Updated October 9, 2023

Introduction of Investment Banking Culture

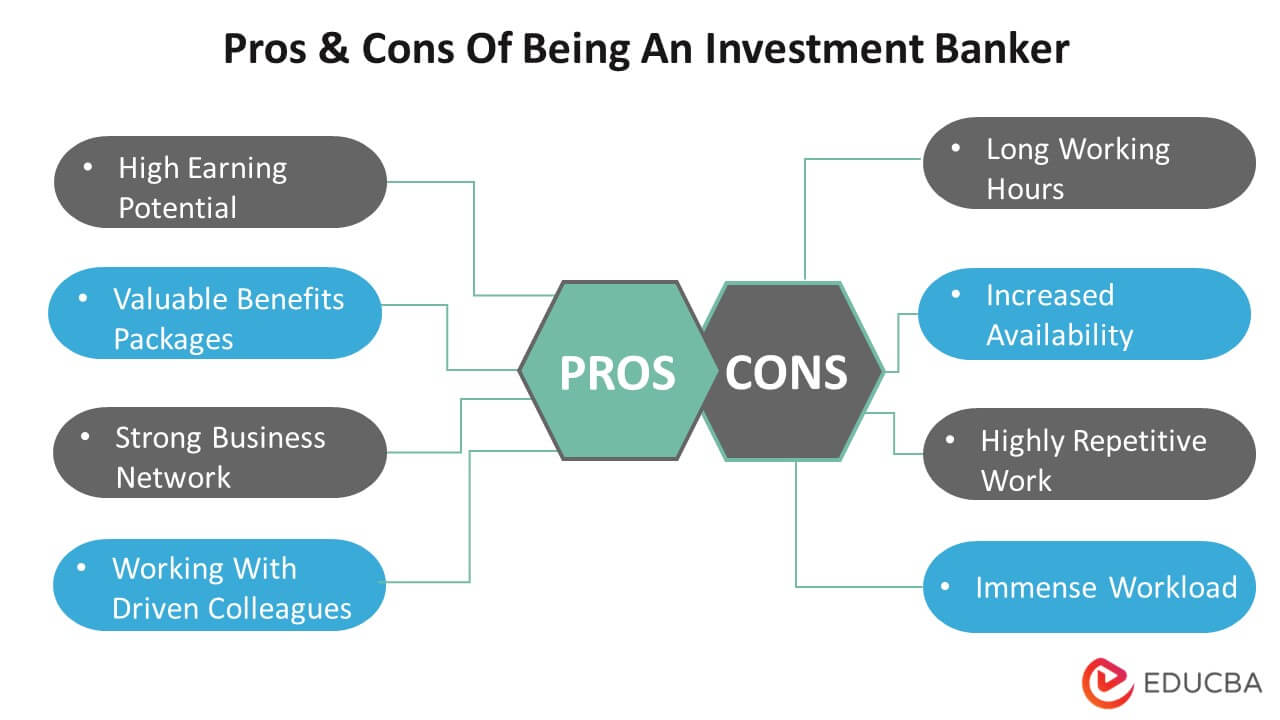

Long working hours, layoffs, and a hostile work atmosphere are part of an investment banking culture. The work is rewarding, but the days are long and demanding. The top investment banks have been under fire for high-stress and exhaustion reports. The investment banking industry has been active throughout the pandemic, resulting in fatigue.

Key Takeaways

- An investment banker engages in several activities: equity research, sales and trading, mergers and acquisitions, security underwriting, raising capital, and front-office vs. back-office operations.

- An investment banker typically puts in 80 to 100 hours per week due to unpredictable workflow and non-divisible tasks.

- The causes of cultural problems in the industry include internal factors like board oversight and external factors like structure, growing size, and scope.

- It must minimize cultural problems and cultivate the right culture, including hiring the right people, establishing appropriate remuneration structures, and guaranteeing staff retention.

Investment bankers- Activities

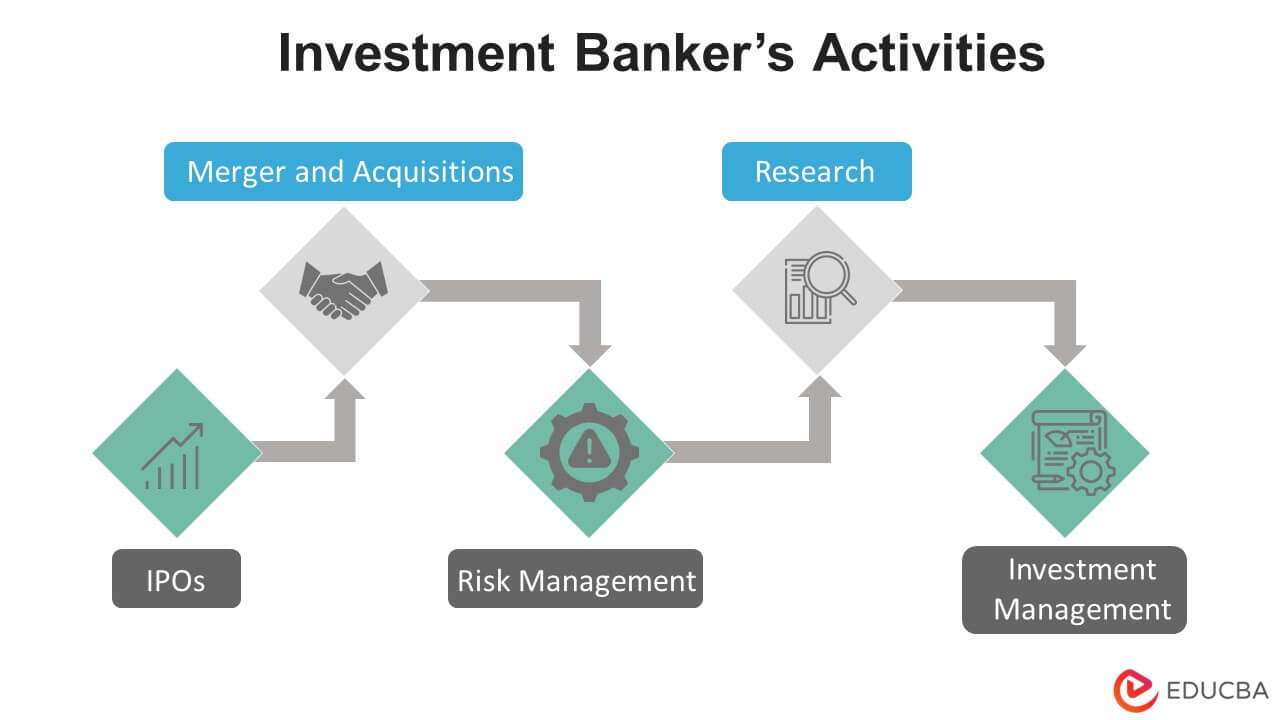

Investment bankers are involved in different activities:-

1. Raising Capital & Security Underwriting

Investment banks are intermediaries between companies that want to issue new securities and the buying public.

Investment bankers mark the price at which they sell the shares to make profits. The underwriting spread is the distinction between the purchase and markup prices.

The investment banker may occasionally act like a facilitator, marketing the offer without taking on any underwriting risk. The investment bankers in this situation might sell a portion of the securities and then be compensated on a commission basis for the quantity they sell.

2. Mergers & Acquisitions

Investment banks can help buyers and sellers by providing critical advice from business valuation, negotiation, and transaction structuring to procedure and implementation.

Investment bankers frequently serve as advisors during the M&A process, especially when determining a fair sale price.

Long-lasting negotiations can be part of mergers and acquisitions, with investment bankers weighing multiple bids and counteroffers on both sides. Therefore, one needs to possess excellent social skills to succeed in the field.

3. Sales & Trading and Equity Research

Investment banks facilitate securities trading by matching up compatible buyers and sellers. Sometimes, they even trade in securities from their accounts.

Research reports indicate whether to buy, sell, or hold a stock based on a company’s rating. Research is conducted by analyzing and contrasting multiple company and performance reports. Investment banks provide clients access to these reports, enabling investors to make money through trading and sales.

Furthermore, some businesses choose not to go public. Clients who choose to raise cash through private placements over the stock or bond markets can also get assistance from investment bankers.

4. Front Office v/s Back Office

Functions like M&A Advisory are “front office” work. The “back office” work includes risk management, control, corporate treasury, compliance, corporate strategy, operations, and technology.

Investment bankers also assist businesses and other organizations in raising capital for development and advancement. They are crucial in the initial public offerings (IPO) of emerging businesses ready to go public.

Investment bankers help their clients raise money and offer financial advice to businesses and occasionally to governments.

Learn more about the roles of Investment Bankers here.

Investment Banking Culture- Working Hours

Working hours of analyst per week

- Investment bankers work 80-100 hours weekly, and analysts may work until 4 a.m. during peak times. Some analysts may brag about only going home to change clothes.

- Investment bankers have unpredictable working hours; they can spend the entire day in a coffee shop or browsing the internet and sometimes don’t have time for lunch.

- Team meetings and replying to emails from clients, senior bankers, or coworkers typically fill the mornings. The morning hours are generally uneventful and unhurried from when an investment banker arrives at the office at around 9 a.m. until they take their lunch break.

- Investment bankers have a busy afternoon schedule, including analyzing paperwork and revising financial statements. They chat with peers during their lunch break, typically 30-60 minutes. These tasks can be time-consuming and stressful.

- To avoid report errors, investment bankers must double and triple-check their work. Mistakes are costly and time-consuming to fix and can lead to clients backing out of agreements, making them unacceptable.

- Investment bankers often eat dinner in the office after concluding revisions around 7-9 p.m. They collaborate with colleagues from different departments to create presentations using IT tools to prepare for the next day’s meetings.

- First-year investment bankers frequently leave the office between 11 p.m. and 1 a.m. and prepare to resume work later that morning.

- Work can come unexpectedly, taking Friday, Saturday, and Sunday nights.

- Investment bankers commonly work on weekends to catch up on tasks that can take a few hours or the entire weekend to complete.

Do an analyst’s working hours improve with time and experience in the same field? If not, why can’t the analyst hire new employees?

The answer to this question is NO .

Investment Banking Culture – Tasks of an Analyst

Within Investment Banking, an analyst is primarily involved in two types of work.

Non-divisible work means that even if you add more employees to complete the task, the result will not get over quickly as the work cannot be divided. Let’s understand this using an example. An analyst will be required to prepare the financial model in Excel. This financial model cannot be broken down into pieces that can be allocated to the different employees. The entire model has to be prepared by a single individual. Once the financial model is ready, the review of this model can be done by a different person.

Unpredictable workflow – Clients’ demands are sometimes unpredictable, and the workflow comes at extreme peaks. You may receive a call for advice on a large M&A transaction at any point or time of the day. These transactions must conclude as fast as possible. There is always a possibility that the information might get leaked to the press, or the parties may lose time advantage.

Investment bankers come with a high cost to the company. Stretching their resources is less expensive than recruiting more people who would spend most of their time idle.

Investment Banking Culture – Cause of Problems

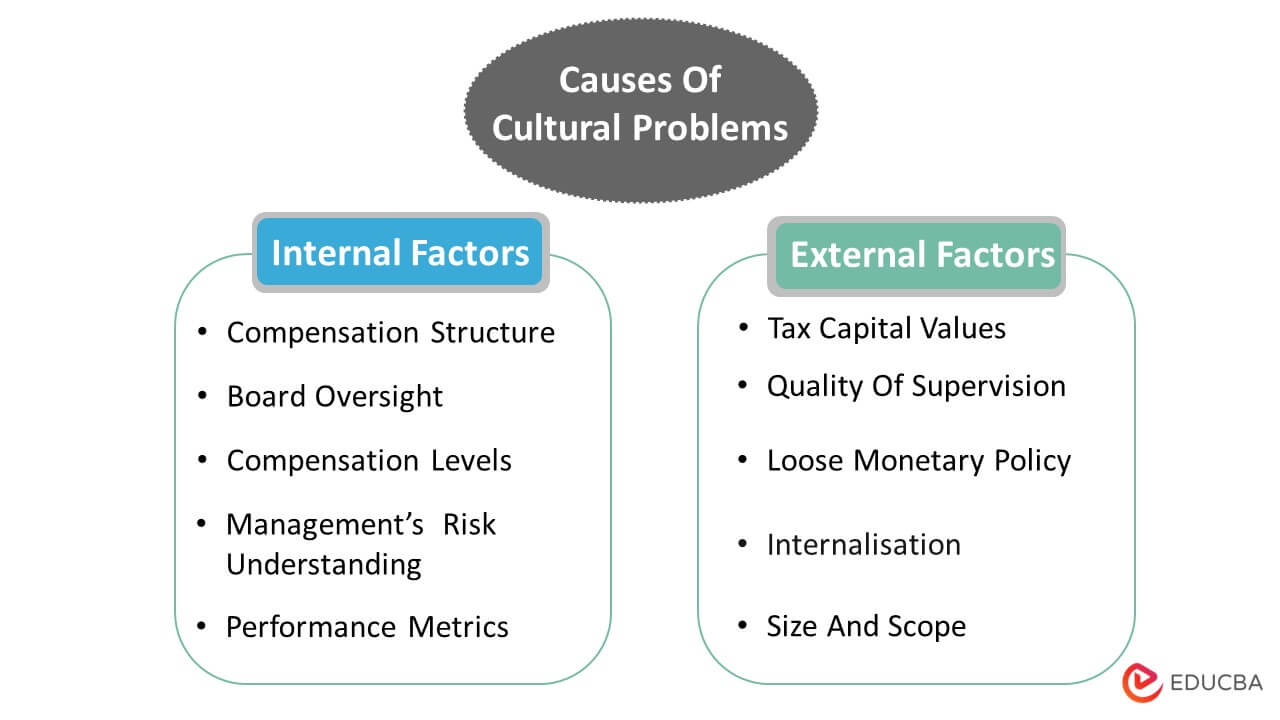

Investment Banking’s corporate culture is often accused of being toxic. Since the financial crisis, many people have brought up industry-wide cultural issues in investment banking. These causes include internal factors like board oversight, awareness of their balance sheets, staff incentives, and external factors like structure, the growing size and scope of banks, regulation, and supervisory.

Furthermore, 62% of senior investment bankers think poor or ineffective upward communication of issues to management is a profound cultural issue. Senior bankers stated that despite providing decent policies and procedures for staff to voice matters, their juniors usually hesitate to speak out.

However, fostering the’ right’ culture has the potential to do more than solve the problem. Organizations with the right culture might have a competitive edge, challenging competitors to imitate.

The Investment Banks must provide the following.

Hire the Right People

- Hiring the right people is crucial in improving the investment banking culture.

- Motivation is one of the most important factors required in a person to succeed. Investment banks hire people who are motivated to become wealthy.

- It allows people to grow and maximize their potential, be it earning or career reasonable progression; investment banks require people with that mentality. The problem comes during the assessment where only one side of the coin is assessed, i.e., how well an employee is performing, and fails to look at the second side, i.e., whether the employee is staying in line with where you want in terms of risk. This creates the framework of a toxic culture.

Some people focus solely on risk management, while others do not. It would be best if you found a balance between the two. Only judging the employee’s performance is not the right way to judge someone.

Choosing the right people is essential to building a strong culture. Senior leadership training is crucial for initiating cultural change. According to Deloitte, companies with strong leadership can have a 35.5% or more difference in value compared to those with weaker leadership. Financial services organizations benefit more from effective leadership, with a potential overall difference of over 37%.

Senior bankers in a survey identified employee assessment metrics as the top lever for cultural change. Performance measurements should balance risk and reward while assessing an employee’s behavior. This is crucial for enhancing culture in an industry where salary is a primary motivator.

Banks are increasingly evaluating staff based not only on their work but also on how they approach it.

Filling the company with risk-hungry, short-term thinkers through bad hiring policies creates a toxic culture.

Right Compensation Arrangements

- Compensation arrangements are one of the important causes of the toxic culture in investment banking. One of the most challenging issues is maintaining motivation when compensation stagnates or declines.

- Structuring incentives and bonuses can be highly lucrative for those who maximize their ascendancy.

- Investment banking does not look at people with a 40-year career and aspiration to get to the top but at people who want to make a significant impact and move that impact up.

Ensuring Employee Retention

- Nowadays, people don’t stay in one organization. They work hard in one organization for two to three years, enjoy a high bonus, and then move to the next organization.

- To counteract this, investment banks must look at personnel policies at every level – recruitment, promotion, and compensation.

Conclusion

Investment bankers have reservations about the industry’s capacity to successfully manage key facets of culture. Furthermore, culture is nebulous, making it challenging to predict precisely what levers will alter it. The investment banking sector is being pushed to change deeply ingrained organizational processes and attitudes in a substantial cultural way. There are unprecedented expectations about the scope and speed of cultural transformation in the sector. However, cultural change might be feasible with the right people and policies in place.

Frequently Asked Questions(FAQs)

Q1. How Do You Get Into Investment Banking?

Answer: Prerequisites include financial modeling, corporate valuation, Accounting, and Excel skills. As for educational backgrounds, a business degree and an MBA can be beneficial. Additionally, many other abilities aren’t always related to a degree. Persuasive and persistent are two qualities that investment bankers possess. They also have the interpersonal skills to create a network and the bargaining ability to close transactions.

Q2. How Much Money Do Investment Bankers Make?

Answer: The base salary for an analyst can range from $85k – $100k, and the total remuneration is $125k – $200k. Accomplished investment bankers in their mid-career can earn anywhere from $300k – $1M.

Q3. What skills does an investment bank look for in a candidate?

Answer: One’s work in the investment banking sector will involve assisting clients in resolving some of their most pressing strategic and financial problems. Businesses seek candidates who will succeed in a fast-paced setting where the ability to multitask and manage time is crucial.

Most importantly, one should be able to think analytically and feel at ease working with numbers; hence, Excel and accounting are important skills. One must also possess strong interpersonal and communication skills to collaborate effectively with clients and team members.

Recommended Articles

Here are some articles that will help you get more details about the Investment Banking Culture, so just go through the link.