What is Liability Insurance?

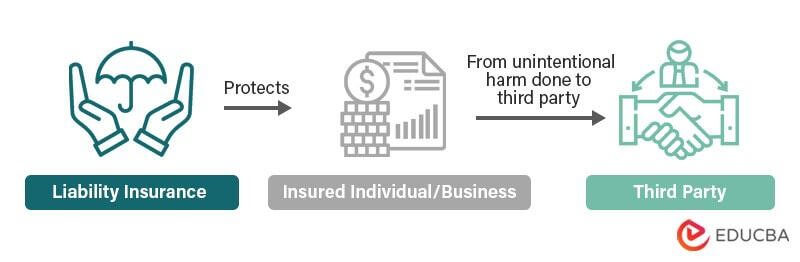

Liability insurance protects individuals or businesses from financial loss if they are held legally responsible for causing harm or damage to someone else or their property. It covers costs like legal fees, medical bills, and damages awarded to the affected party. It provides financial security and peace of mind in case of an unexpected incident that leads to a legal claim.

For example, Steve orders a vegan dish at a restaurant but receives a dish with bones by mistake. While eating, he chokes on a bone, but a doctor dining nearby saves him. Steve asks the restaurant to pay for his medical bills, which they can do because they have Liability insurance that covers his expenses.

Key Highlights

- Liability insurance can protect people or businesses from going broke if they have to deal with a legal case, which can be really expensive and take a lot of time to handle without insurance.

- The amount of coverage and specific terms of this insurance can vary based on the type of policy, the insurance company, and the needs of the policyholder.

- Certain professions, like doctors or lawyers, and businesses operating in high-risk industries are often required by law to have this insurance.

- It’s important to note that this insurance doesn’t cover criminal acts or intentional harm caused by the policyholder.

How Does Liability Insurance Work?

Step #1: The individual or business purchases a Liability insurance policy from an insurance company. The policy will include specific terms and limits for coverage.

Step #2: If the individual or business is in an incident that causes harm or damage to another person or their property, the affected party can file a claim against the policyholder’s Liability policy.

Step #3: The insurance company will investigate the claim and determine if the policyholder is at fault for the incident. If so, the insurance company will provide financial compensation to the affected party, up to the limits of the policy.

Step #4: The insurance covers costs such as legal fees, medical expenses, and damages that can be quite high. It can also provide coverage for legal defense fees and court costs.

Liability Insurance Coverage

- Bodily damage: In the case where the insured party causes bodily damage to another person, the insurance covers all the expenses that the insured party would pay to the victim as compensation.

- Property damage: In the case where the insured party damages the property of another person, the insurance covers all the expenses that the insured party would pay to the property owner as compensation.

- Temporary disability: It also covers expenses that the insured party would pay to the victim as compensation when the insured party causes temporary disability to the victim.

- Death benefits: In the unfortunate event of death, the insurance will cover the expenses as compensation to the deceased’s family or friends, on behalf of the insured.

Types of Liability Insurance

Directors and Officers’ Insurance:

- It protects the directors and officers against claims made by parties in business with the company.

- It includes Customers, Suppliers, Shareholders, Employees, Competitors, and Other Stakeholders.

Cyber Risk Insurance:

- This policy secures the insured party from frauds operating online.

- Various hackers operate online to steal someone’s personal information and use it to their advantage.

- This policy protects the insured party against such hackers.

Personal Liability:

- This type of insurance protects an individual, their family, and pets from any kind of legal action against their actions or inactions which harmed a third party.

- This saves the individual from paying a significant amount in settlements and legal fees.

General Liability:

- It covers any bodily injury to another entity, such as a customer, that occurs at someone’s business.

- Property damage includes any harm an individual or his staff members do to another person’s property.

- Advertising errors might result in copyright infringement liability claims. The policy can support their legal defense if their company unlawfully uses a copyrighted image in an advertisement.

Product Liability:

- It covers the company against lawsuits if someone suffers injury or death from a defective product that the company manufactured.

- This policy protects the manufacturer, seller, or distributor of a product from the risks of an individual suing them for damages caused by the use of their product.

- It’s important for companies to get this type of coverage because it can help protect them from an individual suing them if something goes wrong with their products.

Professional Liability:

- It protects professionals such as doctors, lawyers, and accountants against lawsuits if they make a mistake in their profession. People customize it to cover any number of professions and can offer protection against many risks.

