Difference Between Investing and Savings

Investing vs. Saving are two different ways to save money. Investing is when a person uses the money they have to make more money by taking risks like investing in the stock market, mutual funds, etc. In contrast, saving is when an individual puts their money in a secure place for future needs.

Let us Study Much more About Investment and Savings in Detail.

Investment options vary from Stocks, Bonds, Mutual Funds, the Acquisition of Property, land, etc. Some investment instruments are risky, and thus, they intend to generate higher returns. In the case of savings, there is hardly any possibility of future gains if the money remains idle with the person. In the case of cash lying with banks or in the form of deposits, the fund is expected to give a certain amount of return, which is lower than bonds or debentures.

The philosophy behind Savings is to handle unforeseen financial emergencies or fulfill short-term expectations such as purchasing expensive gifts, going on vacation, buying a two-wheeler, etc., which are typically not possible from regular income. Therefore, a person saves a certain amount from their income, which is leftover after all disposable expenses, and usually utilizes the savings when purchasing certain items. Individuals save the excess amount after covering disposable expenses, and it is typically used for specific purchases.

Investing in stocks, an asset class, is highly volatile as rates fluctuate based on the ever-changing market value. Thus, the investor should select according to the risk-taking ability and the desired goal of the investor. In the case of Bonds, they are ought to give a fixed return (6-7 percent) over some time and considered the safest bet. Instruments like Mutual Funds are very dynamic. It may consist of pure equity, pure Debt, or a combination of Debt and Equity. Over a longer period, Equity has been outperformed, considering all the asset classes generating even one hundred times in 10-15 years! Thus, Fund managers allocate a certain portion of the funds to well-researched companies with healthy financials and sustain business outlook for the future. Most savings are due to high-yield bonds containing a lock-in period of five to ten years.

Investors buy government bonds for tax exemption, while savings in bank accounts or cash do not require such calculations. Savings have short-term goals and do not counter inflation, gradually eroding the real value of money over time.

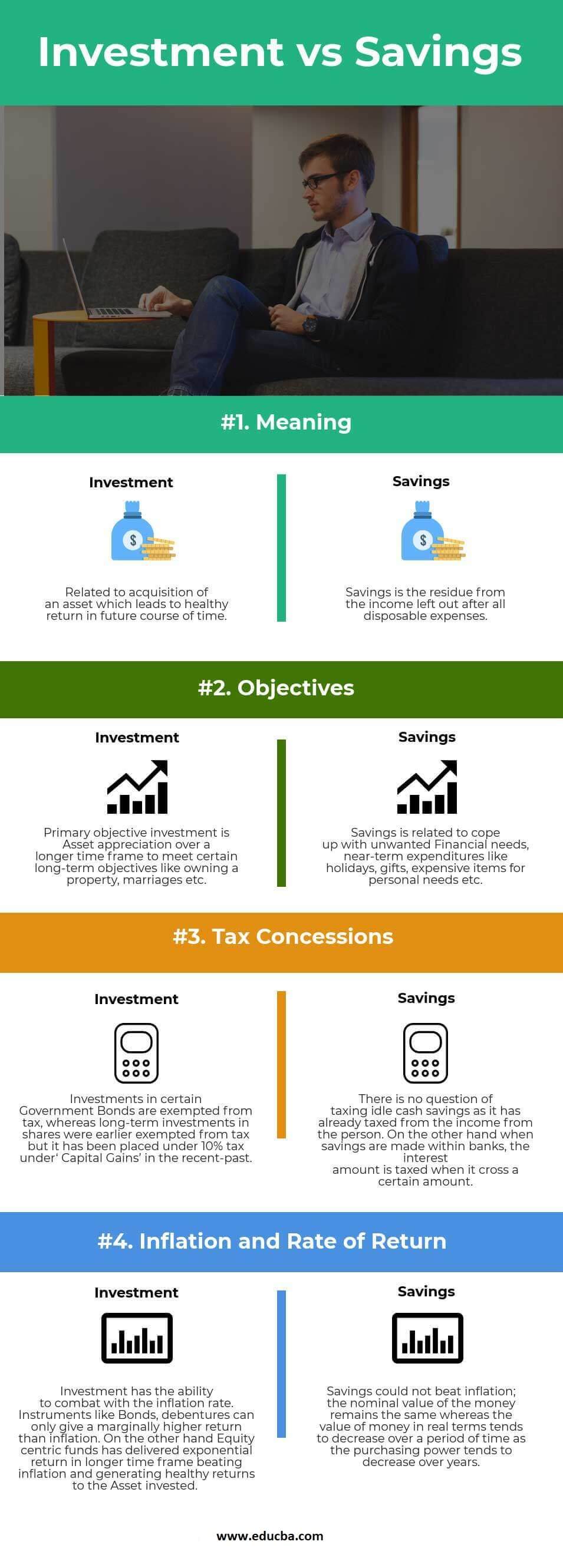

Investing vs Savings Infographics

Below are the top 4 differences between Investing vs Savings.

Key Differences

Both Investments vs Savings are popular choices in the market; let us discuss some of the major differences between Investment and Savings:

- Investors generate asset appreciation through healthy returns while they save the remaining portion for future unforeseen incidents or crises.

- Investment has several instruments like bonds, debentures, stocks, land and property, mutual funds, etc. Saving is done on a cash basis by the individual or deposited in the banks.

- Market volatility can increase the allocation of instruments like stocks and shares, potentially leading to a negative return on investment. But on the other hand, holding savings in the form of cash cannot result in the erosion of the nominal value of the funds. Inflation can be coping by means of Investments, whereas saving has no potential to combat inflation; on the other hand, the real value of money tends to decrease in the case of savings. However, the real value tends to decrease as the purchasing power of the same amount of funds will result in lower commodities compared to its earlier period.

Comparison Table

Below is the topmost comparison between Investing and Savings.

| Basis of Comparison | Investing | Savings |

| Meaning | Related to an acquisition of an asset that leads to a healthy return in the future course of time. | After all disposable expenses, the residue left from the income is known as savings. |

| Objectives | Primary objective investment is Asset appreciation over a longer time frame to meet certain long-term objectives like owning a property, marriages, etc. | Savings are related to coping with unwanted Financial needs, and near-term expenditures like holidays, gifts, expensive items for personal needs, etc. |

| Tax Concessions | The government exempts tax on investments in certain Government Bonds, while it has placed long-term investments in shares under 10% tax under ‘Capital Gains’ in the recent past. | There is no question of taxing idle cash savings as it has already been taxed from the income of the person. On the other hand, when savings are made within banks, the interest amount is taxed when it crosses a certain amount. |

| Inflation and rate of return | Investment can combat the inflation rate. Instruments like Bonds and debentures can only give a marginally higher return than inflation. On the other hand Equity, centric funds have delivered an exponential return in a longer time frame beating inflation and generating healthy returns on the Asset invested. | Savings cannot beat inflation; the nominal value of the money remains the same, whereas the value of money in real terms tends to decrease over a period of time as the purchasing power tends to decrease over the years. |

Conclusion

Now you must have got a fairer idea of both Investments vs. savings. Investment vs. savings are both generated from the income of an individual. Protection in the form of Cash that lies with the banks or with the individual and cannot generate higher returns. Investment has always proved to give returns (moderate to higher depending on the type of instrument allocated) over time, and it can combat inflation. Savings does not have the risk of capital depreciation like Investment (specifically stocks). Stay tuned to our blog for more articles like these.

Recommended Articles

This is a guide to Investing vs Savings. Here we also discuss Investing and Savings key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –