Updated July 11, 2023

Definition of Inventory Shrinkage

Inventory shrinkage (IS) refers to the situation where the physical count of the Inventory is less than the total numbers that are mentioned in the record books of business, such as a condition where a company’s books of accounts show that the total number of inventory items are 5500 but when the physical count was made the total number of items was found only 5200.

Explanation

IS is the situation in a business where the total number of in-inventory items that are recorded in the books is more than the actual numbers of Inventory physically present in the business. The reason for such less number can be a defect, misplacement, wrong counting, or any other kind of error; for example, let’s suppose there is a business of stationery where the books of accounts stated that the total registers are 10,000, but during the audit when the physical count was made the total number of registers were only 9990 pieces and when the auditor tried to find out the reason then it was found that the supplier of registers has committed fraud by billing for more registers and supplying ten fewer registers. This scenario resulted in inventory shrinkage.

How to Calculate Shrinkage Rate?

Basically, there are four steps in the calculation of IS, which are as under:

- Step 1: Determine the Closing Inventory as per books of Account. Closing inv. is to be determined by the following formula:

- Step 2: Calculate the Physical count of the Inv. and determine the Value of the Physical Inventory.

- Step 3: Determine the Value of IS.

- Step 4: Determine the IS Rate using the following formula:

Examples

As Per Accounting Records, the Inv. is of a Value of $50,000, whereas as per physical count, the management found the Value of the Inventory is $47,000. Therefore, calculate the inventory shrinkage and inventory shrinkage rate?

Solution:

IS is the difference between the Value of Inv. as per books and the Value as per physical count.

- Inventory Shrinkage = $50,000 – $47,000

- Inventory Shrinkage = $3,000

IS Rate is calculated as,

- IS Rate = ($50,000 – $47000) / $50,000 * 100

- IS Rate = $3000 / $50000 * 100

- IS Rate = 6%

Causes of Inventory Shrinkage

Following are the main causes of IS:

- Employee Theft: Employee theft is the major cause of IS. The inv. keeper may theft the Inv. without any records, which results in inv. shrinkage.

- Consumer Theft: Consumer Theft happens in supermarkets and malls, especially for eatables and small articles like soaps, perfumes, etc., which cause IS.

- Shoplifting: Shoplifting also causes IS. Shoplifting is the act of stealing goods while pretending to be the consumer.

- Vendor Fraud: Vendor Fraud is an act of billing the higher quantity while the quantity sent is low. This might happen due to a lack of internal control in the organizational system.=

- Damage: Inventory Shrinkage also occurs due to damage to goods which may be due to damage by fire, obsolesce of Inv. etc.

Record Inventory Shrinkage

- IS is recorded only when the actual physical count happens, which varies from the book records.

- IS is recorded as a debit to the profit and loss account as inv. shrinkage is the loss to the organization; hence Inv. is reduced, and the expenses are to be increased.

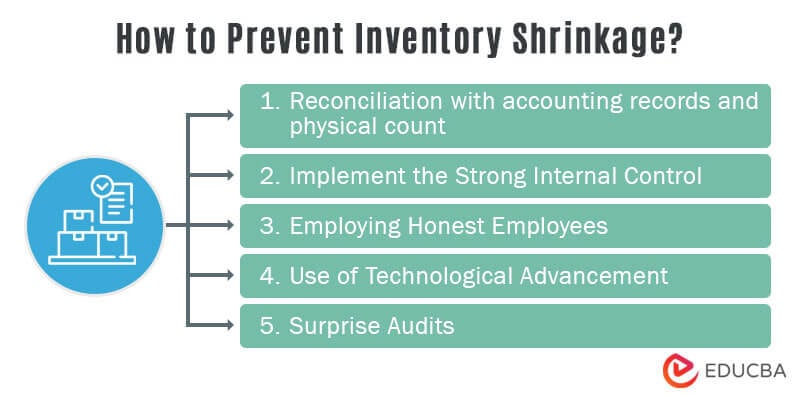

How to Prevent Inventory Shrinkage?

- Reconciliation with accounting records and physical count: To Prevent inv. shrinkage, reconciliation should be done between accounting records and physical count at regular intervals to prevent loss due to IS.

- Implement the Strong Internal Control: Strong Internal Control is to be implemented to avoid inv. shrinkage. Double-checking physical count with the book records is also an internal control to prevent IS.

- Employing Honest Employees: The most important way to avoid IS is to hire honest employees to theft can be reduced and no inventory shrinkage happens.

- Use of Technological Advancement: To Prevent IS, advanced technology like automation of the inv. the process is to be implemented to reduce human intervention and theft so that inv. shrinkage can be minimized.

- Surprise Audits: Surprise Audits are also one of the ways to prevent IS, so those in charge of the inv. control room gets scared, and theft is controlled.

Advantages

Generally, inv. shrinkage has no advantages as it causes loss to the organization. But it teaches a lesson to the organization, like implementing strong internal control, employing trustworthy employees, and not having blind faith in in the employees, even high-class employees. In addition, it teaches the lesson that surprise visits should check and reconcile regularly.

Disadvantages

- Increase the cost of Goods: The cost of inv. shrinkage is recovered from the customer, which results in an increase in the selling price of the Inv.

- Give rise to Employee personal benefit: Inv. shrinkage if not stopped, then the employee can get lots of personal benefits, and it gives encouragement to the employees to theft more and get the personal benefits.

- Increase lots of paperwork and cost: To prevent inv. shrinkage and lots of paperwork can be increased to keep track. If inventory automation is to be done, it may also increase the cost to the organization.

Conclusion

Thus, inventory shrinkage is when the Value of the Inv. recorded in the books of the Account is greater than the actual Inventory physically present in the business. The reason for such shrinkage can be fraud, error, shoplifting, employee theft, etc. Keeping a check on the Inventory may reduce inventory shrinkage.

Recommended Articles

This is a guide to Inventory Shrinkage. Here we also discuss the definition, how to calculate inventory shrinkage rate, and advantages and disadvantages. You may also have a look at the following articles to learn more –