Updated October 31, 2023

Difference Between Interest Rate vs APR

In Interest Rate vs APR, interest is the extra money you must pay on the borrowed amount. In contrast, APR is the total money you must repay, including the loan amount, interest rate, and any other additional charges.

For example, let’s say that a bank has accepted a deposit from a depositor at a 6% interest rate; now, to make profits, banks will charge the borrowers of money a higher interest rate, maybe 8%, with which the bank is expected to make a profit or spread of 2%. Due to the increasing competition to get more depositors and borrowers, all the banks keep their interest rates within a narrow range of each other.

Banks levy interest rates on the total unpaid amount of the loan or your credit card balance. It becomes important to be aware of the prevailing interest rates on your money, and it is the only way to know your outstanding debt. At least the interesting part should be paid out of the loan outstanding; otherwise, the debt will increase even after you make payments.

The annual percentage rate includes any fees a bank may charge and allows you to compare the cost of different borrowing options. Because the bank calculates them as a percentage point of the total, these one-time fees are called points.

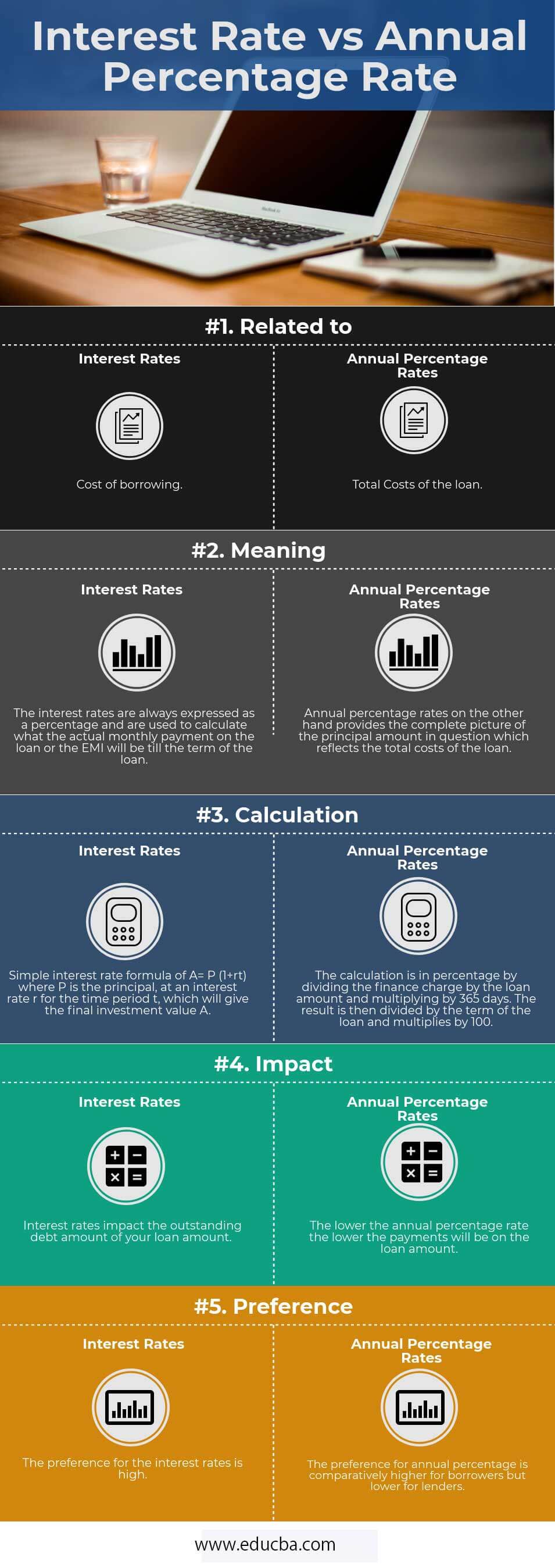

Head To Head Comparison Between Interest Rate vs APR (Infographics)

Below is the top 5 difference between Interest Rate vs Annual Percentage Rate (APR)

Key Differences Between Interest Rate vs Annual Percentage Rate (APR)

Both are popular choices in the market; let us discuss some of the major :

- Interest rates are the cost of borrowing the principal loan amount, whereas APR reflects the additional points like broker fees and the interest rate one pays to get the loan.

- The interest rate calculates the monthly payment i.e. the EMIs will be. In contrast, the annual percentage rate calculates the total cost of the loan, which can help consumers compare loans before going ahead with one.

- If the priority is to get the lowest monthly installments, then one should look at the interest rates, but if the total amount of the loan is a concern, then they should use APR as their metric.

- In terms of time horizon, the longer the stay is, the more likely it becomes to take a loan with a low APR, as you will end up paying the lowest amount for the house. However, if the tenure of the stay is not long, paying upfront fees does not make sense. Instead, one should get a higher APR as the total costs will be less over the first years.

- While using APR, you should also factor in the break-even point.

Interest Rate vs Annual Percentage Rate Comparison Table

Below is the 5 Top most comparison between Interest Rate vs APR

| Basis of Comparison | Interest Rate | Annual Percentage Rate |

| Related To | Cost of borrowing | Total Costs of the Loan |

| Meaning | The interest rates are always expressed as a percentage and are used to calculate the actual monthly payment on the loan or the EMI until the loan term. | On the other hand, annual percentage rates provide the complete picture of the principal amount in question, which reflects the total costs of the loan. |

| Calculation | Simple interest rate formula of A= P (1+rt) where P is the principal, at an interest rate r for the time period t, giving the final investment value A. | The calculation is in percentage by dividing the finance charge by the loan amount and multiplying by 365 days. The result is then divided by the loan term and multiplied by 100. |

| Impact | Interest rates impact the outstanding debt amount of your loan amount. | The lower the annual percentage rate, the lower the payments will be on the loan amount. |

| Preference | The preference for interest rates is high. | The preference for annual percentage is comparatively higher for borrowers but lower for lenders. |

Conclusion

Many borrowers are unaware that both interest rates vs annual percentage rates calculate two different costs of a home loan. The difference between interest rates vs annual percentage rates is very important, as one can pay thousands of dollars more for a mortgage. It helps you identify if getting a lower rate with high fees or a higher rate with low fees is better. APR is a more detailed measure of the cost of borrowing as it includes interest rates and other charges.

Recommended Articles

This has guided the top differences between Interest Rates vs APR. Here, we also discuss the Interest Rate vs Annual Percentage Rate key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –