Life Insurance: a Good Investment Opportunity

When planning your finances, most people think about savings accounts, mutual funds, and stocks. However, people often overlook life insurance as an investment. It is not just about protecting your family in case of your untimely death; it is also a smart way to build wealth for your future. If you are unsure whether life insurance is worth it, this guide will help you understand why it is a wise investment choice that goes beyond mere risk coverage.

What is Life Insurance?

A life insurance plan is an agreement between you and an insurance company where you pay regular premiums in return for financial protection for your loved ones. In the event of your passing, the insurance company provides a death benefit—a lump sum payment—to your beneficiaries, ensuring they are financially secure. Life insurance comes in different types: term plans, whole life plans, endowment plans, and unit-linked insurance plans (ULIPs). Some life insurance policies also feature an investment component, enabling you to grow wealth while providing financial security for your family.

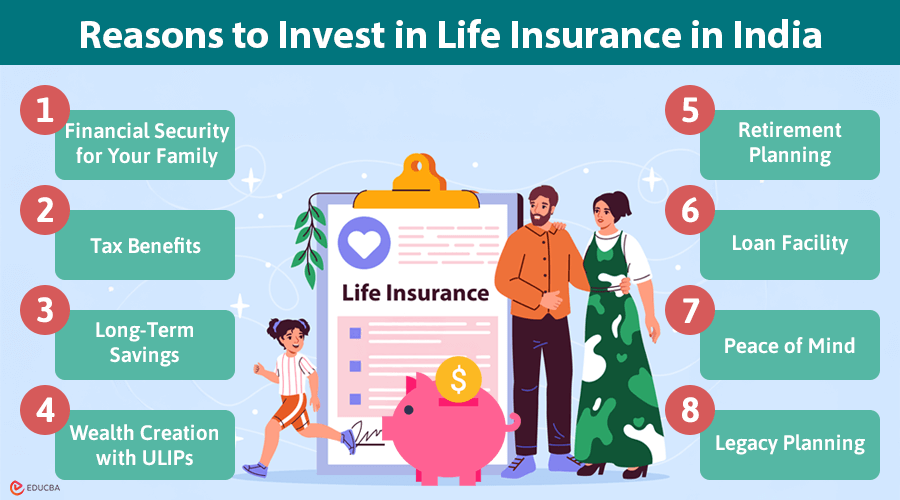

Reasons to Buy Life Insurance as an Investment in India

Here are some reasons why life insurance as an investment is a smart choice for your financial future:

#1. Financial Security for Your Family

Life insurance’s main purpose is to protect your loved ones financially. If something happens to you, the death benefit helps your family pay bills debts, and maintain their lifestyle without financial worry.

#2. Tax Benefits

In India, life insurance provides significant tax benefits under Section 80C of the Income Tax Act, allowing you to deduct premiums paid from your taxable income. Under Section 10(10D) of the Income Tax Act, the death benefit from a life insurance policy is tax-exempt, making it a highly tax-efficient investment choice.

#3. Long-Term Savings

Specific plans, like endowment plans and ULIPs, offer insurance coverage and savings options. These plans encourage long-term savings, helping you reach goals like buying a home or funding your child’s education.

#4. Wealth Creation with ULIPs

Unit-linked insurance plans (ULIPs) let you invest part of your premiums in equity or debt funds, offering market-linked returns. This makes life insurance a protective measure and a way to grow your wealth over time.

#5. Retirement Planning

Some life insurance policies, like pension plans, help you build a retirement fund. These plans offer a steady income after retirement, ensuring financial security when you no longer receive a salary.

#6. Loan Facility

Some life insurance policies let you borrow against the policy’s cash value. This can be helpful in times of need without selling your other investments.

#7. Peace of Mind

The assurance that your family will be financially secure in your absence provides unparalleled peace of mind. Life insurance ensures that your family is protected so you can focus on living without constant financial worry.

#8. Legacy Planning

Life insurance can also help you leave a financial gift for your family or support a cause you care about, making it a powerful tool for legacy planning.

How to Choose the Right Life Insurance Policy?

Here are some factors to consider when selecting a policy:

- Financial Goals: Determine your financial goals. Whether you are securing your family’s future, saving for retirement, or creating wealth, choose a policy that fits your goals.

- Coverage Amount: Evaluate your coverage needs by considering your current income, outstanding debts, and future financial responsibilities. Make sure the coverage is sufficient to support your family in your absence.

- Policy Type: Understand the different types of life insurance available. If you want both coverage and savings, consider endowment plans or ULIPs. If you need risk coverage, a term plan might be better. Choose a policy type that suits your risk tolerance and financial needs.

- Premium Affordability: Make sure the premium is affordable and fits your budget. Since life insurance is a long-term commitment, opt for a plan with premiums that fit comfortably within your budget.

- Riders and Add-Ons: To enhance your policy, consider adding riders (extra benefits) such as critical illness coverage or accidental death benefits. These can be customized based on your personal needs.

Final Thoughts

Life insurance as an investment is not just about protecting your family but also about building wealth, saving for the future, and achieving your financial goals. Whether you are looking for tax savings, retirement planning, or wealth creation, life insurance can be a versatile tool to help secure your financial future. Selecting the right plan that aligns with your goals and budget ensures peace of mind, knowing your loved ones are protected, and your finances are steadily growing.

Recommended Articles

We hope this guide on life insurance as an investment helps you explore the potential benefits of using life insurance for long-term financial planning. Check out these recommended articles for more information on investment strategy.