What is Labor Cost?

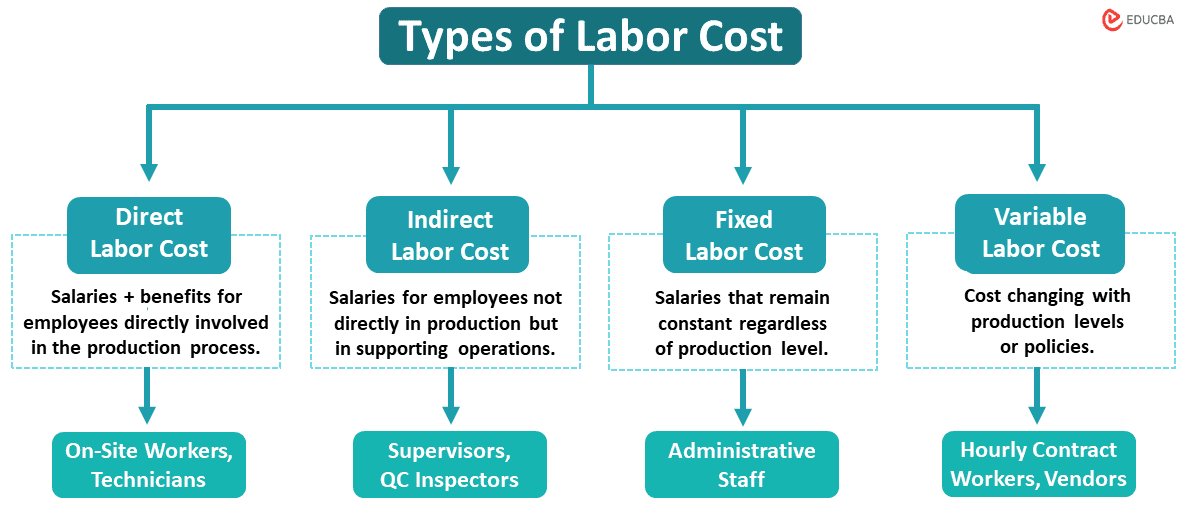

Labor cost or cost of labor refers to all expenses an organization incurs on its employees, including salaries, overtime pay, bonuses, benefits, taxes, insurance, and other related costs. This cost is of 4 types: direct, indirect, fixed, and variable.

This cost helps businesses to manage their financial budget efficiently and determine pricing strategies to maintain profitability.

Table of Contents

Types

The following are the types of labor costs.

1. Direct

Direct costs are the wages of workers or employees directly involved in manufacturing goods or services. It includes their salaries, benefits, and other additional expenses.

2. Indirect

Indirect labor costs refer to the employees’ salaries that indirectly support the production process but are not directly involved in product production.

3. Fixed

Fixed labor costs refer to fixed or constant salaries irrespective of a company’s profits and production levels.

4. Variable

It refers to the cost that changes according to the production level and company policies.

Labor Cost Formula

Here,

- Wages: The basic pay or salary of employees.

- Overtime Pay: Additional money for working extra hours beyond regular working hours.

- Benefits: Health insurance, retirement contributions, bonuses, etc.

- Taxes: Amount employers pay as employees taxes like payroll taxes, social security, medicare, etc.

- Other Labor-Related Expenses: Training, uniforms, meals at work, etc.

Here,

- Total hours worked: Total number of hours worked by all employees during a certain period.

How to Calculate Labor Cost?

The following are the steps to calculate this cost.

- Calculate wages: Multiply hours worked by the hourly rate for employee wages.

- Determine additional benefits: Consider overtime pay, health insurance, retirement contributions, bonuses, etc.

- Calculate payroll taxes: Compute state unemployment, social security, medicare taxes, etc., based on the employee’s gross wages.

- Find total cost: Add wages, benefits, and taxes for the overall cost.

Note: The above steps may vary depending on part-time and full-time employees, specific industry regulations, or benefits offered by the company.

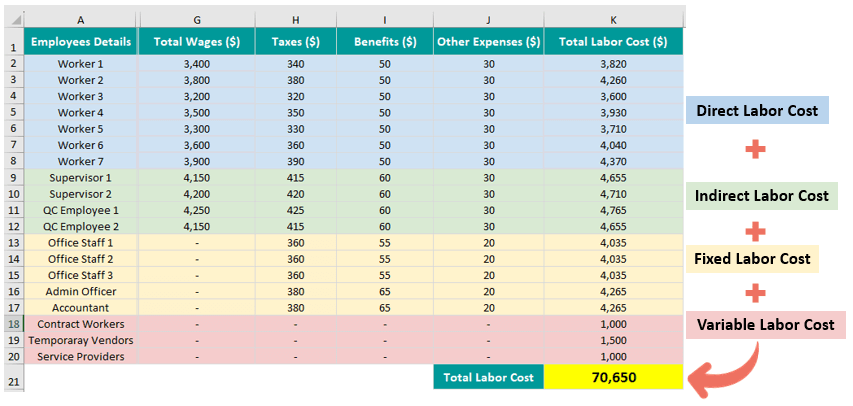

Example (Step-by-Step Calculation in Excel)

Let’s consider the scenario of “SQSD Electronics,” which manufactures high-quality consumer electronics. The total no.of workers is 10, including workers, office staff, and contract workers. We need to calculate the total cost of labor for January 2024.

Solution:

To calculate the total cost for Jan 2024, we need to calculate the costs of each employee separately according to their designation or type.

Here’s a step-by-step process:

#1: Enter Workforce Details in Excel

#2: Calculate Direct Labor Cost

#3: Calculate Indirect Cost

#4: Calculate Fixed Labor Cost

#5: Calculate Variable Labor Cost

#6: Calculate Total Labor Cost

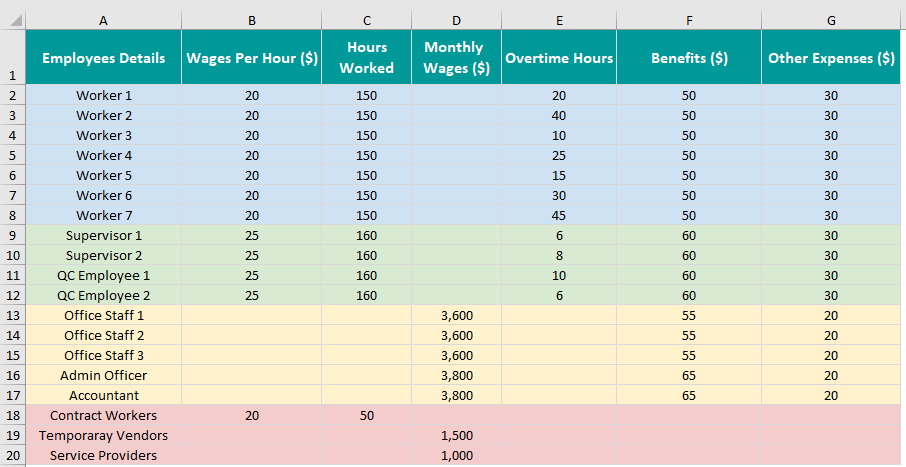

#1: Enter Workforce Details in Excel

Workforce details are details of every employee, including their designation, work hours, compensation, and benefits.

- Start by opening a new “Excel” sheet

- Label columns in the following manner:

➔ Column A: Employees Details

➔ Column B: Wages Per Hour ($)

➔ Column C: Hours Worked

➔ Column D: Monthly Wages ($)

➔ Column E: Overtime Hours

➔ Column F: Benefits

➔ Column G: Other Expenses ($)

- Enter the following details (wages, hours, benefits, etc.) in the respective columns, as shown below.

Note: For easier calculations, we have color-coded employees based on their category, as shown below.

- Blue color: Workers under the direct labor category.

- Green color: Workers under the indirect labor category.

- Yellow color: Workers under fixed labor category.

- Red color: Workers under variable labor category.

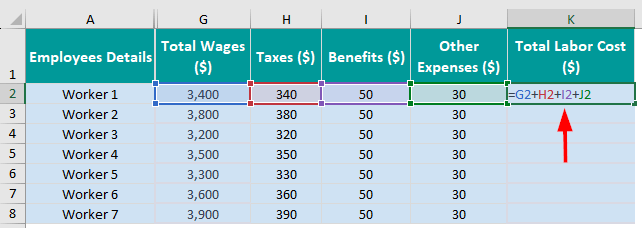

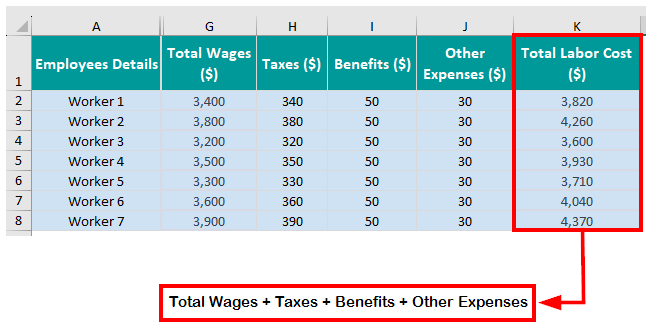

#2: Calculate Direct Labor Cost

Total direct labor cost (K2) = Total Wages (G2) + Taxes (H2) + Benefits (I2) + Other Expenses (J2)

We already have the values for Benefits and Other Expenses, so our next step is calculating Total Wages and Taxes.

Total Wages = Monthly Wages + Overtime Pay

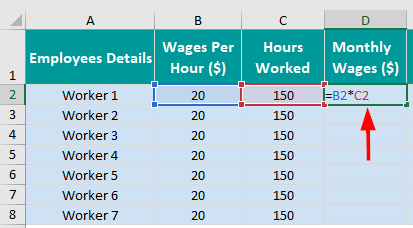

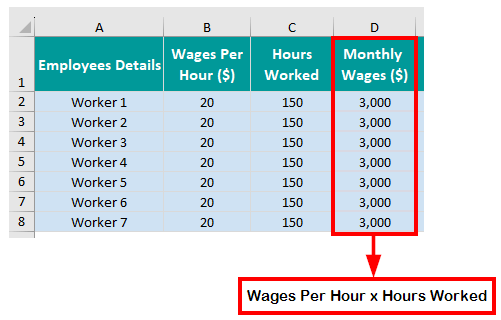

a) Monthly Wages:

Monthly Wages (D2) = Wages per Hour (B2) × Hours Worked (C2)

Example: For worker 1, the monthly wages will be $20 x 150, which is $3,000. Similarly, we can apply the same formula to other workers falling under the direct labor category.

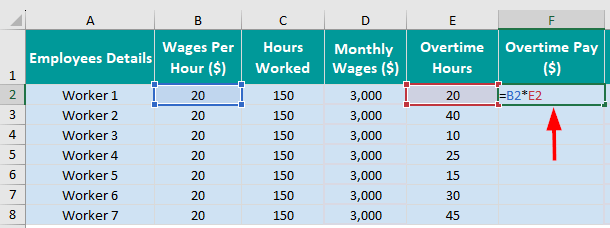

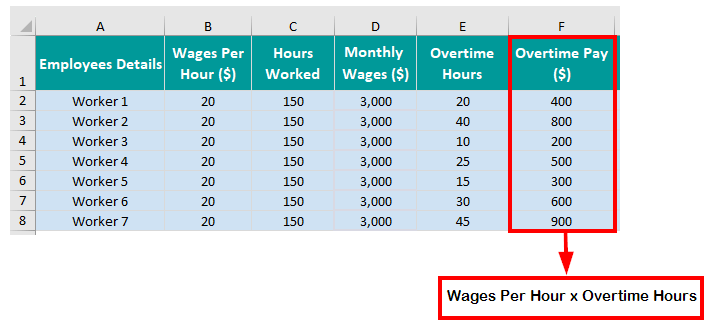

b) Overtime Pay:

Overtime Pay (F2)= Basic Wages per Hour (B2) × Overtime Hours (E2)

Example: For worker 1, the overtime pay will be $20 x 20, which is $400. We will also calculate overtime pay for other workers.

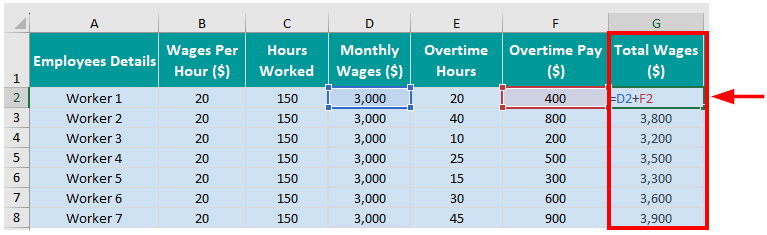

c) Total Wages:

Total Wages (G2) = Monthly Wages (D2) + Overtime Pay (F2)

Example: For Worker 1, total wages will be $3,000+$400, which is $3,400. We will calculate total wages for all other workers in a similar manner.

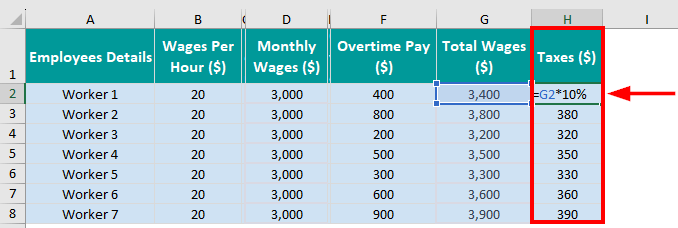

d) Taxes:

Taxes (H2)= Total Wages (G2) x Tax Rate (10%).

Example: For Worker 1, the taxes will be $3,400 x 10%, which is $340. Now, we calculate taxes for the remaining workers.

e) Calculate Total Direct Labor Cost:

Finally, let’s calculate the total direct cost using the following formula.

Total direct cost (K2) = Total Wages (G2) + Taxes (H2) + Benefits (I2) + Other Expenses (J2)

Example: For worker 1, the total direct cost will be $3,400+$340+$50+$30 =$3820. Similarly, let’s calculate the total direct cost of other workers as follows:

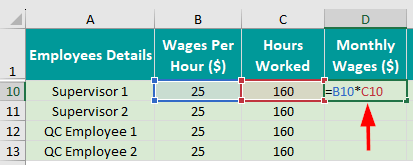

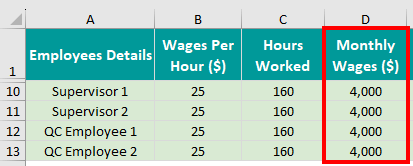

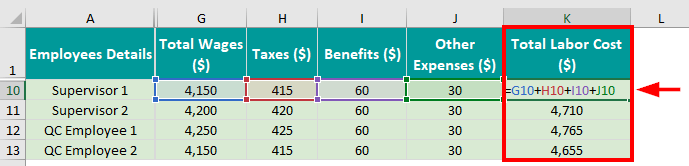

#3: Calculate Indirect Labor Cost

a) Monthly Wages:

Monthly Wages (D10)= Wages per Hour (B10) × Hours Worked (C10)

Example: For Supervisor 1, the monthly wages will be $25 x 160, which is $4000. Similarly, calculate for all employees.

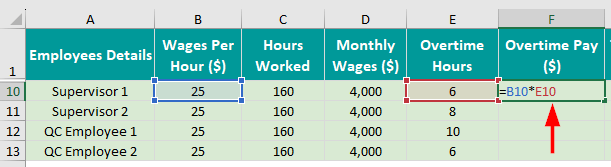

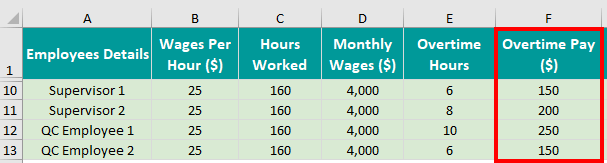

b) Overtime Pay:

Overtime Pay (F10)= Wages per Hour (B10) × Overtime Hours (E10)

Example: Supervisor 1’s overtime pay will be $25 x 6, which is $150. Similarly, calculate for all employees.

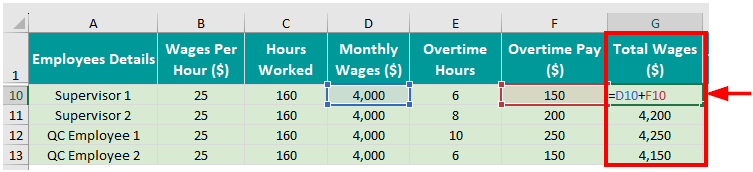

c) Total Wages:

Total Wages (G10) = Monthly Wages (D10) + Overtime Pay (F10)

Example: Supervisor 1’s total wages will be $4,000+$150, which is $4,150. Similarly, calculate for remaining employees.

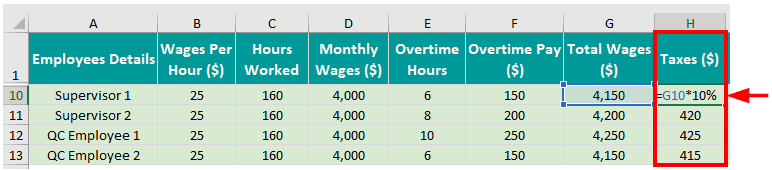

d) Taxes:

Taxes (H2)= Total Wages (G2) x Tax Rate (10%).

Example: Supervisor 1’s taxes will be $4,150 x 10%, which equals $415.

e) Total Indirect Labor Cost:

Now, let’s calculate the total indirect cost using the below formula.

Total Indirect labor cost (K10) = Total Wages (G10) + Taxes (H10) + Benefits (I10) + Other Expenses (J10).

Example: The total indirect cost of Supervisor 1 is $4,655 by adding $4,150 + $415 + $60 + $30.

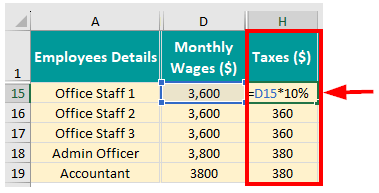

#4: Calculate Fixed Labor Cost

In fixed labor, the monthly wages of office staff, administrative officers, and accountants will be constant. We need only to calculate the tax amount as follows.

a) Taxes:

Taxes (H15)= Monthly Wages (D15) x Tax Rate (10%).

Example: The tax amount for Office Staff 1 will be $3,600 x 10%, which comes to $360.

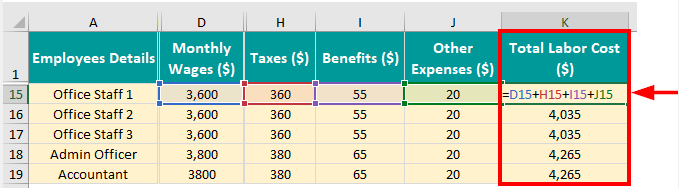

b) Total Fixed Labor Cost:

So,

Total fixed labor cost(K15) = Monthly Wages(G2) + Taxes(H2) + Benefits(I2) + Other Expenses (J2).

Example: The total cost of labor for Office Staff 1 is $4,035 ($3,600 + $360 + $55 + $20).

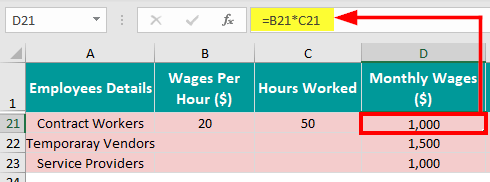

#5: Calculate Variable Labor Cost

a) Monthly Wages:

Monthly Wages (D21)= Wages per Hour (B21) × Hours Worked (C21)

Example: The monthly wages for contract workers are $1,000, i.e., $20 x 50.

We have successfully calculated this cost for each employee; now, we will find out the total amount for “SQSD Electronics” for January 2024.

#6: Calculate Total Labor Cost

Now, we will calculate the cost of all employees in respective types.

1. Total Direct Labor Cost:

=$3,820+ $4,260 + $3,600 + $3,930 +$3,710+ $4,040 + $4,370 = $27,730

2. Total Indirect Labor Cost:

= $4,655 + $4,710 + $4,765 + $4,655 = $18,785

3. Total Fixed Labor Cost:

= $4,035 + $4,035 + $4,035 + $4,265 + $4,265 = $20,635

4. Total Variable Labor Cost:

= $1,000 + $1,500 + $1,000 = $3,500

Therefore,

Total Labor Cost = Total Direct Cost + Total Indirect Cost + Total Fixed Cost + Total Variable Cost

= $27,730 + $18,785 + $20,635 + $3,500 = $70,650

Thus, the total cost of “SQSD Electronics,” for January 2024 is $70,650.

Basic Examples

Let’s understand how to calculate the cost of labor with the help of some basic examples.

Example #1

Let’s consider Jacob, an employee of UKL Corporation. He receives a base wage of $20,000 annually, and his benefits include healthcare and retirement contributions, amounting to $5,000, while the company pays $2,500 in taxes related to his employment. He earns $3000 as overtime payment and other labor-related expenses of $1,000 during his services. Also, the total number of hours worked during this period is 1,200. Here, we need to calculate Jacob’s total cost of labor per hour.

Solution:

#1: Calculate total cost of labor

Total labor cost = Wages + Overtime Pay + Benefits + Taxes + Other Labor-Related

Expenses

= $20,000 + $3,000 + $5,000 + $2,500 + $1,000 = $31,500

#2: Calculate the cost of labor per hour

Labor cost per hour = Total labor cost/ Total hours worked

= $31,500/1,200 = $26.25

So, UKL corporation is paying Jacob $26.35 per hour for their work services.

Example #2

VBN Tech Limited, a software development company, reported an annual sales revenue totaling $6,000,000 from their services or products. They also reported a total annual cost of $1,200,000 in the workforce, and we need to calculate how much percentage is allocated to laborers in VBN Tech Limited.

Solution:

Let’s calculate the cost percentage with the following example.

Labor Cost Percentage = (Total Labor Cost / Total Sales) x 100

= ($1,200,000/$6,000,000) x 100 = 20%.

The cost of labor percentage is 20%. It means that out of the total sales revenue, the company allocates 20% towards its employment workforce.

Cost of Labor vs Cost of Living

Here is the difference between the cost of labor and the cost of living.

| Particulars | Cost of Labor | Cost of Living |

| Meaning | The expenses related to hiring and retaining employees. | The expenses related to sustaining a basic standard of living. |

| Impact on | Business or organizations. | Individual or family wellness. |

| Factors to Consider | Wages, benefits, taxes, and other costs of labor. | Costs associated with food, housing, transportation, and other basic essentials. |

| Influence by | Business profit and workforce management. | Personal budgeting, regional factors, lifestyle choices. |

Final Thoughts

This cost is important to understand and manage employee compensation and operational expenses in business. Companies must consider productivity, employee satisfaction, and overall financial performance to ensure a sustainable workforce.

Frequently Asked Questions (FAQs)

Q1. What are the ways to reduce the cost of labor?

Answer: Companies can reduce this cost by implementing the methods below.

- Plan employee schedules shift-wise, day-wise, and related to specific tasks related to reducing overtime burden.

- Give training to employees in multiple skills and roles. It will enhance flexibility in assigning without the need to hire additional workers.

- Outsource external service providers for highly specific functions or tasks, reducing in-house labor needs and costs.

- Implement advanced tools and technology to automate repetitive processes, reducing the need for extensive human labor.

Q2. What are the disadvantages of the cost of labor?

Answer: The high cost can have several disadvantages for businesses. It can impact profitability by reducing profit margins. These high costs negatively affect budget allocation, limiting funds for investments in business expansion or other crucial areas of improvement. Also, if businesses constantly focus on reducing labor, it will lead to employee dissatisfaction, affecting workforce stability and productivity in the long run.

Recommended Articles

We hope this article on labor costs was useful to you; for more information, refer to the articles below.