Updated July 24, 2023

Difference Between Investment Banking vs Private Equity

Investment Banking vs Private Equity can be defined as a financial mechanism through which individuals or entities receive financial and advisory services with respect to raising their share capital. Investment banks act as mediators between the issuers and receivers (individuals or organizations) of financial securities and help new companies or start-ups to offer their shares to the public. Investment banking serves multiple purposes and businesses.

Investment banking provides a huge range of financial services such as underwriting, research, asset management services, mergers and acquisitions advisory services (that includes mergers, acquisitions, leveraged buyouts, tender offers, consolidations, etc.), sales, trading, and corporate booking. On the other hand, private equity funds can be defined as investment funds that are typically organized in the form of limited partnerships that has the tendency to buy and restructure such entities that are not enlisted on the stock exchange. In other words, private equity funds can be defined as a collective investment mechanism that pools funds from various types of investors with the ultimate goal of acquisition of stakes in entities.

Head To Head Comparison Between Investment Banking vs Private Equity (Infographics)

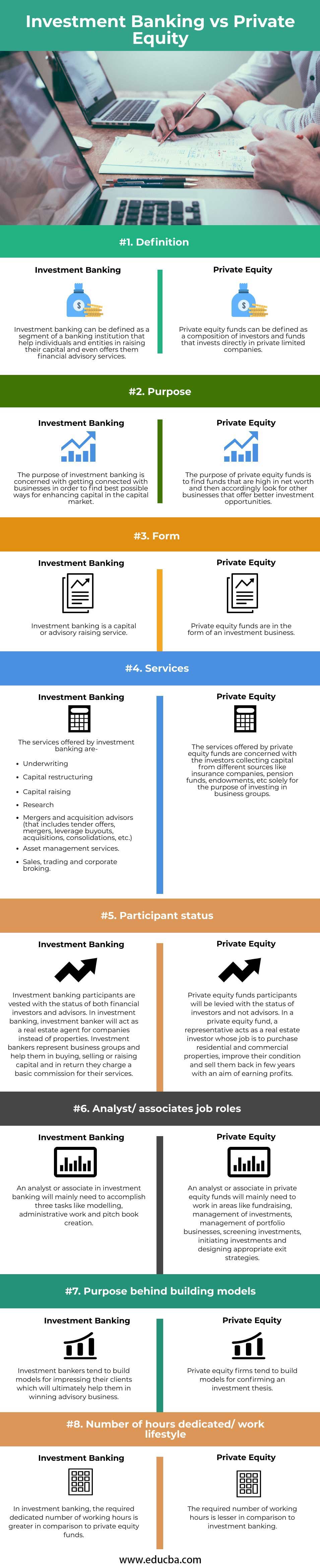

Below are the top 8 differences between Investment Banking vs Private Equity:

Key Differences Between Investment Banking vs Private Equity

The key differences between investment banking and private equity funds are discussed below:

- Investment banking is a capital-raising service, and here, the bankers also offer advisory services, whereas private equity funds are merely an investment business.

- The three basic tasks of an associate or analyst in investment banking are the creation of pitch books, modeling and administration related works, whereas the associates or analysts in private equity funds are concerned with fundraising, screening and generating investments, managing investments, managing the company’s portfolios and designing exit strategies.

- The purpose of investment banking is to connect business groups to evaluate the best mechanisms for leveraging capital in a capital market, whereas the purpose of private equity funds is to find funds that have a high net worth and then find such business groups that offer better investment-related opportunities.

- The services offered in investment banking are underwriting, capital raising, capital restructuring, mergers and acquisition advisors (that includes consolidations, tender offers, leveraged buyouts, mergers, acquisitions, etc.), research, asset management services, sales, trading, and corporate broking whereas the services offered by private equity funds are more often concerned with the investors raising capital from various sources like pension funds, endowments, insurance companies, etc. solely for the purpose of making investments in companies.

- Investment bankers develop models solely to impress their clients and leverage their advisory business, whereas private equity firms develop models to confirm an investment thesis.

- The work lifestyle is erratic in investment banking as compared to a private equity firm. The required number of working hours that needs to be dedicated in investment banking is way greater than as compared to private equity funds

Investment Banking vs Private Equity Comparison Table

Let’s discuss the top comparison between Investment Banking vs Private Equity:

| Basis of Comparison | Investment Banking | Private Equity Funds |

| Definition | Investment banking can be defined as a segment of a banking institution that helps individuals and entities in raising their capital and even offers them financial advisory services. | Private equity funds can be defined as a composition of investors and funds that invest directly in private limited companies. |

| Purpose | The purpose of investment banking is concerned with getting connected with businesses in order to find the best possible ways of enhancing capital in the capital market. | The purpose of private equity funds is to find funds that are high in net worth and then accordingly look for other businesses that offer better investment opportunities. |

| Form | Investment banking is capital or advisory raising service. | Private equity funds are in the form of investment business. |

| Services | The services offered by investment banking are-

|

The services offered by private equity funds are concerned with the investors collecting capital from different sources like insurance companies, pension funds, endowments, etc. solely for the purpose of investing in business groups. |

| Participant status | Investment banking participants are vested with the status of both financial investors and advisors. In investment banking, an investment banker will act as a real estate agent for companies instead of properties. Investment bankers represent business groups and help them in buying, selling, or raising capital, and in return, they charge a basic commission for their services. | Private equity funds participants will be levied with the status of investors and not advisors. In a private equity fund, a representative acts as a real estate investor whose job is to purchase residential and commercial properties, improve their condition, and sell them back in few years with the aim of earning profits. |

| Analyst/ associates job roles | An analyst or associate in investment banking will mainly need to accomplish three tasks like modeling, administrative work, and pitch book creation. | An analyst or associate in private equity funds will mainly need to work in areas like fundraising, management of investments, management of portfolio businesses, screening investments, initiating investments, and designing appropriate exit strategies. |

| The purpose behind building models | Investment bankers tend to build models for impressing their clients, which will ultimately help them in winning advisory business. | Private equity firms tend to build models for confirming an investment thesis. |

| Number of hours dedicated/ work lifestyle | In investment banking, the required dedicated number of working hours is greater in comparison to private equity funds. | The required number of working hours is lesser in comparison to investment banking. |

Conclusion

The type of work in an investment banking takes place is concerned with pitching for better deals, their execution and random tasks like procuring information, delivery of packages and assisting Managing Directors to prepare for calls are the primary tasks in investment banking whereas the types of work in a private equity fund takes place is concerned with a screening of upcoming investments, execution of deals for initiating investments, management of portfolio entities, fundraising, and designing of exit strategies.

Recommended Articles

This is a guide to Investment Banking vs Private Equity. Here we discuss the Investment Banking vs Private Equity key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –