Updated July 24, 2023

Definition of Ratio Analysis

Ratio Analysis is one of the key milestones of fundamental analysis of the company by making use of the information available in its financial statements to get an understanding of the company’s operational efficiency, profitability, liquidity and other key metrics, which helps us understand the financials of the company in a better way.

Ratio analysis primarily aims to compare various line items of the financial statement pertaining to a business. It is targeted to evaluate various metrics required to understand a company’s performance like solvency, liquidity, profitability, and operations efficiency. This is particularly helpful for analysts outside the company as it is only the financial statement which they have to study or understand the company. On the other hand, corporate insiders who have ample information about the company ratio analysis are not that important.In this article, we will discuss the Limitations of Ratio Analysis.

Objectives of Ratio Analysis

Once an organization’s financial statements are compiled, they need to be evaluated or analyzed. The objectives of ratio analysis are as follows:

1. Helps in Measuring the Profitability of the Company

Profit is the key requirement of every business. It is based on profit a business survives and plans for further expansion. Thus if we say a business has earned a certain amount of profit, we are not sure how good or bad the figure is. Thus, here a profitability ratio that includes gross profit, net profit, Expense ratios comes in handy as it provides the profitability of the firm. The management can track down the grey areas and work upon them for improvement.

2. Helps in Evaluating Operational Efficiency

Few of the ratios are targeted to evaluate the firm’s degree of efficiency at how it is handling its assets and other resources. It is a must for a firm that assets and financial resources are well utilized, and unnecessary expense levels are kept to a bare minimum. To get an overall picture of the efficiency of assets, turnover ratios and efficiency ratios can play a major role.

3. Maintaining Liquidity

The liquidity problem is the major issue that many firms face these days, and thus every firm should maintain a certain amount of liquidity to meet its urgent cash requirement. Specifically to main short term solvency issues, quick ratio and current ratio can play a major role.

4. Determining Financial Health

Some ratios are handy to determine the overall financial health and performance of a company. This can be indicated by determining the overall long term solvency of the firm. This helps in judging whether there is too much pressure on the assets or if the firm is over-leveraged. Thus, to avoid future liquidation problem, the business has to quickly recognize this. Ratios that prove handy in such scenarios are leverage ratios and debt-equity ratios.

5. Helps in Comparing

Here, certain ratios are used to compare the benchmarks prevalent in the industry to get a better outlook of the company’s financial performance and position. Businesses can take rectifying actions if the company does not maintain the standard. Here generally, the ratios are compared to the previous year’s ratio to understand the company’s track record.

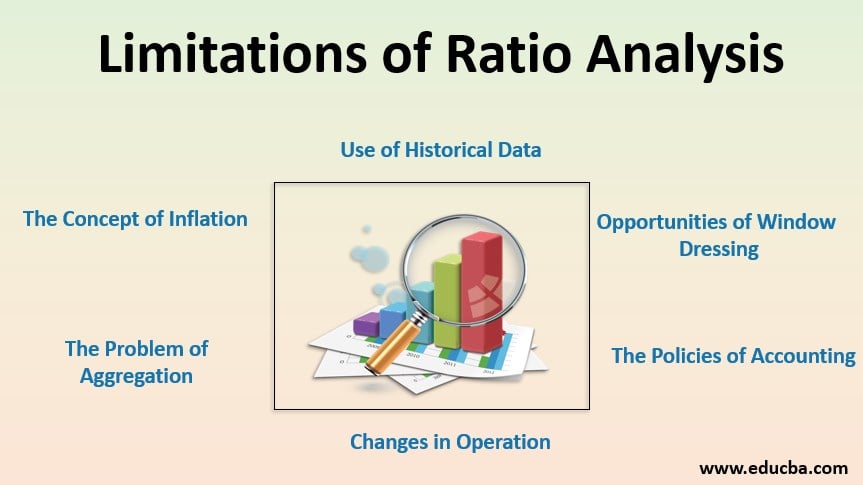

Limitations of Ratio Analysis

Ratio analysis is an important aspect; however, a range of drawbacks of ratio analysis are listed below.

1. Use of Historical Data

All the information used in ratio analysis is based on historical numbers only. These data are drawn from historical actuals and by no means will remain the same in the future as business performance changes with every passing time.

2. The Concept of Inflation

When we compare period-wise numbers for trend analysis, and if the inflationary rate has changed in between the periods, the comparison makes no sense. Ratio analysis does not account for the inflation factor at all.

3. The Problem of Aggregation

The data from the financial statement for a particular line item that we are using for our study or comparison may have been aggregated in a different proportion in the past, and thus doing a trend analysis based on this data doesn’t give a true picture.

4. Changes in Operation

A business can go drastic changes in its operations due to certain unexpected needs, and thus using the data of the past and making a judgment based on that does not give a fruitful conclusion because pre-change and post-change of operation numbers under no circumstances can be compared together.

5. The Policies of Accounting

When we are doing peer to peer comparison, different companies may use different accounting policies and thus, it makes it hard to conclude on such cases.

6. No Standard Definition of Ratios

There is no set standard definition of ratios and numbers to be included in it. Some firms may include some items when calculating a ratio, and few may include others. Thus when it comes to a comparison of both companies, it becomes difficult.

7. Ignorance of the Qualitative Aspect

Ratio analysis ignores the qualitative view of the firm and tends to include only the monetary aspect.

8. Opportunities for Window Dressing

Some firms may manipulate the numbers to bring about changes to the ratio for displaying a better picture of the firm. Thus in ratio analysis, there are scopes of window dressing.

9. The Mix of Historical and Actual Numbers

Ratio analysis can be misleading at times because elements from profit and loss statements are based on actual cost, whereas elements from the balance sheet are based on historical. Thus, comparing elements as a mix of both can be deceptive at times and may not give the desired result.

10. Time Effect

Some ratio pick numbers from the balance sheet, which is prepared only on the accounting period’s last day. Thus if there is any sudden shoot or decline in the number pertaining to the last day of the accounting period, it can drastically impact the overall ratio analysis.

Conclusion

Ratio analysis has both advantages and disadvantages of its own and solely depends on the analyst who is using this and what he/she is using this for. Even then, the advantages clearly outweigh the disadvantages as for people outside the company; this is the only way to get a better view of the company and understand its financials. Ratio analysis plays a major role in any kind of fundamental analysis specific to a company.

Recommended Articles

This is a guide to the Limitations of Ratio Analysis. Here we discuss the definition and objectives of ratio analysis along with various limitations of ratio analysis. You may also have a look at the following articles to learn more –