Updated July 24, 2023

Difference Between IRR vs ROI

IRR vs ROI in this article, IRR stands for Internal Rate of return, and it is a metric used for the determination of the actual performance of a potential investment or a project, especially for a shorter span of time. It can be defined as the discounted ROI (rate of interest) that tends to differentiate between present investments, and the upcoming net present value equals zero. IRR considers the time value of money, and it makes it easy to draw comparisons between different projects.

ROI stands for Return on Investment. It is a metric used in the calculation of the revenues or losses earned from a particular investment compared to the initial investment made by a company. It can be defined as a percentage increase or decrease in returns earned from an investment during the same tenure. ROI is quick and flexible, and it makes it easy to draw comparisons between multiple projects.

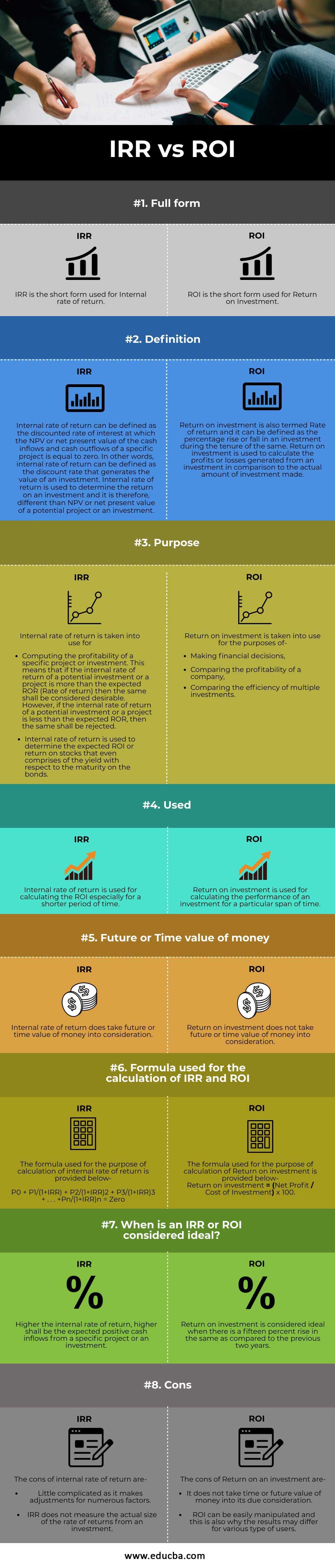

Head To Head Comparison Between IRR vs ROI

Below are the Top 8 comparison between IRR vs ROI:

Key Differences Between IRR vs ROI

The key differences between the Internal Rate of Return and Return on Investment are provided and discussed as follows:

- Internal rate of return is the full form of IRR, whereas Return on investment is the full form of ROI.

- The internal rate of return considers the future value of money, whereas Return on Investment ignores money’s future value.

- Internal rate of return is used to compute the return on investment from a potential investment or a project, especially for a shorter duration of time. On the other hand, Return on investment is used to calculate the overall cash inflows and outflows from an investment over a particular span of time.

- The internal rate of return is a little complicated as it takes multiple factors into its due consideration. On the other hand, Return on investment is not that complicated as compared to the internal rate of return since it does not take the future value of money into its due consideration.

IRR vs ROI Comparison Table

Let’s discuss the top comparison between IRR vs ROI:

| Basis of comparison | IRR | ROI |

| Full form | IRR is the short form used for the Internal rate of return | ROI is the short form used for Return on Investment |

| Definition | The internal rate of return can be defined as the discounted rate of interest at which the NPV or net present value of the cash inflows and cash outflows of a specific project is equal to zero. In other words, the internal rate of return can be defined as the discount rate that generates the value of an investment. Internal rate of return is used to determine the return on investment, and it is, therefore, different than NPV or net present value of a potential project or an investment. | Return on investment is also termed Rate of return, and it can be defined as the percentage rise or fall in investment during the tenure of the same. Return on investment is used to calculate the profits or losses generated from an investment in comparison to the actual amount of investment made. |

| Purpose |

Internal rate of return is taken into use for

|

Return on investment is taken into use for the purposes of-

|

| Used | The internal rate of return is used for calculating the ROI, especially for a shorter period of time. | Return on investment is used for calculating the performance of an investment for a particular span of time. |

| Future or Time value of money | The internal rate of return does take the future or time value of money into consideration. | Return on investment does not take the future or time value of money into consideration. |

| The formula used for the calculation of IRR and ROI | The formula used for the purpose of calculation of the internal rate of return is provided below P0 + P1/(1+IRR) + P2/(1+IRR)2 + P3/(1+IRR)3 + . . . +Pn/(1+IRR)n = Zero |

The formula used for the purpose of calculation of Return on investment is provided below: Return on investment = (Net Profit / Cost of Investment) x 100 |

| When is an IRR or ROI considered ideal? | Higher the internal rate of return, higher shall be the expected positive cash inflows from a specific project or an investment. | Return on investment is considered ideal when there is a fifteen percent rise in the same as compared to the previous two years. |

| Cons |

The cons of the internal rate of return are:

|

The cons of Return on an investment are:

|

Conclusion

Internal rate of return and return on investment are commonly used methods for the evaluation of the financial performance with respect to cash inflows and cash outflows of a particular investment or a project lying ahead of the company.

The companies use both IRR and ROI for decision-making to confirm the acceptance of a particular project or reject the same. The internal rate of return takes the future value of money into consideration, whereas the same is ignored in the case of Return on investment.

Recommended Articles

This is a guide to IRR vs ROI. Here we discuss the difference between IRR vs ROI, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–