Updated November 17, 2023

Difference Between Leveraged vs Unleveraged

Leveraged vs Unleveraged are two different concepts of Capital Structure, which is very important terminology in Finance. Not only finance students, but anyone wanting to raise capital in the future must learn the meaning of the terms and their differences. The information below gives you an overview of Leveraged vs Unleveraged and the major difference between these two terminologies.

Leveraged

Operating with the use of borrowed money. A leveraged portfolio has both positive as well as negative sides. Talking about the negative side – Leveraged increases the company’s risk, as the Leveraged securities may result in loss and even make the company legally responsible for repaying the borrowed capital. And let’s talk about the positive side – It allows the company to take advantage of the opportunity it can select with money available from the borrowed funds. It describes the company’s ability to use fixed-cost funds to increase the return to the owners (i.e. Equity shareholders). Fixed Cost funds e.g. debentures, Term Loans & preference shares, act as the lever i.e. helps the company to lift its amount of capital and, as a result, increase the earnings of the owners of the company.

Unleveraged

Operating without using any borrowed money. An unleveraged portfolio means the company only uses capital invested by the investors during the company formation or when investors infuse more funds in the company or purchase the company’s stocks. These investors are the Equity Shareholders of the company. Equity shareholders have the ownership interest in the business, and they have the residual claim. i.e. Claim on the residual after paying all debts and obligations. There is no legal obligation to the company to pay the equity shareholders. Adding an Unleveraged portfolio in capital reduces the company’s risk but constrains its accessibility of the money for any opportunity investments.

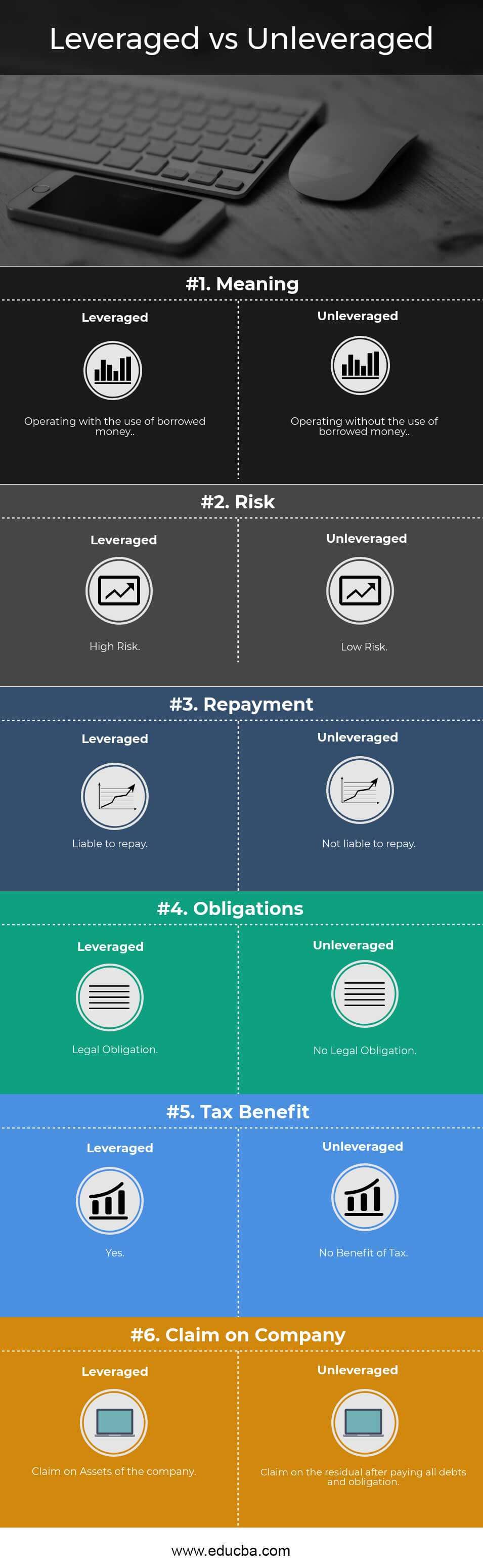

Leveraged vs Unleveraged Infographics

Key Differences Between Leveraged vs Unleveraged

As we already know, both Leveraged vs Unleveraged are the key components that differ in nature. Let us discuss some key differences :

- Companies that operate using borrowed money are categorized as Leveraged, while companies that operate without borrowing money are categorized as having an Unleveraged portfolio.

