Difference Between Liability vs Debt

A business has three major components that every company runs; perhaps that is the most important aspect of any business. There are assets and liabilities and shareholders’ equity. As the accounting equation stands, Assets Liability + Shareholder’s Equity. The right-hand side should balance the left-hand side of the business. Hence, Liability is an important aspect of the business. This Liability vs Debt article will try to understand the two’s major differences and nature. Both liabilities vs debt result in cash outflow, and debt is a subset of liability as debt is also categorized as non-current or long-term liabilities. Efficient management of the two is essential for the smooth running of any business. Additionally, businesses can use invoice finance as a tool to improve cash flow and manage liabilities effectively.

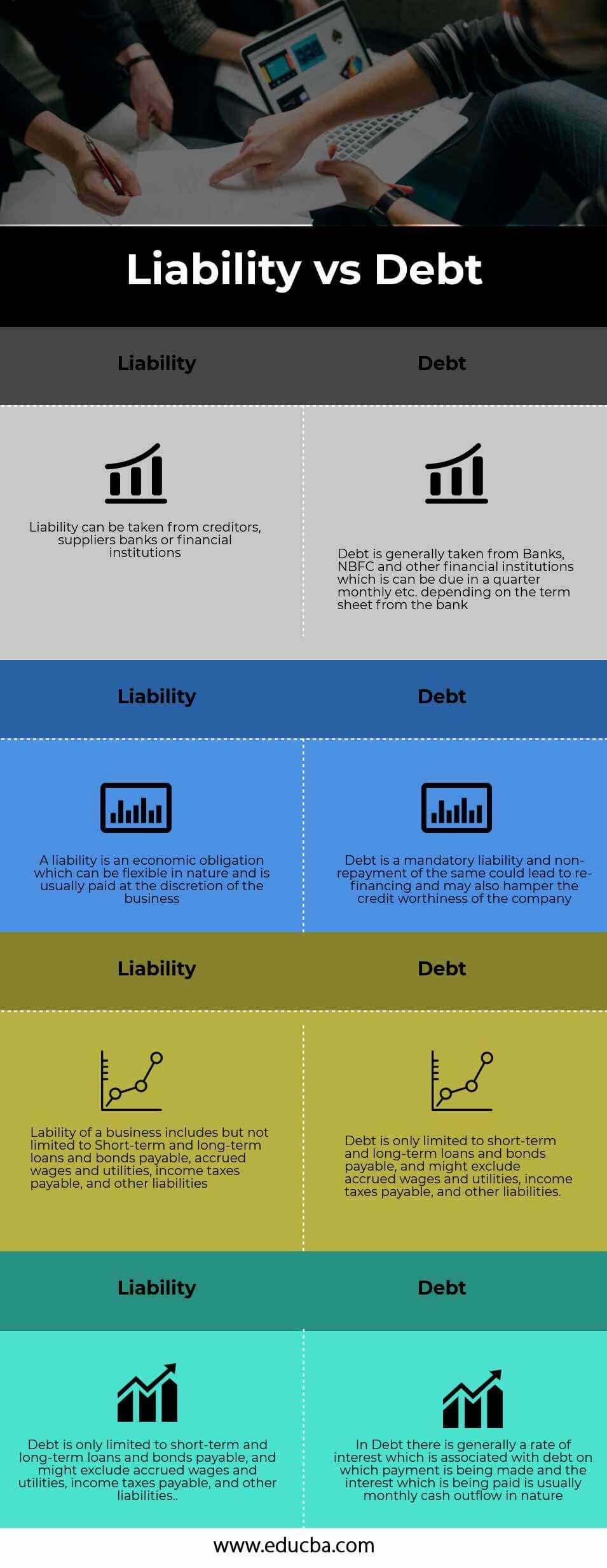

Head To Head Comparison Between Liability vs Debt (Infographics)

Below is the top 4 difference between Liability vs Debt

Key Differences Between Liability vs Debt

Both Liabilities vs Debt are popular choices in the market; let us discuss some major differences between Liability vs Debt.

- The balance sheet generally categorizes liabilities as current and non-current, with debt specifically falling under the non-current category. The balance sheet segregates all liabilities into current and non-current sections, with debt being a subset of the non-current liabilities.

- Liabilities are generally reduced when Debts are paid off from the balance sheet; for example, paying off a loan from banks or financial institutions reduces the business’s liabilities. On the contrary paying-off, any current or non-current liability does not necessarily mean the business’s debt will be reduced. Paying off debt interest will reduce the business’s liability, but it does not reduce the debt component or the principal on the debt outstanding.

- The company generally secures debt by pledging collateral, typically a fixed asset, such as office buildings, when obtaining loans from NBFC. In contrast, liabilities may or may not be secured, and current liabilities due within one year are inherently unsecured.

- Non-payment of debt due to financial institutions or banks leads to the breach of convents, and additional penalty needs to be incurred by the business; on the other hand, non-payment of other balance sheet liability does not always lead to any penalty. For example, non-payment to creditors will not lead to cumulative interest or a late payment penalty.

- All debts are liabilities, but all liabilities are not necessary and might not have a nature of the debt. In other words, liability is the larger universe, and debt is a subset.

Liability vs Debt Comparison Table

Below is the 4 topmost comparison between Liability vs Debt

|

Liability |

Debt |

| Liability can be taken from creditors, suppliers, banks, or financial institutions. | Banks, NBFCs, and other financial institutions generally provide debt, with repayment terms varying based on the term sheet from the bank. The repayment schedule can be quarterly, monthly, or as specified in the agreement. |

| A liability is an economic obligation that can be flexible in nature and is usually paid at the discretion of the business. | Debt is a mandatory liability, and non-repayment could lead to re-financing and hamper the company’s creditworthiness. |

| Business liability includes but is not limited to Short-term and long-term loans and bonds payable, accrued wages and utilities, income taxes payable, and other liabilities. | Short-term and long-term loans and bonds payable limit debt, potentially excluding accrued wages, utilities, income taxes payable, and other liabilities. |

| Liability does not have a specific rate of interest associated with it, and the payment terms can be flexible in nature. | Debt typically incurs an associated interest rate, and individuals make monthly cash outflows to cover the accruing interest. |

Conclusion

Liability vs Debt is a vital and important part of any business that wants to become an industry leader or manage its operations successfully. A good business plan should consider the efficient management of cash outflow from efficient management of debt vs liabilities. A good accountant who tries to smooth the cash cycle so that no payment of any nature, whether current or non-current, should clash, which will decrease the working capital requirement in the business.

A company should place major emphasis on both terms

Recommended Articles

This has been a guide to the top difference between Liability vs Debt. Here, we discuss the Liability vs Debt key differences with infographics and comparison table. You may also have a look at the following articles to learn more.