Investing in Commodity Markets: Overview

Commodity markets play an essential role in global trade, where raw materials like oil, metals, and agricultural products are bought and sold. Investing in commodity markets gives you access to these essential resources, allowing you to capitalize on price fluctuations and market trends. This guide will walk you through the nature of commodities, how commodity markets function, and how you can start investing in them through different financial instruments.

Types of Commodities

Before investing in commodity markets, it is essential to understand the two primary categories of commodities. Understanding these categories can help you decide where to invest within the commodity space.

- Hard Commodities: These include natural resources extracted from the earth, such as oil, gold, and metals like copper. Their value often fluctuates due to economic demand, geopolitical factors, and natural resource discoveries.

- Soft Commodities: These are agricultural products, and livestock, such as coffee, wheat, and cattle, fall into this category. Their prices are primarily affected by weather patterns, seasonal shifts, and crop yields.

How do Commodity Markets Function?

Commodity markets are more than just places to buy and sell raw materials. They are essential for establishing fair pricing and managing global risks for producers and consumers. Here is how they work:

- Price Discovery: Commodity markets help determine fair prices for raw materials by continuously tracking buying and selling activity. Based on factors like production levels, inventory availability, and market sentiment, these prices change in real-time, giving valuable economic insights to producers, consumers, and investors.

- Risk Management: Commodity markets also allow producers like farmers or mining companies to protect themselves from sudden price changes. For example, farmers can lock in a future price for their crops, while manufacturers can set predictable costs for essential materials. This process, known as “hedging,” brings stability to businesses by helping them plan ahead despite market ups and downs. In this way, commodity markets help set prices and enable businesses to manage their financial risks, creating a more stable environment in an otherwise unpredictable market.

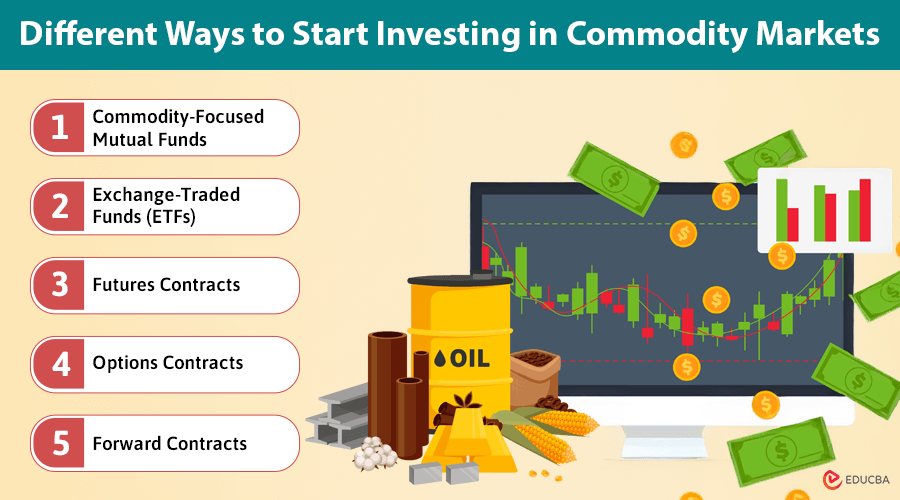

Different Ways to Start Investing in Commodity Markets

Entering the commodity market requires a thoughtful approach to investment strategies and risk tolerance. Here are several accessible ways to participate:

A. Commodity-Focused Mutual Funds

Mutual funds offer a beginner-friendly route into commodity markets. They enable investors to combine their resources to purchase a diversified portfolio of commodities or related assets, which professionals manage. Investing in mutual funds lets individuals benefit from price movements without the complexity of direct trading or physical ownership. These funds may focus on specific sectors, like energy or agriculture, or use broad commodity indexes, providing exposure to market dynamics while mitigating some risks.

B. Exchange-Traded Funds (ETFs)

ETFs provide another easy way to invest in commodities by tracking the performance of individual commodities or a group of them. They give investors market exposure without the need to manage physical assets directly. They are ideal for retail and institutional investors, offering flexibility and ease of access.

C. Futures Contracts

Standardized agreements to purchase or sell a commodity at a fixed price on a given future date are known as futures contracts. These contracts form the backbone of commodity trading, enabling both hedging (to reduce price volatility risk) and speculative activities. Experienced investors and businesses commonly use futures requiring a more hands-on approach.

D. Options Contracts

Options provide an alternative to futures, offering the right—without the obligation—to buy or sell at a specific price within a set timeframe. This flexibility allows investors to hedge or speculate with more controlled risk, making options popular among those seeking sophisticated risk management tools.

E. Forward Contracts

Like futures, forward contracts allow direct transactions with customized terms between parties, typically over the counter. While not standardized like futures, forward contracts offer flexible contract terms, making them ideal for unique or non-standard trading requirements.

Major Commodity Exchanges

Commodity exchanges are the backbone of these markets, providing the infrastructure for smooth trading. Some of the most prominent exchanges include:

- Chicago Mercantile Exchange (CME): A leading exchange for trading various commodity contracts, including energy and agricultural products.

- New York Mercantile Exchange (NYMEX): Specializes in energy products like oil and natural gas.

- London Metal Exchange (LME): This exchange focuses on trading industrial metals such as aluminum, copper, and zinc.

- Intercontinental Exchange (ICE): Facilitates trading in energy and agricultural commodities through electronic platforms.

Price Dynamics and Market Influences

A range of global factors influences the price of commodities:

- Supply and Demand: Commodity prices are affected by the balance of supply and demand. For example, a shortage in oil supply can lead to higher prices.

- Weather and Environmental Conditions: Weather patterns like droughts or floods can heavily impact prices for agricultural commodities.

- Geopolitical Events: Instability in major commodity-producing regions can disrupt supply chains, leading to price fluctuations.

- Economic Indicators: Industrial production and consumer demand play a significant role in determining commodity prices.

- Currency Fluctuations: Since commodities typically price in U.S. dollars, changes in the dollar’s strength can impact global commodity prices.

Final Thoughts

Investing in commodity markets offers unique opportunities for those seeking diversification and potential high returns. Whether you are new to investing or a seasoned professional, understanding the dynamics of commodity prices, trading mechanisms, and available investment options will help you navigate these markets effectively. As global economic trends evolve, staying informed and adopting sound strategies will allow you to make the most of your commodity investments.

Recommended Articles

We hope this guide on investing in commodity markets offers valuable insights to help you navigate this dynamic field. Check out these recommended articles for additional tips and strategies to make informed investment decisions.