Updated July 26, 2023

Intrinsic Value Formula (Table of Contents)

What is the Intrinsic Value Formula?

Intrinsic value is the calculated value or the perceived value of an entity or of the company, that includes both intangible and tangible factors by making use of fundamental analysis. Intrinsic value is also called the true value, further, the intrinsic value may or may not be similar to the current stock price or current market value.

There are several variations for calculating the intrinsic value formula of the specific financial instrument whether it be bonds, stocks or derivatives or any complex product like structured products, etc., but the most “standard” approach is similar to the NPV i.e. net present value formula.

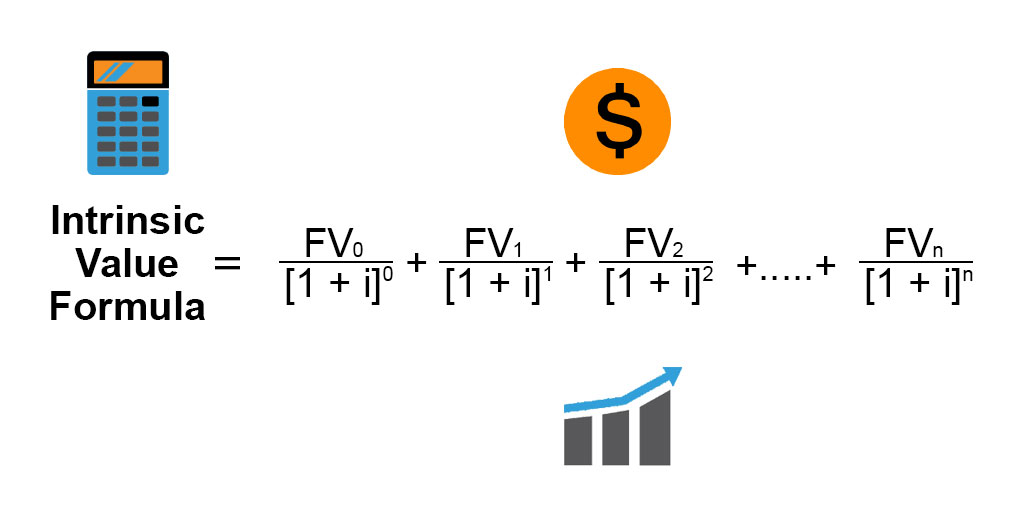

Formula For Intrinsic Value is:-

Where,

- NPV = Net Present Value

- FVj = Net cash flow (inflow or outflow) for the jth period (for the initial “Present” cash flow, j = 0

- i = Annual rate of interest (also called a discount rate)

- n = Number of periods to be included

The intrinsic value of an entity or of the business (or it could be any investment security) is the present value i.e. discounted values of all the expected future cash flows at an appropriate discount rate. Unlike other relative forms of valuation that look at comparable organizations or the companies.

Examples of Intrinsic Value Formula (With Excel Template)

Let’s take an example to understand the calculation of Intrinsic Value in a better manner.

Intrinsic Value Formula – Example #1

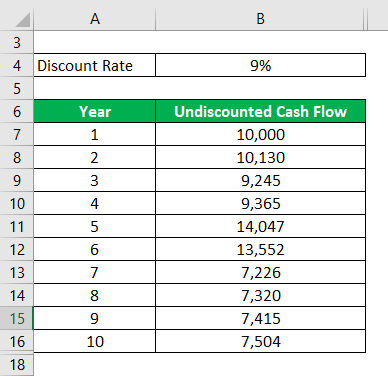

Victor Jain has identified a small-cap value stock and has arrived at following undiscounted cash flows and he is willing to determine to find out the intrinsic value of the stock. You are required to calculate the intrinsic value of the small-cap value stock, assuming a 9% rate of interest annually.

Solution:

Intrinsic Value is calculated using the formula given below

Intrinsic Value = [FV0 /(1+i)0] + [FV1 /(1+i)1] + [FV2 /(1+i)2] + …..+ [FVn /(1+i)n]

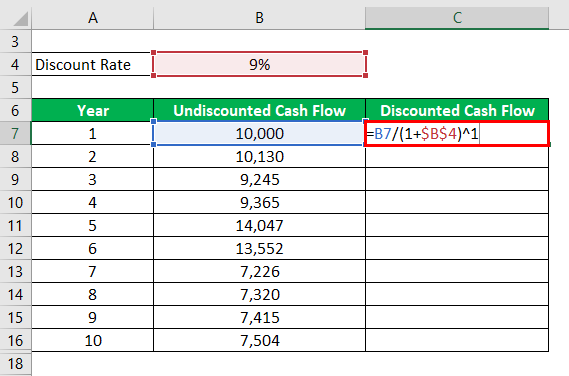

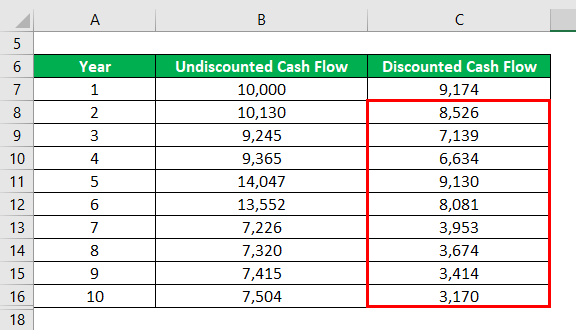

We are here given undiscounted cash flows, we need to now calculate first the discounted cash flows and then we will sum up them to arrive at intrinsic value.

First, we calculate discounted cash flow

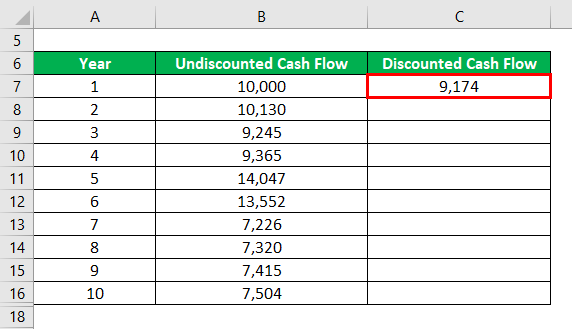

Output will be:

Similarly, we calculate other values.

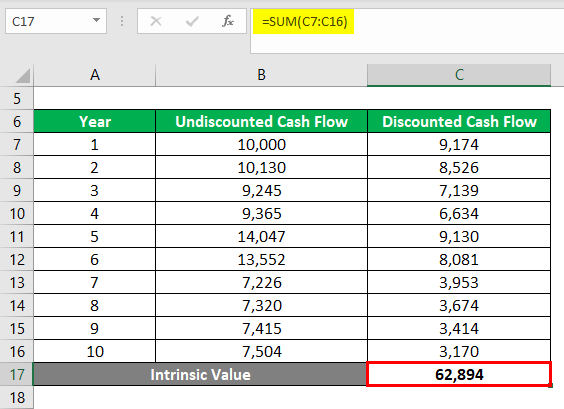

To find intrinsic Value, we sum up all values of discounte cash flow

- Intrinsic Value = 9,174 + 8,526 + 7,139 + 6,634 + 9,130 + 8,081 + 3,953 + 3,674 + 3,414 + 3,170

- Intrinsic Value = 62,894

All the cash flows have been discounted at 9% and have been summed up per formula. (See excel template for more detailed calculations).

Intrinsic Value Formula – Example #2

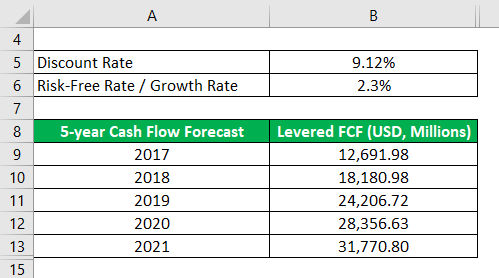

Let us take a simple example of Amazon Inc. As per the consensus data available on Bloomberg, the following are the undiscounted cash flows current as well as forecast, you are required to calculate the intrinsic value of amazon Inc. You can assume a discount rate of 9.12% and a risk-free rate of 2.3%.

Solution:

Intrinsic Value is calculated using the formula given below

Intrinsic Value = [FV0 /(1+i)0] + [FV1 /(1+i)1] + [FV2 /(1+i)2] + …..+ [FVn /(1+i)n]

We need to calculate both the discounted cash flows as well as the terminal value to arrive at the intrinsic value of amazon inc.

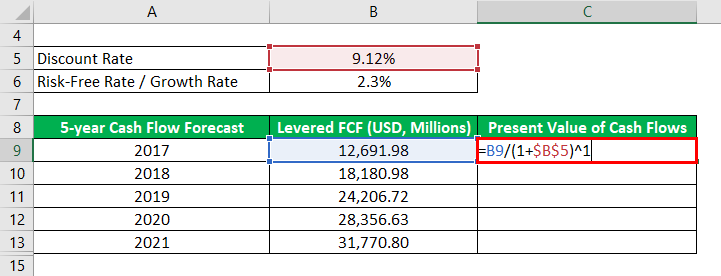

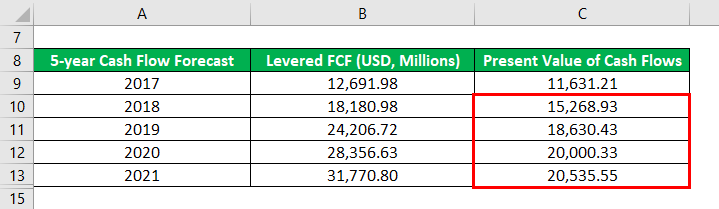

First, we calculate, the present value of cash flows

Output will be:

Similarly, we calculate other values.

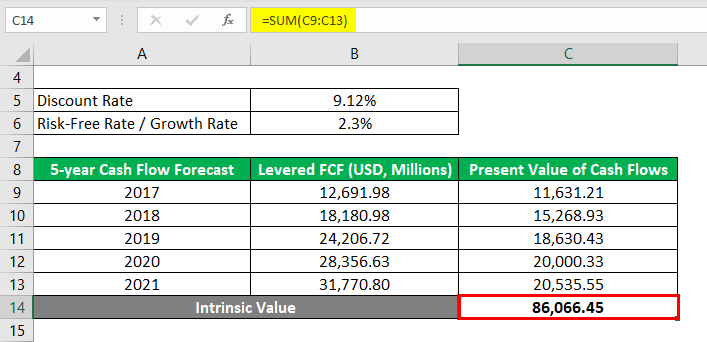

To find intrinsic Value, we sum up all values of present value of cash flow

- Intrinsic Value = 11,631.21 + 15,268.93 + 18,630.43 + 20,000.33 + 20,535.55

- Intrinsic Value = 86,066.45

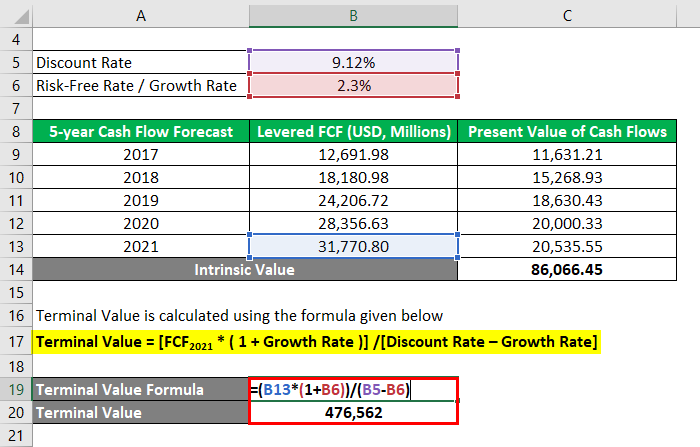

Terminal Value is calculated using the formula given below

Terminal Value =[ FCF2021 * ( 1 + Growth Rate )] /[Discount Rate – Growth Rate]

- Terminal Value = [31,770.80 * (1 + 2.3%)] / [9.12% – 2.3%]

- Terminal Value = 476,562

Discounted Terminal Value is calculated as

- Discounted Terminal Value = 4,76,562 / (1 + 9.12%)^5

- Discounted Terminal Value = 308,033.27

Total Intrinsic Value of Equity is calculated using the formula given below

Total Intrinsic Value of Equity = Terminal Value + Discounted Terminal Value

- Total Intrinsic Value of Equity = 476,562 + 308,033.27

- Total Intrinsic Value of Equity = 784,595.27

Intrinsic Value Formula – Example #3

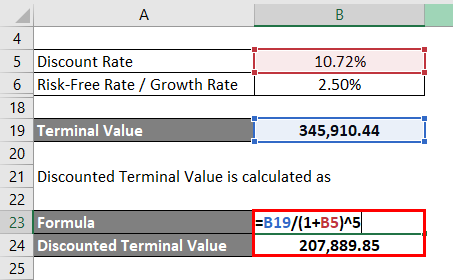

Let us take an example of Facebook. As per the consensus data available on Bloomberg, the following are the undiscounted cash flows current as well as forecast, you are required to calculate the intrinsic value of facebook Inc. You can assume a discount rate of 10.72% and a risk-free rate of 2.5%.

Solution:

Intrinsic Value is calculated using the formula given below

Intrinsic Value = [FV0 /(1+i)0] + [FV1 /(1+i)1] + [FV2 /(1+i)2] + …..+ [FVn /(1+i)n]

We need to calculate both the discounted cash flows as well as the terminal value to arrive at the intrinsic value of facebook inc.

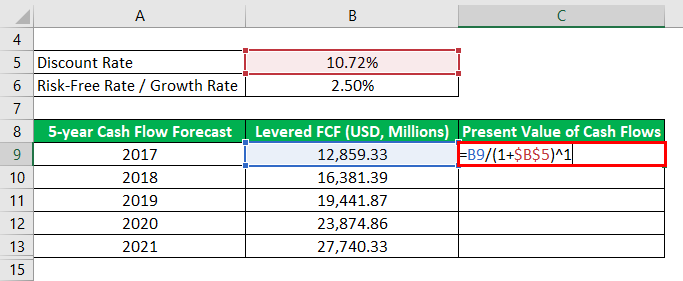

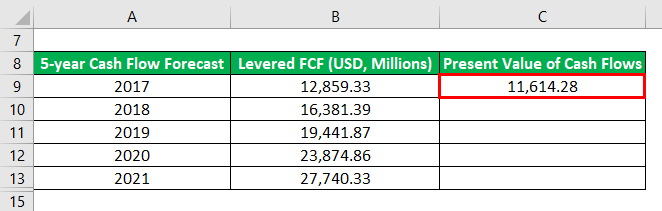

First, we calculate the present value of cash flows

Output will be:

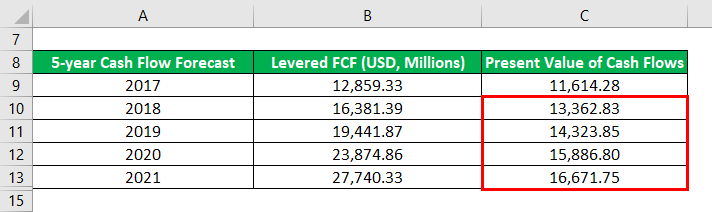

Similarly, we calculate other values.

