Updated June 28, 2023

Difference Between Insurance Agent vs Insurance Broker

The terms ‘broker’ and ‘agent’ are often used interchangeably in the insurance market. Both brokers and agents must possess the necessary licenses and serve as intermediaries between insurance companies and policy buyers.

Let’s delve into these concepts further to gain a clearer understanding. An insurance broker represents multiple insurance companies, providing their customers with a diverse range of selective and personalized options. An insurance agent, often referred to as a captive agent, exclusively associates with one company and exclusively sells products offered by that particular company. They are tied to and appointed by a specific insurance company.

However, there are additional significant distinctions between insurance agents and insurance brokers in terms of their job responsibilities and the parties they represent. Let’s explore these differences in more detail.

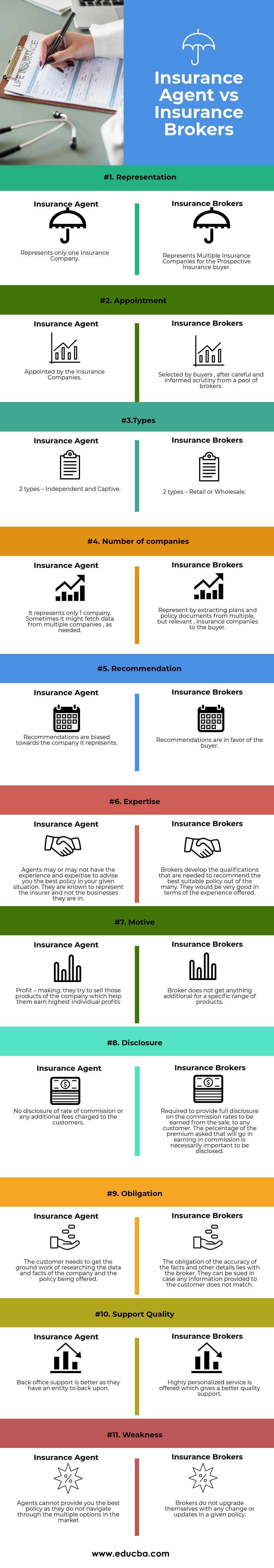

Head To Head Comparison Between Insurance Agent vs Insurance Broker (Infographics)

Below is the top 11 difference between Insurance Agent vs Insurance Broker:

Key Differences Between Insurance Agent vs Insurance Broker

Both Insurance Agent vs Insurance Brokers are popular choices in the market; let us discuss some of the major differences:

- Insurance agents represent the Insurance Company and would provide information only for the same company to any prospective buyer. They have a deep understanding of the company they are associated with. Insurance brokers represent Insurance buyers and provide information from multiple Insurance companies to ensure the right insurance plan for the buyer.

- Products offered by the agents are that of the insurance company only for whom they are the employees. They are more responsible for the paperwork required after any plan is sold, processing of the forms, and the premiums. On the other hand, brokers choose to be more involved in knowing your requirement and getting you the best possible policy available among different insurance companies and products.

- An insurance agent can usually represent a maximum of 1 of each of these – life insurance, general insurance, and health insurance. They also do not have access to all the insurance vendors’ policies. At the same time, a broker can fetch your information for the companies and insurance plans available and does not limit him. The broker is also equipped enough to further give you more details if more than 1 type of insurance is what you would need.

- Since brokers need to identify the best insurance contracts for their client’s specific needs, they must assess their business / financial needs and situation for the best available. To do this, they need to assess all possible unique insurance situations and have useful and in-depth knowledge about the market and its products. Because of this additional seeking quality, insurance brokers charge administrative and premium fees (which includes a percentage of their commission) higher than the insurance agents. Some companies also pay salaries to their captive agents as they are treated like employees.

Insurance Agent vs Insurance Broker Comparison Table

Below is the 11 topmost comparison between Insurance Agent vs Insurance Broker

| Basic comparison |

Insurance Agent |

Insurance Brokers |

| Representation | Represents only one Insurance Company | Represents Multiple Insurance Companies for the Prospective Insurance buyer |

| Appointment | Appointed by the Insurance Companies | Selected by buyers after careful and informed scrutiny from a pool of brokers |

| Types | 2 types – Independent and Captive | 2 types – Retail or Wholesale |

| Number of companies | It represents only 1 company. Sometimes it might fetch data from multiple companies as needed. | Represent by extracting plans and policy documents from multiple but relevant insurance companies to the buyer. |

| Recommendation | Biased toward the company it represents. | In favor of the buyer. |

| Expertise | Agents may or may not possess the experience and expertise to provide you with the best policy advice in your given situation. It is known that they represent the insurer, not the businesses they are involved in. | Brokers develop qualifications to recommend the best suitable policy out of the many, offering a high level of experience. |

| Motive | Profit-making: they try to sell those products of the company which help them earn the highest individual profits. | The broker does not get anything additional for a specific range of products. |

| Disclosure | No disclosure of the rate of commission or any additional fees charged to the customers. | We must disclose the commission rates earned from the sale to any customer, including the percentage of the premium allocated as commission. |

| Obligation | The customer needs to research the data and facts of the company and the policy being offered. | The obligation of the accuracy of the facts and other details lies with the broker. They can be sued in case any information provided to the customer does not match. |

| Support Quality | Back office support is better as they have an entity to back upon. | Highly personalized service is offered, which gives better quality support. |

| Weakness | Agents cannot provide you with the best policy as they do not navigate through the multiple options in the market. | Brokers do not upgrade themselves with any change or updates in a given policy. |

Conclusion

Choosing between an agent and a broker depends on your needs. If you have a specific product in mind, go for a captive agent. If you want to help explore various options and make an informed decision, choose an insurance broker. Some companies, known as’ direct writers, sell directly to buyers without intermediaries.’ Consider factors like cost, speed, data security, and peace of mind when selecting a plan. Gather complete information and be diligent in choosing an agent or broker.

Recommended Articles

This has been a guide to the top difference between Insurance agents vs Insurance Broker. Here we also discuss the Insurance Agent vs Insurance Broker key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –