Updated July 24, 2023

Definition of Debt to Equity Ratio

Debt to equity ratio shows the company’s capital structure and how much part of it was financed by Debt (Bank loans, Debentures, Bonds, etc.) compared to the investor’s or shareholder’s funds i.e. Equity.

High Debt to equity ratio and high level of creditor financing in company operations. If a business cannot perform a high debt to equity ratio can lead to bankruptcy. However, in case of business wants to expand, debt financing can be helpful and easy.

Interpretation of Debt to Equity Ratio

This article will discuss the Interpretation of the Debt Equity Ratio. The debt to Equity ratio helps us understand the company’s financial leverage. It is part of the ratio analysis under the section on the leverage ratio. This ratio measures how much of the company’s operations are financed by debt compared to equity; it calculates the entire debt of the company against shareholders’ equity. The debt to equity ratio reflects the company’s capital structure and tells in case of shutdown whether the outstanding debt will be paid off through shareholders’ equity or not.

Formula

The formula for interpretation of debt to equity ratio is:

Examples of Interpretation of Debt to Equity Ratio(With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

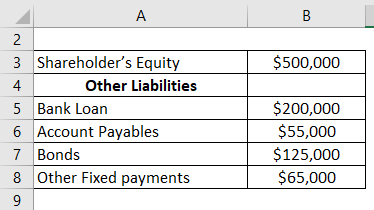

The capital structure of ABC company is given below calculate the debt to equity ratio

Solution:

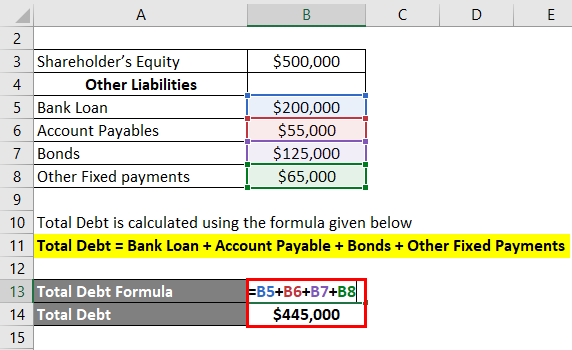

Total Debt is calculated using the formula given below

Total Debt = Bank Loan + Account Payable + Bonds + Other Fixed Payments

- Total Debt = $200,000 + $55,000 + $125,000 + $65,000

- Total Debt = $445,000

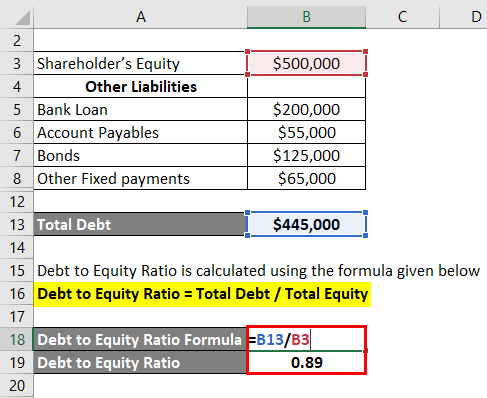

Debt to Equity Ratio is calculated using the formula given below

Debt to Equity Ratio = Total Debt / Total Equity

- Debt to Equity Ratio = $445,000 / $ 500,000

- Debt to Equity Ratio = 0.89

Debt to Equity ratio below 1 indicates a company is having lower leverage and lower risk of bankruptcy. But to understand the complete picture it is important for investors to make a comparison of peer companies and understand all financials of company ABC.

Example #2

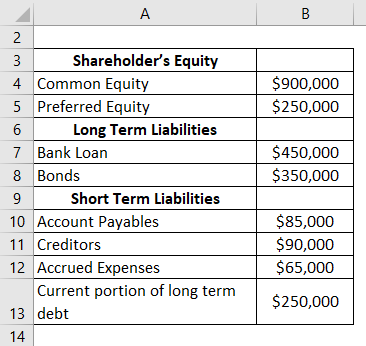

The capital structure of XYZ company is given below calculate the debt to equity ratio

Solution:

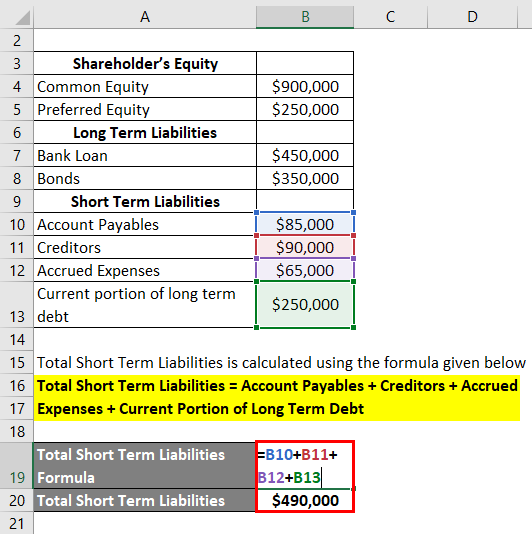

Total Short Term Liabilities is calculated using the formula given below

Total Short Term Liabilities = Account Payables + Creditors + Accrued Expenses + Current Portion of Long Term Debt

- Total Short Term liabilities = $85,000 + $90,000 + $65,000 + $250,000

- Total Short Term liabilities = $490,000

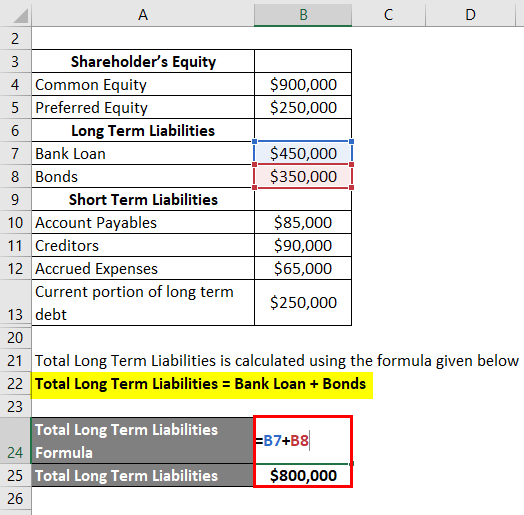

Total Long Term Liabilities is calculated using the formula given below

Total Long Term Liabilities = Bank Loan + Bonds

- Total Long Term Liabilities = $450,000 + $350,000

- Total Long Term Liabilities = $800,000

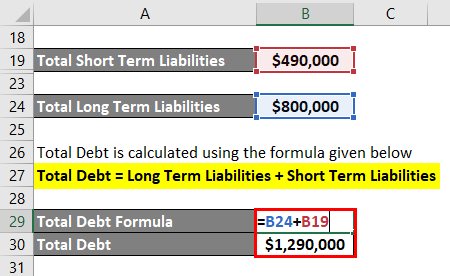

Total Debt is calculated using the formula given below

Total Debt = Long Term Liabilities + Short Term Liabilities

- Total Debt = $800,000 + $490,000

- Total Debt = $1,290,000

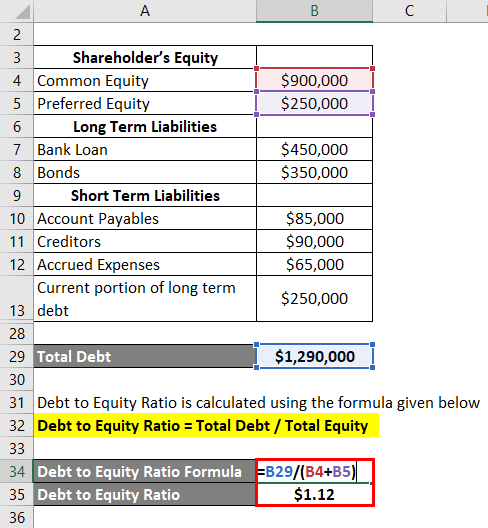

Debt to Equity Ratio is calculated using the formula given below

Debt to Equity Ratio = Total Debt / Total Equity

- Debt to Equity Ratio = $1,290,000 / $1,150,000

- Debt to Equity Ratio = 1.12

In this case, we have considered preferred equity as part of shareholders’ equity but, if we had considered it as part of the debt, there would be a substantial increase in debt to equity ratio. In this case, the company has a balanced debt to equity ratio, but investors need to understand the concept of debt.

Example #3

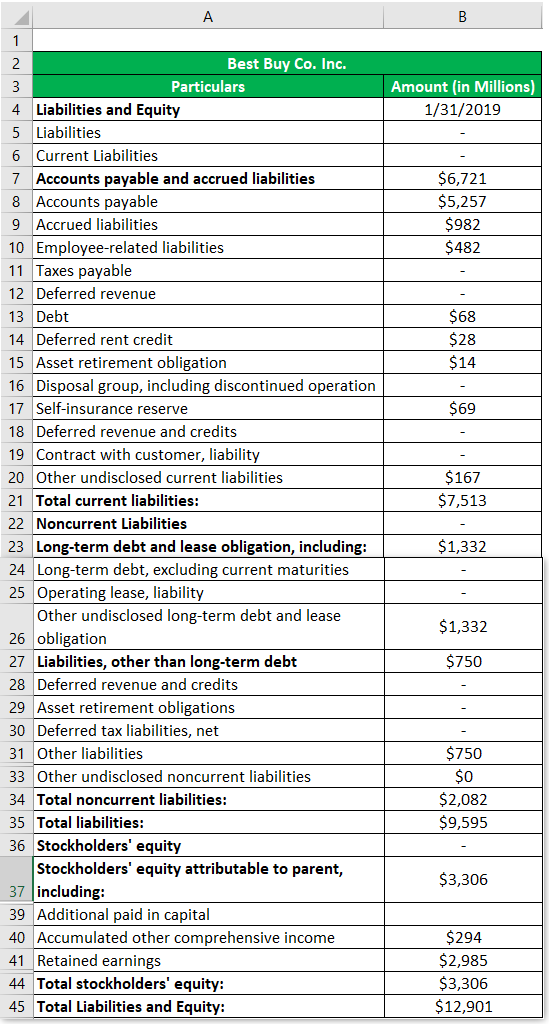

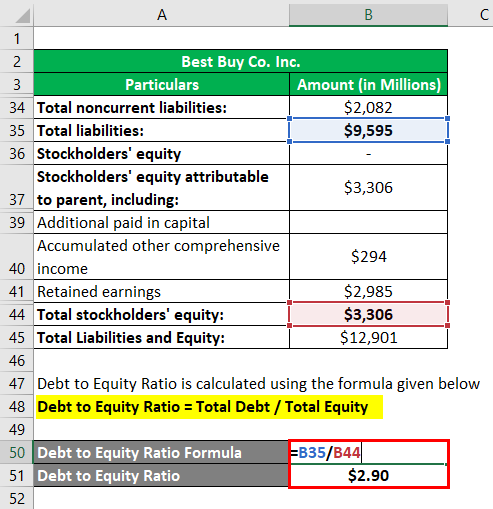

The following information on best buy co.inc company is given below to calculate the debt to equity ratio.

Source Link: www.readyratios.com

Solution:

Debt to Equity Ratio is calculated using the formula given below

Debt to Equity Ratio = Total Debt / Total Equity

- Debt to Equity Ratio = $9,595 / $3,306

- Debt to Equity Ratio = 2.90

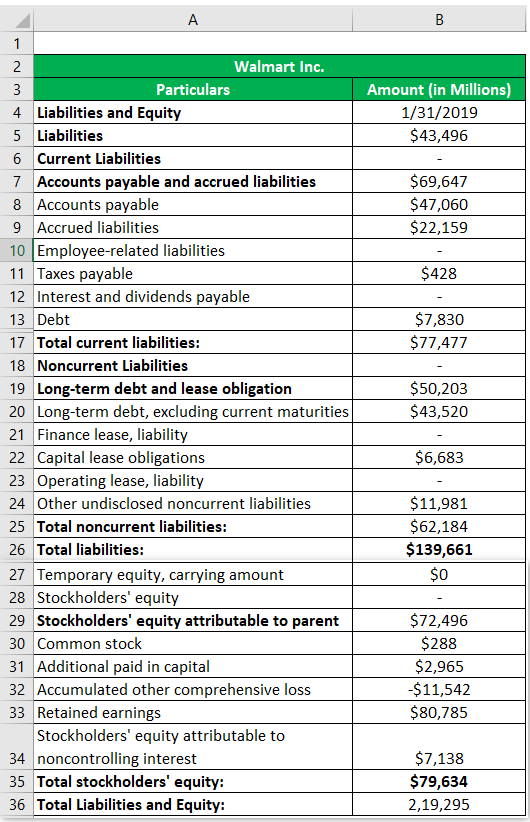

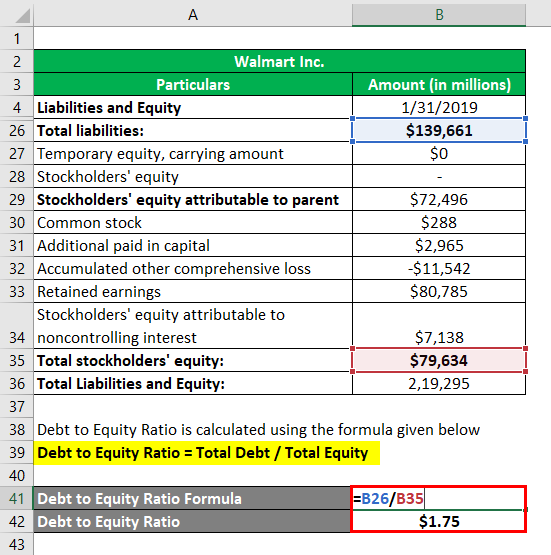

Example #4

The following information on Walmart inc. is given below to calculate the debt to equity ratio.

Source Link: Walmart Inc. Balance Sheet

Solution:

Debt to Equity Ratio is calculated using the formula given below

Debt to Equity Ratio = Total Debt / Total Equity

- Debt to Equity Ratio = $139,661 / $79,634

- Debt to Equity Ratio = 1.75

For example, 3 and 4 if we compare both the company’s debt to equity ratio Walmart looks much attractive because of less debt. However, after doing research from all aspects investor can decide which company to invest.

Importance of Debt to Equity Ratio

Some of the Importance is given below:

1. Financial Analysis

During the process of financial analysis of the company, it is important for an investor to understand the debt structure of a company, which tells us how much the is company dependent on borrowers and its capacity to pay off debt if the business is facing a hard time.

2. Capital Structure

The capital structure of the company is described by Debt to Equity ratio, it specifically tells how much part of the capital in business is financed from borrowed funds and how much part is financed from owned funds i.e. Shareholders equity. It helps investors understand the capacity of the company to pay out the company’s debt and determine the risk of the amount invested in the company.

3. Risk Analysis

Debt to Equity ratio is also known as risk ratio and gearing ratio which defines how much bankruptcy risk a company is taking in the market. A high debt to equity ratio means a higher risk of bankruptcy in case business is not able to perform as expected, while a high debt payment obligation is still in there.

4. Shareholder’s Earnings

The debt to equity ratio also describes how much shareholders earn as part of the profit. High debt to equity ratio means, profit will be reduced, which means less dividend payment to shareholders because a large part of the profit will be paid as interest and fixed payment on borrowed funds.

5. Trustworthiness

When a business applies for loan lenders check the ability of a business to pay off its debt, this credit trustworthiness can be tested through Debt to equity ratio by checking past records and regular installment payments made by the company to its lenders.

6. Tool for Management

The debt to equity ratio tells management where the business stands in comparison to peers. The ideal debt to equity ratio will help management to make expansion decisions for further growth of business and increase its share in the market by adding more units or operations.

Limitations of Interpretation of Debt to Equity Ratio

Some of the Limitations of Interpretation of Debt to Equity Ratio are:

1. Can Misguide Investors

It is important for an investor to analyze the company from all angles and understand all ratios since the single ratio can be misguided like in this case debt to equity ratio can misguide investors. Lower debt to equity ratio can be the result of technical insufficiency, where the company is not able to handle debt through properly investing in assets required which can lead to lower returns on investment even with lower debt to equity ratio.

2. An Ideal Ratio is Not Applicable to All Industries

Ideal debt to equity ratio of 1:1 is not applicable to all companies. Some companies may require high debt to purchase, update and maintain their assets through debt financing, which will help a business to grow and gain more profit in the future. While in the case of business in the IT industry does not require high capital for factory and machinery, which help them to maintain better debt to equity ratio.

3. Requires Clear Understanding

Investor needs a clear understanding of the concept of debt while understanding and analyzing the debt to equity ratio of the company. Some business considers prefer stock as equity but, dividend payment on preferred stocks is like debt. If a company includes preferring stock in debt then the total debt will increase significantly, which means the company will look a lot more risky to an investor. It is important to understand the concept of debt working in that specific industry.

Conclusion

The debt to equity ratio helps investors to understand the risk involved in business while making an investment decision. High leverage company has a higher risk of bankruptcy in case business is not able to perform as expected, on the other side debt helps businesses to expand and grow in operations which results in more profit for the future.

To understand the risk involved in investment investors must not depend on only a single ratio but should make the entire 360-degree analysis of the company, which will give him a clear picture of company financials. An investor can make comparisons with peer companies in case of debt to equity ratio to understand requirements average capital structure for companies operating in a specific sector.

Recommended Articles

This is a guide to the Interpretation of Debt to Equity Ratio. Here we discuss how to calculate debt to equity ratio along with practical examples. we also provide a downloadable excel template. You may also look at the following articles to learn more –