Updated July 18, 2023

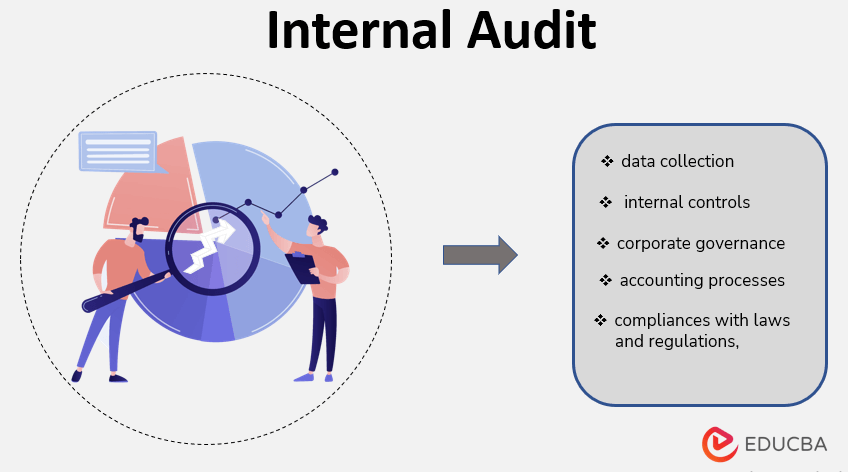

Definition of Internal Audit

Internal audit, a department run by the management of the company, helps in the evaluation of the internal controls of the processes of the company including the corporate governance, accounting processes, compliances with laws and regulations, maintenance and overseeing of the timely and accurate financial data and financial statements along with financial reporting and data collection, etc.

Internal audit is a department of the management that oversees all the issues related to the processes of the business and reports to the management regarding the same on a continuous basis

Example of Internal Audit

Internal audit function of the company is as similar to the external audit function. It oversees the issues in financial reporting and other management-related challenges. But internal audit employees are appointed by the board of directors and these are used to manage and oversee multiple processes and functions of the internal audit. It helps in offering the risk management and other floor-related work of the company.

Objectives of Internal Audit

The objectives are varied in number. Since the implementation of the Sarbanes-Oxley Act of 2002, the responsibility for the accuracy of the financial statements and other financial reporting related issues has relied upon the managers of the company and they would be legally liable for it. So, internal auditor plays a critical role in the organization. SOX also requires internal auditor to prepare all the documents related to the processes performed and procedures implemented by the company to ensure that the financial and accounting information is accurate and promotes accountability and helps in the prevention of fraud and error. A few examples could be the authorization of the documents, segregation of the duties, well written and documented processes and procedures, and tracing out any shortcomings in the processes of the company.

Internal Audit Process

The process includes the identification of the department, and to avail the understanding of the current process related to the department. It also includes checking the fieldwork testing, following up with the departmental staff, finding out issues in the processes, conversing with the management staff related to respective issues, creating the official report related to an internal audit, reviewing the audit report, and communicating the same to the management, etc. It also includes following up with the management and board of directors as required to ensure that whatever recommendations have been assigned and put forwarded have been implemented or not.

Types of Internal Audit

It comes in various types and it could have diverse functions relating to the same. A few examples of the same are financial or control audits, compliance audits, integrated audits, special investigation related audits, information system audits, follow-up audits, construction audits, etc. Out of those primarily used audits are Financial audits, compliance audits, operational audits, information system audits, etc.

Internal Audit Report

It is prepared by an internal auditor and it is a document that specifies the formal result of the audit. the report is used by the internal auditor to show and reflect the area of examination, highlighting the positives, negatives, and the conclusion of the issues investigated. The report is presented to the management of the company so that the management knows what is going well and what is there which requires more improvement. An internal audit report includes criteria, conditions, causes, consequences, and any corrective actions which should be implemented or changed. It also offers an insight into the working of the organization’s culture, procedures, policies, board, and management oversight so that the operating efficiency and effectiveness are taken into consideration. It also includes risk mitigation policies and the status of compliance with relevant laws and regulations.

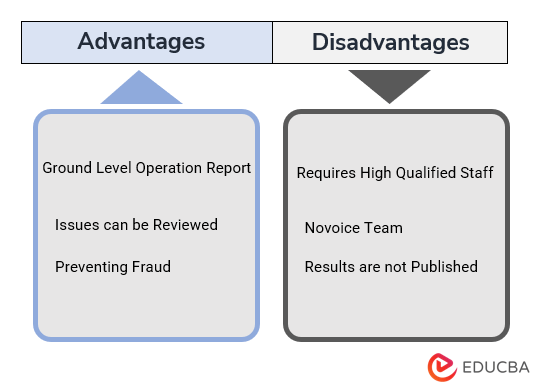

Advantages & Disadvantages

There are various advantages and disadvantages, a few of the prominent ones are described below:

Advantages

- It helps in making the decision of the management more effective as it provides the ground level report of the operation and helps in getting the issues managed effectively.

- Internal audit is an ongoing process and because of that all the issues and weaknesses in the system come under the review of the auditor and the same is being reported to the management on a continuous basis. It helps the management to assure that the organization is going in the right direction and achieving the strategic goals.

- Due to the continuous nature of the internal audit, the employees at various levels tend to avoid making mistakes or committing fraud. It helps the business environment to handle operations effectively and in a riskless manner.

- It also helps in keeping the optimization of the resources. Internal audit helps in finding out the issues consistently. And, the same is being reported to the management on a consistent basis. So, the issues are resolved and shortcomings are looked after. In this manner, the resources are used at an optimum level.

Disadvantages

Though internal audit has a lot of benefits, it comes with some limitations too. It requires highly qualified and experienced staff who could handle the audit very well. In the case of staff that is a novice in nature, the audit would not be as fruitful as expected. Again, the findings, suggestions, or results are not published which has been done as in the case of external audit. So, it doesn’t come to the notice of stakeholders which issues are resolved or ignored.

Conclusion

Overall, an internal audit is a great tool through which the management could get a complete overview of the operations of eh entity at various levels and manage to get the errors and frauds identified in a consistent manner. The report is also shared with the management and that helps to take corrective actions which eventually leads to better utilization of resources. Despite having a lot of benefits, internal audit suffers from issues related to the lack of highly qualified staff, and the non-publishing of the auditing reports in the public domain.

Recommended Articles

This is a guide to Internal Audit. Here we also discuss the definition and types of internal audits along with their advantages and disadvantages. You may also have a look at the following articles to learn more –