Updated July 12, 2023

Definition of Kickback

The term “kickback” refers to any illicit reward received in exchange for offering preferential treatment or carrying out something considered unethical. Kickback is a type of bribery.

Typically, kickbacks are paid in the form of money, credit, gift, or anything of value. Both payment and acceptance of kickbacks are considered corrupt practices that influence an employee’s choice of action, culminating in unbiased decisions.

How Does Kickback Work?

A typical kickback is disguised in normal operations, making it very difficult to detect. It is a form of negotiated bribery usually associated with white-collar employees.

In a kickback arrangement, the process starts with the payer’s intention, who approaches the person (receiver) in a position of power for some preferential treatment. The payer pays the commission or kickback package to the receiver, and in exchange, the receiver acts in favor of the payer. However, the entire process is engineered in a convoluted manner such that it is very difficult to trace where and how the kickback arrangement panned out.

Whether the purpose of the kickback is good or bad doesn’t make much of a difference, as the practice itself is corrupt. The payment made to the receiver is referred to as a commission. Following are some of the significant red flags for kickback arrangement:

- Vendors contact the employees directly beyond the scope of normal operations.

- Limited to no review of critical processes within an organization.

- Showing a special preference for a particular vendor or customer.

- No quality inspection process for goods received.

- Approval of inflated cost of goods sold.

Examples of Kickback

Let us have a look at some of the examples of kickback to understand how it operates under different scenarios.

Example #1

An accounting professional in an organization approves an invoice for purchased goods despite knowing that the bill was inflated. Later, the seller paid the accountant a part of the difference (between the inflated and the original price) in the form of cash or some other kind. This resulted in the misrepresentation of the financial statements.

Example #2

A government employee is responsible for selecting contractors for an infrastructure project. Unfortunately, the employee decided to select a contractor who didn’t have the required technical qualification. Later it was revealed that the government employee received a kickback from that particular contractor. In this way, it resulted in the failure of the contract bidding process.

Example #3

In the US, the medical care service companies were well-known for their kickback arrangements. For example, the medical care companies used to announce fraudulent referral schemes that eventually ended up bribing doctors. Basically, companies rewarded the doctors for prescribing the patients tests, treatment, and diagnoses that they hardly needed. However, the US government passed the Anti-Kickback Enforcement Act to curb the occurrence of such kickback arrangement schemes.

Risks of Kickback

There are several risks associated with kickback, and some of the major risks are listed below:

- Any person who is not willing to corroborate with the arrangement is going to end up on the wrong side of the deal owing to the biasness of the corrupt officials.

- There is a high probability that the quality of the goods and services offered would be compromised.

- There is a very low chance that the vendors or contractors, who leveraged kickbacks, would complete the job honestly.

- In many cases, the lives of the common man get adversely impacted due to all these corrupt practices.

How to Control Kickback?

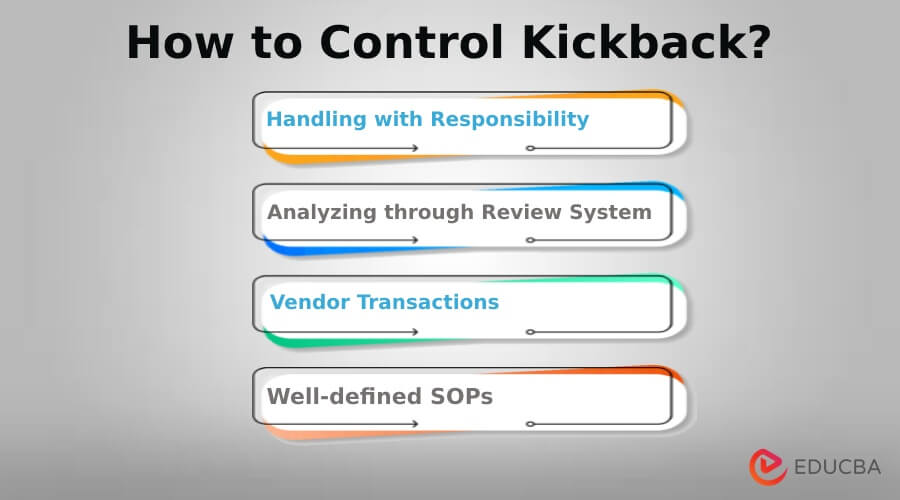

Some of the ways or methods to control kickback are as follows:

- As already mentioned above, the detection of kickbacks is a very difficult task. However, the whistle-blower culture is one of the ways to derail a kickback scheme. So, if there is any such whistle-blower, then that person is usually handled with great care and responsibility.

- The management should set up a review system to analyze the third-party vendors at a specific interval. In the review system, the vendors can be selected randomly, and then their transaction details should be checked for the last few quarters. Further, other details like quoted price, physical address, contact numbers, website, and any other relevant information can also be retrieved for review.

- If there is a vendor closely related to one of the company’s employees, then the management should check whether or not the transactions of this vendor are taking place at arm’s length. In addition, the ownership details of the vendor company should also be checked.

- The introduction of any new vendor should be filtered using well-defined SOPs. It will ensure that only genuine or authentic vendors can join the company and get on board.

Key Takeaways

Some of the key takeaways of the article are:

- A kickback refers to an illegal reward system that compensates some of the employees of an organization in exchange for their preferential treatment.

- Kickback is considered a type of bribery, which is more prevalent in a white-collar jobs.

- Kickbacks usually result in compromised quality of goods and services, which eventually adversely impacts the life of a common man.

- Some of the ways to control kickbacks include encouraging a whistle-blower culture within the organization, setting up a periodic vendor review system, and creating an SOP for new vendor onboarding.

Conclusion

Kickback is a serious issue, and it escalates the cost of doing business across the globe. It is the reason behind much of the world’s government corruption. However, it can be prevented or controlled if the above-mentioned measures are followed diligently.

Recommended Articles

This is a guide to Kickback. Here we also discuss the definition, working, examples, and risk of Kickback, along with different ways to control it. You may also have a look at the following articles to learn more –