What is an Internal Auditing?

The following article provides an outline for Internal Auditing Career. Internal auditing is entirely related to the functions within the company as internal auditors ensure that the organization smoothly conducts its business operations without breaching the laws and regulations prevalent in the industry. In other words, internal auditors endeavor to shield their company from fraudulent activities. As such, such auditors must combine an analytical bent of mind with knowledge of finance, economics, and tax regulations.

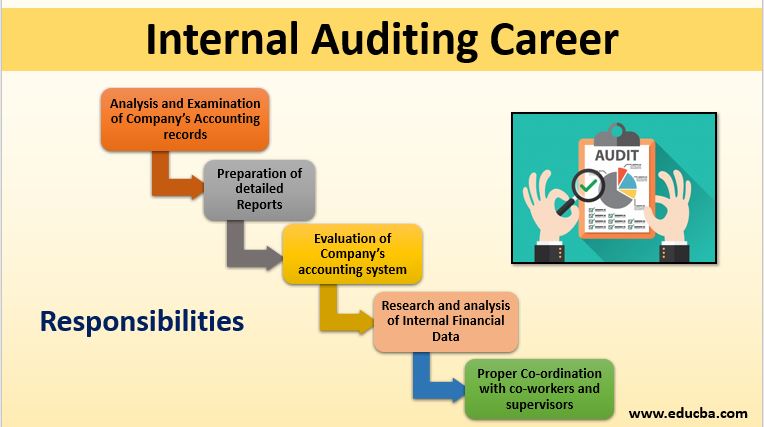

Responsibilities of an Internal Auditor

The company’s internal auditor is engaged in various internal matters. However, the major responsibilities of an internal auditor include:

- Analysis and examination of the company’s accounting records to assess its final financial position

- Prepare detailed reports covering audit findings to improve operating procedures while following applicable guidelines and laws.

- Evaluation of the company’s accounting systems and books of account to make sure that their effectiveness and efficiency further improves

- Research and analysis of the internal financial data of the company and evaluation of its results for suggesting the most effective solutions

- Regularly update co-workers and supervisors on internal audit progress, findings, and their impact through effective coordination.

Required Skills and Abilities

The primary set of skills and abilities required to become an internal auditor are as follows:

- Should have the ability to comprehend documents quickly and properly to analyze it

- Critical thinking is essential for internal auditors as it enables them to effectively evaluate financial information and documents.

- Strong communication is vital for auditors to work independently and effectively communicate audit findings to management and colleagues.

- Having a keen eye for detail is essential for internal auditors to identify anomalies that may serve as potential fraud indicators.

- Should have strong reasoning ability to be able to come up with practical and useful solutions based on the analyses

- Should possess sound writing and oral skills as internal auditors and are required to prepare detailed reports on findings along with ideas for improvements; as such, they must be able to communicate their findings through written and oral means

Educational Qualification for an Internal Auditing Career

An internal auditor should have the following educational background:

- At least a bachelor’s degree in accounting, finance, or a related field

- A master’s degree draws more and better job opportunities

- Undergraduate programs specially designed for internal auditing

- Certified Public Accountant (CPA) or Certified Fraud Examiner (CFE) credentials are preferable

Salary of an Internal Auditor

As per the Bureau of Labour Statistics, the average annual salary of an internal auditor was $70,500 in 2018. However, as with most professions, the compensation varies with experience, educational background, designation, and job location. A candidate with less than a year of work experience earns $51,000, and a candidate with 1 to 4 years earns an average salary of $54,000. A candidate with 5 to 9 years of work experience earns around $63,000, and a candidate with 10 to 19 years of relevant experience earns around $70,000. Internal auditors with a master’s degree (median salary: $91,000) are much higher than those with a bachelor’s degree ($69,000). Regarding career path, a senior internal auditor makes around $77,106, an internal auditing manager earns around $98,444, and a senior auditor earns around $68,821. New York tops the list among cities in the US with a median salary of $96,300, followed by California with a median salary of $84,430.

Link: accounting-careers-internal-auditor-salary

Need and Demand of Internal Auditing Career

The internal auditing industry is expected to grow significantly, so let us see the expectations for an internal auditor.

Need for Internal Auditor

According to the Securities and Exchange Commission (SEC), all publicly traded companies must periodically have their financials audited internally. Further, as per the Listed Company Manual of the New York Stock Exchange (NYSE), all those companies that offer to sell their shares to the general public must have their internal controls and accounts audited internally regularly. Although most closely held companies and small businesses don’t require internal audits, many private companies employ internal auditors to improve their business processes and procedures.

Demand for Internal Auditor

As far as demand for internal auditors is concerned, it has remained stable in the past, given the necessity of internal audits for businesses in the US. The trend is expected to continue over the next ten years as the job opportunities for internal auditors are projected to grow by 6% during 2018-28. The growth looks promising, with all states projecting growth in varying amounts, the highest being Utah (32.7% during 2016-26), followed by Colorado (24.8%).

Conclusion

So, it can be seen that the internal auditing industry is expected to grow significantly in some states in the next decade. Regulatory mandates primarily drive growth and attract healthy compensation, which varies based on multiple criteria.

Recommended Articles

This is a guide to Internal Auditing Career. Here we discuss internal auditing, with responsibility, skills, abilities, qualifications, needs, and demands. You can also go through our other related articles to learn more –