How Entrepreneurs Can Turn Ideas into an Investor-Ready Pitch Deck?

Every successful business starts with a great idea, but securing funding requires more than just an idea. Entrepreneurs must translate their vision into a compelling investor-ready pitch deck that attracts investors. A well-structured pitch deck, like those offered by Propitchdeck Services, presents the business concept and convinces investors of its potential and profitability.

This article guides entrepreneurs to secure funding by creating a strong investor-ready pitch deck.

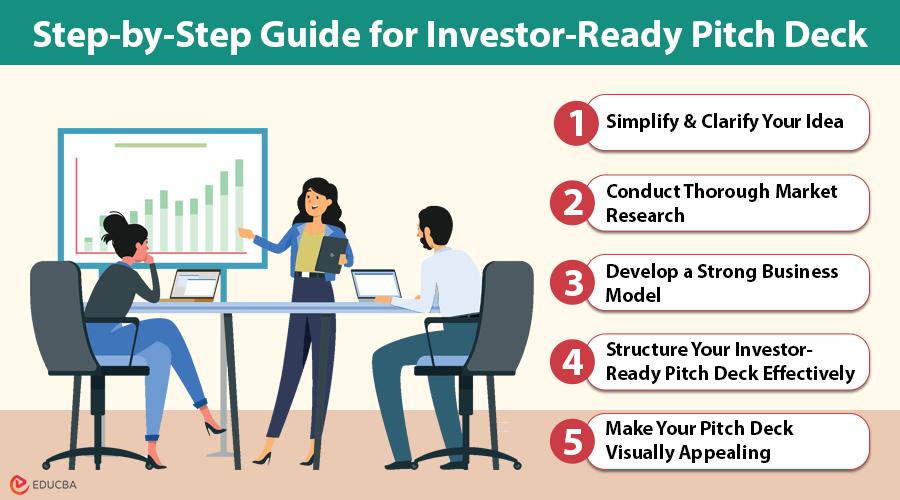

Step-by-Step Guide for Investor-Ready Pitch Deck

Follow these steps to create a compelling investor-ready pitch deck that clearly communicates your business vision, attracts investors, and secures funding:

#1. Simplify and Clarify Your Idea

Before creating a pitch deck, refine your idea into a clear and engaging value proposition. Investors have limited time, so your idea should be simple, compelling, and understandable.

Steps to Achieve Clarity:

- Define the Problem: Identify a real-life challenge your business addresses.

- Present the Solution: Explain how your product or service solves the problem better than alternatives.

- Highlight Uniqueness: Showcase what makes your solution innovative or superior.

- Craft an Elevator Pitch: Summarize your business idea in one powerful sentence that conveys its importance.

#2. Conduct Thorough Market Research

Investors want data-driven proof that your idea has market potential. Your pitch deck should incorporate solid market research demonstrating demand and opportunity.

Key Market Insights to Include:

- Competitor Analysis: Identify key players and highlight how your business stands out.

- Target Market Demand: Use reliable data to define your ideal customers and industry trends.

- Market Potential: Show statistics on the total addressable market (TAM) and serviceable market (SAM) to prove scalability.

#3. Develop a Strong Business Model

A brilliant idea alone is insufficient—investors want to see a feasible business model generating revenue. Clearly explain how your business will make money.

Important Business Model Elements:

- Revenue Streams: Will your model be subscription-based, transaction-focused, or ad-supported?

- Cost Analysis: Define pricing, customer acquisition costs, and expected profit margins.

- Scalability: Prove that your model is sustainable and can grow over time.

#4. Structure Your Investor-Ready Pitch Deck Effectively

An investor-friendly pitch deck should be concise, visually appealing, and structured into 10 to 15 slides. Here is a recommended slide structure:

- Title Slide: Company name, logo, and tagline that summarize your business.

- Problem Statement: Define the issue your product/service addresses with real-world examples.

- Solution: Clearly illustrate how your business provides a better alternative.

- Market Opportunity: Use data and visual charts to show your market’s size and growth potential.

- Product or Service Overview: Present screenshots, demos, or samples to make your offering tangible.

- Revenue Model: Explain how your business plans to make money and expand its revenue streams.

- Go-to-Market Strategy: Describe how you will get and keep customers, l digital marketing, partnerships, or direct sales.

- Competitive Advantage: Highlight how your business stands out and why investors should bet on you.

- Financial Projections: Provide financial estimates, including revenue, expenses, and profit forecasts for the next 2-4 years.

- Milestones and Achievements: Showcase traction such as sales, customer growth, partnerships, or media recognition.

- Team Introduction: Highlight key team members, their expertise, and how they contribute to success.

- Funding Request: Clearly state how much funding you need and how you will use it.

- Closing Slide with Call to Action: End with a powerful statement encouraging investors to take action.

#5. Make Your Pitch Deck Visually Appealing

Investors skim through pitch decks, so clarity and design are crucial. A visually compelling, investor-ready pitch deck enhances engagement and understanding.

Design Best Practices:

- Use Simple Language: Avoid jargon and keep the text concise.

- Visuals Over Text: Incorporate charts, graphs, and infographics.

- Consistent Branding: Stick to a uniform color scheme and font style.

#6. Prepare for Investor Questions

Be ready for tough investor questions. Anticipate and refine responses to key concerns such as:

- Market Size: How big is the opportunity?

- Competitive Landscape: What makes your solution different?

- Scalability: How will you scale efficiently?

- Revenue Potential: When will the business be profitable?

- Risk Mitigation: What are potential risks, and how will you address them?

#7. Tell a Compelling Story

A pitch deck is more than just data—it should tell a story. Investors connect emotionally when they understand the problem, believe in the solution, and trust the team behind it.

Storytelling Tips:

- Start with a relatable problem.

- Showcase how your product changes the game.

- Demonstrate the market demand with solid numbers.

- End with a strong vision of future success.

#8. Practice and Perfect Your Pitch

A great pitch deck is only effective if it is delivered confidently. Regular practice improves clarity, timing, and delivery.

How to Improve Your Pitch:

- Practice in front of peers, mentors, or potential customers.

- Record yourself and refine your presentation.

- Keep it concise—the ideal pitch length is 10-15 minutes.

Final Thoughts

Turning an idea into an investor-ready pitch deck requires clarity, data-backed insights, and compelling storytelling. Entrepreneurs should conduct thorough market research, highlight their competitive advantage, and present a scalable business model. A well-structured and visually engaging pitch deck increases the chances of securing investor interest and funding.

With the right preparation, design, and delivery, your pitch deck can open doors to the capital needed to bring your business vision to life.

Recommended Articles

We hope this guide has been helpful. Check out these recommended articles for expert insights on crafting compelling pitch decks, securing funding, and growing your startup successfully.