Updated July 12, 2023

Definition of Inventory Valuation Method

The following article, Inventory Valuation Methods will provide you with some of the inventory methods. Inventory valuation is the most important of the financial calculation for a firm as it has a huge impact on the top line numbers, bottom-line numbers, and the cash flow situation as in most industries inventory is one of the huge input costs.

Types of Inventory Valuation Method

There are three main types of inventory valuation methods by which inventory management calculations can be done:

1. FIFO Method

FIFO stands for First In First Out. This simply means that the goods should be sold in the order they were purchased. Good produced first should be sold first and this is the order in which the cost of goods sold and inventory should be calculated.

2. LIFO Method

LIFO stands for Last In First Out and is conceptually opposite to FIFO. Simply put, the goods purchased recently should be sold first while the goods purchased first should be sold last.

3. WAC Method

Weighted Average Calculation as the name suggests calculates the weighted average of the whole inventory irrespective of the order in which it was placed.

Mathematically, it can be expressed as:

Examples of Inventory Valuation Methods (With Excel Template)

Let’s take an example to understand the calculation of Inventory Valuation in a better manner.

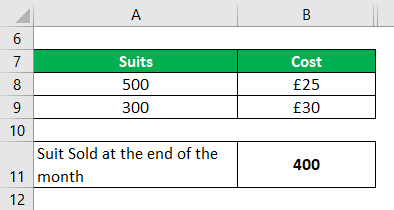

Consider the case of a garment manufacturer who buys suits through 2 transactions,500 suits at £ 25 each and 300 suits at £ 30 each Also, assume that there were 400 suits sold at the end of the month.

Solution:

Cost of Goods Sold is calculated using FIFO and LIFO Methods

FIFO Method:

Considering the suits bought first were sold first.

Cost of Goods Sold is calculated as

- Cost of Goods Sold = 400 * £ 25

- Cost of Goods Sold = £10,000

LIFO Method:

In LIFO, it is assumed that the goods recently purchased are sold first.

Cost of Goods Sold is calculated as

- Cost of Goods Sold = [300 * £30] + [(500 – 400) * £25]

- Cost of Goods Sold = [300 * £30] + [100 * £25]

- Cost of Goods Sold = £9000 + £2500

- Cost of Goods Sold = £11,250

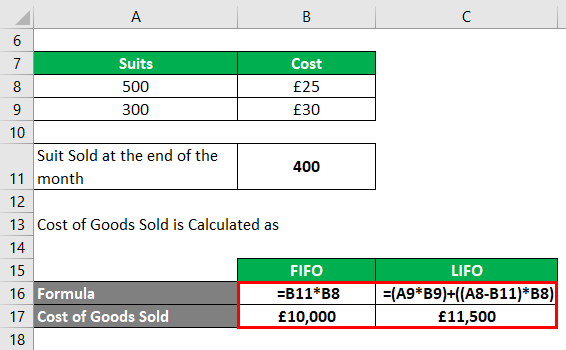

Remaining Inventory is calculated using FIFO and LIFO Methods

FIFO Method:

Remaining Inventory is calculated as

- Remaining Inventory = [(500 – 400) * £ 25] + [300 * £ 30]

- Remaining Inventory = 2500 + 9000

- Remaining Inventory = £ 11,250

LIFO Method:

Remaining Inventory is calculated as

- Remaining Inventory = 400 * £25

- Remaining Inventory = £ 10,000

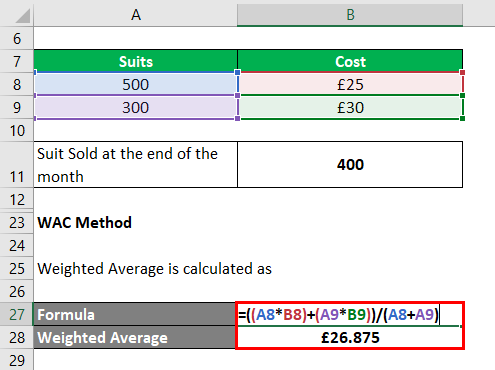

WAC Method:

Weighted Average is calculated as

- Weighted Average = [(500 * £25) + (300 * £30)] / 800

- Weighted Average = £26.875

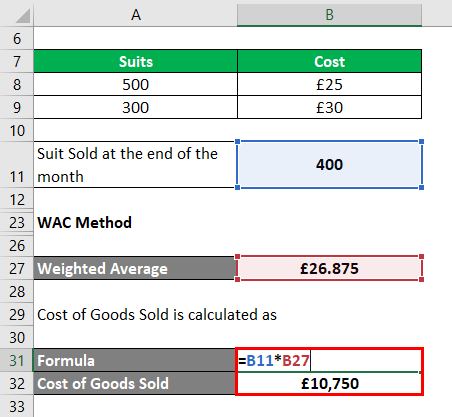

Cost of Goods Sold is calculated as

- Cost of Goods Sold = 400 * 26.875

- Cost of Goods Sold = £ 10,750

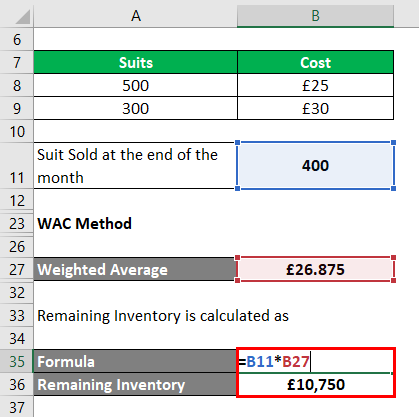

Remaining Inventory is calculated as

- Remaining Inventory = 400 * 26.875

- Remaining Inventory = £ 10,750

Advantages and Disadvantages of Inventory Valuation Methods

Some of the advantages and disadvantages are mentioned below:

FIFO Method

Here we discuss the advantages and disadvantages of FIFO:

Advantages

- First in First out is the most intuitive and easiest of the three mechanisms to apply. Most of the time it is applied by default in small-scale shops and retail outlets. In fact, there would be businesses that will not be aware they are using this mechanism to assess their inventory in their workshops and warehouses.

- Because of its simplicity and intuitiveness, it is difficult to manipulate and hence avoid any suspicion

- Since FIFO prices inventory in the order they were purchased and sold, most often than not the price calculated matches the actual costing involved.

- Another advantage owing to its simplicity is the assumed flow of cash flow because the costs matches the actual cash flow and the physical flow of goods across the warehouse and

- Purchases made at the end of the period under consideration do not affect the revenue calculations as the input cost is calculated based on the order in which these goods were produced.

Disadvantages

- It is common in economics that prices of the products do increase with time. However, there are times when these prices rise in a very short span of time, especially for agro-commodities affected by climate and drastic weather conditions. Hence sometimes it leads to mismatches between costs and revenues when FIFO is applied because the paper calculations do not justify the actual inflated calculations.

- Even with assuming normal inflation, profits look inflated and hence attract more tax burden as compared to other methods and since it is difficult to manipulate, no accounting rules can help the firm.

LIFO Method

Here we discuss the advantages and disadvantages of LIFO:

Advantages

- The biggest advantage of the LIFO mechanism is that it matches the profitability in a much better way as it takes the latest cost into consideration. This is the reason that profits are less as the corresponding net income is low. This is the reason many accountants and regulators think that it helps in gauging the management’s ability to generate profits. It is much better than the FIFO method which has huge paper profits compared to the actual ones.

- Another advantage is that since LIFO uses the current costs for calculation costs of gold sold, it can not be manipulated by inflation and provides a very concurrent view. Also because of using the latest prices into consideration, there is less burden of taxes on the bottom line.

Disadvantages

- LIFO is a difficult method to implement as it can lead to older inventory getting stocked up while the new inventory gets sold. This can be dangerous with regard to perishable goods and lead to huge wastage, thereby increasing the costs and decrease in revenues.

- Many accounting regulators, including US GAAP, do not approve the LIFO method of inventory valuation. Hence there is a country and regulatory risk involved.

WAC Method

Here we discuss the advantages and disadvantages of WAC:

Advantages

- Weighted average calculation is a very systematic and scientific way of evaluating inventory across all three methods. It is unaffected by when goods were purchased and when they were sold. The only thing that matters is at what price these transactions were done and ideally, that’s what should matter. Hence it is easy to implement, hassle-free to maintain, and simple to audit.

- Like FIFO and unlike LIFO, it is difficult to manipulate.

- This method is best utilized when the goods under consideration are difficult to differentiate and it does not matter how they were sourced into the warehouse.

Disadvantages

- Difficult to implement when the inventory consists of goods that are easily differentiable.

- Most often than not, due to the complex calculation involved, the cost of inventory does not match the current market price of the goods and may raise suspicion.

Conclusion

Inventory valuation is important because of the impact it has on the financial numbers of the firm. One should do a proper analysis and due diligence before selecting and implementing the valuation method as once selected, it cannot be changed mid-way.

Recommended Articles

This is a guide to the Inventory Valuation Method. Here we discuss the types, examples of inventory valuation method along with the advantages and disadvantages. You may also look at the following article to learn more –