Updated July 14, 2023

What is LIBOR Curve?

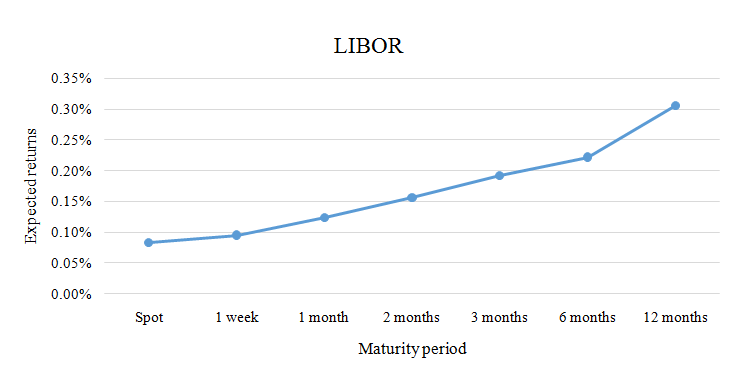

LIBOR is the acronym for London Interbank Offer Rate, and the term “LIBOR curve” refers to the graphical representation of the LIBOR rates at various maturity intervals, which vary in the range from a single day to 12 months. Banks and other financial institutions use the LIBOR curve to determine the interest rates for various debt instruments and other related financial products.

In addition, the central banks of various countries usually use the LIBOR curve as a benchmark to craft their monetary policies. Overall, the LIBOR rates are determined for 7 maturity periods for deposits of five major currencies – EUR (Euro), GBP (Pound Sterling), USD (US Dollar), JPY (Japanese Yen), and CHF (Swiss Franc).

Explanation

LIBOR refers to the short-term floating rates that larger high-creditworthy banks use to lend to other similar banks, while the LIBOR curve represents the yield curve for the LIBOR rates for maturity periods of less than a year.LIBOR is one of the most widely used benchmarks for both short and long-term debt-based products and serves as one of the primary indicators of the average interest rate levels in most economies, as the central banks rely on LIBOR for monetary policies.

Example of LIBOR Curve

An example of the LIBOR curve is:

Example #1

Let us assume that David raised a personal loan worth $50,000 for one year with the interest rate stated as 6-month LIBOR + 2%, which means that David has to pay a premium of 2% over and above the prevailing LIBOR for 6-month maturity. Next, determine the total interest payment for the year if the 6-month LIBOR is 2.5% for the 1st six months and 3.0% for the next six months.

Solution:

Now, if the 6-month LIBOR is 2.5%, then the interest rate on loan will be 4.5%for the first six months, and the interest payment can be calculated as,

- Interest payment 1st six months = 4.5% * (6/12) * $50,000

- Interest payment 1st six months = $1,125

Again, if the 6-month LIBOR increases to3.0%, then the interest rate on the loan will be 5.0%for the next six months, and the interest payment can be calculated as,

- Interest payment next six months = 5.0% * (6/12) * $50,000

- Interest payment next six months = $1,250

Therefore, the total interest payment for the year can be calculated as,

Total Interest Payment = Interest Payment 1st Six Months + Interest Payment Next Six Months

- Total Interest Payment = $1,125 + $1,250

- Total Interest Payment = $2,375

Example #2

This example will show how LIBOR is applied to derivative instruments (interest rate swaps). Let us assume that John has a $500,000 investment that pays him a LIBOR-based return of 3 months LIBOR + 1%. Now, John intends to change his variable earnings into fixed-rate interest payments. On the other hand, Smith has a similar $500,000 investment that pays him a fixed interest of 1.5% every quarter, and he intends to switch to variable earnings. So, John and Smith entered into an interest rate swap agreement such that John would receive the fixed interest payment and Smith would receive the variable payment. Discuss the swap arrangement if the 3-month LIBOR is 1% and 0.25%.

Solution:

John will receive $1,875 from Smith every quarter.

If LIBOR is 1%, Smith will receive 2% or $2,500 from John per quarter. Since it is higher than what Smith owes to John, Smith will get $625 (= $2,500 – $1,875) from John.

Again, if LIBOR comes down to 0.25%, Smith will receive 1.25% or $1,562 from John per quarter. Since it is lower than what Smith owes to John, John will get $313 (= $1,875 – $1,562) from Smith.

Importance of LIBOR Curve

From the perspective of banks and financial institutions, the LIBOR curve holds immense importance as they utilize it as the benchmark for global interest rates. It is a crucial tool in determining the interest rates for debt-based products and other financial instruments, including LIBOR futures and interest rate swaps. Furthermore, regulatory bodies worldwide rely on these rates to establish lending spreads for borrowers outside the lender’s country.

LIBOR Curve Future

Currently, LIBOR and Secured Overnight Financing Rate (SOFR) exist. However, it is expected that SOFR will gradually completely replace LIBOR over the next few years as most banks dealing in the dollar-denominated benchmark favor using SOFR.

On 30th November 2020, the Federal Reserve stated that LIBOR would eventually be phased out by June 2023. Thus, the banks were instructed to stop writing LIBOR-based in December 2021 such that all LIBOR-based contracts could be wrapped up by June 2023. The SOFR will replace LIBOR, and the Alternative Reference Rates Committee will oversee it.

Regulators across the globe have pushed the banks to find alternatives to LIBOR. Currently, some of the alternatives for LIBOR and its equivalents include SONIA (Sterling Overnight Index Average) for the UK, TONAR(Tokyo Overnight Average Rate)for Japan, and SARON (Swiss Average Rate Overnight) for Switzerland.

Advantages of LIBOR Curve

Some of the major advantages of the LIBOR curve are as follows:

- First, the LIBOR curve is representative of the average rates at which the leading global banks lend to each other.

- The LIBOR curve helps determine the forward-term rates that the borrowers and lenders can use to know the interest payments for any period.

Disadvantages of LIBOR Curve

Some of the major disadvantages of the LIBOR curve are as follows:

- In 2012, US and British regulators fined various banks for manipulating LIBOR rates to enhance profits on their derivative positions. Since then, LIBOR has lost its credibility in the mark as a benchmark, and thus the LIBOR curve lost its popularity.

- Most of the central banks are considering the replacement of LIBOR as a benchmark, which means that the LIBOR curve will further lose its relevance in the financial market.

Conclusion

So, the LIBOR curve is the graphical representation of the LIBOR rates for various maturity periods. Although various globally leading banks are currently using the rate, it is being replaced by other benchmark indexes. Nevertheless, it is still an important tool for banks and other financial institutions.

Recommended Articles

This is a guide to LIBOR Curve. Here we also discuss the introduction, examples of the LIBOR curve, and advantages and disadvantages. You may also have a look at the following articles to learn more –