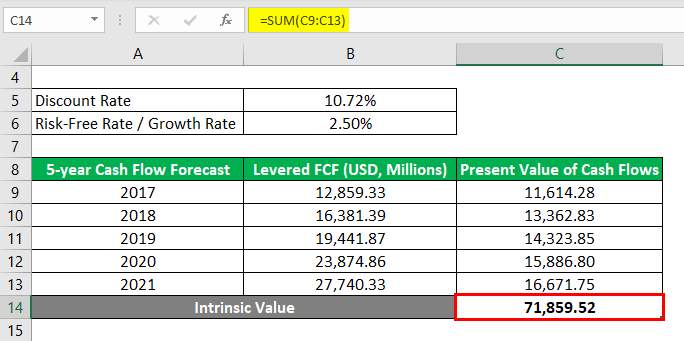

To find intrinsic Value, we sum up all value values of present value of cash flows

- Intrinsic Value = 11,614.28 + 13,362.83 + 14,323.85 + 15,886.80 + 16,671.75

- Intrinsic Value = 71,859.52

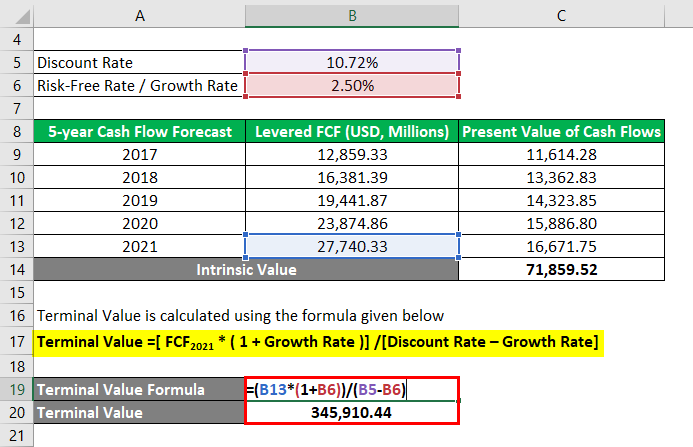

Terminal Value is calculated using the formula given below

Terminal Value = [FCF2021 * ( 1 + Growth Rate )] /[Discount Rate – Growth Rate]

- Terminal Value = [27,740.33 (1 + 2.5%)] / [10.72% – 2.5%]

- Terminal Value = 3,45,910.44

Discounted Terminal Value is calculated as

- Discounted Terminal Value = 3,45,910.44 / (1 + 10.72%)^5

- Discounted Terminal Value = 207,889.85

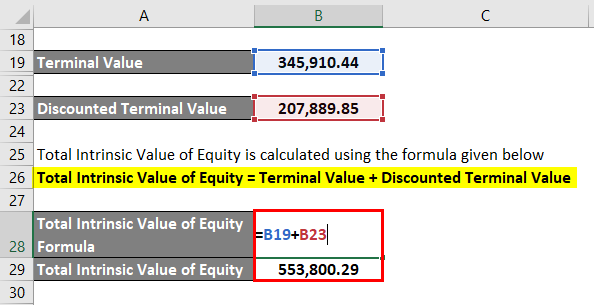

Total Intrinsic Value of Equity is calculated using the formula given below

Total Intrinsic Value of Equity = Terminal Value + Discounted Terminal Value

- Total Intrinsic Value of Equity = 3,45,910.44 + 207,889.85

- Total Intrinsic Value of Equity = 553,800.29

Explanation

While there are several formulas used to calculate the intrinsic value but the most common and popular method among them is the use of a discounted cash flow method which is quite similar to NPV calculation. This method first accumulates all the cash flows whether present or forecasted and then they are discounted at an appropriate rate to arrive at the present value of those cash flows and then all of these cash flows are summed up and we get a rough figure of intrinsic value of that product, whether it be stock or bond etc.

Relevance and Uses of Intrinsic Value Formula

Market value is the firm’s or the company’s value which is calculated from its current market price or current stock price and it will rarely reflect the actual present value of the entity or of the company. The reason for the same is that the market value ideally will reflect demand and supply in the investing market, how eager (or how eager they are not) investors are willing to participate in the entity’s or the company’s future.

The market value in most cases is usually higher than the intrinsic value if there is a specific strong investment demand for that product or stock in this case, which can lead to possible over-valuation. The opposite will also be held as true if there is weaker investor demand, which can result in under-valuation of the entity or the company.

Recommended Articles

This is a guide to the Intrinsic Value Formula. Here we discuss how to calculate Intrinsic Value Formula along with practical examples and downloadable excel template. You may also look at the following articles to learn more –