Updated July 29, 2023

Interest Expense Formula (Table of Contents)

- Interest Expense Formula

- Examples of Interest Expense Formula (With Excel Template)

- Interest Expense Formula Calculator

Interest Expense Formula

Interest Expense is one of the primary components of Income Statement, where it is treated as an ‘Expense’ and is directly related to the Current Debt Position of the Business.

The formula to calculate Interest Expense is as below:

Or,

Examples of Interest Expense Formula (With Excel Template)

Let’s take an example to understand the calculation of the Interest Expense formula in a better manner.

Example #1

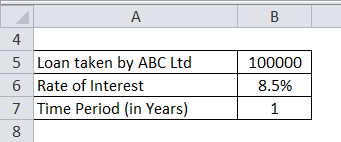

ABC Ltd. took a Loan of INR 1,00,000 on 1st January with a simple interest rate of 8.5% per annum. On 31st December, ABC Ltd. paid the Principle loan Amount along with the Interest expense.

Solution:

The formula to calculate Interest Expense is as below:

Interest Expense = Principal Amount (Total Borrowed Amount) * Rate of Interest * Time Period

- Interest Expense = INR 1,00,000 * 8.5% * 1

- Interest Expense = INR 8,500

Total amount paid for Interest is INR 8,500

Thus, the amount paid by ABC Ltd at the end of the year = INR (8,500 + 1,00,000) = INR 1,08,500

Example #2

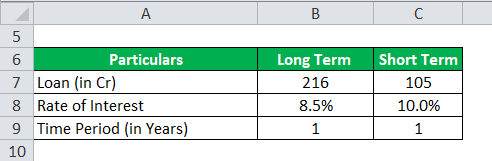

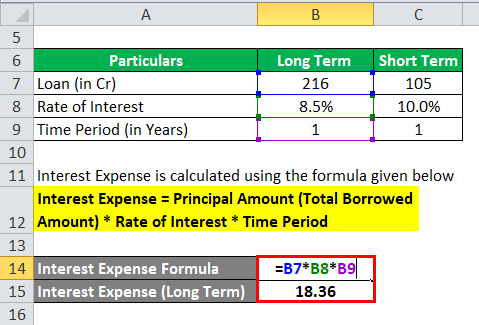

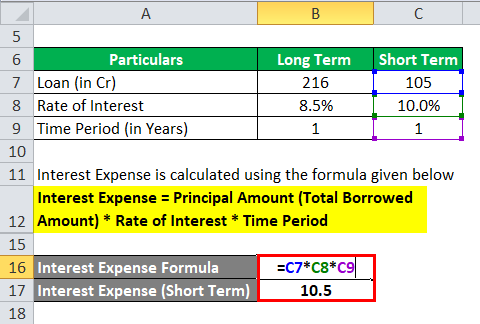

Gati Ltd. has a long-term Loan of INR 216 Cr on 31st March with a simple interest rate of 8.5% per annum and a Short-term loan of INR 105 Cr during that period with a rate of interest of 10% per annum. Both were taken a year ago. Calculate the Interest expense on 31st March.

Solution:

Interest Expense = Principal Amount (Total Borrowed Amount) * Rate of Interest * Time Period

- Interest Expense (Long Term) = INR 216 Cr * 8.5% * 1

- Interest Expense (Long Term) = INR 18.36 Cr

Interest Expense = Principal Amount (Total Borrowed Amount) * Rate of Interest * Time Period

- Interest Expense (Short Term) = INR 105 Cr * 10% * 1

- Interest Expense (Short Term) = INR 10.5 Cr

Total amount paid for Interest = INR (18.36+ 10.5) = INR 28.86 Cr.

Example #3

Tata Motors Ltd had total Borrowings (including Long-term and Short-term borrowings) of INR 88,950 Cr on 31st March 2018. On 1st October, the Company increased its total Borrowings to INR 92,923 Cr. Calculate the total amount of Interest the Company has to pay at the end of March 31st, 2019, if the rate of interest stands @ 5.25% / annum.

Solution:

- Loan taken by Tata Motors Ltd. one year ago = INR 88,950 Cr.

- The rate of Interest per annum = 5.25%

- Tenure = 365 Days (One Year)

Interest Expense is calculated using the formula given below

Interest Expense = Principal Amount (Total Borrowed Amount) * Rate of Interest * Time Period

- Interest Expense = INR 88,950 Cr * 5.25% * 1

- Interest Expense = INR 4,669.88 Cr

Again, the Loan is taken by Tata Motors Ltd. for the last six months = INR (92,923 – 88,950) Cr = INR 3,973 Cr

- Loan = INR 3,973 Cr

- The rate of Interest per annum = 5.25%

- Tenure = 180 Days (Half Year)

Interest Expense is calculated using the formula given below

Interest Expense = Principal Amount (Total Borrowed Amount) * Rate of Interest * Time Period

- Interest Expense = INR 3,973 Cr * 5.25 % * 1/2

- Interest Expense = INR 104.29 Cr

Total amount paid for Interest = INR (4,669.88 + 104.29) Cr =INR 4,774.17 cr.

Explanation of the Interest Expense Formula

Interest expense is the cost of the Lender giving money to the required party. Business houses need capital to do business. Capital can be of two types – one is Equity, and another is Debt. Equity holders are the real owners who are entitled to take the risk of the business, and their return is not Fixed. On the other hand, the Debenture holders are willing to invest in the business but with an assurance of guaranteed return. Debenture holders charge a fixed interest rate, and the Business is liable to pay irrespective of the loss or profit of the Business. The same phenomenon happens with Financial Institutions or banks when they lend money to the business.

Relevance and Uses

- Interest Expense formula is extensively used by Companies, Firms, Governments, Banks, and Financial institutions as it is the revenue of the lender and an expense for the Borrower. Details of Interest calculations are always required as it might affect their business negatively or positively depending upon the rate of interest and tenure of the loan.

- Due to higher Borrowings, some companies might find it hard to see profitability due to higher expenses, and margins with profitability are sinking. Thus, the management might discuss a revised interest rate to save their ‘bottom-line’. Again, during swift interest payment, the borrowers might give a certain interest rate rebate which helps borrowers pay interest before the time. The interest rate also depends on the Central bank’s interest rate changes. During high inflation, the government hikes interest costs for the banks so that the excess liquidity would get arrested, resulting in lower inflation and vice versa.

- Thus, Interest costs have played a vital role for the Lender and the borrower. From the borrower’s point of view, higher interest costs lower the profit as it tends to lower the Company’s Net profit margin. Higher interest costs are always healthy for Lenders as it tends to generate income from the existing Funds.

Interest Expense Formula Calculator

You can use the following Interest Expense Calculator.

| Principal Amount | |

| Rate of Interest | |

| Time Period | |

| Interest Expense Formula | |

| Interest Expense Formula = | Principal Amount x Rate of Interest x Time Period |

| = | 0 x 0 x 0 = 0 |

Recommended Articles

This has been a guide to the Interest Expense formula. Here we discuss How to Calculate Interest Expenses along with practical examples. We also provide Interest Expense Calculator with a downloadable Excel template. You may also look at the following articles to learn more :