Updated July 25, 2023

Difference Between Leading vs Lagging Indicators

Indicators tell us the state of something which is going to happen next. The most closely tracked indicators are social, business, economic and behavioral indicators. For example, we use indicators (flashing lights) in motorcycles that show us that the vehicle is about to change the lane. In the same way, indicators in this leading vs lagging article are more in economic terms; these indicators show us how the economy is changing; a possible estimation that can happen in the future in the coming economic business cycle.

What are the Leading Indicators?

Like the leader in any group who leads the rest of the members and guides them further, leading indicators do the same for the economy. These indicators in economic terms transfer before all and guide the economic market cycle to forecast future changes. Leading indicators changes before the actual economy begin to move. As it has a primitive and nature analyst and economist rely on these indicators to arrive at conclusions about any economical shifts and to forecast them. Leading indicators are the actions necessary to achieve the goal.

What are Lagging Indicators?

These indicators assure that the particular cycle is confirmed. e.g., Recently, in the Indian economy, the employment rate for 2019 had fallen from 8.7% to 8.2%, stating that the economy is performing low and may remain the same in the future. They have behavior to change post change of any scenario. Only after the economy has changed and moved in a particular direction are they sources of evidence. They do not help in showing the changes in the economy but show the effects of the change in the trend. Economists, traders, and analysts use these data to generate signals. Lagging indicators are the result of all the efforts taken to achieve the goal.

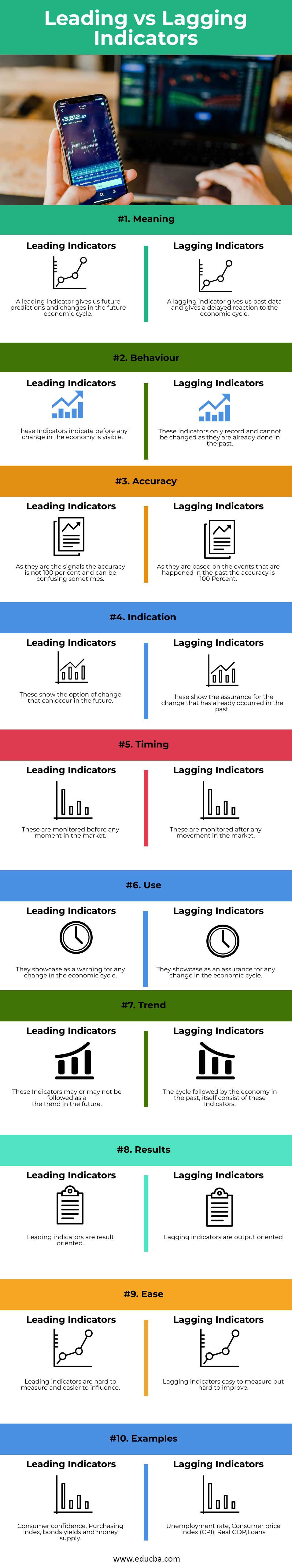

Head To Head Comparison Between Leading vs Lagging Indicators (Infographics)

Below are the top 10 differences between Leading and Lagging Indicators

Key Differences Between Leading vs Lagging Indicators

let us discuss some of the major differences between leading vs lagging indicators:

1) The main difference between the two indicators is that lagging indicators are future-looking, and lagged indicators are past actions results. Lagging indicators are output-oriented, whereas Leading indicators are result-oriented.

2) Leading Indicators work as a red flag for giving some signal if any trend happens in the economy whereas, lagging indicators are the results of changes that already happened in the past. Lagging indicators is easy to measure but hard to improve, but Leading indicators are hard to measure and easier to influence. Leading indicators measure change. They show the likelihood for an aim to be achieved.

3) Relying on Leading Indicators and taking decisions may or may not be accurate. This is because there are many factors that influence the trend.

4) Leading Indicators are like options that can happen in the future; however, lagging is proof of an event that happened in the past. Leading indicators allow you to make decisions before lagging indicators reveal what has happened in the past.

5) Leading Indicators are monitored before taking any decisions to reach to our goal, whereas lagging indicators are like lessons that one can learn from past actions. Lagging indicators are like confirmation that the trend is repeating itself.

6) Leading indicators are like warning signals, and Lagging Indicators are as assurance. This is because Lagging indicators quantify current conditions, and Leading indicators provide insight into the future.

7) The trend could be followed by the economy is shown in the leading Indicator and the trend which is already followed by the economy is a lagging indicator. To track Leading indicators, you need advanced tools and techniques.

e.g., All the numbers of the Balance sheet, Income statement, and Cash Flow statements are lagging indicators.

Leading vs Lagging Indicators Comparison Table

Let’s discuss the top comparison between Leading vs Lagging Indicators:

| Basis of Comparison | Leading Indicators | Lagging Indicators |

| Meaning | A leading indicator gives us future predictions and changes in the future economic cycle. | A lagging indicator gives us past data and gives a delayed reaction to the economic cycle. |

| Behavior | These Indicators indicate before any change in the economy is visible. | These Indicators only record and cannot be changed as they are already done in the past. |

| Accuracy | As they are the signals, the accuracy is not 100 percent and can be confusing sometimes. | As they are based on the events that are happened in the past, the accuracy is 100 Percent. |

| Indication | These show the option of change that can occur in the future. | These show the assurance for the change that has already occurred in the past. |

| Timing | These are monitored before any moment in the market. | These are monitored after any movement in the market. |

| Use | They showcase as a warning for any change in the economic cycle. | They showcase as an assurance for any change in the economic cycle. |

| Trend | These Indicators may or may not be followed as a trend in the future. | The cycle followed by the economy in the past itself consists of these Indicators. |

| Results | Leading indicators are result-oriented. | Lagging indicators are output-oriented |

| Ease | Leading indicators are hard to measure and easier to influence | Lagging indicators easy to measure but hard to improve |

| Examples | Consumer confidence, Purchasing index, bonds yields, and money supply. | The unemployment rate, Consumer price index (CPI), Real GDP, Loans |

Conclusion

All the economists and investors regularly keep track of the signs for what is ahead of the market to predict and take further decisions. Indicators are a statistic that is used to understand, predict, and come to decisions. These signs are traced and tracked for days, months, and years to result in a trend. The most important use of indicators is the study of the business cycle.

Lagging indicators are evidence of the pattern actually followed in the economy and how the future trends are like, and lagging indicators are the results. The market analyst uses this data that arrives at decisions. The purpose of indicators is to identify ways to improve future performance.

Any indicator (Leading or Lagging) is not the only criteria for finalizing any economical decision. So relying on just indicators is not the best solution, but when put together with other data and information and aggregated properly can be a major source for forecasting the future economy.

Recommended Articles

This has been a guide to Leading vs Lagging Indicators. Here we have discussed the Leading vs Lagging Indicator’s key differences with infographics and comparison table. You can also go through our other suggested articles to learn more –