Updated July 27, 2023

Internal Growth Rate Formula (Table of Contents)

- Internal Growth Rate Formula

- Examples of Internal Growth Rate Formula (With Excel Template)

- Internal Growth Rate Formula Calculator

Internal Growth Rate Formula

In very simple language, the internal growth rate is the maximum growth rate that company can achieve only by using internal funds (retained earnings).

It is the rate of growth for which a company does need external financing, and any growth expected beyond that might need to be funded by external capital, i.e., by debt or equity. The internal growth rate is a very important parameter for small companies and startups since they can measure their ability to grow their business without seeking external help.

There is another parameter that is related to the internal growth rate, and that is a sustainable growth rate. A sustainable growth rate assumes that a company can achieve its growth rate while keeping its current capital structure intact, which refers to the existing combination of debt and equity. So as far as we are keeping the mix the same, we can source for external financing, which is why the sustainable growth rate is higher than the internal growth rate. Another difference between the internal growth rate and sustainable growth rate is that the Internal growth rate considers the Return on Assets while the sustainable growth rate uses the Return on Equity.

The formula to calculate the Internal Growth Rate is as follows:

Or

So

The retention Ratio is the rate of earnings that a company reinvests in its business. In other words, the remaining amount after paying dividends to shareholders represents the retention rate.

The formula to calculate the Return on an Asset is:

Examples of Internal Growth Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of the Internal Growth Rate in a better manner.

Internal Growth Rate Formula – Example #1

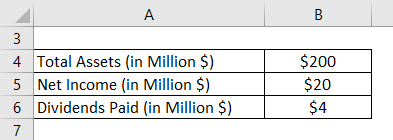

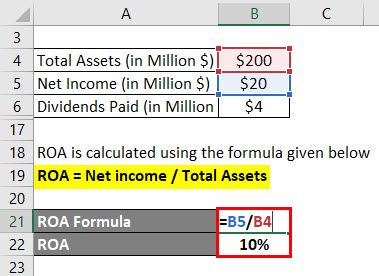

Consider a small-scale listed company X’s, which is a wholesale dealer of spare parts. Calculate the internal growth rate using the below information.

Solution:

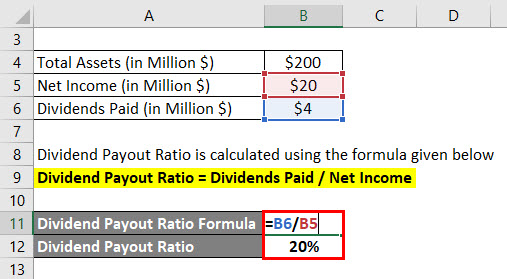

The dividend Payout Ratio is calculated using the formula given below

Dividend Payout Ratio = Dividends Paid / Net Income

- Dividend Payout Ratio = $4 / $20

- Dividend Payout Ratio = 20%

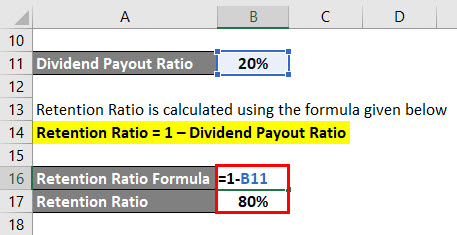

Retention Ratio is calculated using the formula given below

Retention Ratio = 1 – Dividend Payout Ratio

- Retention Ratio = 1 – 20%

- Retention Ratio = 80%

ROA is calculated using the formula given below

ROA = Net income / Total Assets

- ROA = $20 / $200

- ROA = 10%

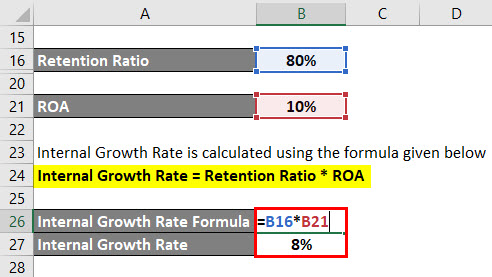

Internal Growth Rate is calculated using the formula given below

Internal Growth Rate = Retention Ratio * ROA

- Internal Growth Rate = 80% * 10%

- Internal Growth Rate = 8%

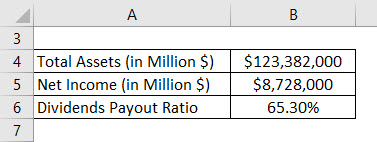

Internal Growth Rate Formula – Example #2

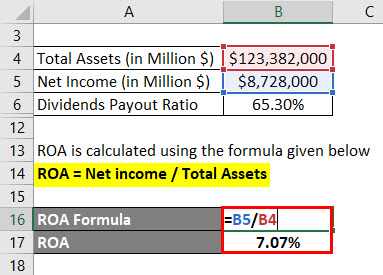

I have taken IBM as a Target Company, for which we need to calculate the internal growth rate. Below is the extract of their financial statements for 2018:

Solution:

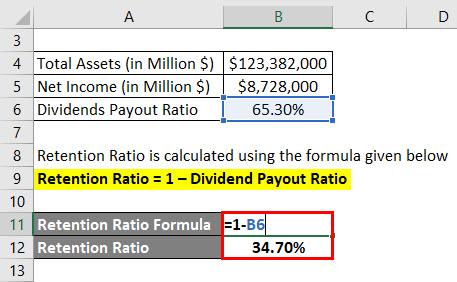

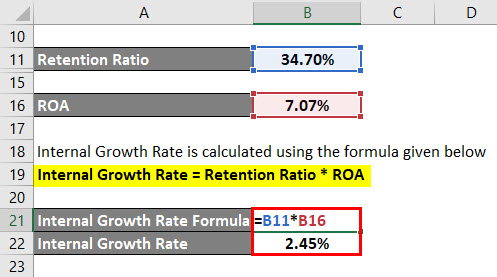

Retention Ratio is calculated using the formula given below

Retention Ratio = 1 – Dividend Payout Ratio

- Retention Ratio = 1 – 65.30%

- Retention Ratio = 34.70%

ROA is calculated using the formula given below

ROA = Net income / Total Assets

- ROA = $8,728,000 / $123,382,000

- ROA = 7.07%

Internal Growth Rate is calculated using the formula given below

Internal Growth Rate = Retention Ratio * ROA

- Internal Growth Rate = 34.70% * 7.07%

- Internal Growth Rate = 2.45%

Explanation

Any business can generate an excellent internal growth rate if it can efficiently use its resources. When we say efficient manner, the company should try to maximize its efficiency by utilizing the resources and minimizing the waste and idle periods. The main driver for the internal growth rate is the reinvestment earnings. If a company can make its operations efficient, thereby increasing its profits and reinvesting those profits to grow, it can achieve an excellent internal growth rate of Return.

Every business wants to grow and achieve new heights. So every company wants to achieve a sustainable growth rate, but some limitations and headwinds can stop a business from growing and achieving its sustainable growth rate. Many companies cannot sustain growth solely with internal funds and eventually require external financing to reach new heights. So the company can decide its target ratio for debt and equity, and using that Ratio, the growth rate they can achieve is the sustainable growth rate.

Relevance and Uses of Internal Growth Rate Formula

Internal growth rate, as discussed above, assumes that a company will not choose any external financing and will growth internal, and that growth rate is the internal growth rate. Companies can improve their operations and increase resource efficiency to maximize the internal growth rate. For companies, it is tough to sustain a high internal growth rate, and they have to go for financing at some stage.fsa

In a nutshell, the internal growth rate is one of the key parameters businesses need to analyze and consider when analyzing their internal growth potential. Still, companies can choose external financing if they have an excellent project to help them achieve greater heights.

Internal Growth Rate Formula Calculator

You can use the following Internal Growth Rate Calculator

| Retention Ratio | |

| ROA | |

| Internal Growth Rate | |

| Internal Growth Rate = | Retention Ratio x ROA |

| = | 0 x 0 = 0 |

Recommended Articles

This has been a guide to Internal Growth Rate formula. Here we discuss how to calculate Internal Growth Rate along with practical examples. We also provide Internal Growth Rate calculator with a downloadable Excel template. You may also look at the following articles to learn more –