Updated November 30, 2023

Difference Between IRA vs 401 (k)

This is an outline of IRA vs 401 (k). Firstly, IRA stands for Individual Retirement Account, which is used as a retirement savings tool. Investment in an IRA for retirement savings comes with a tax-saving advantage. There are mainly three types of IRA, i.e. Traditional IRA, Roth IRA, and Rollover IRA. IRAs can be opened with financial institutions by either individuals or businessmen for retirement savings with taxation benefits.

401 (k), similar to IRA, is also a retirement saving plan with a taxation advantage. The employer shall sponsor and establish the 401 (k) plan wherein the employer can contribute to the 401 (k) account. In addition, employers offering the 401 (k) may choose to offer matching contributions or any other contribution to the 401 (k) account.

Moreover, IRA vs 401 (k) are common retirement saving options with taxation advantages. Either individuals or businessmen can use both IRA vs 401 (k). Employees or businessmen can use one or both the IRA vs 401 (k) tools for their retirement savings plan.

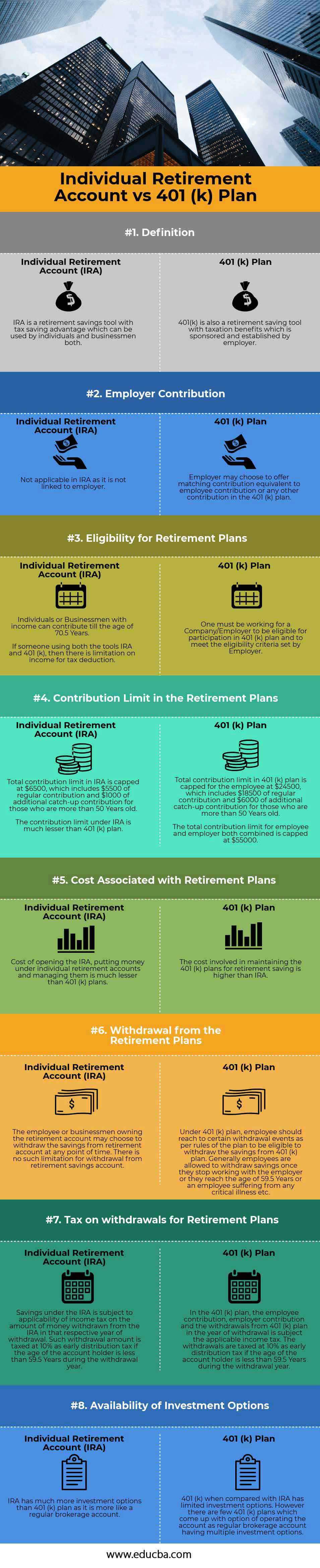

Head To Head Comparison Between IRA vs 401 (k) (Infographics)

Below is the top 8 difference between IRA vs 401 (k).

Key Differences Between IRA vs 401 (k)

Both IRA vs 401 (k) are popular choices in the market; thus, let us discuss some of the major differences between IRA vs 401 (k).

- IRA vs 401 (k) are common retirement saving options with taxation advantages. Individuals and businessmen can use both. One may choose to use either IRA or IRA and 401 (k) both for their retirement savings plan.

- Individuals can open IRAs and don’t have any linkage with an employer. However, 401 (k) shall be established and sponsored by the employer.

- There is no employer contribution to the IRA. However, an employer may offer a matching contribution or any other contribution in the 401 (k) account in a 401 (k) plan.

- Individuals or Businessmen with income can contribute to the age of 70.5 Years in IRA. However, one must work for a Company/Employer to be eligible for participation in the 401 (k) plan and meet the Employer’s eligibility criteria.

- The contribution limits in 401 (k) are significantly higher than the ones in IRA plans.

- The cost involved in maintaining the 401 (k) plans for retirement savings is higher than the IRA.

- IRA is more flexible regarding withdrawing savings from the retirement plan than 401 (k).

- The withdrawals in IRA vs 401 (k) are taxed at 10% as early distribution tax if the account holder’s age is less than 59.5 Years during the withdrawal year.

- IRA has much higher investment options than a 401 (k) plan.

Comparison Table

Below are the 8 topmost comparisons between IRA vs 401 (k):

| Sr. No | Particulars | Individual Retirement Account (IRA) | 401 (k) Plan |

| 1 | Definition | IRA is a retirement savings tool with a tax-saving advantage that individuals and businessmen can use. | 401(k) is also a retirement saving tool with tax benefits sponsored and established by an employer. |

| 2 | Employer Contribution | It is not applicable in IRA as it is not linked to the employer. | An employer may offer a matching contribution equivalent to an employee contribution or any other 401 (k) plan contribution. |

| 3 | Eligibility for Retirement Plans | Individuals or Businessmen with income can contribute to the age of 70.5 Years. However, if someone uses both the IRA vs 401 (k) tools, income is limited for the tax deduction. | One must work for a Company/Employer to be eligible for participation in a 401 (k) plan and meet the Employer’s eligibility criteria. |

| 4 | The contribution limit in the Retirement Plans | The total contribution limit in an IRA is capped at $ 6,500, including $ 5,500 of regular contribution and $ 1,000 of additional catch-up contribution for those over 50 years old.

The contribution limit under IRA is much less than a 401 (k) plan. |

The total contribution limit in the 401 (k) plan is capped for the employee at $24500, including $18500 of regular contribution and $6000 of additional catch-up contribution for those over 50 Years old.

The total contribution limit for employees and employers combined is capped at $55000. |

| 5 | Cost Associated with Retirement Plans | The cost of opening the IRA, putting money under individual retirement accounts, and managing them is much less than 401 (k) plans. | The cost involved in maintaining the 401 (k) plans for retirement savings is higher than the IRA. |

| 6 | Withdrawal from the Retirement Plans | The employee or businessman owning the retirement account may choose to withdraw the savings from the retirement account at any time. There is no such limitation for withdrawal from the retirement savings account. | Under the 401 (k) plan, the employee should reach certain withdrawal events per the plan’s rules to be eligible to withdraw the savings from the 401 (k) plan. Generally, employees can withdraw savings once they stop working with the employer or reach 59.5 Years or an employee suffering from critical illness, etc. |

| 7 | Tax on withdrawals for Retirement Plans | Savings under the IRA are subject to the applicability of income tax on the amount of money withdrawn from the IRA in that respective year of withdrawal. The withdrawal amount is taxed at 10% as early distribution tax if the account holder’s age is less than 59.5 Years during the withdrawal year. | In the 401 (k) plan, the employee contribution, employer contribution, and withdrawals from the 401 (k) plan in the year of withdrawal are subject to the applicable income tax. The withdrawals are taxed at 10% as early distribution tax if the account holder’s age is less than 59.5 Years during the withdrawal year. |

| 8 | Availability of Investment Options | IRA has many more investment options than a 401 (k) plan as it is more like a regular brokerage account. | 401 (k), when compared with the IRA, has limited investment options. However, few 401 (k) plans come up with an option of operating the account as a regular brokerage account, having multiple investment options. |

Conclusion

However, Individual retirement accounts and 401 (k) plans are popular retirement savings plans. Both come with tax-saving advantages with different contribution limits, availability of investment options, associated costs, and withdrawal options. 401 (k) differs in multiple ways from the IRA, with a key difference of 401 (k) being an employer-sponsored plan. 401 (k) scores higher regarding the contribution limit being significantly higher than IRA and the cost of maintaining the plan being lower than IRA. However, IRA has significantly higher investment options, providing higher flexibility than 401 (k). Individuals or businessmen can use both IRA vs 401 (k) plans to optimize their retirement savings.

Recommended Articles

This is a guide to IRA vs 401 (k). Here we also discuss the IRA vs 401 (k) key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.