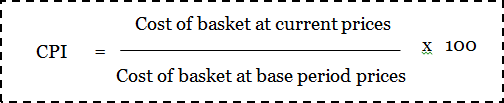

A price index is used as a proxy for the price level to calculate the inflation rate. A price index measures the average price for a defined basket of goods and services. The Consumer Price Index (CPI) is the most prevalently used indicator for inflation rate and is widely used by many countries. The CPI indicator consists of a basket of goods and services representing the purchasing patterns of a typical urban household. For example, in the United States, the CPI basket contains Food (14.2%), Energy (10.5%), and all items with less food and energy (75.4%) as the categories of estimating CPI. To calculate CPI, the Bureau of Labour Statistics in the US or similar organizations in any country (where basket percentages may be different) compares the cost of a CPI basket with the cost of a basket in an earlier base period. The formula for calculating CPI is: –

Take an example for calculating the CPI: –

|

Item |

Quantity |

Price in the Base period |

Current Price |

| Cheeseburgers | 200 | 2.50 | 3 |

| Movie Tickets | 50 | 7 | 10 |

| Automobile fuel | 300 | 1.50 | 3 |

| Watches | 100 | 12 | 9 |

Reference base period: –

Cheeseburgers – 200 x 2.5 = 500

Movie Tickets – 50 x 7 = 350

Automobile fuel – 300 x 1.5 = 450

Watches – 100 x 12 = 1200

Cost of basket = 2500

Current period –

Cheeseburgers – 200 x 3 = 600

Movie Tickets – 50 x 10 = 500

Automobile fuel – 300 x 3 = 900

Watches – 100 x 9 = 900

Cost of basket = 2900

CPI = (2900/2500) x 100 = 116

The price index is 16% over the base period; hence inflation rate is 16%.

Some countries use the Wholesale Price Index (WPI) to measure inflation. To monitor emerging price pressures, WPI examines the prices of goods at various processing stages, including raw materials, intermediate goods, and finished goods.

To comprehend the occurrence of inflation or the targeting of a specific inflation rate, one must examine the interest rate established by a country’s Central Bank. Monetary policy refers to the Central Bank using the interest rate to affect the quantity of money and credit in an economy to influence economic activity. When the Central Bank lowers the interest rate, causing an increase in the quantity of money and credit in the economy, it is considered expansionary. Conversely, when the Central Bank increases the interest rate, which reduces the amount of money and credit in an economy, the monetary policy is said to be contractionary.

So the Central Bank uses the interest rate to affect the money supply, thereby targeting inflation. The quantity theory of money states that the quantity of money is some proportion of total spending in an economy and implies the quantity equation of exchange: –

The equation of exchange states that total spending equals price times the real output, with velocity representing the average number of times money is used to buy goods and services in a year. Assuming constant velocity and real output, an increase in the money supply leads to a proportionate price increase. Monetarists believe that interest rates control the money supply. Decreasing interest rates leads to more borrowing, consumer spending, and inflation, while increasing rates lead to less borrowing, reduced spending, and lower inflation. Central banks adjust interest rates to control inflation.

Head To Head Comparison Between Inflation vs Interest Rates (Infographics)

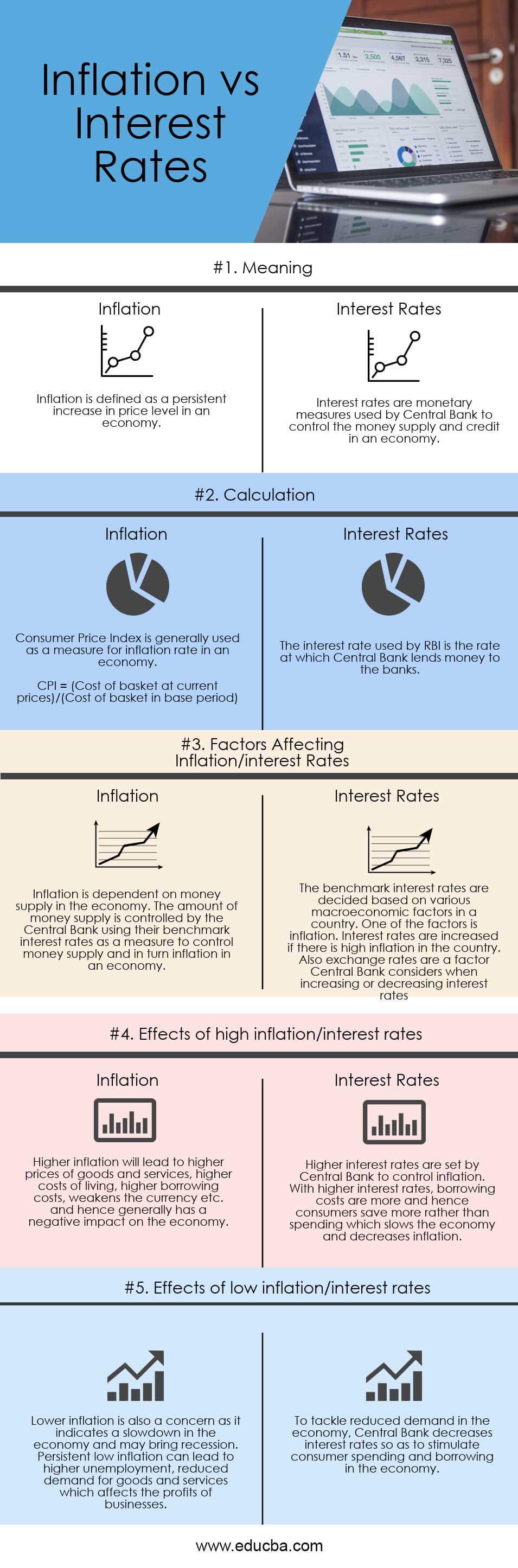

Below is the top 5 difference between Inflation vs Interest Rates:

Key Differences Between Inflation vs Interest Rates

Both Inflations vs Interest Rates are causing the economy to grow, but there are a lot of differences :

- In the context of Inflation vs Interest Rates, inflation can be characterized as a continual increase in the price level in an economy. In contrast, interest rates are monetary policy tools a country’s Central Bank employs to regulate the amount of money supply and credit in the economy.

- Inflation depends on the level of money supply in an economy that the Central Bank decides. An economy’s interest rates depend on many macroeconomic factors, including inflation.

- Higher inflation will lead to higher prices of goods and services in an economy. It also leads to higher costs of living, higher borrowing costs, weakening the currency, etc. Conversely, lower inflation indicates a slowdown in the economy and may bring a recession. Low inflation can lead to higher unemployment and reduced demand for goods and services, which may affect profits. Central Bank sets higher interest rates to control inflation. With higher interest rates, borrowing costs are higher; hence, consumers save more than they spend, which slows the economy and decreases inflation. Interest rates are reduced when there is a need to stimulate demand in the economy, leading to higher borrowing and consumer spending, which leads to an increase in inflation.

Head To Head Comparisons Between Inflation vs Interest Rates

Below are the Topmost comparisons between Inflation vs Interest Rates

| Basis of Comparison |

Inflation |

Interest Rates |

| Meaning | A persistent rise in the price level within an economy is the definition of inflation. | Monetary measures a Central Bank uses to manage the money supply and credit within an economy are known as interest rates. |

| Calculation | Consumer Price Index is generally used to measure an economy’s inflation rate.

CPI = (Cost of basket at current prices)/(Cost of basket in base period) |

The interest rate used by RBI is the rate at which Central Bank lends money to the banks |

| Factors affecting

Inflation vs Interest rates |

Inflation is dependent on the money supply in the economy. The Central Bank manages the money supply by utilizing its benchmark interest rates to regulate the supply and inflation within an economy. | The benchmark interest rates are decided based on various macroeconomic factors in a country. One of the factors is inflation. Interest rates are increased if there is high inflation in the country. Also, exchange rates are a factor the Central Bank considers when increasing or decreasing interest rates. |

| Effects of high Inflation vs Interest rates | Higher inflation will lead to higher prices of goods and services, higher costs of living, higher borrowing costs, weakening the currency, etc., and hence generally harms the economy. | Central Bank sets higher interest rates to control inflation. With higher interest rates, borrowing costs are high; hence, consumers save more than they spend, which slows the economy and decreases inflation. |

| Effects of Low Inflation vs Interest Rates | Lower inflation is also a concern as it indicates a slowdown in the economy and may bring a recession. Persistent low inflation can lead to higher unemployment and reduced demand for goods and services, affecting businesses’ profits. | Central Bank decreases interest rates to tackle reduced economic demand to stimulate consumer spending and borrowing. |

Conclusion

Central banks worldwide have used various economic variables and indicators to make monetary policy decisions. Inflation targeting is the most commonly used approach for making monetary policy decisions and is mandated by law in some nations. Central Banks in countries like the UK, Brazil, Canada, India, Australia, Mexico, and the European Central Bank currently use inflation targeting. Inflation targeting is used by either increasing or decreasing the benchmark interest rates in the economy.

The most common inflation rate is 2%, and the target band is 1% to 3%. In countries like India, which is on a path to higher growth, the inflation target is 4%. The inflation target is not 0% because variations around that rate would allow for negative inflation i.e. deflation, which is considered disruptive to the smooth functioning of an economy. Central Banks all over the world follow controlled inflation as the way forward for sustainable growth in the economy.

Recommended Articles

This has guided the top differences between Inflation vs Interest Rates. Here, we also discussed the Inflation vs Interest Rates key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –