Updated July 25, 2023

Invested Capital Formula (Table of Contents)

What is the Invested Capital Formula?

The term “invested capital” refers to the total amount of money invested by both shareholders, debt holders and other lenders of a company.

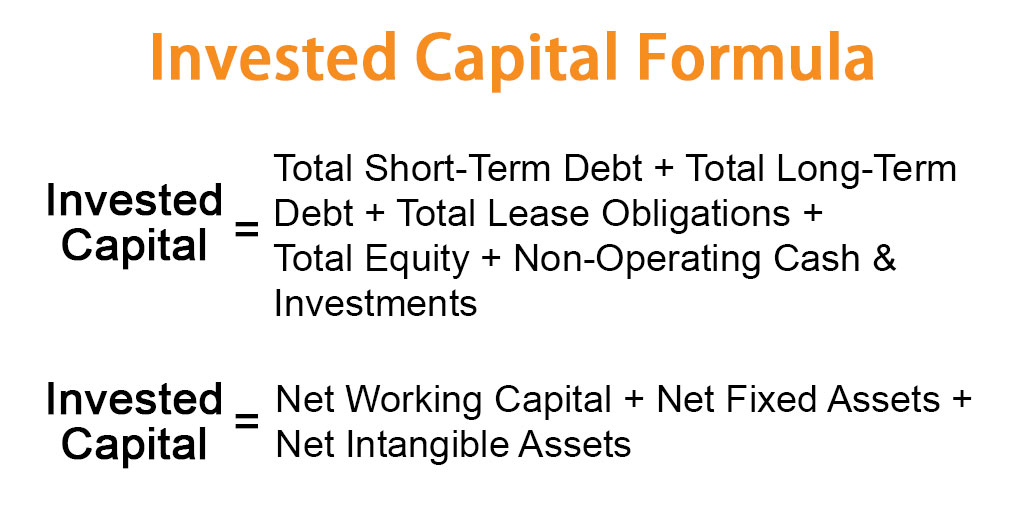

The formula for invested capital can be derived either by using the financing approach or the operating approach. Using the financing approach, the formula for invested capital can be represented as,

Using the operating approach, the formula for invested capital can be represented as,

Examples of Invested Capital Formula (With Excel Template)

Let’s take an example to understand the calculation of Invested Capital in a better manner.

Invested Capital Formula – Example #1

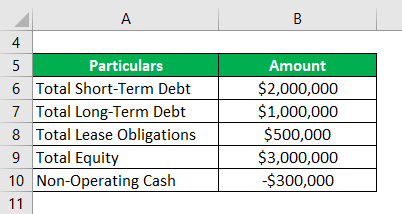

Let us take the example of a company with shareholder’s equity worth $3,000,000, term loan of $1,000,000, short-term bonds valued at $2,000,000 and $500,000 of lease obligations. Calculate the invested capital of the company if cash invested in non-operating activities is $300,000.

Solution:

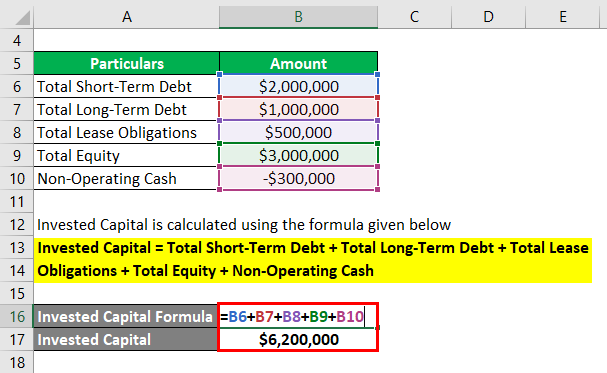

Invested Capital is calculated using the formula given below

Invested Capital = Total Short-Term Debt + Total Long-Term Debt + Total Lease Obligations + Total Equity + Non-Operating Cash

- Invested Capital = $2,000,000 + $1,000,000 + $500,000 + $3,000,000 + (-$300,0000)

- Invested Capital = $6,200,000

Therefore, the company’s invested capital is $6.2 million.

Invested Capital Formula – Example #2

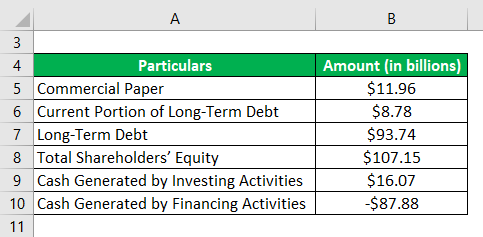

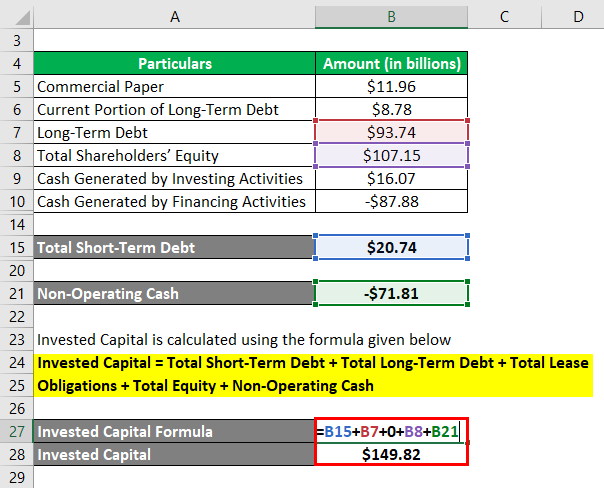

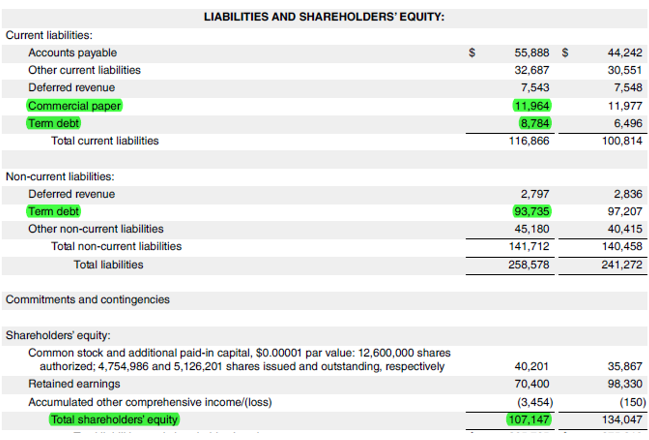

Let us take the example of Apple Inc. for the illustration of invested capital calculation using the financing approach. According to the latest annual report, the following financial information is available for FY18:

Solution:

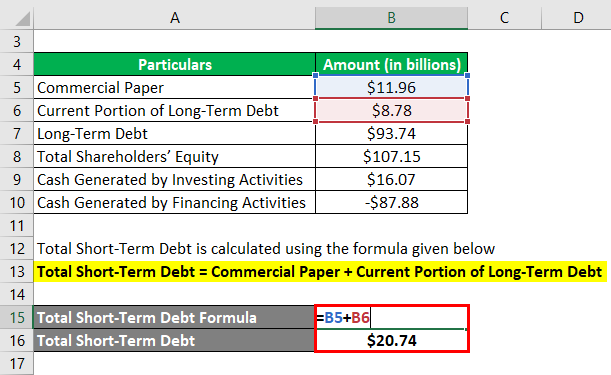

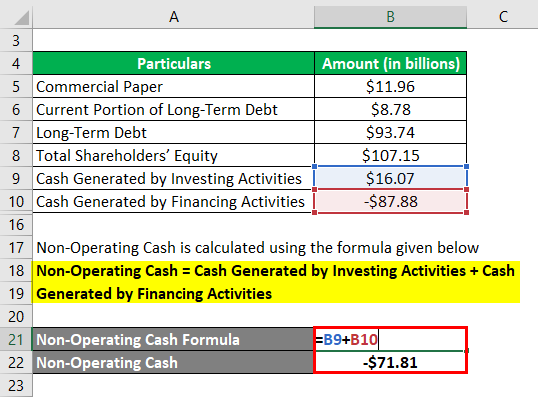

Total Short-Term Debt is calculated using the formula given below

Total Short-Term Debt = Commercial Paper + Current Portion of Long-Term Debt

- Total Short-Term Debt = $11.96 Bn + $8.78 Bn

- Total Short-Term Debt = $20.74 Bn

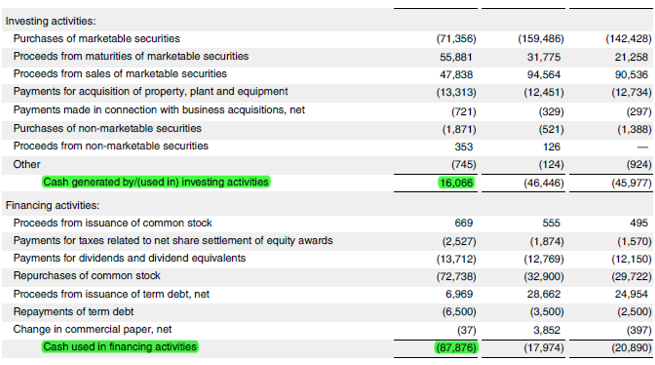

Non-Operating Cash is calculated using the formula given below

Non-Operating Cash = Cash Generated by Investing Activities + Cash Generated by Financing Activities

- Non-Operating Cash = $16.07 Bn + (-$87.88 Bn)

- Non-Operating Cash = -$71.81 Bn

Invested Capital is calculated using the formula given below

Invested Capital = Total Short-Term Debt + Total Long-Term Debt + Total Lease Obligations + Total Equity + Non-Operating Cash

- Invested Capital = $20.74 Bn + $93.74 Bn + 0 + $107.15 Bn + (-$71.81 Bn)

- Invested Capital = $149.82 Bn

Therefore, the invested capital of Apple Inc. for the year 2018 stood at $149.82 Bn.

Source Link: Apple INC. Balance Sheet

Invested Capital Formula – Example #3

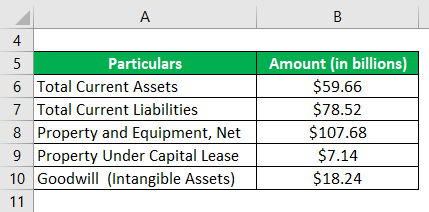

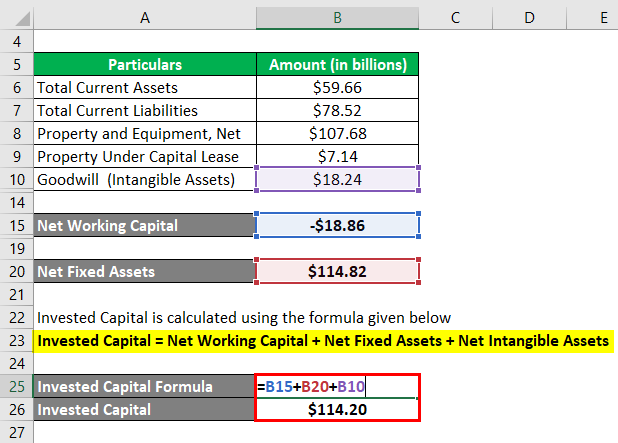

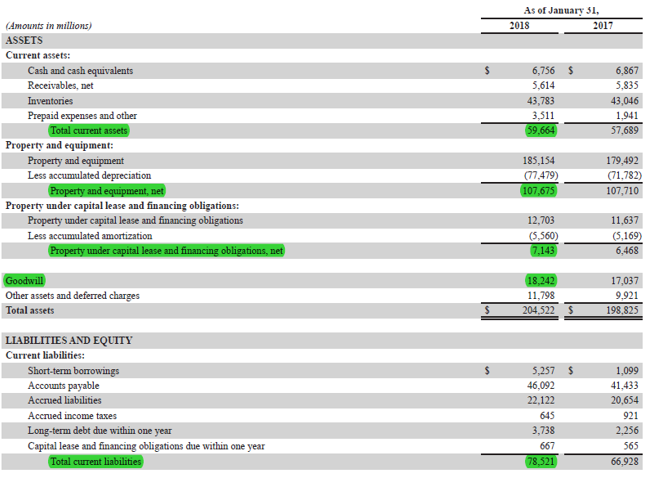

Let us take the example of Walmart Inc. for the illustration of invested capital calculation using an operating approach. According to the latest annual report, the following financial information is available for FY18. Calculate the invested capital of Walmart Inc. for the year 2018.

Solution:

Net Working Capital is calculated using the formula given below

Net Working Capital = Total Current Assets – Total Current Liabilities

- Net Working Capital = $59.66 Bn – $78.52 Bn

- Net Working Capital = -$18.86 Bn

Net Fixed Assets is calculated using the formula given below

Net Fixed Assets = Property and Equipment, Net + Property under Capital Lease

- Net Fixed Assets = $107.68 Bn + $7.14 Bn

- Net Fixed Assets = $114.82 Bn

Invested Capital is calculated using the formula given below

Invested Capital = Net Working Capital + Net Fixed Assets + Net Intangible Assets

- Invested Capital = (-$18.86 Bn) + $114.82 Bn + $18.24 Bn

- Invested Capital = $114.20 Bn

Therefore, the invested capital of Walmart Inc. for the year 2018 stood at $114.87 Bn.

Source: Walmart Annual Reports (Investor Relations)

Explanation

Using the financing approach, the formula for invested capital can be derived by using the following steps:

Step 1: Firstly, determine the total short-term debt of the subject company, which will include the short-term borrowings, revolving facilities and the current portion of long-term debt.

Step 2: Next, determine the total long-term debt of the company, which will include term loan, promissory notes, senior notes, etc.

Step 3: Next, determine the total lease obligations which are the aggregate of the present value of the future lease payments.

Step 4: Next, determine the total equity of the company which is the summation of common stock, reserve & surplus, additional paid-in capital, etc.

Step 5: Next, determine the non-operating cash & investment which is the aggregate of cash generated from financing and investing activities.

Step 6: Finally, the formula for invested capital can be derived by adding total short-term debt (step 1), total long-term debt (step 2), total lease obligations (step 3) and total equity (step 4) minus cash & investments not needed for operations (step 5) as shown below.

Invested Capital = Total Short-Term Debt + Total Long-Term Debt + Total Lease Obligations + Total Equity + Non-Operating Cash & Investments

Using the operating approach, the formula for invested capital can be derived by using the following steps:

Step 1: Firstly, determine the company’s networking capital requirement, which is the summation of inventory holding and accounts receivable minus trade payable.

Step 2: Next, determine the net fixed assets of the company, which is gross fixed assets minus accumulated depreciation.

Step 3: Next, determine the net tangible assets, which are gross tangible assets minus accumulated amortization.

Step 4: Finally, the formula for invested capital can be derived by adding net working capital, net fixed assets, and net intangible assets as shown below.

Invested Capital = Net Working Capital + Net Fixed Assets + Net Intangible Assets

Relevance and Use of Invested Capital Formula

It is important to understand the concept of invested capital because usually companies use it as a source of funds to either purchase fixed assets or to cover day-to-day operating expenses. Inherently, companies prefer this source of funding before opting to take out a loan from the bank. On the other hand, an investor uses invested capital primarily to calculate the return on invested capital (ROIC) to monitor the investment profitability.

Invested Capital Formula Calculator

You can use the following Invested Capital Formula Calculator

| Total Short-Term Debt | |

| Total Long-Term Debt | |

| Total Lease Obligations | |

| Total Equity | |

| Non-Operating Cash & Investments | |

| Invested Capital | |

| Invested Capital = | Total Short-Term Debt + Total Long-Term Debt + Total Lease Obligations + Total Equity + Non-Operating Cash & Investments | |

| 0 + 0 + 0 + 0 + 0 = | 0 |

Recommended Articles

This is a guide to Invested Capital Formula. Here we discuss how to calculate Invested Capital Formula along with practical examples. We also provide an Invested Capital calculator with a downloadable excel template. You may also look at the following articles to learn more –