- A leveraged portfolio can be considered at high risk as, in case of Loss, the company is liable to pay the interest to the lenders for the borrowed money. Whereas, in case of an Unleveraged portfolio is considered at low risk as the company is not liable to repay in case of a Loss

- The leveraged portfolio supports the company in increasing its overall capital and even allows it to take advantage of an opportunity with available money from borrowed funds. However, an Unleveraged portfolio means the company only uses capital invested by the investors during the company formation or when investors infuse more funds in the company or purchase the company’s stocks. This limits the capital and availability of money for any opportunity investment.

- In the case of Leveraged, the company has a legal obligation to repay the lenders. Lenders may be the Banks that have provided a Term Loan or debentures or the preferred shareholders. The company is liable to pay them even in case of loss. At the same time, the company has no legal obligation in the case of an Unleveraged portfolio to repay the equity shareholders. It completely depends on whether the company wants to pay dividends to the equity shareholders.

- The leveraged portfolio provides a tax shield to the company, as the tax to be paid is calculated after paying the interest for the Term loans, debentures, or Bonds, which reduces the amount of tax to be paid. At the same time, no such benefit is available for the company’s Unleveraged portfolio.

- The leveraged portfolio provides the lenders the benefit of claim on assets first in case of insolvency. The lenders will be paid the borrowed amount first if the company announces them as bankrupt. The company has to settle the borrowed amount, even if they have sold off their assets. In the case of the company having an Unleveraged portfolio, equity shareholders have also claimed, but on residual. i.e. Claim on the residual after paying all debts and obligations. In the case of Insolvency, the company has to pay the equity shareholders after settling all the obligations.

- A leveraged portfolio can be a combination of equity with Fixed-cost funds. The fixed cost funds can be Term Loan, Debentures, Bonds, or Preference shareholders. At the same time, an Unleveraged portfolio is only constituting equity. The equity can be the capital invested by the investors during the company formation, or someone else purchasing the company’s stocks.

Head To Head Comparisons Between Leveraged vs Unleveraged

Below Is The Topmost Comparison between Leveraged vs Unleveraged:

| The Basis Of Comparison |

Leveraged |

Unleveraged |

| Meaning | Operating with the use of borrowed money. | Operating without the use of borrowed money. |

| Risk | High Risk | Low Risk |

| Repayment | Liable to repay | Not liable to repay |

| Obligations | Legal Obligation | No Legal Obligation |

| Tax Benefit | Yes | No Benefit of Tax |

| Claim on Company | Assets of the company | Residual, after paying all debts and obligation |

Conclusion

After reading the above information, we can easily differentiate between Leveraged vs Unleveraged. Leveraged can be a good option for increasing a company’s overall capital, but it should be under the paying capacity of the company. There are many ways a Company can opt for an Unleveraged portfolio. Suppose a company has a good bottom line, i.e., Profitable, and can repay the lenders. In that case, they should include an Unleveraged portfolio as it provides a tax shield to the company. This also depends on the risk-taking ability. If the company is risk-averse, it will opt for the Unileveraged portfolio. Both have pros and cons; after analyzing both aspects, the company must select it per their requirements.

If you are interested in Finance and want to work in the Financial Sector in the future, then you should know the difference between Leveraged vs Unleveraged. This is the most important topic of Finance used for cost analysis, project evaluation, and Strategy implementation in the long run.

Recommended Articles

This has been a guide to the top difference between Leveraged vs Unleveraged. We also discuss the Leveraged vs Unleveraged key differences with infographics and comparison tables. You may also have a look at the following articles to learn more –