Lease Meaning

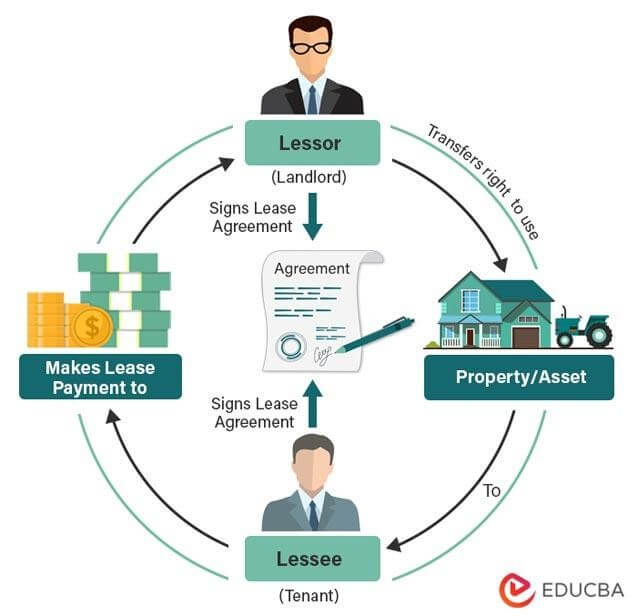

Leasing is when someone lets another person use their property for a certain period in exchange for money. The person who uses the property is the lessee, while the person who owns it is the lessor. Both parties sign an agreement that outlines the terms of the lease.

However, it is essential to understand that leasing and renting are different. Leasing is a longer commitment, where lessees may have to pay for maintenance while renting is usually short-term and may include maintenance in the agreement.

How does a Lease Work?

Here’s a step-by-step explanation of how it works, along with an example:

1. The lessor and lessee negotiate and sign an agreement outlining the terms of the rental agreement.

Example: Michael and Sarah agree on a one-year lease, with Sarah paying $1,000 per month in rent.

2. The lessee pays a security deposit, and the lessor will return it at the end of the term if there are no damages or unpaid rent.

Example: Sarah gives Michael a $1,000 security deposit.

3. The lessee moves in and pays rent on a regular schedule.

Example: Sarah moves into the apartment and pays Michael $1,000 in rent each month.

4. The lessor is responsible for property maintenance, while the lessee keeps the property in good condition and reports any issues.

Example: Michael fixes any apartment issues, while Sarah keeps the apartment clean and reports any problems.

5. The lessor expects the lessee to vacate the property and return it in good condition upon the term’s end.

Example: Sarah moves out and cleans the apartment before Michael inspects it and returns her security deposit.

Example of Lease Agreement

The table below shows an agreement between XYZ Corporation and ABC Properties, Inc. for a commercial office space located at 456 Market Street, Suite 1000. It includes important features such as parties involved, terms, rent, etc.

|

Corporate Agreement |

|

| Parties | Lessor: ABC Properties, Inc. |

| Lessee: XYZ Corporation | |

| Property | Address: 456 Market Street, Suite 1000 |

| Description: A commercial office space | |

| Term | Start date: January 1, 2023 |

| End date: December 31, 2025 | |

| Rent | Monthly rent: $10,000 |

| Late fee: $500 | |

| Grace period: 10 days | |

| Security Deposit | Amount: $30,000 |

| Use: To cover damages or unpaid rent at the end of the term. | |

| Maintenance and Repairs | Lessee is responsible for all repairs and maintenance. |

| Utilities | Lessee is responsible for all utilities, such as electricity, gas, water, etc. |

| Termination | Early termination is allowed with a 60-day written notice and payment of three months’ rent. |

Lease Agreement Template Download

Elements of a Lease

1. Rent amount: It refers to the payment made by the lessee to the lessor for using the property.

2. Duration: The duration refers to the length of time it is in effect, which can range from a few months to several years.

3. Renewal options: The lessee can renew the lease at the end of the original term.

4. Maintenance and repair obligations: Typically, the agreement outlines the lessee’s responsibilities for maintaining the property during the term. These responsibilities may include tasks such as keeping the property clean, repairing any damage caused by the lessee, and notifying the lessor of any necessary repairs.

5. Assignment and subletting provisions: The agreement may also include provisions related to the lessee’s ability to sublet or assign it to another party.

6. Termination provisions: The agreement will specify the conditions for terminating the lease, such as a breach of contract by either party or the expiration of the term.

Types

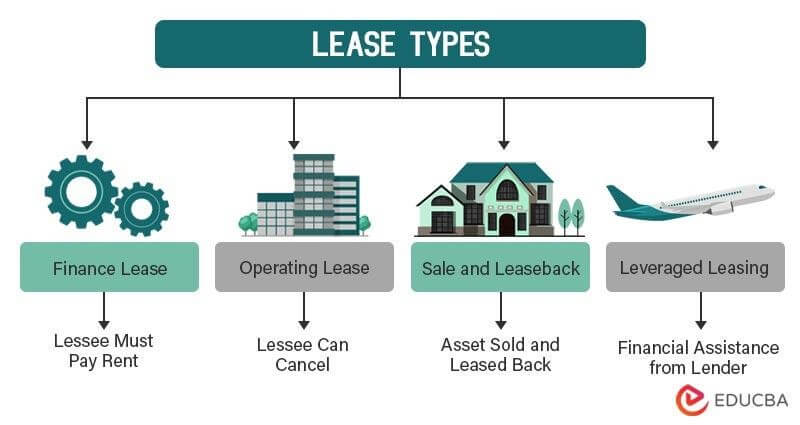

There are different types of leases based on the lessor’s preferences and market trends:

1. Finance Lease: This refers to a finance lease where the lessee is obligated to pay rent until the end of the lease, which aligns with the asset’s useful life. The lessee records the leased item as an asset and payments as liabilities. Moreover, the lessor considers it a sale, and cancellation is not an option.

Example: A company leasing machinery for five years, which is the expected useful life of the machinery.

2. Operating Lease: In this type, the lessee can cancel the lease before its expiry by providing prior notice. The duration is less than the useful life of the asset, and the lessor cannot recover the full cost of the asset during the full period. The lessor is also liable to bear the maintenance costs.

Example: A company leasing office space for two years.

3. Sale and Leaseback: In this type, a company sells an asset to someone else (third party) and then rents it back. The company receives consideration against the sale and retains the right to use the asset. Companies enter into this arrangement when they face a short-term liquidity crisis.

Example: A company selling its real estate property to another party and then leasing it back.

4. Leveraged Leasing: Companies use leveraged leasing to finance big-ticket assets such as airplanes, oil rigs, and railroad equipment. It involves three parties: the lessee, the lessor, and the lender. The lessor and lessee enter into an agreement for an asset. However, the lessor finances the asset with the financial assistance of a lender who invests in the asset.

Example: A company leasing a jet plane with the help of a lender who invests in the asset.

How to Negotiate a Lease?

1. Understand your needs as a tenant or landlord: It is important to understand your needs and priorities before negotiating. For example, a tenant may prioritize a shorter term or lower rent, while a landlord may prioritize a longer term or higher rent.

2. Identify negotiating points: Both parties should identify the key issues they want to negotiate such as rent amount, maintenance responsibilities, or renewal options.

3. Communicate effectively during negotiations: Effective communication is key during negotiations. Both parties must clearly communicate their expectations and be open to compromise for a mutually beneficial agreement.

Example:

1. John needs an office space with a private bathroom and a designated parking space.

2. Sarah, the landlord, wants a long-term tenant who will take good care of the space and pay rent on time. She is also looking for a tenant who is willing to pay a higher rent.

3. John and Sarah negotiate for a rent reduction in exchange for a long-term commitment.

4. John asks for a significant rent reduction, from $2,500/month to $1,800/month, but Sarah is only willing to reduce the rent to $2,200/month.

5. During negotiations, both communicate and listen to each other’s concerns and are ready to compromise.

6. They eventually reach an agreement that meets both of their needs, with John agreeing to a longer commitment and Sarah reducing the rent to $2,000/month.

7. They sign the agreement and begin their landlord-tenant relationship.

Signing a Lease

1. Review and understand the agreement: It is important to review it carefully and ensure that all terms and conditions are understood before signing.

2. Seek legal advice if necessary: If any complex legal issues or uncertainties are related, seeking legal advice can help protect both parties.

3. Sign and fulfill obligations: Once signed, both parties must fulfill their obligations under the agreement. These obligations may include paying rent on time, maintaining the property, and adhering to any other terms and conditions mentioned in the agreement.

Common Issues

1. Failure to pay rent: One of the most common issues in such agreements is failure to pay rent. This can lead to late fees, legal action, and eviction.

2. Property damage: The agreement will outline the tenant’s responsibilities for maintaining the property. If the tenant damages the property, they may have to pay for repairs.

3. Dispute resolution: If there is a disagreement or dispute between the landlord and tenant, the agreement may specify a process for resolving the issue, such as mediation or arbitration.

Lease vs Rent

|

Aspect |

Lease |

Rent |

| Definition | Lessors and lessees sign a contract for the lessee’s exclusive use of a property for a specified period in exchange for payments.

|

Tenants pay the landlord for using property or assets, typically short-term. |

| Parties | Lessor and Lessee | Landlord and Tenant |

| Duration | Long-term, often a year or more | Short-term, often month-to-month or a few months |

| Payment | Remains unchanged throughout its duration. | Can change monthly based on the market or other factors. |

| Responsibility | Tenant responsible for maintenance and repairs. | Landlord is responsible for maintenance and repairs. |

| Renewal | The lessee can choose to renew the agreement when it ends. | No option to renew, but it can be renegotiated or extended. |

| Ownership | Option to purchase property at the end of the term. | No option to purchase property at the end of the rental term. |

| Modifications | One cannot change the conditions of the contract until it ceases to exist. | The landlord may alter the contract’s conditions. |

Advantages

- Quality Assets: Leasing allows a corporation to invest in high-quality assets that may otherwise be too expensive or out of reach. The lessor retains asset ownership, while the lessee is only responsible for rental payments.

- Balanced Cash Flow: Leasing payments are spread out over several years, which helps maintain a stable cash flow for the company.

- Capital Usage: Leasing frees up resources for other capital requirements or to store money for a wiser capital investment decision.

- Tax Benefit: The payments and associated costs are tax deductible as operating expenses.

- Low Capital Expenditure: Leasing has a lower initial cost and requires less capital expenditure, making it a good option for newly established businesses.

- Off-Balance Sheet Debt: These expenses are handled differently from loan expenses and are not recorded on the company’s balance sheet, making leasing an off-balance sheet debt.

- No-Risk of Obsolescence: Leasing protects firms from investing in technology that may quickly become outdated, making it an ideal choice for industries with high technology risks.

- Termination Rights: The lessee can end the lease after the term, giving the company flexibility and the ability to purchase the property.

- Better Planning: The expenses often remain the same or increase with inflation over the asset’s life or the tenor, making it easier to plan spending or cash outflow for a budget.

Disadvantages

- Expenses: Treating leasing payments as costs instead of equity payments towards an asset is common practice.

- Limited Financial Benefits: The business cannot profit from any increase in the asset’s value if making lease payments to it, and the long-term arrangement continues to burden the company.

- Debt: Long-term leases are viewed as debt by investors, which may affect a company’s valuation and access to loans and other forms of debt.

- Reduced Return for Equity Holders: Such expenses reduce net income without raising the asset’s value, leading to limited or negative returns for equity holders.

- Maintenance: The lessee is responsible for maintaining the asset in good working order.

- Documentation: Individuals or companies must carefully inspect the equipment or property and complete a lot of paperwork when entering a leasing agreement.

Frequently Asked Questions FAQs

Q1. What is the difference between leased and rented?

Answer: Leasing typically refers to a longer-term agreement, often for a year or more, whereas renting may be for a shorter period of time. For example, a tenant might rent an apartment for a few months but lease a commercial property for several years.

Q2. Can a lease be broken or terminated?

Answer: Yes, either party has the right to break or terminate it. For example, if the lessee breaches any terms, the lessor may terminate the agreement.

Q3. Which section of the Transfer of Property Act in the Indian Constitution defines lease?

Answer: Section 105 of the Transfer of Property Act defines it as the transfer of immovable property for a specific period in exchange for money, with the transferee accepting the terms and conditions stated in the agreement.

Q4. What is a commercial lease?

Answer: It is an agreement between a landlord and a tenant to rent commercial property. There are three types:

1. Gross Lease: The landlord deducts all maintenance costs for the property from the tenant’s rent.

Example: A tenant renting an office space pays a monthly rent that includes property taxes, insurance, and maintenance costs.

2. Net Lease: The tenant pays for regular expenses in addition to the rent for the rented space.

Example: A tenant leasing a retail store pays for electricity, property taxes, and maintenance costs in addition to the rent.

3. Modified Gross Lease: This is similar to a gross lease with some exceptions, and the parties may negotiate the fees included in the introductory price.

Example: A tenant leasing a warehouse negotiates with the landlord to include property taxes and maintenance costs in the rent but pays separately for electricity and cleaning services.

Recommended Articles

This EDUCBA article explains the concept of a lease. For more educational articles and blogs, EDUCBA recommends the following.