Getting Started with Market Index Investing

Investing is one of the best ways to grow your wealth over time. Investing in market indices can be a smart and simple option if you are just starting out. Market indices measure the performance of a group of companies, providing broad stock market exposure without requiring you to select individual stocks.

In this guide, we will cover three major market indices, how they work, and why they can be a smart investment option for beginners.

Understanding the Three Major Market Indices

Before investing in market indices, it is essential to understand how they work. The three most well-known indices in the U.S. are:

#1. S&P 500 (Standard & Poor’s 500)

The S&P 500 monitors the 500 biggest US publicly traded companies. It is a market-weighted index, meaning companies with larger market capitalization influence their performance more.

- Covers about 80% of the total U.S. stock market.

- Considered a good indicator of the overall U.S. economy.

- Includes major companies like Apple, Microsoft, and Amazon.

#2. Dow Jones Industrial Average (DJI)

The Dow Jones Industrial Average (DJI) consists of 30 well-established blue-chip companies. Unlike the S&P 500, this index is price-weighted, meaning stock prices determine a company’s weight in the index.

- Includes major companies like McDonald’s, JPMorgan Chase, and Boeing.

- Focuses on stable, well-known businesses.

- Less diversified than the S&P 500.

#3. Nasdaq-100

The Nasdaq-100 monitors the 100 largest non-financial companies listed on the Nasdaq stock exchange, primarily featuring tech-focused firms.

- Includes major tech firms like Google, Tesla, and Meta.

- More volatile but offers higher growth potential.

- Strongly influenced by the tech industry and innovation trends.

These indices often follow similar trends, but the Nasdaq-100 has risen strongly due to blockchain and AI advancements.

Comparing Index Performance

The chart below illustrates the performance of the S&P 500, DJI, and Nasdaq-100. While they follow similar trends, rapid advancements in blockchain and AI have primarily driven the recent surge in the Nasdaq-100, propelling tech stocks to new heights.

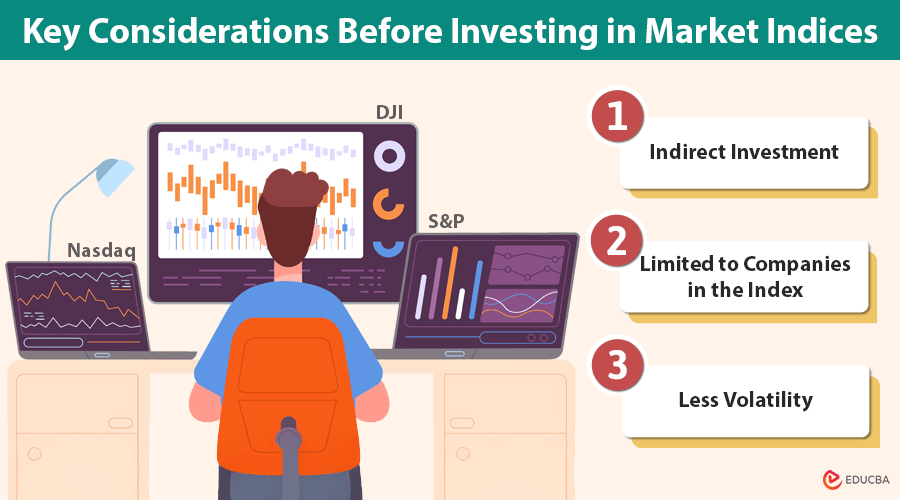

Key Considerations Before Investing in Market Indices

If you are used to investing in individual stocks, there are some important differences to keep in mind:

- Indirect Investment: You cannot invest directly. Instead, you invest in financial instruments that track the index’s performance. For example, if you want to invest in the Nasdaq-100, you can buy the Invesco QQQ ETF (exchange-traded fund). For the DJI, you can invest in the DIA ETF, and for the S&P 500, you can buy the SPY ETF.

- Limited to Companies in the Index: When you invest in an index, you are limited to the companies included. For example, if you invest in the DJI, you would not benefit from the growth of companies like T-Mobile, which are not part of the index. However, T-Mobile is part of the S&P 500, so investing in that index will benefit from its performance.

- Less Volatility: Indices tend to be less volatile than individual stocks. If McDonald’s stock falls, it will have less impact on your investment in the S&P 500 or DJI than if you held McDonald’s stock directly. While you may miss out on big surges in individual stocks, the index offers a more stable investment.

Final Thoughts

Initially designed to track the market’s health, market indices have evolved into some of the safest investment instruments available. Managed by trusted authorities, these indices offer a reliable way to invest in various companies. For beginners with limited capital, investing in market indices can be a great way to start building your portfolio. ETFs that track these indices are affordable and easy to access, making them a smart choice for new investors.

Recommended Articles

We hope this comprehensive guide on investing in market indices helps you make informed decisions about diversifying your investment portfolio. Check out these recommended articles for more insights on optimizing your investment portfolio.