- However, it is important to note that it does not cover workers who suffer from illnesses or accidents at work. In the event that one of your employees suffers injury on the job or becomes ill, workers’ compensation insurance, a type of employer liability policy, will pay benefits to them.

Examples of Liability Insurance

#1 Slip-and-Fall Accident:

A customer slips and falls on a wet floor in a store, suffering injuries. The store’s Liability policy covers the customer’s medical expenses and other damages.

#2 Property Damage:

A construction company damages a neighboring property while working on a project. The property owner files a claim against the construction company’s Liability coverage policy for repairs and other damages.

#3 Car Accident:

A car accident causes injuries and property damage to the other party involved. The at-fault driver’s insurance covers the medical expenses and repairs of the other party’s vehicle.

#4 Food Contamination:

A restaurant serves contaminated food that causes customers to get sick. The restaurant’s insurance covers the customers’ medical expenses and other damages.

#5 Professional Service Mistake:

A professional service provider, such as an accountant or lawyer, makes a mistake that causes financial harm to their client. The client files a claim against the provider’s insurance for damages.

Real Cases of Liability Insurance Claims

#1 Boeing

In 2018 and 2019, Boeing faced multiple lawsuits after its 737 Max airplanes were in two fatal crashes. The families of the crash victims filed wrongful death lawsuits against Boeing, and the company’s Liability insurance policies covered the cost of the settlements.

#2 Princess Cruises

In 2020, the cruise ship company Princess Cruises faced a lawsuit related to a COVID-19 outbreak on one of its ships. The company’s Liability insurance policy covers the cost of the lawsuit and settlement.

#3 Uber

In 2020, Uber settled a lawsuit related to a 2016 data breach that exposed the personal information of millions of users. Uber’s Liability insurance policy covered the cost of the settlement.

Importance of Liability Insurance

- It is important because it helps protect an individual against the financial consequences of an individual suing them for negligence, errors, or omissions in their work.

- It is crucial for individuals like property buyers to present the insurance to the clients to assure them that they can complete an undertaken task if unforeseen circumstances occur.

- It can help protect the company and its employees from lawsuits or claims

- It protects against losses due to bodily injury or property damage caused by an employee on behalf of the employer.

Liability Vs. Full Coverage Insurance

| Liability Insurance | Full Coverage Insurance | |

| What it covers | Covers damages and injuries you cause to others | Covers damages and injuries you cause to others as well as damages and injuries to your own vehicle |

| Coverage types | Typically includes bodily injury liability and property damage liability | Includes liability coverage as well as collision and comprehensive coverage |

| Required by law? | Yes, in most states | No, but often required by lenders for leased or financed vehicles |

| Cost | Typically less expensive than full coverage insurance | Generally more expensive than liability insurance |

| Deductible | Not applicable | Usually includes a deductible |

| Coverage limits | Limits vary by state but typically include a maximum amount for bodily injury per person, bodily injury per accident, and property damage per accident. | Limits vary by policy but may include a maximum amount for liability, collision, and comprehensive coverage. |

| When to choose it | When you want to meet legal requirements or have a lower premium. | When you want more protection for your vehicle and are willing to pay a higher premium. |

Frequently Asked Questions (FAQs)

What is the limit of liability insurance?

Each state sets different limits on insurance coverage. The three basic types of limits on liability insurance that individuals can purchase are:

- Property Damage Liability Limit: This is the maximum amount the policymaker will pay an individual in case their vehicle causes bodily or property damage to another individual.

- Bodily Injury Liability Limit Per Person: This is the maximum amount that every person involved in the accident receives for bodily damage.

- Bodily Injury Liability Limit Per Accident: This is the maximum amount your insurer will pay for the hospital bills for an individual accident caused by you.

What are the 2 types of liabilities in insurance?

The two types of liability insurance coverage are Bodily injury and property damage. If an individual suffers bodily harm at your hands, the insurance covers all of your expenses as compensation to the victim. Moreover, the insurance covers the cost of repairs required on the property of another person that you may have unintentionally harmed.

What is an example of Liability Insurance?

An example of such insurance could be a customer coming into a hardware store to purchase some supplies. A bucket of paint falls on his foot, injuring his toes. The owner’s general liability insurance can cover all of the medical bills that he’s supposed to pay.

Why do I need Liability Insurance?

If you are an adult functioning in the modern world, you need liability insurance. It will cover all your expenses in case of an unfortunate event where some other individual gets hurt or experiences some kind of loss due to your negligence.

Recommended Articles

This was an EDUCBA guide to liability insurance. To learn more, please read the following articles: