Difference Between Insolvency vs Bankruptcy

The terms bankruptcy and insolvency are often confused because they are highly related to each other. The origin of the word Bankrupt came from the Italian bancoo rotta meaning broken bench. The bench was a money dealer’s table. When the dealer goes out of the money the bench gets broken. Hence came the word Bankrupt. These two terms have few things in common – Both occur when liabilities exceed assets and arise when the company/person is unable to pay the debt.

What is Insolvency?

Inability to pay back the debt. There are many ways in which one can deal with Insolvency: Changing debt structure or changing cash flows. Insolvency has two types: 1) Cash flow insolvency 2) Balance-sheet insolvency. Balance sheet insolvency occurs when debt exceeds assets. Cash flow insolvency occurs when a debtor is not in a condition to repay the money. Insolvency becomes a great obstacle when the debtor is unable to pay the due. e.g If you own a house and fail to pay the installment soon there would be a foreclosure at your house and you will be into default.

The same can be applied with the credit card if one fails to meet minimal monthly requirements it would turn out to be a default. Insolvency works as an alarm for the financial systems. Various indicators show insolvency like overdue of taxes, liquidity ratio less than 1, losses for a long period, no alternative finance option, poor relationship with the banks, creditors unpaid outside trading terms, one cannot solve these issues and it would turn out to be bankrupt. To decide for balance sheet insolvency, the business needs to evaluate.

What is Bankruptcy?

It is the final state when other attempts fail to clear the debt. In Bankruptcy the company itself declares insolvent by going to court. There are two forms of bankruptcy: reorganization and liquidation bankruptcy. Reorganization bankruptcy means reorganizing a person or company’s debt. Liquidation bankruptcy means a person/business sells its assets to meet the debt. Bankruptcy can be issued in two ways: When a person himself files declaring himself bankrupt known as ‘Debtors Petition’.When the court issues an order and declares a company or an individual bankrupt known as a Sequestration order.

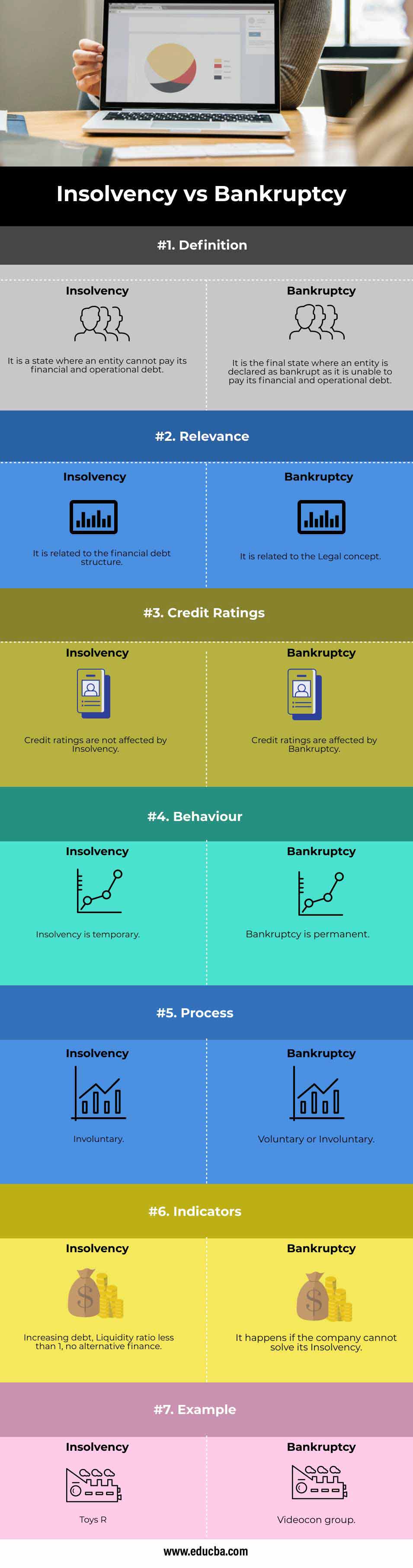

Head To Head Comparision Between Insolvency vs Bankruptcy (Infographics)

Below are the top 7 differences between Insolvency vs Bankruptcy:

Key Differences Between Insolvency vs Bankruptcy

Let us discuss some of the major key differences between Insolvency vs Bankruptcy.

- In simple terms Insolvency means you don’t have enough money to repay the debt to the creditors. This term Insolvency can be applied to any person or business. If you can pay your bills you know as a solvent person or a corporation. If you are unable to pay it is known as insolvent. For a person, it simply means that the debt is more than the income. For any business, it means that the money inflow and assets are lesser than the money outflow. Bankruptcy means the final state of being insolvent. Bankruptcy means a declaration of inability to pay off its debt. It’s just a term used for a person/company when declared insolvent by a court of law.

- Insolvency occurs when the debt increases in the balance sheet or it could be also when cash outflows are greater than cash inflows. As it could be related to the balance sheet as well as cash flow. Bankruptcy is only said when declared in the state of law.

- Credit ratings are affected only when there is a huge change observed. As insolvency can be resolved and is temporary doesn’t affect the credit rating changes. Bankruptcy cannot be resolved and thus has a huge impact on credit ratings.

- Insolvency can be solved by improving the debt structure and by increasing cash inflows. Insolvency is for a limited period till the time one exceeds its assets then liabilities to pay back the debt. So, Insolvency is not permanent. Bankruptcy doesn’t have any solution.e.g: If some company doesn’t have enough sales and little cash inflows in business, the company cannot meet its daily expenses but it can, however, be solved.

- For declaring a company to be Bankrupt an individual has to initiate himself and go to court. So it is voluntary. It can also happen that the court declares a person/company bankrupt. So it can be Involuntary as well. On the other hand, insolvency is involuntary.

- There are various indicators to predict insolvency. Increasing debt in the balance sheet and no more cash inflows lead to insolvency. However, if insolvency remains for a long time and is not solved it may lead to Bankruptcy. If the company becomes insolvent and declared bankrupt then it’s time to liquidate the company. If the company’s Board of directors comes to the conclusion that the company should be liquidated then further liquidation process should be conducted.

Example

Toys R Us has gone into solvency putting 3200 people jobs at risk. It is heavily leveraged. Videocon group owes over 90,000 crores to various banks and other institutes. It is the biggest case that is filed for bankruptcy in entire Indian banking history.

The solutions to these problems could be two ways: It could be either controllable or uncontrollable factor.

- Controllable factors are the one which can increase the bottom line. Even if the debt of the company increases the company can manage it by balancing cash by improving ways of increasing revenue.

- The second type is the one where the factors are not controllable. Examples of such types are political factors, ecological factors, etc. The controllable factors should be well noticed, cash inflows and outflows should be monitored. Uncontrollable factors there should be a contingency and other plans set in advance. Many of the companies don’t get insolvent because of the increase in debt structure but because of being ignorant towards these factors. If they pay attention to the factors above and set plans company can rarely get into insolvency and hence can never be bankrupt.

Insolvency vs Bankruptcy Comparison table

Let’s discuss the top comparison between Insolvency vs Bankruptcy:

| Basis of Comparison |

Insolvency |

Bankruptcy |

| Definition | It is a state where an entity cannot pay its financial and operational debt. | It is the final state where an entity is declared as bankrupt as it is unable to pay its financial and operational debt. |

| Relevance | It is related to the financial debt structure. | It is related to the Legal concept. |

| Credit Ratings | Credit ratings are not affected by Insolvency. | Credit ratings are affected by Bankruptcy. |

| Behavior | Insolvency is temporary. | Bankruptcy is permanent. |

| Process | Involuntary | Voluntary or Involuntary. |

| Indicators | Increasing debt, Liquidity ratio less than 1, no alternative finance. | It happens if the company cannot solve its Insolvency. |

| Example | Toys R | Videocon group. |

Conclusion

The two terms are highly correlated with each other. When one ends the other initiates.When insolvency ends bankruptcy starts. Every insolvent person/company doesn’t have to be bankrupt but every bankruptcy needs to be insolvent.

Recommended Articles

This has been a guide to the top difference between Insolvency vs Bankruptcy. Here we also discuss the Insolvency vs Bankruptcy key differences with infographics and comparison table. You may also have a look at the following articles to learn more-