Updated November 16, 2023

Difference Between Large Cap vs Small Cap

Depending on their current market capitalization, stocks or companies are classified into three categories

- Large-cap company

- Mid-cap company

- Small-cap company

A company’s market capitalization is calculated by the current price per share multiplied by the total number of its outstanding shares in the market. It gives the investor an estimated valuation of the company, or it shows the size of the company. For example, Suppose a company has 20,000 outstanding shares in the market, and the price per share is Rs. 20.

Thus, its market capitalization can be calculated as outstanding shares * price per share.

20,000 * 20 = Rs. 4,00,000 (Market cap of the company)

What is Large Cap Stocks or Company?

These stocks or companies are the first class in market capitalization. As the name itself suggests, these companies have large market capitalization. These are stocks of reputed companies that have been around for decades. The market capitalization of such companies is very high – above Rs20,000cr.

Large-cap companies have a strong market presence, and their stocks are generally considered very safe and less volatile (low risk). Most listed companies regularly disclose information through exchange filing or media, such as newspapers, television, or the company’s website. In other words, information on large-cap companies is very easily available for investors, clients, or customers.

Examples of large-cap companies in India include Reliance, Tata Steel, and Hindalco, among others. Nifty 50, BSE 100, and SENSEX 30 indices comprise large-cap companies. Generally, market indices are designed to comprise large-cap companies, for example – Nifty 50, SENSEX, etc.

Investors who want to invest in an index or many companies with a large market cap can choose mutual or large-cap funds. Depending on the size of the companies, some mutual fund schemes are categorized as large-cap, mid-cap, and small-cap funds. As their name suggests, large-cap funds comprise large-cap companies. Mid-cap funds & small-cap funds comprise mid-cap companies and small-cap companies, respectively.

What is Small-Cap Stocks or Company?

Large-cap stocks have the highest market capitalization, whereas Small-cap stocks lie at the other end of the market capitalization spectrum with a low market cap. Most small-cap companies are either companies in the development stage or start-up enterprises. As the name suggests, small-cap companies have few employees, low revenues, and clients. Information on these companies isn’t easily available to investors, clients, or customers.

As small-cap companies are small in size, they have tremendous potential for growth. This allows investors to multiply their money. However, small-cap companies are highly volatile and high risk. As growing a business is not an easy task, many hurdles are faced by small-cap companies; due to this, small-cap stocks are considered a highly risky investment.

Generally, small-cap stocks have a market capitalization of fewer than 500 crores. Small-cap companies have a small-cap index from where an investor can track the performance of the small-cap stocks.

Investors who want to invest in an index or many companies with a small market cap can choose mutual funds depending on their growing appetite and risk profiling.

Four major risks small-cap companies have –

- Liquidity risk: When an investor wants to buy a share, it may not be available, or when an investor wants to sell his stocks, the buyer might not be there.

- Limited access to financial resources: Compared to large-cap, small-cap companies have limited options for capital raising. Also, these companies need to pay more premiums for debt as the risk associated is high compared to large-cap companies.

- Lack of operational history and the potential for its unproven business model. It might happen the business model may not be scalable or cannot be sustained for a longer time.

- Limited availability of data for analysis.

Although small-cap stocks are considered riskier investments than large-cap stocks, enough small-cap stocks are offering excellent growth potential and high potential returns on equity. Another major advantage the small-cap offers is growth potential if the business model succeeds. It is relatively easy to double sales from 10 million to 20 million, but it is tough to double sales from 1 billion to 2 billion. So, compared to large-cap, small-cap companies have high growth potential.

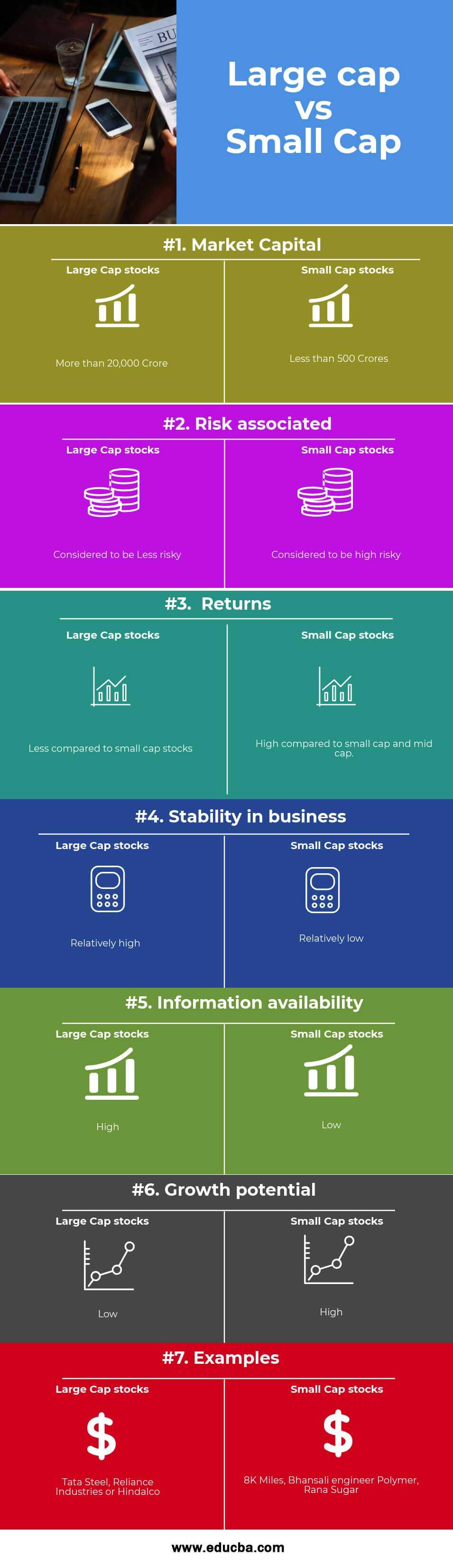

Head To Head Comparison Between Large Cap vs Small Cap (Infographics)

Below is the top 7 difference between Large Cap vs Small Cap

Key Differences Large Cap Stocks vs Small-Cap Stocks

Both Large Caps vs Small Caps are popular choices in the market; let us discuss some of the major differences between Large Caps vs Small Caps:

- Market size-wise, large-cap companies have more than 20,000 crores in market capitalization, whereas small-cap companies have a market capitalization of fewer than 500 crores.

- Large-cap companies have been well-established players in the market for decades, whereas small-cap companies are newly established players or start-ups.

- Investors consider large-cap companies safe and less volatile, while they perceive small-cap companies as risky and highly volatile.

- As analyst tracks large-cap companies, getting information on such companies is relatively easy.

Large Cap vs Small Cap Comparison Table

Below are the 7 topmostComparison between Large Cap vs Small Cap:

| The Basis of Comparison | Large Cap Stocks | Small Cap Stocks |

| Market Capital | More than 20,000 Crore | Less than 500 Crores |

| Risk associated | Considered to be Less risky | Considered to be highly risky |

| Returns | Less compared to small-cap stocks | High compared to small-cap and mid-cap. |

| Stability in business | Relatively high | Relatively low |

| Information availability | High | Low |

| Growth potential | Low | High |

| Examples | Tata Steel, Reliance Industries, or Hindalco | 8K Miles, Bhansali engineer Polymer, Rana Sugar |

Conclusion

Hence, as discussed above, an investor has three options for allocating money to stocks. And the allocation of money depends entirely on an investor’s risk appetite and return expectations. All these categories (large-cap, mid-cap, and small-cap) have good long-term investment opportunities for high returns. It is always prudent to allocate funds proportionately to each segment as each segment offers a unique opportunity.

For highly risky investors, the small-cap stock is their playground, but for safe investors, a large-cap stock is their playground.

Recommended Articles

This has guided the top difference between Large Caps vs Small Caps. Here, we also discuss the key differences between the Large Cap and Small Cap with infographics and a comparison table. You may also have a look at the following articles to learn more-