What is a Journal Entry?

When a company makes a transaction (buying, selling, payment, etc.), it writes down that transaction in its first book called a journal. A journal has a simple record of all the company’s transactional activities. Each record in that journal is called a journal entry.

Large companies use the double-entry accounting system, which records every transaction in two accounts: Debit and Credit. This system helps businesses create financial statements: Income statements, balance sheets, and cash flow statements.

Format of Journal Entry

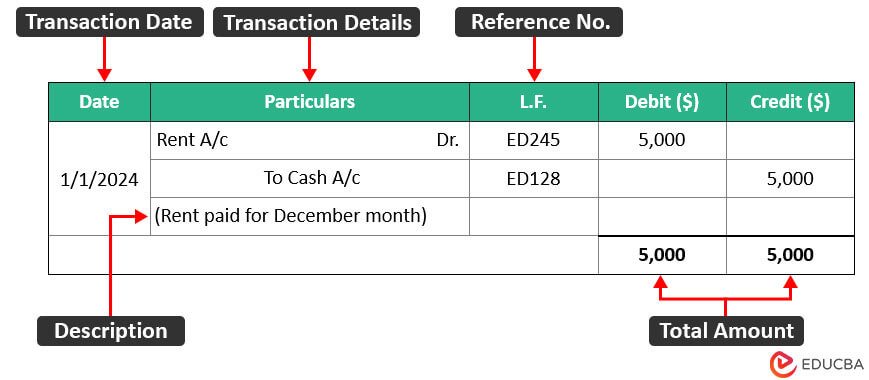

The basic format of a journal entry in accounting is as follows.

A journal entry consists of several important parts that ensure the entry is easy to understand and complete:

#1: Transaction Date

The first column in the journal book records the transaction date, which refers to the actual day of the transaction.

#2: Transaction Details

The second column consists of transaction details, listing the involved accounts. It records the debited account with “Dr.” at the end of a row and enters the credited account on the next line, after leaving a little space on the left, and starts with “To.”

#3 Description/Narration

This includes a brief description or explanation of the transaction under each entry to understand the purpose and nature of the transaction.

#4: Ledger. Folio or L.F

The Ledger. Folio or L.F. is the reference page number of the ledger where the company mentions that particular transaction.

#5: Debit Amount

In simple terms, debits mean the incoming amount. They are present in a journal or ledger on the left side.

#6: Credit Amount

In simple terms, credits mean an outgoing amount. They are present in a journal or ledger on the right side.

How to Write a Journal Entry?

Follow these steps to create a journal entry,

#1: Note down the date of the transaction.

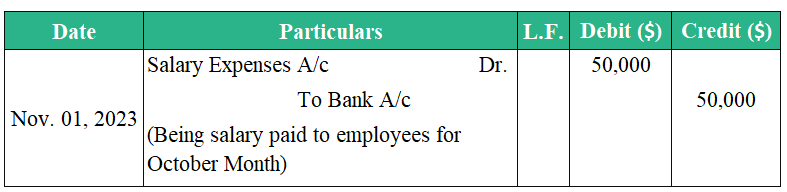

Example: James & Co. made a transaction (paid salary to its employees) on 1st November 2023.

#2: Determine which accounts affected the transaction as well as their type (asset, liability, etc.)

Example: The two accounts involved were bank account (asset) and salary expense (liability account).

#3: Determine the amount involved and decide which account you should debit and which to credit.

Example: Total salary paid was $50,000. Thus, the company will debit the salary expense account and credit the bank account.

#4: Finally, write a journal entry with all available information.

Example: James & Co. finally creates the following journal entry:

Journal Entry Types (With Examples)

Following are the several types of journal entries, along with examples.

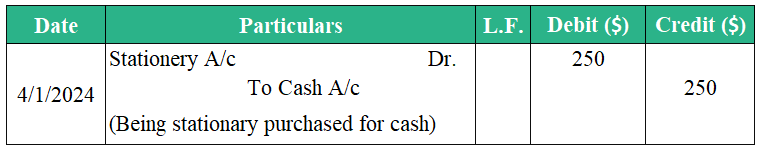

1. Simple Entry

Simple journals include routine entries, like day-to-day transactions, such as sales, expenses, payment for utility, payroll, etc. It consists of only two accounts: one debited account and another credited account.

Example: Suppose a company purchased stationery and some office supplies in cash for their office. The simple journal entry of this transaction will be as follows:

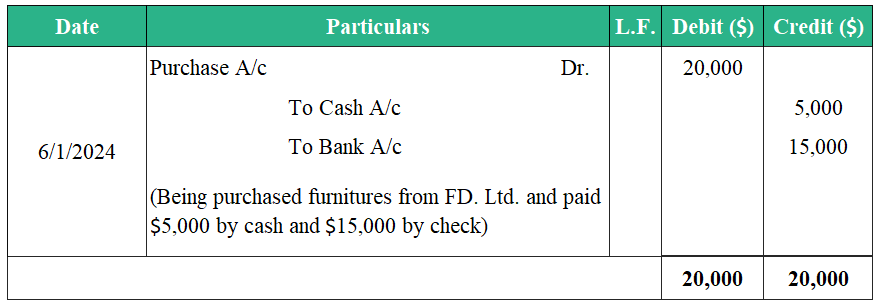

2. Compound Entry

The compound journal entries consist of record transactions from three or more account names, meaning more than one account is debited, more than one account is credited, or both.

Example: Tech_link Ltd. purchased furniture from FD. Ltd. for their new office. The company paid $5,000 and $15,000 by check. Here, the amount is debited from one account and credited by two accounts.

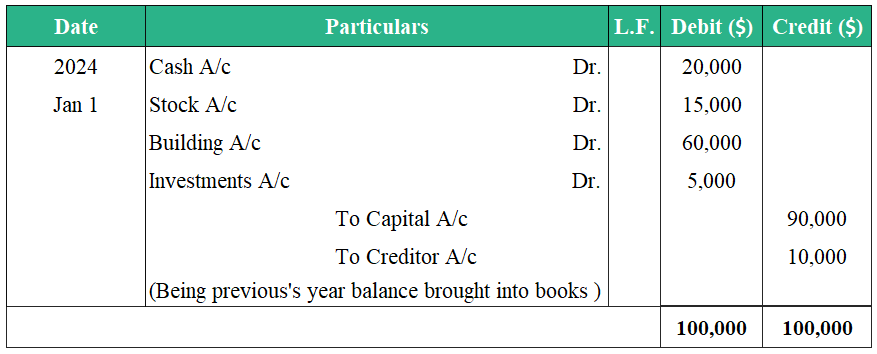

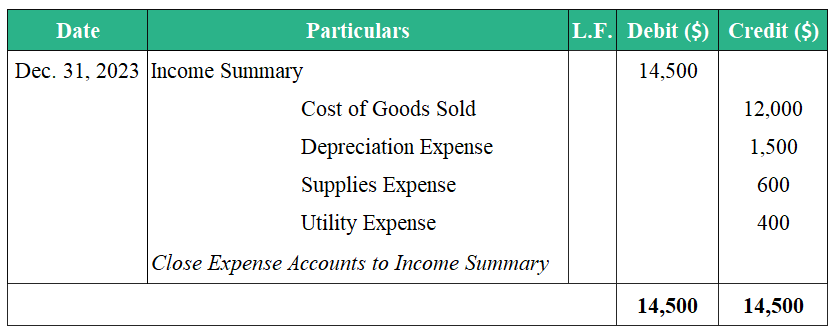

4. Closing

Closing entry is the ending balance for a debit or credit account at the end of the accounting period. This balance is carried forward or transferred as an opening balance/ entry for the next accounting period.

Example: Let’s assume company KJG. Ltd closes its expense and income statement account. The expense accounts include all expenditures, while the income summary bridges previous and new accounting periods. Here, we will transfer the expense accounts to the income summary account, showing the company had to pay for these expenses during that period.

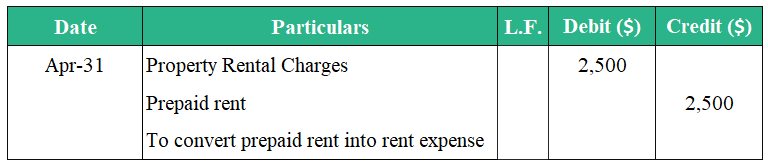

5. Adjusting

Adjusting entries are unrecorded entries that are not there in the general journal. These entries get added at the end of an accounting period before preparing financial statements for accrued expenses, depreciation, etc.

Example: The company paid rent of $2,500 in advance for May during April. Now, the company can show the conversion of prepaid rent for May into rent expense in the following adjusting journal entry.

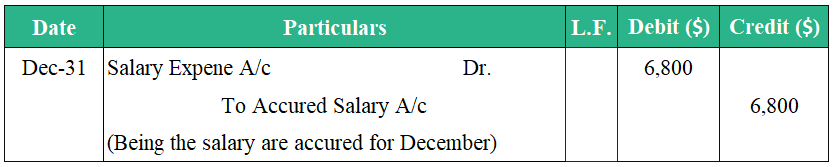

6. Reversing

Reversing journal entries helps reverse or delete adjustments/entries from previous accounting periods that are no longer required. Companies use these entries at the beginning of a new accounting period.

Example:

SKM Automobiles ends its fiscal year on December 31st. In mid-December, the company hired new staff, and the total salary owed to these employees was $6,800. However, the company did not pay their salary that month. This unpaid amount recorded as an accrued salary expense will be reversed as salary expenses in the next month.

The following is the entry of accrued salary in reversing journal.

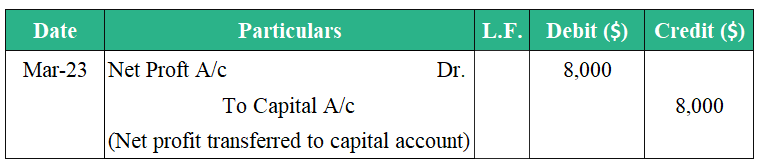

7. Transfer

Transfer journal entry records the transfer of amount from one account to another. For example, if a company moves assets between bank accounts or departments, they are recorded in a transfer journal.

Example: A company with a net profit of $8,000 will transfer this to capital accounts in the next fiscal year. The transfer journal entry will be as follows:

Final Thoughts

A journal entry serves as the foundation for all financial reporting. Accounting and tracking journals become more complicated when there are numerous entries, particularly in systems involving human intervention. Thus, accounting software is a better option for most businesses because it automates tracking, retrieving, and allocating journal entries to appropriate accounts.

Frequently Asked Questions (FAQs)

Q1. What is the purpose of journal entries?

Answer: The following are some of the purposes of journal entry:

- Journal entries provide a detailed record of a business’s financial transactions.

- They help maintain financial transactions systematically and historically.

- They help in preparing financial statements, budgeting, and forecasting future performance.

- They are also beneficial in tracking debit & credit balances and facilitating internal and external auditing.

- They help identify trends and patterns in financial data and provide available insights in decision-making.

- They are useful for identifying errors, missing, suspicious, and fraudulent transactions in financial records.

Q2. How to track journal entries?

As journal entries are a crucial part of the accounting system, tracking them is important. To track journal entries, you can use T-accounts. A T-account is a graphical representation that looks like a general ledger and helps companies record and track journal entries easily.

Q3. What are some common errors to avoid while recording a journal entry?

Answer: Common mistakes to avoid when making journal entries include using incorrect account codes, recording transactions in the wrong accounting period, and failing to record all necessary transaction details. It is critical to double-check journal entries for accuracy to prevent financial reporting errors.

Recommended Articles

We wish this article on Journal Entry was helpful. For further guidance, EDUCBA recommends these articles,